Market Definition

RNA analysis is the process of studying ribonucleic acid (RNA) molecules to understand gene expression, regulation, and cellular function. It involves the identification, quantification, and sequencing of various RNA types, including messenger RNA (mRNA), microRNA (miRNA), and long non-coding RNA (lncRNA).

The primary goal is to determine which genes are active in specific conditions, offering insights into biological processes, disease mechanisms, and therapeutic targets. Techniques such as quantitative real-time PCR (qPCR), RNA sequencing (RNA-Seq), and microarrays are commonly used in RNA analysis.

It plays a critical role in functional genomics, biomarker discovery, and drug development, and is increasingly applied in personalized medicine and clinical diagnostics to support precision treatment strategies.

RNA Analysis Market Overview

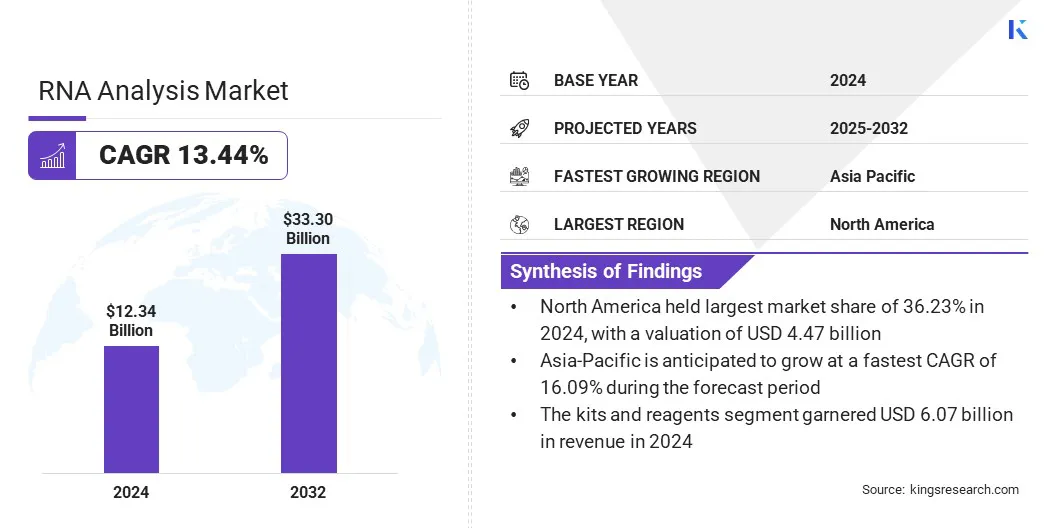

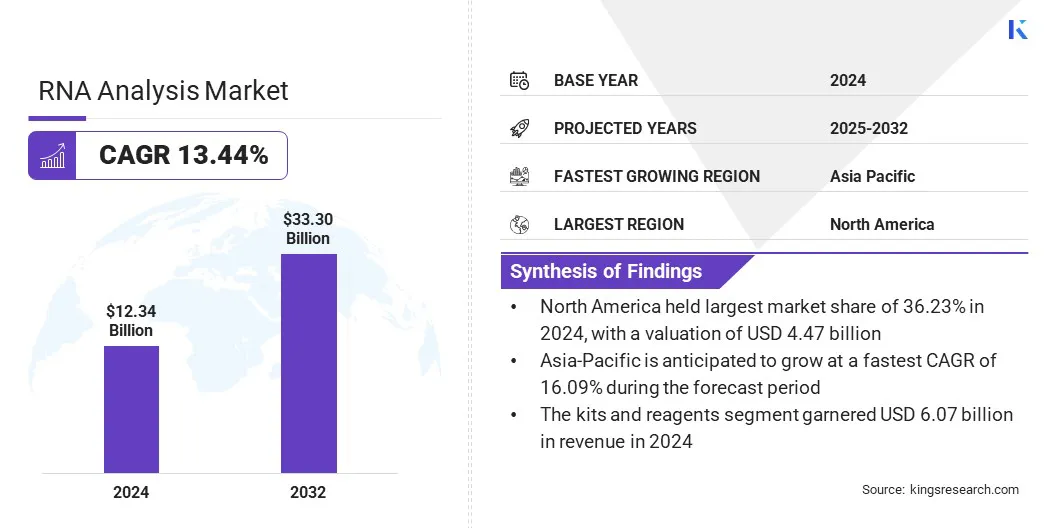

The global RNA analysis market size was valued at USD 12.34 billion in 2024 and is projected to grow from USD 13.77 billion in 2025 to USD 33.30 billion by 2032, exhibiting a CAGR of 13.44% during the forecast period.

The market growth is driven by the rising demand for personalized medicine and the growing use of transcriptomics in disease research. Advancements in RNA sequencing technologies and increased funding for genomics research further support market growth across pharmaceutical, academic, and clinical applications.

Key Market Highlights:

- The global RNA analysis industry size was recorded at USD 12.34 billion in 2024.

- The market is projected to grow at a CAGR of 13.44% from 2024 to 2032.

- North America held a market share of 36.23% in 2024, with a valuation of USD 4.47 billion.

- The kits & reagents segment garnered USD 6.07 billion in revenue in 2024.

- The RNA sequencing segment is expected to reach USD 17.00 billion by 2032.

- The drug discovery & development segment is projected to grow at a CAGR of 15.50% from 2024 to 2032.

- The academic & government research institutes segment recorded a market share of 40.00% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 16.09% over the forecast period.

Major companies operating in the RNA analysis market are Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., QIAGEN, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc, Merck KGaA, PerkinElmer, Promega Corporation., Eurofins Scientific, Azenta US, Inc., BGI, Takara Bio Inc., Zymo Research Corporation., and Lexogen GmbH.

Growing emphasis on therapeutic innovation is accelerating demand for RNA analysis technologies in the pharmaceutical and biotechnology sectors. RNA-based methods enable more precise target identification, support early-stage screening, and advance the development of next-generation therapies.

Enhanced transcriptomic profiling improves the understanding of disease mechanisms across oncology, neurology, and rare genetic disorders. Advancements in RNA sequencing and editing technologies are helping companies optimize discovery pipelines, reduce development cycles, and improve candidate selection.

Adoption of RNA analytics supports streamlined R&D workflows, lowers attrition rates, and drives faster, data-informed decisions throughout drug development.

- In November 2023, ShapeTX expanded its collaboration with Roche by adding a new disease target program. The new program will utilize ShapeTX’s proprietary AI-driven RNA editing platform to develop a potential one-time therapy for a high-burden disease affecting millions of patients globally.

Market Driver

Growing Demand for Personalized Medicine

Rising demand for personalized medicine is driving increased adoption of RNA analysis in clinical and research settings. Healthcare providers are relying on RNA-based methods to detect gene expression changes and identify patient-specific biomarkers that support customized treatment decisions.

Precision care is becoming a central focus, and RNA analysis enables more accurate diagnosis and improved therapeutic targeting. The ability to match treatments to individual genetic profiles is helping clinicians optimize outcomes while reducing trial-and-error approaches.

This growing reliance on individualized care is expected to significantly expand the application of RNA analysis across healthcare systems, thereby driving sustained market demand.

- For instance, in June 2024, the National Institutes of Health (NIH), in collaboration with the U.S. National Science Foundation (NSF), announced a funding initiative of approximately USD 15.4 million over three years to support research into the structures, functions, and interactions of ribonucleic acid (RNA). This initiative also includes the development of advanced RNA-based technologies.

Market Challenge

High Cost and Operational Complexity

A key challenge in the RNA analysis market is the high cost and operational complexity associated with advanced sequencing technologies. Conducting accurate and reproducible RNA analysis requires specialized instruments, extensive sample preparation, and skilled personnel, which can strain budgets and infrastructure, especially in smaller labs. Data processing and interpretation add another layer of technical demand, often requiring sophisticated bioinformatics support.

To address this challenge, companies are developing cost-effective platforms and streamlined workflows that reduce hands-on time and minimize the need for advanced technical training. They are also integrating AI-driven analytics to simplify data interpretation and expand accessibility across research and clinical settings.

Market Trend

Growing Adoption of Single-Cell and Spatial Transcriptomics

A key trend in the market is the growing adoption of single-cell and spatial transcriptomics for high-resolution gene expression studies. Researchers are increasingly focused on understanding cell-to-cell variability and uncovering how individual cells contribute to complex biological processes.

These advanced methods offer deeper insights into cell heterogeneity, which is critical for disease research, drug development, and precision medicine. Moreover, the demand is rising for tools that can map RNA activity in specific cells and tissue regions, helping scientists pinpoint molecular changes that standard bulk RNA techniques often overlook.

This shift toward single-cell analysis is reshaping RNA research priorities and accelerating innovation across biomedical and clinical applications.

- In November 2024, Caris Life Sciences announced that the U.S. Food and Drug Administration (FDA) approved MI Cancer Seek as a companion diagnostic (CDx) to identify cancer patients eligible for targeted therapies. This assay is the first and only FDA-approved diagnostic that combines Whole Exome Sequencing (WES) and Whole Transcriptome Sequencing (WTS) for molecular profiling of solid tumors.

RNA Analysis Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product & Service

|

Kits & Reagents, Instruments, Services

|

|

By Technology

|

Quantitative Real-Time PCR, RNA Sequencing, Microarray, Others

|

|

By Application

|

Infectious Diseases & Pathogenesis, Epigenetics, Drug Discovery & Development, Functional Genomics, Others

|

|

By End-User

|

Academic & Government Research Institutes, Pharmaceutical & Biotechnology Companies, Contract Research Organizations, Hospitals & Diagnostic Laboratories

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product & Service (Kits & Reagents, Instruments, Services): The kits & reagents segment earned USD 6.07 billion in 2024 due to the rising demand for rapid, high-throughput RNA profiling tools in clinical diagnostics and academic research settings.

- By Technology (Quantitative Real-Time PCR, RNA Sequencing, Microarray, and Others): The RNA sequencing segment held 43.23% of the market in 2024, due to its ability to deliver high-throughput, unbiased, and detailed gene expression data, supporting advanced research in oncology, neurology, and personalized medicine.

- By Application (Infectious Diseases & Pathogenesis, Epigenetics, Drug Discovery & Development, Functional Genomics, and Others): The drug discovery & development segment is projected to reach USD 15.30 billion by 2032, owing to the growing reliance on RNA analysis for identifying therapeutic targets, validating biomarkers, and accelerating the development of precision-targeted treatments across oncology, neurology, and rare diseases.

- By End-User (Academic & Government Research Institutes, Pharmaceutical & Biotechnology Companies, Contract Research Organizations, and Hospitals & Diagnostic Laboratories): The pharmaceutical & biotechnology companies segment held 35.74% of the market in 2032, due to increasing adoption of RNA analysis tools to support advanced therapeutic development, biomarker discovery, and personalized medicine strategies across preclinical and clinical research pipelines.

RNA Analysis Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America RNA analysis market share stood at 36.23% in 2024 in the global market, with a valuation of USD 4.47 billion. The market growth in the region is driven by established research infrastructure, sustained investments in genomics, and a strong focus on precision medicine.

The region benefits from significant funding support from government bodies and private entities aimed at advancing RNA-based diagnostics and therapeutics. Leading pharmaceutical and biotechnology companies in the U.S. and Canada are actively deploying RNA analysis platforms to accelerate drug discovery pipelines and improve biomarker identification.

The widespread integration of RNA sequencing technologies across academic, clinical, and commercial settings is enhancing the region’s research and diagnostic capabilities.

In addition, favorable regulatory frameworks and reimbursement structures are supporting the commercialization of RNA-based assays. Continued advancements in high-throughput sequencing and bioinformatics are expected to fuel market growth over the forecast period.

Asia-Pacific is poised for significant growth at a robust CAGR of 16.09% over the forecast period. The growth is supported by rising government initiatives and institutional investments aimed at advancing RNA-based research and diagnostics across the Asia-Pacific region.

Countries such as Australia, China, and South Korea are actively funding RNA-focused research centers and infrastructure, which is strengthening regional capabilities in transcriptomics, RNA sequencing, and mRNA therapeutics. This is enabling academic institutions and biotechnology firms to pursue high-throughput RNA sequencing projects and develop precision medicine solutions.

- In March 2024, the Government of Australia awarded a grant of AUD 40 million (USD 26 Million) to the UNSW RNA Institute to support the development of RNA-based vaccines and therapeutics. The funding aims to strengthen Australia’s sovereign capabilities in RNA research, manufacturing, and translational science, positioning the country as a competitive player in the global RNA innovation landscape.

Regulatory Frameworks

- In the U.S., RNA analysis tools and therapeutics are regulated by the Food and Drug Administration (FDA) under the Federal Food, Drug, and Cosmetic Act. Diagnostic platforms based on RNA technologies require either 510(k) clearance or Premarket Approval (PMA), depending on their classification. RNA therapeutics, including mRNA vaccines and RNA interference (RNAi) products, must undergo Investigational New Drug (IND) applications and subsequent Biologics License Applications (BLAs). Oversight is also provided by the Center for Biologics Evaluation and Research (CBER), ensuring safety, efficacy, and consistency in clinical development and commercial use.

- The European Union governs RNA-based diagnostics and therapeutics through the In Vitro Diagnostic Regulation (IVDR) and Regulation (EC) No. 726/2004. The European Medicines Agency (EMA) and the European Commission assess RNA therapeutics, requiring centralized marketing authorization procedures. Diagnostic products based on RNA technologies must meet the stringent requirements of IVDR, including performance evaluation, clinical evidence, and post-market surveillance. Developers must also comply with General Data Protection Regulation (GDPR) provisions concerning patient data privacy.

- In China, the National Medical Products Administration (NMPA) regulates RNA-based medical products, including diagnostics and therapeutics. RNA therapies are reviewed under the Drug Registration Regulation and must demonstrate safety, pharmacokinetics, and efficacy in preclinical and clinical trials. RNA diagnostic products fall under the Medical Device Regulation, requiring classification, clinical performance data, and local type testing. Both domestic and foreign manufacturers must meet strict submission protocols and are subject to periodic inspections and batch release requirements.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) and the Ministry of Health, Labour and Welfare (MHLW) regulate RNA-based technologies under the Pharmaceutical and Medical Device Act (PMD Act). RNA drugs and diagnostics require detailed clinical and quality documentation and are evaluated through priority review schemes if they address serious or rare diseases. Safety, quality, and efficacy are assessed during pre-market and post-market phases, and regulatory frameworks are continuously updated to reflect advancements in RNA science and therapeutic applications.

Competitive Landscape

The global RNA analysis market is characterized by a large number of participants, including established corporations and rising organizations. Major players in the market are focusing on platform innovation, AI integration, and strategic partnerships to advance the precision and scalability of RNA-based research and therapeutics.

Companies are investing in proprietary RNA sequencing technologies, bioinformatics pipelines, and synthetic biology tools to enable faster, more accurate analysis of transcriptomic data. Moreover, market players are collaborating with pharmaceutical firms and academic institutions to accelerate the development of RNA-targeting therapies and diagnostics.

- In June 2024, Illumina launched DRAGEN v4.3, the latest version of its DRAGEN software, as part of the Illumina Connected Software portfolio. This update enhances RNA analysis capabilities in next-generation sequencing workflows, offering improved accuracy and speed for transcriptomic profiling and RNA-based biomarker detection across research and clinical applications.

Key Companies in RNA Analysis Market:

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- QIAGEN

- Hoffmann-La Roche Ltd

- Bio-Rad Laboratories, Inc

- Merck KGaA

- PerkinElmer

- Promega Corporation.

- Eurofins Scientific

- Azenta US, Inc.

- BGI

- Takara Bio Inc.

- Zymo Research Corporation.

- Lexogen GmbH

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In June 2025, Ethris GmbH announced a strategic collaboration with Thermo Fisher Scientific to deliver a fully integrated mRNA solution for biopharmaceutical developers. This aims to streamline RNA production and accelerate the development of mRNA-based therapies by combining Ethris’ RNA platform with Thermo Fisher’s manufacturing and analytical capabilities.

- In June 2025, QIAGEN and GENCURIX, Inc. formed a strategic partnership to co-develop oncology assays for the QIAcuityDx platform, QIAGEN’s high-performance digital PCR system tailored for clinical diagnostics. This collaboration is expected to enhance precision in RNA-based cancer detection by integrating GENCURIX’s assay expertise with QIAGEN’s advanced digital PCR technology, supporting the expansion of molecular diagnostics applications in oncology.

- In June 2024, Bio-Rad Laboratories, Inc. launched the ddSEQ Single-Cell 3' RNA-Seq Kit along with the Omnition v1.1 analysis software. This new offering is designed to advance single-cell transcriptome and gene expression research by enabling high-resolution RNA analysis at the single-cell level.

- In May 2025, Azenta, Inc. entered a strategic partnership between GENEWIZ and Form Bio to advance adeno-associated virus (AAV) gene therapy development. The partnership integrates GENEWIZ’s multiomics sequencing capabilities with Form Bio’s AI-driven data analysis platform, offering a streamlined solution for RNA and viral genome analysis in therapeutic development.

- In May 2024, QIAGEN launched the QIAseq Multimodal DNA/RNA Library Kit, enabling integrated preparation of DNA and RNA libraries from a single sample for applications such as whole genome sequencing (WGS) and whole transcriptome sequencing (WTS). The product supports hybrid-capture enrichment workflows, streamlining next-generation sequencing (NGS) for comprehensive RNA analysis and enhancing efficiency in multi-omic research.