Market Definition

The market encompasses technologies and applications focused on using RNA interference (RNAi) to treat diseases by silencing specific gene expressions. It includes the development and commercialization of therapeutics based on RNA (siRNA), short hairpin RNA (shRNA), and microRNA (miRNA) that regulate gene activity post-transcriptionally.

The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

RNAi Therapeutics Market Overview

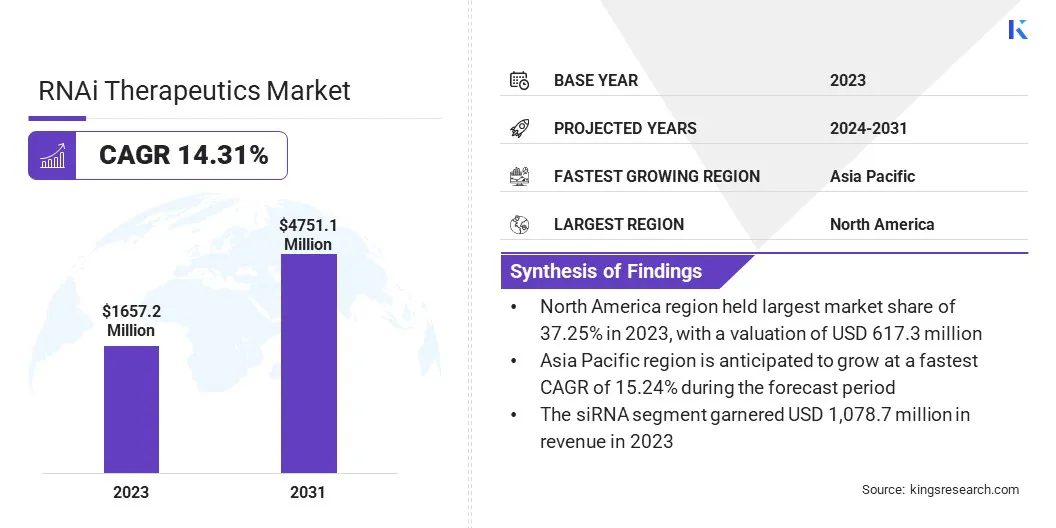

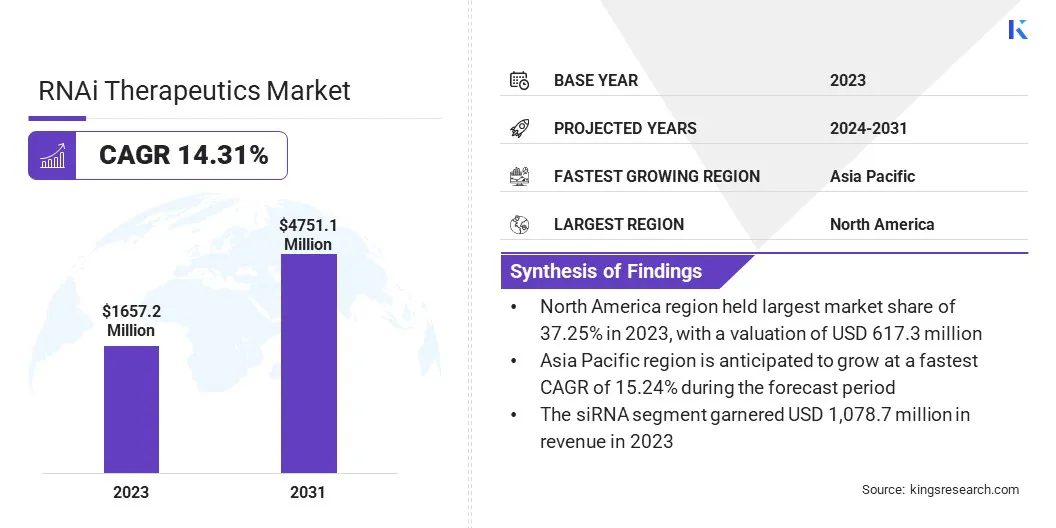

The global RNAi therapeutics market size was valued at USD 1,657.2 million in 2023 and is projected to grow from USD 1,862.7 million in 2024 to USD 4,751.1 million by 2031, exhibiting a CAGR of 14.31% during the forecast period.

Market growth is driven by the rising prevalence of genetic and chronic diseases, which is increasing the need for highly targeted and effective therapeutic approaches. The rise in conditions such as cancer, rare inherited disorders, and neurological diseases highlights the limitations of conventional treatments.

Major companies operating in the RNAi therapeutics industry are Eli Lilly and Company, Takeda Pharmaceutical Company Limited, Alnylam Pharmaceuticals, Inc., F. Hoffmann-La Roche, Regeneron Pharmaceuticals Inc., Wave Life Sciences, Aro Biotherapeutics Company, Amgen Inc., Sanofi, Eleven Tx, Arrowhead Pharmaceuticals, Inc., GSK plc, Novo Nordisk A/S, Silence Therapeutics, Sirnaomics, Inc., and others.

Moreover, the scope of RNAi therapies is widening beyond their initial focus on liver-related diseases. Advances in delivery systems are allowing for efficient targeting of tissues such as the lungs, eyes, and central nervous system.

This expansionis significantly enhancing the clinical potential of RNAi therapeutics, enabling the development of treatments for a broader range of complex and previously hard-to-treat conditions.

- In July 2024, Sirnaomics Ltd. entered into a joint venture with Gore Range Capital LLC to form Sagesse Bio, Inc., aimed at advancing its novel RNAi-based therapeutic products into aesthetic medicine. The collaboration leverages Sirnaomics' expertise in RNAi technology and Gore Range Capital’s leadership in the skin health sector to accelerate clinical development, with initial indications focused on body contouring and fat reduction.

Key Highlights:

- The RNAi therapeutics industry size was recorded at USD 1,657.2 million in 2023.

- The market is projected to grow at a CAGR of 14.31% from 2024 to 2031.

- North America held a share of 37.25% in 2023, valued at USD 617.3 million.

- The siRNA segment garnered USD 1,078.7 million in revenue in 2023.

- The intravenous (IV) segment is expected to reach USD 2,504.5 million by 2031.

- The oncology segment is expected to reach USD 1,489.7 million by 2031.

- The hospitals & clinics segment is expected to reach USD 2,189.6 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 15.24% over the forecast period.

Market Driver

"Rising Prevalence of Genetic and Chronic Diseases"

The growth of the RNAi therapeutics market is driven by the increasing global prevalence of genetic and chronic diseases, inlcuding cancer, rare genetic disorders, and neurodegenerative diseases.

RNAi-based therapeutics, including siRNA, shRNA, and miRNA, offer a strategic advantage by targeting disease at the genetic level, enabling highly specific gene silencing.

This upstream intervention, compared to traditional therapies that act at the protein level, enhances treatment efficacy while minimizing off-target effects. This has positioned RNAi as a a promising modality, accelerating R&D activity, clinical trials, and investment across the pharmaceutical industry.

- In May 2024, according to the U.S. Department of Health and Human Services, an estimated 14,910 new cases of cancer cases are expected among individuals aged 0—19, with approximately 1,590 projected fatalities. This reflects a rising prevalence of severe genetic and chronic diseases, reinforcing the urgent need for advanced, targeted treatment approaches such as RNAi therapeutics.

Market Challenge

"High Manufacturing Costs and Operational Complexities"

A major factor impeding the expansion of the RNAi therapeutics market is the high manufacturing costs and operational complexities associated with RNAi drug production.

The process involves intricate chemical synthesis, extensive quality control, and sophisticated delivery systems such as lipid nanoparticles, requiring specialized infrastructure and skilled expertise. These factors significantly increase production expenses, limit economies of scale, and affect pricing and market access.

To mitigate this challenge, companies are adopting cost-optimization strategies, including partnerships with contract development and manufacturing organizations (CDMOs), investments in automated production technologies, and streamlining of supply chains.

These initiatives aim to enhance scalability, improve profit margins, and support the sustainable commercialization of RNAi therapies across broader patient populations.

Market Trend

"Expansion Beyond Hepatic Targets"

The RNAi Therapeutics market is witnessing a significant trend marked by the expansion of RNAi applications beyond hepatic targets, with a growing focus on pulmonary indications. Historically, RNAi drugs have predominantly targeted liver diseases due to the organ's natural affinity for RNA-based molecules.

However, recent innovations in delivery technologies are enabling more effective targeting of extrahepatic tissues, particularly the lungs. Advanced delivery platforms such as aerosolized formulations, ligand-targeted nanoparticles, and intranasal administration methods are improving the uptake and stability of RNAi agents in lung tissue.

This progress is opening new therapeutic possibilities for treating respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), pulmonary fibrosis, and even lung infections.

Efficient delivery of RNAi therapeutics to the lungs has emerged as a key focus in research and development, aiding market growth and expanding clinical applications across diverse respiratory conditions.

- In April 2023, scientists at UMass Chan Medical School announced a breakthrough in siRNA delivery through intranasal administration. The study, published in The Proceedings of the National Academy of Sciences, demonstrated that multimeric siRNA molecules can be effectively delivered to lung tissue, enabling safe and robust gene silencing.

RNAi Therapeutics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

siRNA (Chemically synthesized siRNA, Biologically derived siRNA), shRNA (Vector-based shRNA, Plasmid-based shRNA), miRNA (microRNA)(miRNA mimics, miRNA inhibitors)

|

|

By Route of Administration

|

Intravenous (IV)(Hospital IV infusions, Home-based IV therapy), Subcutaneous (Self-injection, Nurse-administered), Others

|

|

By Application

|

Genetic Disorders (Hereditary Transthyretin Amyloidosis (hATTR), Acute Hepatic Porphyria, Hemophilia), Oncology (Liver Cancer (Hepatocellular carcinoma), Breast Cancer, Others), Infectious Diseases (Hepatitis B, HIV/AIDS, COVID-19/Influenza) , Cardiovascular Diseases, Others

|

|

By End User

|

Hospitals & Clinics, Research & Academic Institutes, Pharma & Biotech Companies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (siRNA, shRNA, and miRNA (microRNA)): The siRNA segment earned USD 1,078.7 million in 2023 due to its advanced clinical pipeline, favorable regulatory approvals, and growing use in targeting specific gene expressions in rare and chronic diseases.

- By Route of Administration (Intravenous (IV), Subcutaneous, and Other): The intravenous (IV) held a share of 55.09% in 2023, attributed to its high bioavailability and widespread adoption in clinical trials for RNAi-based therapeutics.

- By Application (Genetic Disorders, Oncology, Infectious Diseases, and Cardiovascular Diseases): The oncology segment is projected to reach USD 1,489.7 million by 2031, fueled by the increasing prevalence of cancer and the growing adoption of RNAi therapies for tumor-specific gene silencing.

- By End User (Hospitals & Clinics, Research & Academic Institutes, and Pharma & Biotech Companies): The hospitals & clinics segment is projected to reach USD 2,189.6 million by 2031, propelled by the rising number of RNAi-based treatment administrations and increased integration of gene-silencing therapies into clinical care.

RNAi Therapeutics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America RNAi therapeutics market share stood at around 37.25% in 2023, valued at USD 617.3 million. This dominance is primarily attributed to the presence of leading biopharmaceutical companies, robust research infrastructure, and strong funding support for RNA-based drug development.

Additionally, the regional market benefits from early adoption of advanced therapeutic technologies, a favorable regulatory environment led by the FDA, and rising prevalence of chronic and genetic diseases, all of which have accelerated clinical trials and commercialization of RNAi therapies.

Strategic collaborations, substantial healthcare spending, and a growing number of FDA-approved RNAi drugs further support regional market expansion.

- In March 2025, Alnylam Pharmaceuticals, Inc. announced FDA approval of Qfitlia (fitusiran). Qfitlia is the first and only siRNA-based treatment approved for routine prophylaxis to prevent or reduce bleeding episodes in patients aged 12 and older with hemophilia A or B, with or without inhibitors, by lowering antithrombin levels to support thrombin generation and restore hemostatic balance.

Asia Pacific RNAi therapeutics industry is poised to grow at a CAGR of 15.24% over the forecast period. This notable growth is stimulated by increasing investments in biotechnology research, rising awareness of precision medicine, and a growing patient population affected by cancer and genetic disorders.

Countries such as China, Japan, and India are enhancing their capabilities in RNA-based therapeutics through government initiatives, strategic collaborations, and improved healthcare infrastructure, positioning the region as a key hub for RNAi innovations.

The regional market further benefits from lower clinical trial costs, growing pharmaceutical manufacturing, and expanding academic research focused on RNA technologies.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates RNAi therapeutics under the framework for new drug applications (NDAs) and investigational new drugs (INDs), primarily through its Center for Drug Evaluation and Research (CDER).

- In Europe, the European Medicines Agency (EMA) regulates RNAi therapeutics through the Committee for Medicinal Products for Human Use (CHMP). Products are assessed under the centralized procedure, which is mandatory for advanced therapies, including RNA-based drugs. EMA provides guidance specific to gene-silencing agents and requires a comprehensive evaluation of quality, efficacy, and safety in accordance with EU regulations.

Competitive Landscape

The RNAi therapeutics industry is characterized by intense innovation-driven competition, with key players actively engaging in strategic collaborations, licensing agreements, and joint ventures to expand therapeutic pipelines and access advanced RNAi technologies.

Companies are increasingly prioritizing in-licensing of novel RNAi candidates and partnering with research institutions to accelerate early-stage development. A key focus is on long-term alliances with delivery technology providers to enhance tissue-specific targeting and improve the safety and efficacy profiles of RNAi therapies.

Additionally, players are investing significantly in expanding their manufacturing capabilities, particularly for lipid nanoparticles and other delivery systems critical for RNAi drug formulation.

Companies are further implementing regional expansion strategies by establishing clinical trial sites and research hubs in emerging markets to capitalize on lower operational costs and untapped patient pools

- In July 2023, Alnylam Pharmaceuticals, Inc. and Roche announced a strategic collaboration to jointly develop and commercialize Zilebesiran, an investigational RNAi therapeutic designed for the treatment of hypertension in patients with elevated cardiovascular risk. This partnership leverages Alnylam’s scientific leadership in RNAi-based drug development and Roche’s global capabilities in clinical advancement and market execution.

List of Key Companies in RNAi Therapeutics Market:

- Eli Lilly and Company

- Takeda Pharmaceutical Company Limited

- Alnylam Pharmaceuticals, Inc.

- F. Hoffmann-La Roche

- Regeneron Pharmaceuticals Inc.

- Wave Life Sciences

- Aro Biotherapeutics Company

- Amgen Inc.

- Sanofi

- Eleven Tx

- Arrowhead Pharmaceuticals, Inc.

- GSK plc

- Novo Nordisk A/S

- Silence Therapeutics

- Sirnaomics, Inc.

Recent Developments (Partnerships)

- In January 2025, City Therapeutics, Inc. entered into a strategic collaboration with Bausch + Lomb to develop a novel RNAi-based therapy for retinal diseases, including geographic atrophy, an advanced form of age-related macular degeneration. The partnership aims to leverage City Therapeutics' next-generation RNAi engineering technologies for intravitreal administration.