Market Definition

Risk based inspection (RBI) is a systematic approach used to assess the likelihood and potential impact of equipment failure in industrial settings. It prioritizes inspections based on risk levels rather than fixed intervals, improving safety, reliability, and cost efficiency.

By integrating data on equipment condition, operational history, and failure probabilities, RBI optimizes maintenance planning and reduces unplanned downtime. Widely used in the oil & gas, power generation, and chemical industries, it supports regulatory compliance, asset integrity, and overall risk management strategies.

Risk Based Inspection Market Overview

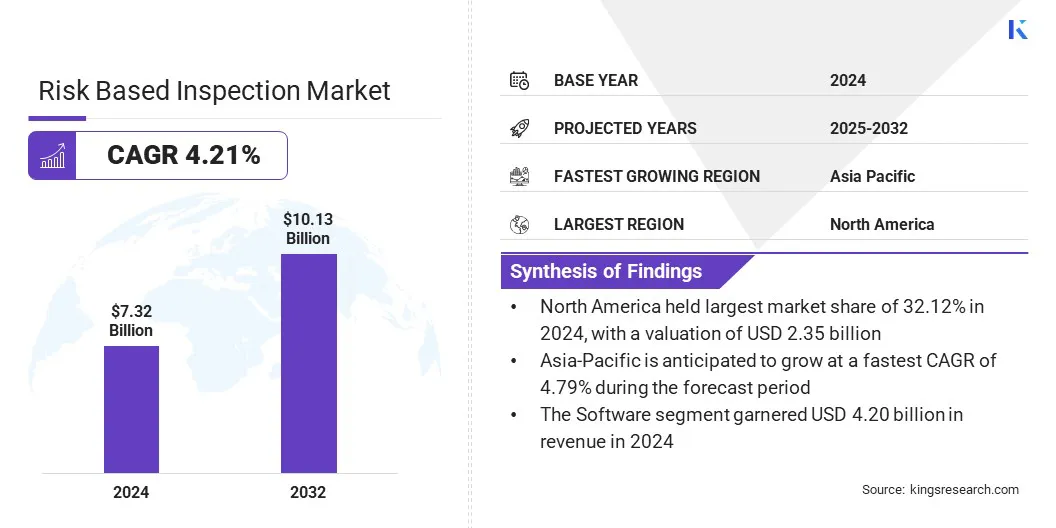

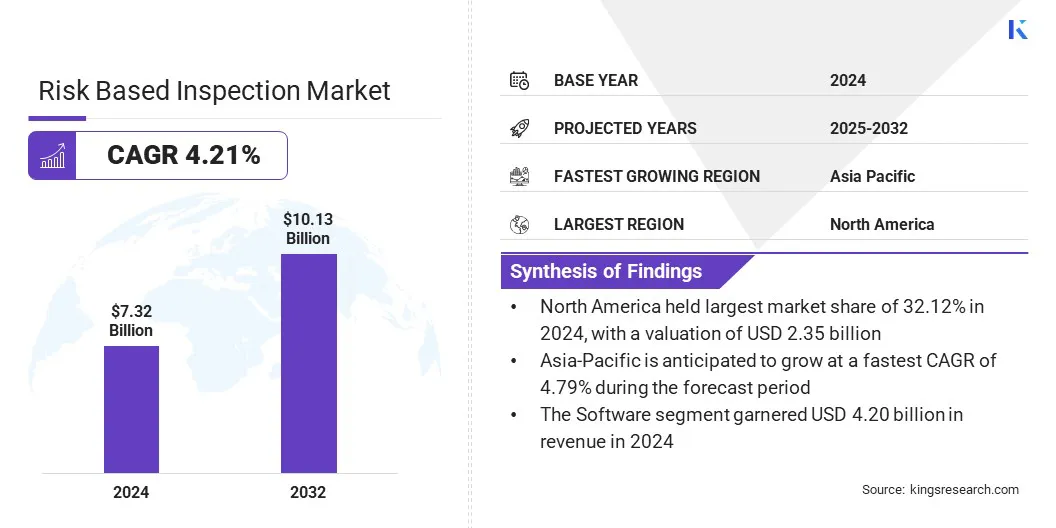

The global risk based inspection market size was valued at USD 7.32 billion in 2024 and is projected to grow from USD 7.59 billion in 2025 to USD 10.13 billion by 2032, exhibiting a CAGR of 4.21% during the forecast period. This growth is driven by the rising focus on predictive asset management, which demands advanced software and service-based risk-based inspection solutions to enhance equipment reliability and operational efficiency.

Moreover, the shift toward digital transformation in heavy industries is creating opportunities for integrated RBI platforms that support real-time risk assessment, compliance, and cost-effective maintenance strategies.

Key Highlights:

- The risk based inspection industry size was USD 7.32 billion in 2024.

- The market is projected to grow at a CAGR of 4.21% from 2025 to 2032.

- North America held a share of 32.12% in 2024, valued at USD 2.35 billion.

- The software technology segment garnered USD 4.20 billion in revenue in 2024.

- The power generation segment is expected to reach USD 2.46 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 4.79% over the forecast period.

Major companies operating in the global risk based inspection market are SAP SE, TÜV SÜD, Interek Group plc, SGS Société Générale de Surveillance SA., Metegrity Inc., MISTRAS Group, GE Vernova, TCR Advanced Engineering Private Limited, Velosi Asset Integrity Ltd, Equity Engineering Group, Steinbeis Advanced Risk Technologies, Keel Solution, Industrial Support Services Co.Ltd., Asset Optimization Consultants, Inc., and AccurDigital.

Risk-based inspection (RBI) solutions are gaining traction across asset-heavy sectors such as oil & gas, chemicals, and power generation. Organizations are leveraging RBI software to prioritize inspections based on asset condition, probability of failure, and potential consequences. This approach enables more strategic allocation of resources, reduced inspection frequency, and lower maintenance costs—without compromising safety or compliance.

Large enterprises are integrating RBI with digital twins, sensors, and AI-driven analytics to enhance predictive maintenance, extend equipment life, minimize unplanned downtime, and ensure regulatory adherence in complex industrial environments.

Market Driver

Rising Regulatory Pressure and Digital Transformation

Rising adoption of risk-based inspection (RBI) strategies is being driven by increasing regulatory pressure and the growing need to optimize asset integrity across aging infrastructure. Asset-intensive industries such as oil & gas, power generation, and chemicals are turning to RBI to prioritize inspections based on risk profiles, minimizing unplanned downtime while maintaining safety compliance.

Organizations are leveraging RBI to extend equipment life, improve resource allocation, and reduce maintenance costs. The ability of RBI to combine historical data, failure probabilities, and consequence modeling is enabling smarter inspection planning.

As digital transformation accelerates, RBI frameworks are increasingly integrated with digital twins and AI-powered analytics, unlocking more predictive and data-driven maintenance models, thereby further contributing to market demand.

Market Challenge

Data Quality and Reliability Issues Undermining Risk Accuracy

A key challenge hindering the expansion of the risk based inspection (RBI) market is ensuring the accuracy and reliability of data used to evaluate asset risk. RBI programs rely heavily on high-quality, real-time data inputs, including corrosion rates, operational history, and environmental conditions, to generate accurate risk models. Incomplete, outdated, or inconsistent data can lead to flawed risk prioritization, increasing the likelihood of unplanned failures and safety incidents.

To address this challenge, companies are adopting advanced data acquisition technologies such as sensor-based monitoring, drones, and digital twins. These tools enhance data precision and support continuous risk evaluation, enabling optimized inspection intervals and maintaining regulatory compliance.

Market Trend

Integration of Predictive Analytics and Digital Twin Technology

The growing incorporation of digital twin technology and AI-driven predictive analytics is reshaping risk-based inspection by enabling more dynamic and data-centric inspection processes. These technologies reduce reliance on fixed inspection schedules by providing real-time monitoring and advanced simulations that improve accuracy in assessing asset health and degradation.

Compared to traditional inspection methods, digital twin and predictive analytics offer substantial benefits for asset-heavy industries like oil & gas, chemicals, and power generation, where minimizing unplanned downtime and ensuring safety are critical. This approach supports optimized maintenance planning, aligns with evolving regulatory requirements, and facilitates smoother transitions to digital infrastructure.

Furthermore, ongoing improvements in sensor integration, AI algorithms, and simulation fidelity are driving enhanced predictive capabilities, operational efficiency, and regulatory compliance across diverse industrial sectors.

Risk Based Inspection Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software, Services.

|

|

By End-Use Industry

|

Oil & Gas, Power Generation, Chemicals & Petrochemicals, Aerospace & Defense, Others.

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Software and Services): The services segment earned USD 3.12 billion in 2024, mainly due to growing demand for customized inspection planning and ongoing support for implementing and maintaining RBI programs across complex industrial assets.

- By End-Use Industry (Oil & Gas, Power Generation, Chemicals & Petrochemicals, Aerospace & Defense, and Others): The oil & gas segment held a share of 52.34% in 2024, attributed to the industry's high reliance on risk-based inspection to manage aging infrastructure and comply with stringent safety and environmental regulations.

Risk Based Inspection Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America risk based inspection market share stood at 32.12% in 2024, valued at USD 2.35 billion. This dominance is reinforced by mature industries such as oil & gas, chemicals, and power generation, supported by stringent regulations from agencies such as OSHA and the EPA. These frameworks prompt operators to adopt advanced RBI strategies for risk mitigation and compliance.

The regional market further benefits from early adoption of digital inspection tools, including AI-integrated software and predictive analytics. Major players in the U.S. and Canada are investing in RBI technologies to optimize asset performance and reduce maintenance costs across critical infrastructure.

The Asia-Pacific risk based inspection industry is set to grow at a CAGR of 4.79% over the forecast period. This growth is supported by rapid industrialization and increasing investment in refining, petrochemical, and power generation infrastructure. Countries such as China, India, and South Korea are adopting RBI frameworks to improve plant reliability and safety while minimizing downtime.

The region's growing focus on operational efficiency, coupled with the rising need for asset integrity in aging facilities, is creating a strong demand for RBI services and software. Government regulations mandating periodic inspections are further prompting industries to opt for risk-based maintenance approaches.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA) mandate the use of risk-based approaches under the Process Safety Management (PSM) and Risk Management Plan (RMP) regulations. The American Petroleum Institute’s API 580 and 581 standards provide core guidance for RBI programs in the oil & gas, chemicals, and power sectors.

- In the EU, risk-based inspection aligns with the European Pressure Equipment Directive (PED) and the Seveso III Directive, requiring systematic risk assessments for hazardous industrial assets.

- In Asia-Pacific, regulatory maturity varies. China has strengthened industrial safety through policies under the State Administration for Market Regulation (SAMR), driving predictive inspection strategies following major accidents. India and South Korea are progressively aligning with API 580/581, particularly in oil & gas and petrochemicals.

- In Japan, the Ministry of Economy, Trade and Industry (METI) and Japan Industrial Standards (JIS) guide RBI practices in critical infrastructure, with growing emphasis on digitized inspection systems and lifecycle integrity management.

- Globally, organizations such as the ISO and API continue to advance RBI standards, fostering harmonization across industries. Multinational firms advocate unified frameworks to enhance safety, ensure compliance, and standardize inspection protocols across borders.

Competitive Landscape

Major players operating in the risk-based inspection industry are leveraging long-standing client relationships in the oil & gas, chemicals, and power sectors, supported by strong brand credibility and global networks. They are prioritizing strategic product development, digital integration, and industry partnerships to enhance asset integrity management.

By investing in advanced software platforms that incorporate AI, digital twins, and predictive analytics, companies are enabling clients to optimize inspection intervals and reduce unplanned downtime.

Service providers are also tailoring RBI solutions to meet sector-specific compliance standards, particularly in oil & gas and chemicals. These initiatives reflect a broader industry shift toward data-driven decision-making, cost optimization, and regulatory alignment across high-risk infrastructure environments.

Key Companies in Risk Based Inspection Market:

- SAP SE

- TÜV SÜD

- Interek Group plc

- SGS Société Générale de Surveillance SA.

- Metegrity Inc.

- MISTRAS Group

- GE Vernova

- TCR Advanced Engineering Private Limited

- Velosi Asset Integrity Ltd

- Equity Engineering Group

- Steinbeis Advanced Risk Technologies

- Keel Solution

- Industrial Support Services Co.Ltd.

- Asset Optimization Consultants, Inc.

- AccurDigital