Market Definition

The market encompasses commercial and industrial systems, comprising booth hardware and software, designed to automate tasks and processes across various industries.

These platforms include autonomous robots, robotic arms, drones, and other automated systems used in applications such as manufacturing, logistics, and healthcare. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

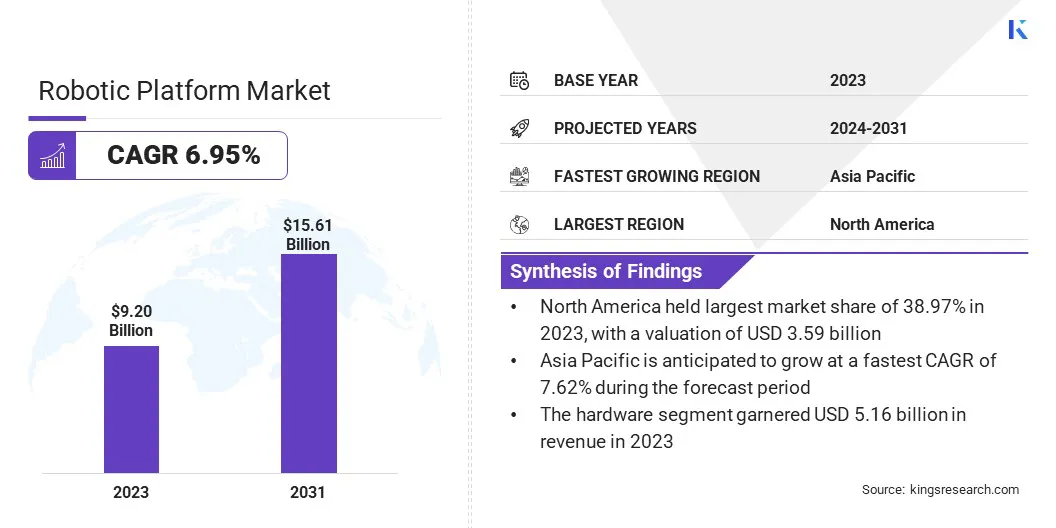

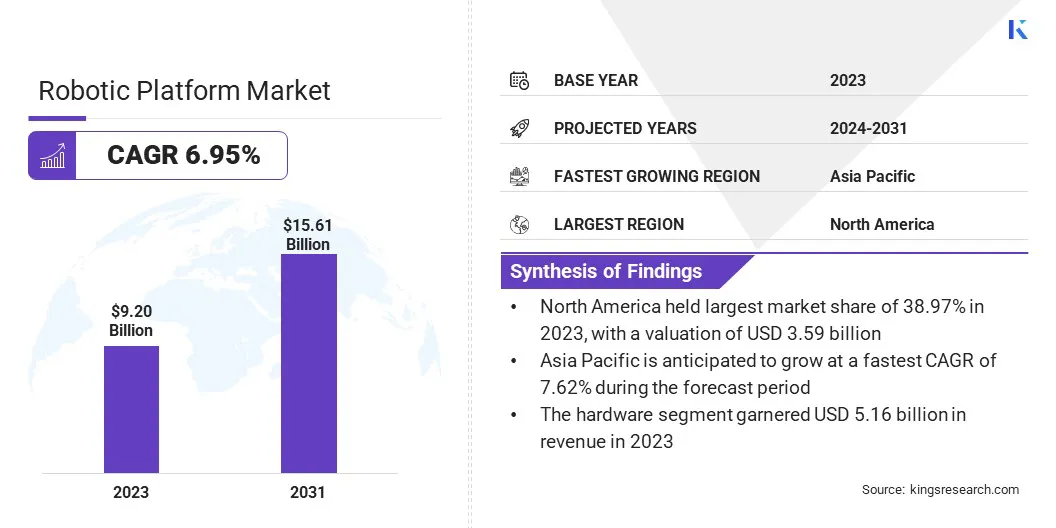

Global robotic platform market size was valued at USD 9.20 billion in 2023, which is estimated to be valued at USD 9.76 billion in 2024 and reach USD 15.61 billion by 2031, growing at a CAGR of 6.95% from 2024 to 2031.

This growth is primarily fueled by advancement in medical robotics. Continuous innovations in robotic-assisted technologies are improving the precision, speed, and safety of medical procedures, leading to increased adoption across various healthcare sectors such as surgery and diagnostics.

Major companies operating in the robotic platform industry are IBM, Alphabet Inc., KUKA AG, NVIDIA Corporation, Universal Robots A/S, ABB, KEBA, Mitsubishi Electric Corporation, FANUC CORPORATION, Kawasaki Heavy Industries, Ltd., DENSO WAVE INCORPORATED, Dassault Systèmes, Rethink Robotics, Cyberbotics Ltd., Rockwell Automation, and others.

The market is witnessing significant growth, driven by advancements in AI and robotics, particularly in navigating unstructured environments. AI-powered vision systems enable robots to handle unpredictable items, such as returns and irregularly shaped products.

This automation enhances efficiency in warehouses and sorting centers, addressing labor shortages and the demand for faster, more accurate processing. With the rise of e-commerce, robotic solutions offer scalable, cost-effective optimization of logistics and supply chain operations.

- In March 2025, ABB expanded its robotic solutions portfolio for logistics and e-commerce supply chains by introducing two new AI-powered functional modules to its Item Picking family.. The Fashion Inductor and Parcel Inductor, equipped with ABB’s AI-based vision technology, provide solutions for key logistics processes: item picking and sorter induction. The new solutions, including the Fashion and Parcel Inductors, address key challenges in item singulation, picking, and sorter induction, increasing efficiency and reducing labor dependency.

Key Highlights:

- The robotic platform industry size was recorded at USD 9.20 billion in 2023.

- The market is projected to grow at a CAGR of 6.95% from 2024 to 2031.

- North America held a market share of 38.97% in 2023, valued at USD 3.59 billion.

- The hardware segment garnered USD 5.16 billion in revenue in 2023.

- The mobile robotic platform segment is expected to reach USD 7.98 billion by 2031.

- The industrial automation segment held a share of 32.09% in 2023.

- The e-commerce & retail segment is anticipated to grow at a CAGR of 8.50% over the forecast period.

- Asia Pacific is projected to grow at a CAGR of 7.62% through the projection period.

Market Driver

"Advancements in Medical Robotics"

The continuous advancements in medical robotics are boosting the growth of the robotic platform market. Innovations in robotic systems are enhancing the precision and efficiency of various procedures, particularly in minimally invasive surgeries, leading to reduced recovery times, fewer complications, and better patient outcomes.

Consequently, healthcare providers are increasingly adopting robotic platforms for a broader range of medical applications, from diagnostics to complex surgeries, fueling continued market expansion.

- In November 2024, Rush University System for Health became the first Midwest institution to acquire Quantum Surgical’s Epione platform. This robotic-assisted technology enhances precision in percutaneous ablations for abdominal cancer, offering a minimally invasive treatment option with faster recovery and lower risks for patients.

Market Challenge

"Skill and Training Gaps"

A key challenge impeding the expansion of the robotic platform market is the skill and training gap. The demand for highly skilled professionals to operate and maintain robotic systems can slow adoption and increase training costs. This can create a barrier for businesses, particularly in industries lacking specialized labor.

To address this, companies can invest in comprehensive training programs, collaborate with educational institutions to develop specialized curriculums, and offer ongoing support to ensure efficient operation and maintenance, reducing long-term costs and accelerating adoption.

- In March 2025, ABB launched the RoboMasters personalized training app to address the skills gap in robotic automation. The app offers flexible, cost-effective remote training for both beginners and advanced users,enabling them to program and operate ABB robots and enhance their skills outside traditional classroom settings.

Market Trend

"Modular and Scalable Architecture"

The growing trend of modular and scalable architecture in robotic control platforms is influencing the market. This approach allows businesses to customize automation systems to specific needs, ensuring flexibility and adaptability across various applications.

As industries evolve, the ability to scale and integrate new technologies is crucial for maintaining competitiveness. Modular designs help optimize operations, reduce downtime, and foster innovation, providing a significant advantage in dynamic environments.

- In June 2024, ABB launched the OmniCore platform, featuring a modular and scalable control architecture. This advancement empowers industries such as biotechnology, construction, automotive, and manufacturing to enhance their automation capabilities. It offers improved flexibility, efficiency, and sustainability, enabling businesses to optimize operations and future-proof robotic applications.

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Type

|

Mobile Robotic Platform, Stationary Robotic Platform, Marine & Aerial Robotic Platform

|

|

By Application

|

Industrial Automation, Military & Defense, Healthcare, Logistics & Warehousing, Agriculture, Research & Education

|

|

By End-User

|

Automotive, Electronics, Healthcare Institutions, Defense Agencies, E-Commerce & Retail, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 5.16 billion in 2023 due to the growing demand for advanced robotics and automation solutions across various industries such as manufacturing and logistics.

- By Type (Mobile Robotic Platform, Stationary Robotic Platform, and Marine & Aerial Robotic Platform): The mobile robotic platform segment held a share of 50.12% in 2023, fueled by increasing adoption in industries such as logistics, warehouse automation, and material handling for enhanced flexibility.

- By Application (Industrial Automation, Military & Defense, Healthcare, Logistics & Warehousing, Agriculture, and Research & Education): The industrial automation segment is projected to reach USD 4.73 billion by 2031, propelled by the growing demand for efficient, high-precision automation in manufacturing processes across diverse industries.

- By End-User (Automotive, Electronics, Healthcare Institutions, Defense Agencies, E-Commerce & Retail, and Others): The e-commerce & retail segment is anticipated to grow at a CAGR of 8.50% over the forecast period, fostered by increased demand for robotic systems to optimize inventory management, packaging, and order fulfillment.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America robotic platform market share stood at around 38.97% in 2023, valued at USD 3.59 billion. This dominance is reinforced by the increasing adoption of automation across industries such as logistics, automotive, and healthcare.

The region's strong technological infrastructure, high investments in R&D, and a robust manufacturing base contribute significantly to its leading position. Additionally, the presence of key players and the growing demand for advanced automation solutions to address labor shortages and enhance operational efficiency solidifies North America's market dominance.

- In March 2024, Addverb partnered with DHL Supply Chain in North America to deploy 52 sorting robots at its Columbus, Ohio facility. Enabled by Addverb’s enterprise software, the collaboration achieved a 300% increase in throughput, improving efficiency and scalability without additional staffing.

Asia Pacific robotic platform industry is set to grow at a CAGR of 7.62% over the forecast period. This growth is fostered by rapid industrialization, increased automation adoption, and significant investments in advanced robotics.

The region’s expanding manufacturing sector, particularly in countries such as China, Japan, and South Korea, is fueling demand for robotic solutions in industrial automation, logistics, and other sectors.

Additionally, the rise of smart factories, government initiatives promoting AI and robotics, and the growing need for cost-effective automation are accelerating regional market growth.

Regulatory Frameworks

- In the EU, robots sold must bear the the "CE", indicating compliance with safety, health, and environmental standards under EU regulations for products in the European Economic Area (EEA).

- In the US, the FDA regulates medical robots to ensure their safety, efficacy, and security, protecting public health and providing reliable, science-based information.

Competitive Landscape

Companies in the robotics platform industry are developing software to simplify the process of programming and managing robots. They aim to create universal platforms that allow for easy integration and portability across various robotic systems.

These platforms often incorporate AI, enabling faster communication and advanced capabilities. The goal is to make robotics more accessible to general software developers, reducing reliance on specialized expertise and fostering innovation across industries.

- In January 2025, BOW, a universal robotics software company, raised USD 5.30 million in a seed round led by Northern Gritstone. This investment aims to reduce the cost and complexity of programming robots, making robotics accessible to general software developers and accelerating innovation across industries, including AI-driven applications and robot fleet management.

List of Key Companies in Robotic Platform Market:

- IBM

- Alphabet Inc.

- KUKA AG

- NVIDIA Corporation

- Universal Robots A/S

- ABB

- KEBA

- Mitsubishi Electric Corporation

- FANUC CORPORATION

- Kawasaki Heavy Industries, Ltd.

- DENSO WAVE INCORPORATED

- Dassault Systèmes

- Rethink Robotics

- Cyberbotics Ltd.

- Rockwell Automation

Recent Developments (M&A/Partnerships/New Product Launch)

- In March 2025, Google DeepMind unveiled Gemini Robotics, a new generation of AI-powered robots. These advanced models, built on Gemini 2.0, offer enhanced abilities in generality, interactivity, and dexterity, enabling robots to perform complex tasks in dynamic real-world environments. The technology integrates embodied reasoning, ensuring safe and adaptable robotic actions.

- In January 2025, LG Electronics secured a majority stake in Bear Robotics, a leading AI-driven robotics startup. This strategic investment aims to strengthen LG’s commercial, industrial, and home robotics businesses. LG plans to integrate Bear Robotics’ innovative service robots into its portfolio, including the development of advanced AI-powered home robots such as the Q9.

- In June 2024, NVIDIA revealed that leading robotics companies across various industries are adopting its NVIDIA Isaac platform to develop AI-powered autonomous robots. Companies such as BYD Electronics, Siemen, Teradyne Robotic, and Intrinsicare integrating NVIDIA’s advanced robotics technologies into their operations.NVIDIA aims to accelerate the development of autonomous machines, including robot arms, humanoids, and mobile robots, driving significant innovation in these sectors.