Shared Mobility Market Size

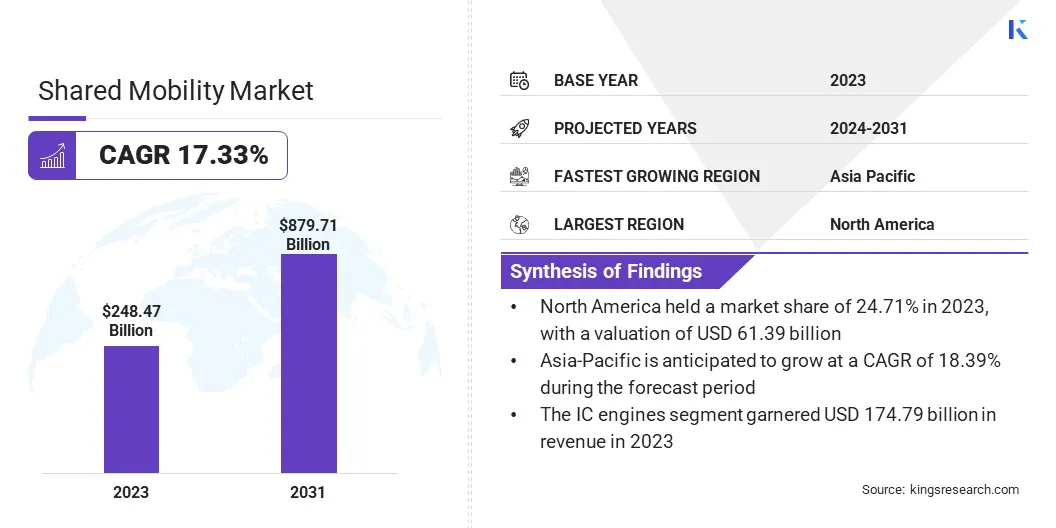

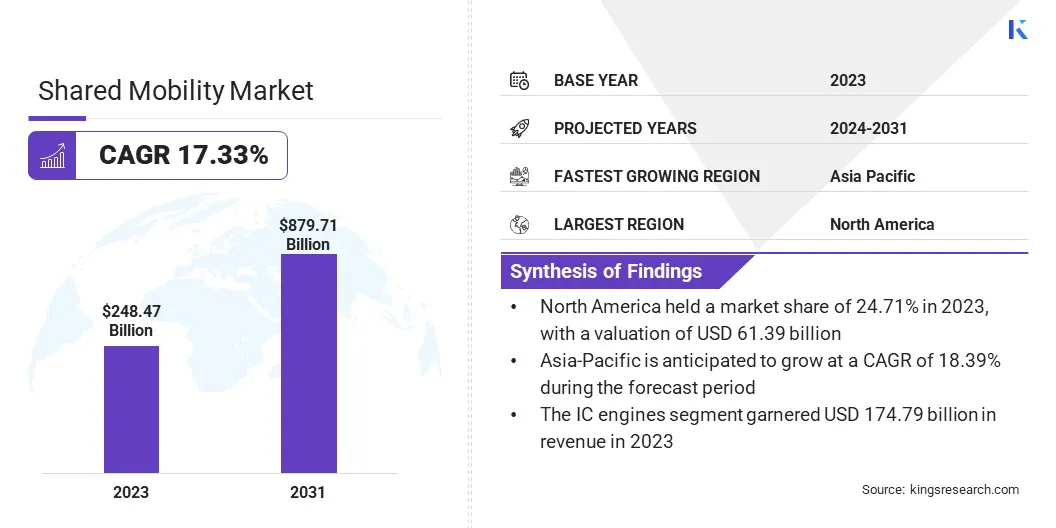

Global Shared Mobility Market size was recorded at USD 248.47 billion in 2023, which is estimated to be at USD 287.35 billion in 2024 and projected to reach USD 879.71 billion by 2031, growing at a CAGR of 17.33% from 2024 to 2031. In the scope of work, the report includes services offered by companies such as BlaBlaCar, Uber Technologies Inc., DiDi, Lyft, Inc., ANI Technologies Pvt. Ltd. (OLA), Zipcar, Inc., Bolt Technology OÜ, Grab, Zoomcar Ltd., SUOL INNOVATIONS LTD (in-Drive), and others. The rise of micro-mobility options represents a significant trend in the shared mobility market, driven by the increasing demand for convenient, cost-effective, and environmentally friendly transportation solutions.

Micro-mobility refers to the use of small, lightweight vehicles for short-distance trips, typically within urban areas. The rise of micro-mobility is fueled by the proliferation of electric scooters, bicycles, and electric bikes, which offer a convenient alternative to traditional modes of transportation such as cars or public transit. These options provide users with greater flexibility, allowing them to navigate congested city streets more efficiently while reducing their carbon footprint.

- The rise of micro-mobility aligns with the overarching emphasis on environmental concerns and sustainability goals, as cities seek to reduce congestion and air pollution by promoting alternative modes of transportation.

Shared mobility encompasses a range of transportation services that enable users to access vehicles on a short-term basis, typically through a shared platform or network. These services include ride-sharing, car-sharing, bike-sharing, and scooter-sharing, among others. Shared mobility vehicles are often powered by electric or hybrid propulsion systems, contributing to lower emissions and reduced environmental impact compared to traditional gasoline-powered vehicles.

The vehicles used in shared mobility services vary depending on the specific mode of transportation, encompassing a range of opptions from cars and vans to bicycles and scooters. Shared mobility platforms leverage technology to facilitate the seamless booking, payment, and coordination of vehicles, thereby enhancing convenience and accessibility for users.

Analyst’s Review

In the rapidly evolving global shared mobility market, key players encounter numerous opportunities and challenges. Analysts project robust growth driven by rapid urbanization, technological advancements, and changing consumer preferences. Focusing on strategic imperatives such as enhancing the user experience through seamless integration of multi-modal solutions, investing in electric and autonomous fleets to align with sustainability goals, and leveraging data analytics to optimize operations and personalize services, are key imperatives to capitalize on this growth.

Additionally, partnerships with public transport systems and regulatory compliance are crucial for expanding market presence and overcoming regulatory hurdles. Adopting innovation and agility is imperative for staying competitive in this dynamic landscape.

Shared Mobility Market Growth Factors

The widespread adoption of mobility-as-a-service (MaaS) platforms is reshaping the landscape of shared mobility by offering integrated, convenient, and on-demand transportation solutions to users. MaaS platforms leverage digital technology to provide a seamless experience for accessing various modes of transportation, including public transit, ride-sharing, bike-sharing, and more, all through a single interface. This trend is further bolstered by rapid urbanization, which is leading to greater congestion and the need for more efficient transportation options.

MaaS platforms are addressing this need by offering users a comprehensive solution for planning, booking, and paying for their transportation needs, thereby enhancing the overall mobility experience. Additionally, MaaS platforms contribute to sustainability efforts by promoting the use of alternative modes of transportation and reducing reliance on private car ownership. As these platforms continue to evolve and expand their reach, they are expected to play a significant role in shaping the landscape of shared mobility.

However, regulatory and legal challenges pose significant hurdles to the widespread adoption and expansion of shared mobility services in various regions. These challenges encompasses several issues, including licensing and permitting requirements and restrictions on operating areas and vehicle types.

In some cases, regulatory frameworks may not be well-suited to accommodate emerging shared mobility models, leading to uncertainty and barriers to entry for service providers. Additionally, growing concerns regarding safety, liability, and insurance further complicate the regulatory landscape.

As shared mobility continues to evolve and disrupt traditional transportation models, policymakers are faced with the task of balancing innovation with public safety and consumer protection. Collaborative efforts between industry stakeholders and government agencies are essential to address these challenges and establish clear, supportive regulatory frameworks that foster the shared mobility market growth.

Shared Mobility Market Trends

The integration of multi-modal solutions is a key trend fostering innovation in the shared mobility market, offering users greater flexibility and convenience in their transportation choices. This trend involves the seamless coordination and integration of various modes of transportation, such as public transit, ride-sharing, bike-sharing, and walking, to create a cohesive and interconnected mobility network.

By combining different transportation options into a single platform or ecosystem, users are easily planning and optimizing their journeys based on factors such as cost, time, and environmental impact.

Integration of multi-modal solutions enhances the overall mobility experience for users and contributes to more sustainable and efficient transportation systems by promoting the use of alternative modes of transportation and reducing reliance on single-occupancy vehicles. As cities are increasingly adopting the concept of smart and connected mobility, the integration of multi-modal solutions is expected to play a pivotal role in shaping the future of urban transportation.

Segmentation Analysis

The global market is segmented based on service model, vehicle type, vehicle propulsion, sales channel, and geography.

By Service Model

Based on service model, the shared mobility market is categorized into ride hailing, bike sharing, ride sharing, car sharing, and others. The ride-hailing segment is poised to record a staggering CAGR of 18.26% through the forecast period. This robust growth is attributed to the rapid urbanization, changing consumer preferences toward on-demand transportation services, and advancements in technology. Ride-hailing services offer users convenient and cost-effective alternatives to traditional taxi services, with features such as real-time tracking, cashless transactions, and driver ratings, thus contributing to their popularity.

Moreover, the emergence of ride-hailing platforms in the shared mobility ecosystem, along with their expansion into new markets and services such as food delivery and micro-mobility, fuels the growth of the segment.

By Vehicle Type

Based on vehicle type, the market is classified into cars, two-wheeler, and others. The cars segment captured the largest shared mobility market share of 54.77% in 2023, largely due to their convenience, flexibility, and cost-effectiveness. This dominance is further stimulated by several factors, including the widespread availability of car-sharing services in urban and suburban areas, the diverse range of vehicle options offered by car-sharing platforms, and the increasing adoption of shared mobility solutions by both businesses and individuals.

Additionally, advancements in technology, such as mobile apps for booking and unlocking vehicles, have facilitated the growth of the segment, making it a preferred choice for users seeking convenient transportation solutions.

By Vehicle Propulsion

Based on vehicle propulsion, the market is divided into IC engines, electric and hybrid vehicles, and others. The IC engines garnered the highest revenue of USD 174.79 billion in 2023, mainly propelled by the widespread adoption of IC engine vehicles in traditional car-sharing and ride-hailing fleets, as well as the higher upfront cost associated with electric and hybrid vehicles.

Despite increasing concerns regarding environmental sustainability and the growing shift toward electric mobility, IC engine vehicles continue to dominate the market due to their established infrastructure, longer driving ranges, and lower initial purchase prices compared to electric alternatives. Additionally, the availability of a wide range of IC engine vehicle models and the existing refueling infrastructure contribute to their popularity among both service providers and consumers.

Shared Mobility Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Shared Mobility Market share stood around 24.71% in 2023 in the global market, with a valuation of USD 61.39 billion. This growth is mainly bolstered by the presence of key market players, ongoing technological advancements, and rapid urbanization. Cities such as New York, Los Angeles, and San Francisco have seen significant adoption of shared mobility services, including ride-hailing, car-sharing, and bike-sharing, due to their dense populations and traffic congestion.

Additionally, the region's well-developed infrastructure, supportive regulatory environment, and strong consumer demand for convenient transportation options have contributed to the regional market growth. With ongoing investments in electric and autonomous vehicles, as well as the expansion of multi-modal transportation solutions, the region is expected to maintain its leading position in the shared mobility market in the coming years.

Asia-Pacific is poised to grow at the robust CAGR of 18.39% in the forthcoming years, facilitated by rapid urbanization, expanding middle-class population, and increasing smartphone penetration. China, India, and Southeast Asian nations, are experiencing a significant increase in the demand for shared mobility services due to rising congestion levels, environmental concerns, and the need for cost-effective transportation solutions.

Moreover, government initiatives to promote sustainable mobility, investments in infrastructure development, and the emergence of innovative start-ups are fueling Asia-Pacific shared mobility market growth. The region's large and densely populated cities provide ample opportunities for shared mobility operators to scale their services and address the evolving transportation needs of urban dwellers.

Competitive Landscape

The shared mobility market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Shared Mobility Market

- BlaBlaCar

- Uber Technologies Inc.

- DiDi

- Lyft, Inc.

- ANI Technologies Pvt. Ltd. (OLA)

- Zipcar, Inc.

- Bolt Technology OÜ

- Grab

- Zoomcar Ltd.

- SUOL INNOVATIONS LTD (in-Drive)

Key Industry Developments

- May 2024 (Launch): Uber launched Bubbles, a champagne tour bookable directly in the Uber app. This exclusive addition to the ‘Go Anywhere’ travel series offers riders seamless access to one of Europe’s most iconic regions throughout the summer, thereby enhancing the premium travel experience.

- April 2024 (Launch): Green was introduced to Lyft Business clients across 14 cities, broadening access to sustainable transportation for millions of riders without a business profile. This initiative aims to increase earning prospects for electric and hybrid vehicle drivers.

- March 2024 (Partnership): Zoomcar and EaseMyTrip unveiled a strategic collaboration aimed at providing customers with unparalleled convenience in travel planning. This integration seamlessly incorporates Zoomcar’s extensive fleet of self-drive vehicles into the EaseMyTrip platform, thus expanding the range of travel options available to users.

- April 2023 (Acquisition): BlaBlaCar acquired Klaxit, France's leading short-distance carpooling operator. This acquisition, including the integration of all Klaxit employees, enhances BlaBlaCar's offering to local authorities and businesses, marking a significant milestone in BlaBlaCar Daily’s strategy to make carpooling accessible for every car commute.

The Global Shared Mobility Market is Segmented as:

By Service Model

- Ride Hailing

- Bike Sharing

- Ride Sharing

- Car Sharing

- Others

By Vehicle Type

By Vehicle Propulsion

- IC Engines

- Electric and Hybrid Vehicles

- Others

By Sales Channel

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America