Market Definition

A robotaxi is an autonomous vehicle developed to provide on-demand ride-hailing services without the need for human drivers. These vehicles are equipped with advanced sensor technologies, artificial intelligence–based navigation systems, and digital booking platforms that enable safe and efficient passenger transport.

The scope of the market includes electric, hybrid, and fuel-based vehicle types.Service models span from traditional ride-hailing to car-sharing and short-term rental solutions, reflecting diverse commercial approaches to meet varying urban mobility needs.

Robotaxi Market Overview

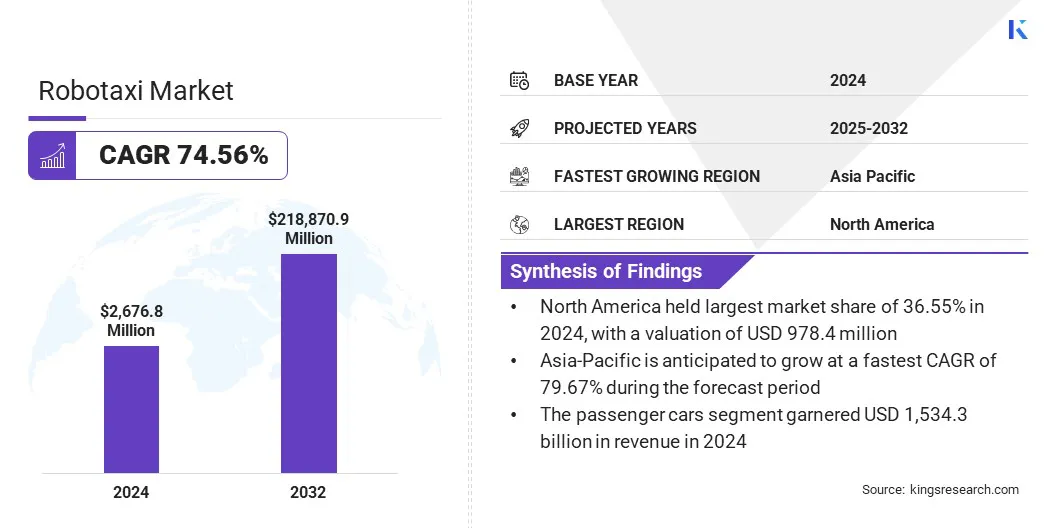

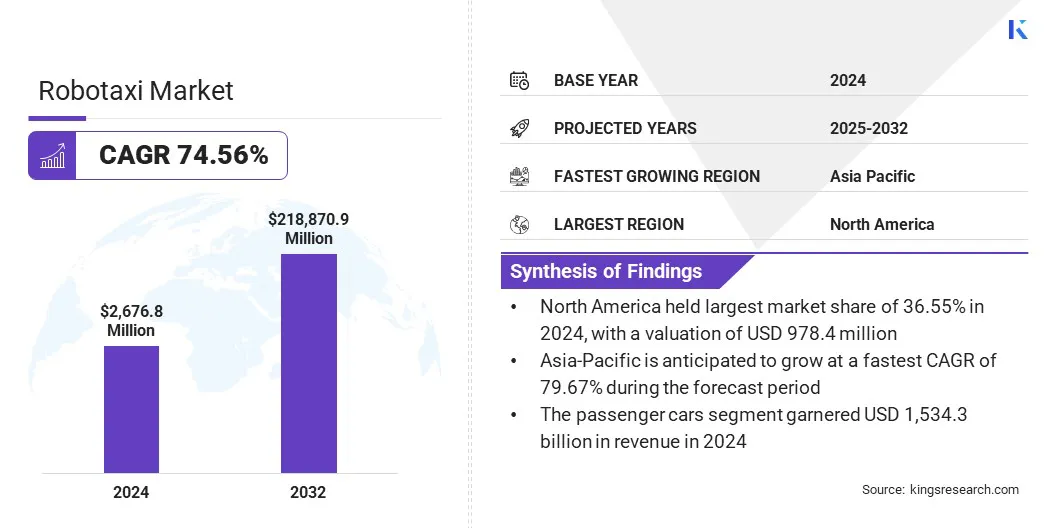

The global robotaxi market size was valued at USD 2,676.8 million in 2024 and is projected to grow from USD 4,432.2 million in 2025 to USD 2,18,870.9 million by 2032, exhibiting a staggering growth at 74.56% CAGR over the forecast period.

The market is primarily driven by the rising demand for cost-efficient, sustainable mobility solutions. Further, advancements in autonomous vehicle technology are enhancing the safety and reliability of robotaxis. The expansion of app-based ride-hailing and shared mobility services are also fueling market adoption.

Key Highlights:

- The robotaxi industry size was recorded at USD 2,676.8 million in 2024.

- The market is projected to grow at a CAGR of 74.56% from 2024 to 2032.

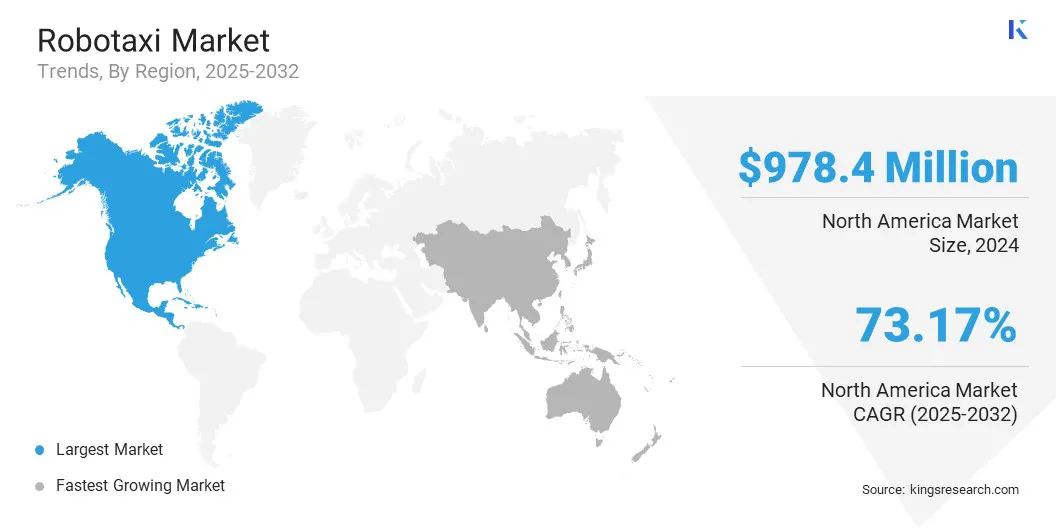

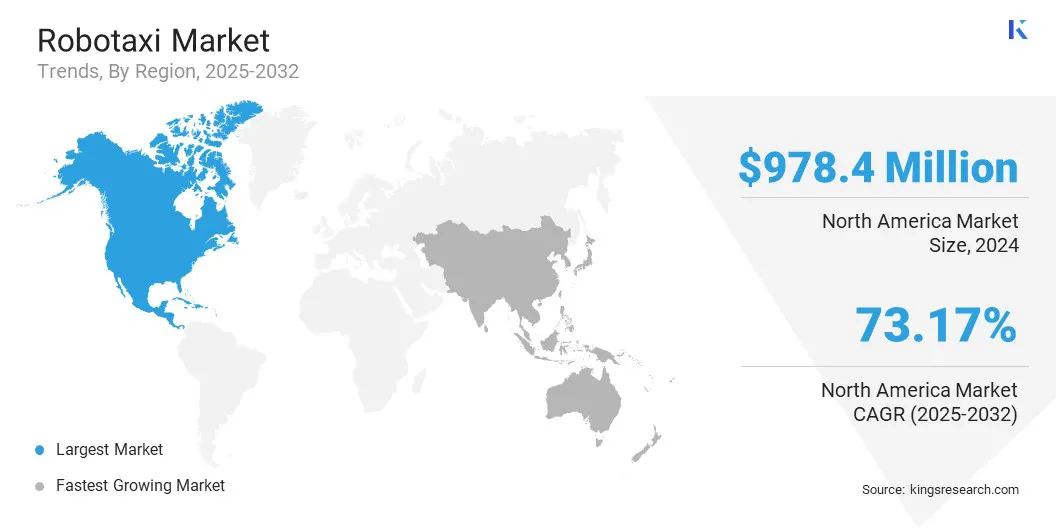

- North America held a share of 36.55% in 2024, valued at USD 978.4 million.

- The LiDAR segment garnered USD 1,007.8 million in revenue in 2024.

- The passenger cars segment is expected to reach USD 1,16,002.3 million by 2032.

- The level 4 segment is projected to register a share of 58.12% by 2032.

- The electric vehicle segment accounted for a share of 59.34% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 79.67% over the forecast period.

Major companies operating in the robotaxi market are Waymo LLC, Baidu Apollo, Zoox, Inc., Tesla, Pony.ai, WeRide.ai., AutoX, Inc, Didi Chuxing, Motional, Inc., Uber Technologies Inc., BMW Group, Hyundai Motor Company, Aurora Operations, Inc., Avride Inc., and DeepRoute.ai.

The market is witnessing significant growth due to the commercialization of autonomous mobility solutions and the increasing demand for efficient, scalable, and sustainable urban transportation. Rapid advancements in AI, sensor technologies, and electric vehicle platforms are enabling the deployment of safe and reliable driverless services.

Manufacturers and technology providers are expanding pilot programs, forming strategic partnerships, and integrating robotaxis with app-based ride-hailing platforms to meet consumer demand. Investments in next-generation hardware, fleet management systems, and urban mobility infrastructure are further contributing to the market development.

- In June 2025, Pony.ai partnered with Shenzhen Xihu Corporation Limited, the city’s largest taxi operator, to deploy over 1,000 seventh-generation (Gen 7) robotaxis in Shenzhen. The collaboration leverages an “asset-light + AI-empowered” model to accelerate large-scale, safe, and efficient autonomous mobility services in tier-one Chinese cities.

Market Driver

Rising Urbanization and Demand for Efficient Mobility

The growth of the robotaxi market is driven by the increasing demand for efficient and scalable urban mobility solutions. Robotaxis are helping to manage city congestion and optimize traffic flow through on-demand, driverless mobility services. Rising urbanization further strengthens this demand base.

- According to the U.S. Census Bureau, as of July 1, 2024 nearly 294 million people, or approximately 86% of the total U.S. population, resides in metropolitan areas.

Additionally, integration with app-based ride-hailing platforms allows for flexible and cost-effective transport. Additionally, investments in smart city infrastructure and regulatory initiatives are facilitating broader adoption, which is driving market growth.

Market Challenge

Regulatory and Safety Compliance

A key challenge impeding the growth of the robotaxi market is the complexity of regulatory approval and safety compliance across regions. Variations in autonomous vehicle regulations, stringent safety standards, and liability concerns create barriers to large-scale deployment and increase operational costs for manufacturers and service providers. This regulatory uncertainty can slow adoption, particularly in regions with fragmented or evolving policy frameworks.

To address this challenge, companies are collaborating with policymakers to establish standardized safety protocols and testing guidelines. Additionally, pilot programs, strategic partnerships, and controlled urban deployments are helping demonstrate reliability, build public trust, and facilitate smoother regulatory approvals, mitigating risks associated with autonomous vehicle operations.

Market Trend

Integration of Electric and Autonomous Technologies

A notable trend shaping the robotaxi market is the integration of electric propulsion with autonomous driving technologies to enhance operational efficiency and sustainability. Electric robotaxis reduce carbon emissions and lower operational costs, while advanced AI-driven navigation and sensor systems improve route optimization, safety, and passenger experience.

Fleet operators are leveraging these technologies to scale urban mobility services efficiently. The combined focus on electrification and autonomy is driving investments in smart city infrastructure and shared mobility platforms, supporting adoption and market growth.

- For instance, in July 2025, Uber, in collaboration with Lucid Group, Inc. and Nuro, Inc., announced a next-generation premium robotaxi program for the Uber ride-hailing platform. The initiative aims to deploy over 20,000 Lucid vehicles equipped with the Nuro Driver across multiple global markets over six years.

Robotaxi Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Camera, LiDAR, Radar, Ultrasonic Sensors, Others

|

|

By Vehicle Type

|

Passenger Cars, Shuttles/Vans

|

|

By Level of Autonomy

|

Level 4, Level 5

|

|

By Propulsion

|

Electric Vehicle (EV), Hybrid Vehicle, Fuel Cell Vehicle

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Camera, LiDAR, Radar, Ultrasonic Sensors, and Others): The LiDAR segment earned USD 1,007.8 million in 2024 mainly driven by its high-precision 3D mapping capabilities, superior object detection in various lighting conditions, and increasing adoption in autonomous vehicle navigation systems.

- By Vehicle Type (Passenger Cars and Shuttles/Vans): The passenger cars segment held 57.32% market share in 2024, fueled by higher consumer preference for on-demand ride-hailing services and widespread integration with app-based autonomous mobility platforms.

- By Level of Autonomy (Level 4 and Level 5): The level 4 segment is projected to reach USD 1,27,199.9 million by 2032, owing to its readiness for commercial deployment, regulatory support for urban pilot programs, and widespread adoption in ride-hailing and shared mobility services.

- By Propulsion (Electric Vehicle (EV), Hybrid Vehicle, and Fuel Cell Vehicle): The electric vehicle segment is expected to register a share of 67.70% by 2032, driven by government incentives for EV adoption, and growing emphasis on sustainable and zero-emission urban mobility solutions.

Robotaxi Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America robotaxi market share stood at 36.55% in 2024, with a valuation of USD 978.4 million in the global market. This dominance is primarily reinforced by increasing urbanization, supportive regulatory frameworks, and investments in smart city infrastructure. Furthermore, the rapid expansion of early large-scale deployments led by technology providers and ride-hailing platforms is driving market demand in the region.

Technology providers and automotive manufacturers are advancing AI-driven navigation, sensor systems, and electric propulsion to enhance operational efficiency, safety, and passenger experience. Urban mobility operators are leveraging app-based platforms to manage fleets, optimize routes, and deliver scalable, on-demand transport services in major metropolitan areas.

- In May 2025, Uber partnered with May Mobility to deploy thousands of autonomous vehicles on its ride-hailing platform across U.S. cities, starting with Arlington, Texas, by late 2025.

Asia-Pacific is poised for significant growth at a robust CAGR of 79.67% over the forecast period. This growth is supported by large-scale pilot deployments, high consumer adoption potential, and investments from domestic market players in the region. Countries such as China, Japan, and South Korea are at the forefront of deployment, leveraging advanced 5G networks, AI integration, and vehicle-to-everything (V2X) technologies to accelerate commercialization.

Local ride-hailing platforms and automotive manufacturers are partnering with global technology firms to expand pilot programs and achieve early adoption at scale. Major urban centers in Asia-Pacific are prioritizing autonomous transport to reduce congestion, improve environmental sustainability, and meet the mobility needs of growing populations, thereby contributing to the market growth.

- For instance, in April 2025, Didi Autonomous Driving unveiled its first Level 4 robotaxi developed in partnership with GAC Aion. The vehicle, equipped with a next-generation hardware platform and multi-dimensional safety redundancy system, is scheduled for mass production by the end of 2025.

Regulatory Frameworks

- In North America, autonomous vehicle testing and operations are regulated by the National Highway Traffic Safety Administration (NHTSA) as well as state-level transportation authorities. California, Arizona, and Texas have specific guidelines for on-road testing, fleet operations, and driverless deployments.

- In Europe, the European Commission and UNECE provide harmonized frameworks for autonomous vehicle testing, certification, and cross-border operations. EU member states, including Germany, France, and others, enforce safety validation, liability coverage, and data protection requirements under GDPR for commercial robotaxi services.

- In China, autonomous vehicle test zones, fleet licensing, and Level 4 commercialization standards have been established. Japan and South Korea offer regulatory sandboxes for pilot operations, focusing on safety verification, compliance with AI-driven navigation requirements, and integration with vehicle-to-infrastructure systems.

- On the international stage, International Organization for Standardization has developed standards such as ISO 26262 for functional safety of road vehicles, and ISO/PAS 21448 (SOTIF) for safety of intended functionality, which apply to autonomous systems including robotaxis.

Competitive Landscape

Major players operating in the robotaxi industry are implementing strategic measures to accelerate market expansion. Firms are developing modular and upgradable vehicle platforms to facilitate rapid iteration of autonomous hardware and software. Collaborations with logistics, retail, and last-mile delivery operators are extending fleet utilization beyond passenger transport.

Investments in data-driven predictive maintenance and fleet optimization systems are reducing operational costs and enhancing service reliability. Additionally, companies are establishing cross-border partnerships and conducting international pilot programs to validate technology, expand regional presence, and strengthen consumer demand in autonomous mobility solutions.

- For instance, in March 2025, Baidu’s autonomous ride-hailing service, Apollo Go, partnered with UAE-based Autogo, a subsidiary of Kintsugi Holding, to deploy the largest fully driverless fleet in Abu Dhabi, aiming to introduce next-generation autonomous mobility across the city.

Top Key Companies in Robotaxi Market:

- Waymo LLC

- Baidu Apollo

- Zoox, Inc.

- Tesla

- Pony.ai

-

WeRide.ai.

- AutoX, Inc

- Didi Chuxing

- Motional, Inc.

- Uber Technologies Inc.

- BMW Group

- Hyundai Motor Company

- Aurora Operations, Inc.

- Avride Inc.

-

DeepRoute.ai

Recent Developments

- In September 2025, YFT and May Mobility launched robotaxi services in Atlanta, marking an important expansion of autonomous ride-hailing operations in the U.S. market.

- In September 2025, Amazon’s Zoox launched its robotaxi service in Las Vegas, offering free rides in select areas of the city with fully driverless vehicles operating without a steering wheel.

- In June 2025, MOIA unveiled the series production version of the ID. Buzz AD, the first fully autonomous production vehicle from Volkswagen, specifically optimized for deployment in mobility services and turnkey autonomous transport solutions.

- In March 2025, Avride partnered with Hyundai Motor Co. to expand its robotaxi fleet and jointly develop and operate self-driving vehicles in South Korea.

- In January 2025, HERE and BMW Group extended their partnership to advance an AI-powered mapping system designed to support automated driving and enhance road safety.