Market Definition

The market encompasses a broad range of components essential for wireless communication, signal processing, and high-frequency applications across various industries, including telecommunications, consumer electronics, automotive, aerospace, and defense.

Key components include RF filters, power amplifiers, switches, mixers, multipliers, oscillators, synthesizers, and antennas, ensuring efficient signal transmission and reception. The report highlights critical factors fueling market development, while also offering a detailed regional analysis and an overview of the competitive landscape shaping future opportunities

RF Semiconductor Market Overview

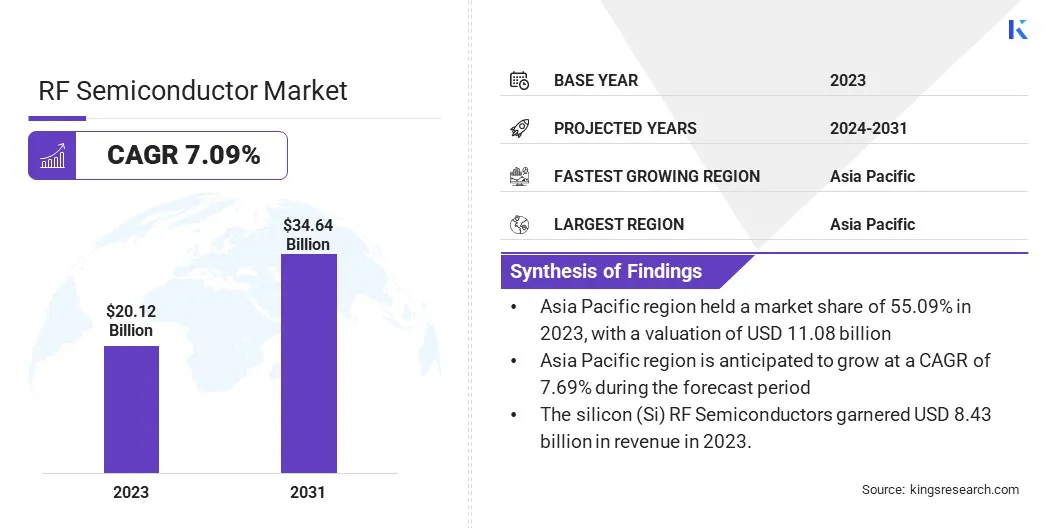

The global RF semiconductor market size was valued at USD 20.12 billion in 2023 and is projected to grow from USD 21.44 billion in 2024 to USD 34.64 billion by 2031, exhibiting a CAGR of 7.09% during the forecast period.

Market growth is driven by advancements in wireless communication technologies, increasing demand for high-speed connectivity, and the proliferation of connected devices. The widespread deployment of 5G networks has significantly accelerated the need for high-performance RF components, enabling faster data transmission, lower latency, and enhanced network efficiency.

Major companies operating in the RF semiconductor industry are Renesas Electronics Corporation., Qualcomm Technologies, Inc., Samsung, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION, Panasonic Industry Co., Ltd., Skyworks Solutions, Inc., Infineon Technologies AG, MACOM, Analog Devices, Inc., Texas Instruments Incorporated, Murata Manufacturing Co., Ltd., Broadcom, NXP Semiconductors, Wolfspeed, Inc., Qorvo, Inc., and others.

Technological advancements, including the adoption of GaN-based RF semiconductors and AI-driven RF optimization, are reshaping the industry by improving power efficiency, signal integrity, and system performance. With growing demand for seamless, high-speed connectivity across sectors, the market is set to witness sustained expansion, fueled by ongoing innovations in next-generation wireless communication solutions.

- In April 2024, Guerrilla RF, Inc. completed the acquisition of Gallium Semiconductor’s entire portfolio of front-end modules, GaN power amplifiers, and related intellectual property. The acquisition is intended to enhance Guerrilla RF’s capabilities in developing and commercializing advanced GaN devices for wireless infrastructure, military, and satellite communications applications.

Key Highlights:

- The RF semiconductor industry size was recorded at USD 20.12 billion in 2023.

- The market is projected to grow at a CAGR of 7.09% from 2024 to 2031.

- Asia Pacific held a share of 55.09% in 2023, valued at USD 11.08 billion.

- The RF filters segment garnered USD 6.54 billion in revenue in 2023.

- The silicon (Si) RF semiconductors segment is expected to reach USD 14.80 billion by 2031.

- The telecommunications & 5G infrastructure segment is estimated to generate a revenue of USD 13.95 billion by 2031.

- Europe is anticipated to grow at a CAGR of 6.40% over the forecast period.

Market Driver

Expansion of 5G Networks

The growth of market is propelled by the global expansion of 5G networks. This rollout demands advanced RF components to support higher frequency bands, increased data rates, and lower latency.

The adoption of millimeter-wave (mmWave) technology and massive MIMO antennas in 5G networks has further intensified the need for high-performance RF filters, switches, and power amplifiers. Additionally, as 5G coverage extends to rural and industrial areas, the demand for robust RF semiconductor solutions in small cells, base stations, and mobile devices continues to grow, fostering innovation and market expansion.

- In March 2025, the Government of India announced that approximately 250 million mobile subscribers had adopted 5G services since launch, with 469,000 5G BTSs (base transceiver stations) installed nationwide, highlighting the steady growth of 5G infrastructure.

Market Challenge

Supply Chain Volatility and Semiconductor Shortages

The RF semiconductor market faces major challenges due to supply chain volatility and semiconductor shortages, disrupting production and delaying critical component deployment. Factors such as geopolitical tensions, trade restrictions, and fluctuating raw material availability have led to supply constraints, affecting industries such as telecommunications, automotive, and aerospace.

To address these challenges, companies are diversifying supply chain diversification and increasing domestic semiconductor manufacturing. They are further investing in new fabrication facilities, securing long-term supplier agreements, and leveraging government-backed initiatives to strengthen local production capabilities.

Market Trend

Integration of AI for RF Performance Enhancement

The market is witnessing a significant shift toward AI-driven optimization, which is revolutionizing RF performance in wireless communication systems. The integration of AI for RF performance enhancement is enabling advanced signal processing, dynamic spectrum management, and improved power efficiency.

AI algorithms are increasingly being used for real-time RF tuning, predictive maintenance, and adaptive beamforming, ensuring more efficient and reliable wireless connectivity. This trend is crucial for the advancement of 5G networks, IoT devices, and next-generation satellite communications, where high-speed, low latency data transmission is critical.

As AI advances, its role in RF semiconductor development is expected to grow, supporting more intelligent and adaptive wireless communication solutions.

- In February 2024, Qualcomm Technologies, Inc. launched the Snapdragon X80 5G Modem-RF System, its most advanced modem-to-antenna platform. Featuring AI-powered enhancements, the system enhances spectrum efficiency, power consumption, and performance. Built on a 5G-Advanced-ready architecture, it supports a wide range of applications, including smartphones, mobile broadband, XR, PCs, automotive, private networks, industrial IoT, and fixed wireless access.

RF Semiconductor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component Type

|

RF Filters, RF Power Amplifiers, RF Switches, RF Mixers & Multipliers, RF Oscillators & Synthesizers, RF Antennas, Other RF Components

|

|

By Material Type

|

Silicon (Si) RF Semiconductors, Gallium Arsenide (GaAs) RF Semiconductors, Silicon Germanium (SiGe) RF Semiconductors, Gallium Nitride (GaN) RF Semiconductors

|

|

By Application

|

Telecommunications & 5G Infrastructure, Consumer Electronics, Automotive & Transportation, Aerospace & Defense, Industrial & IoT

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component Type (RF Filters, RF Power Amplifiers, RF Switches, RF Mixers & Multipliers, and RF Oscillators & Synthesizers, RF Antennas, and Other RF Components): The RF filters segment earned USD 6.54 billion in 2023 due to the increasing deployment of 5G networks and the rising demand for advanced filtering solutions to enhance signal quality and reduce interference.

- By Material Type (Silicon (Si) RF Semiconductors, Gallium Arsenide (GaAs) RF Semiconductors, Silicon Germanium (SiGe) RF Semiconductors, and Gallium Nitride (GaN) RF Semiconductors): The silicon (Si) RF semiconductors held a share of 41.89% in 2023, attribuited to their cost-effectiveness, high integration capabilities, and widespread use in consumer electronics and wireless communication devices.

- By Application (Telecommunications & 5G Infrastructure, Consumer Electronics, Automotive & Transportation, and Aerospace & Defense): The telecommunications & 5G infrastructure segment is projected to reach USD 13.95 billion by 2031, as a result of the rapid expansion of 5G networks, increased mobile data consumption, and growing investments in next-generation wireless technologies.

RF Semiconductor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific RF semiconductor market share stood at around 55.09% in 2023, valued at USD 11.08 billion. This leadership is supported by its well-established semiconductor manufacturing ecosystem, with major production hubs in China, Taiwan, South Korea, and Japan.

The rapid expansion of 5G infrastructure, rising adoption of consumer electronics, and increasing demand for RF components in automotive applications is significantly contributing to regional market growth. Additionally, government initiatives supporting domestic semiconductor production, coupled with the growing investments in satellite communication and defense applications, boosts regional market expansion.

- In March 2025, the Government of India reported a 99.6% district coverage in its 5G rollout, launched in October 2022. Telecom service providers have deployed 469000 5G Base transceiver stations (BTSs) nationwide, marking one of the fastest 5G expansions globally.

Europe RF semiconductor industry is poised to grow at a CAGR of 6.40% over the forecast period. This expansion is fostered by increasing investments in 5G deployment, automotive connectivity, and aerospace & defense applications. The regional market benefits from a strong presence of semiconductor manufacturers and technology companies focused on innovation in RF components, particularly in countries such as Germany, France, and the UK.

The rising demand for advanced driver-assistance systems (ADAS) and electric vehicles (EVs), which require high-performance RF semiconductors, is contributing to this growth. Additionally, government initiatives to strengthen the European semiconductor supply chain and reduce dependence on imports domestic support market expansion.

Regulatory Frameworks

- In Europe, RF semiconductors must comply with the Radio Equipment Directive (RED), which establishes essential requirements for electromagnetic compatibility (EMC), radio spectrum efficiency, and safety. The European Chemicals Agency (ECHA) enforces the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation, impacting semiconductor manufacturing materials.

- In India, the Ministry of Electronics and Information Technology (MeitY) regulates the electronics sector, including RF semiconductors. Although there is no dedicated regulatory framework for RF semiconductors, India follows international standards and agreements governing the export of dual-use technologies, including specific semiconductor devices.

Competitive Landscape

Companies operating in the RF semiconductor market are heavily investing in R&D to enhance RF component performance, focusing on power efficiency, miniaturization, and integration with advanced semiconductor materials such as GaN and SiGe. Mergers and acquisitions remain for portfolio expansion and technology access.

Strategic collaborations with telecommunications providers and device manufacturers are also rising, supporting the co-development of RF solutions for 5G infrastructure, automotive connectivity, and satellite communications.

Additionally, market players are enhancing manufacturing capabilities through new fabrication facilities and long-term supply agreements to mitigate semiconductor shortages and maintain steady production. A key focus is the shift toward highly integrated RF front-end modules for improved efficiency in mobile and IoT devices.

Companies are also adopting software-defined radio (SDR) technologies and artificial intelligence (AI)-driven design tools to accelerate innovation in RF semiconductors. Furthermore, government-backed localization efforts are influencing competitive strategies, prompting firms to diversify supply chains to reduce dependency on specific regions.

- In April 2024, QuantalRF introduced the QWX27105, a cutting-edge 5-7 GHz front-end IC and the first in its Elementum Wi-Fi 7 lineup. Featuring a compact CMOS SOI design, it outperforms GaAs and SiGe solutions while reducing power consumption by 50% in Wi-Fi 7 devices.

List of Key Companies in RF Semiconductor Market:

- Renesas Electronics Corporation.

- Qualcomm Technologies, Inc.

- Samsung

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- Panasonic Industry Co., Ltd.

- Skyworks Solutions, Inc.

- Infineon Technologies AG

- MACOM

- Analog Devices, Inc.

- Texas Instruments Incorporated

- Murata Manufacturing Co., Ltd.

- Broadcom

- NXP Semiconductors

- Wolfspeed, Inc.

- Qorvo, Inc

Recent Developments (Product Launch)

- In March 2025, pSemi Corporation, a Murata company specializing in RF SOI technology, introduced the PE562212, the world’s smallest integrated PA-LNA-SW IoT front-end module (FEM). Designed to support Thread and Matter connectivity protocols, the ultra-compact 2.4-GHz FEM offers a leading noise figure to enhance wireless range in IoT devices.