Reverse Logistics Market Size

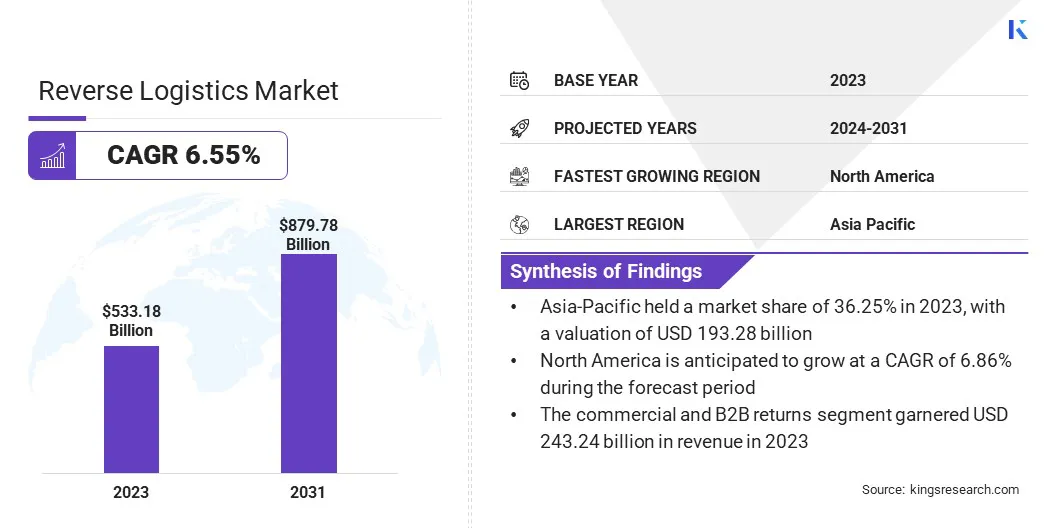

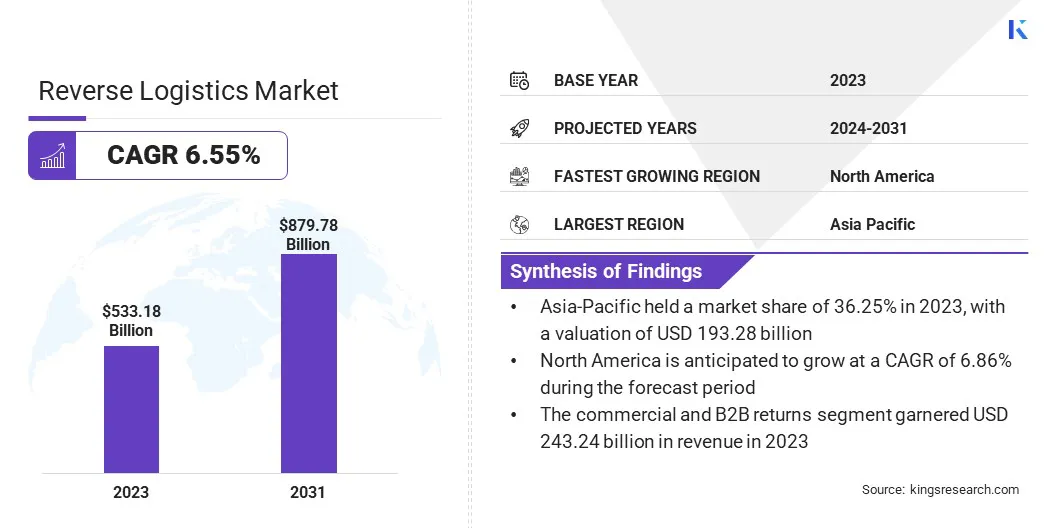

Global Reverse Logistics Market size was recorded at USD 533.18 billion in 2023, which is estimated to be at USD 564.47 billion in 2024 and projected to reach USD 879.78 billion by 2031, growing at a CAGR of 6.55% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as Blue Dart Express Limited, Core Logistic Private Limited., DHL International GmbH, FedEx, Kintetsu World Express, Inc, RLG Systems AG, United Parcel Service of America, Inc., DB SCHENKER, SAFEXPRESS, and YUSEN LOGISTICS CO., LTD., and others.

The expansion of the reverse logistics market is propelled by the increasing awareness among businesses regarding the environmental and economic benefits of efficient reverse logistics processes. This awareness is leading to a notable shift toward sustainable practices and circular economy models.

Additionally, the rise of e-commerce and online retailing is amplifying the need for effective reverse logistics to handle returns and manage inventory efficiently. Moreover, stringent regulations regarding waste management and recycling are prompting companies to adopt advanced reverse logistics solutions to comply with these mandates and reduce their environmental footprint.

The reverse logistics market encompasses a range of activities involved in handling product returns, recycling, and managing the reverse flow of goods in the supply chain. This market addresses challenges such as product recalls, returns due to defects or customer dissatisfaction, recycling of materials, and the optimization of processes to minimize costs and environmental impact. The market is witnessing steady growth globally, driven by increasing consumer expectations, regulatory pressures, and the imperative for businesses to enhance sustainability practices while managing operational efficiency.

Reverse logistics refers to the processes, systems, and strategies employed by businesses to manage the reverse flow of goods from consumers back to the manufacturer or point of origin. It encompasses activities such as product returns, refurbishment, recycling, and disposal. The primary goal of reverse logistics is to optimize the handling of returned products, reduce waste, recover value from returned items, and minimize environmental impact.

Analyst’s Review

Manufacturers are actively investing in sustainable reverse logistics practices and are focusing on efficient product returns and recycling. Furthermore, new product innovations, such as advanced tracking systems and automated sorting technologies, are reshaping the market landscape. Key efforts include enhancing collaboration among stakeholders and optimizing end-to-end reverse logistics processes. These initiatives are fueled by the dual objectives of reducing costs and minimizing environmental impact while meeting evolving consumer demands.

Reverse Logistics Market Growth Factors

The increasing emphasis on sustainability across diverse industries is a key factor fueling the growth of the reverse logistics market. Businesses are increasingly seeking ways to reduce waste and minimize their environmental impact. This is leading to the widespread adoption of reverse logistics strategies focused on refurbishment, recycling, and responsible disposal of products. Companies are investing heavily in innovative technologies and partnerships to streamline reverse logistics processes and maximize resource recovery.

Integration of sustainability goals into their reverse logistics operations impacts organizations by ensuring compliance with regulatory requirements, enhancing their brand reputation, and appealing to environmentally conscious consumers. The complexity of managing diverse product returns and disposition processes presents a key challenge to market development, prompting companies to implement advanced data analytics and automation technologies. Access to real-time data insights enables businesses to optimize routing decisions, prioritize returns based on factors such as condition and value, and streamline reverse logistics workflows.

Additionally, establishing clear communication channels with customers and providing transparent return policies helps mitigate returns-related issues. Collaborations with third-party logistics providers and recycling partners further enhances efficiency and reduces costs associated with managing product returns and other processes.

Reverse Logistics Market Trends

The increasing adoption of technologies such as artificial intelligence, machine learning, and blockchain is enhancing visibility, traceability, and efficiency in reverse logistics processes. These technologies enable real-time tracking of returned products, automate decision-making regarding their disposition, and facilitate seamless communication between stakeholders in the reverse supply chain. Utilizing technology enables resource recovery, reducs operational costs, and improves customer satisfaction through enhanced transparency and responsiveness in managing product returns and recycling activities.

- In April 2024, Holman Logistics announced the implementation of a new AI-enabled Warehouse Management Software (WMS) developed by Fulfilld. The Fulfilld WMS integrates data from multiple sources to improve warehouse productivity, user experience, and employee satisfaction. This development marked a significant advancement in leveraging technology to optimize warehouse operations and enhance overall efficiency.

The growing focus on omnichannel returns management is shaping the landscape of the reverse logistics market. The rise of omnichannel retailing is resulting in consumers expecting consistent and convenient methods to manage returns across all channels, including online, in-store, and mobile. Businesses are investing heavily in integrated returns management systems that enable seamless returns initiation, processing, and tracking across multiple channels.

This emphasizes the importance of aligning reverse logistics strategies with overall omnichannel fulfillment strategies to enhance customer loyalty, minimize returns-related costs, and drive operational efficiency in managing product returns and exchanges.

Segmentation Analysis

The global market is segmented based on return type, service, end-user industry, and geography.

By Return Type

Based on return type, the market is categorized into recalls, commercial and B2B returns, repairable returns, and end-of-use returns. The commercial and B2B returns segment led the reverse logistics market in 2023, reaching a valuation of USD 243.24 billion. The segment has experienced significant expansion due to the increasing volume of global business-to-business transactions, which has resulted in a higher number of returns.

Moreover, businesses are placing greater emphasis on customer satisfaction and service excellence, leading to a rise in returns related to commercial purchases. Additionally, advancements in technology are enabling efficient handling and processing of commercial returns, thereby contributing to the growth of the segment.

By Service

Based on service, the market is segmented into transportation, warehousing, data management and tracking, replacement management, and others. The transportation segment secured the largest reverse logistics market share of 33.55% in 2023. The expansion of the segment is largely attributable to the rise of e-commerce and online retailing. This is increasing the demand for efficient management of product returns by transportation services.

Additionally, companies are focusing on optimizing transportation routes and modes to reduce costs and improve delivery times for returned goods. The widespread adoption of technology-enabled tracking and visibility solutions is further enhancing the efficiency and reliability of transportation services, thereby fostering the expansion of the segment.

By End-User Industry

Based on end-user industry, the market is classified into e-commerce, automotive, consumer electronics, healthcare, and others. The e-commerce segment is poised to witness significant growth, registering a robust CAGR of 8.85% through the forecast period (2024-2031). This notable expansion is mainly propelled by the continued growth of the e-commerce industry globally. This has led to a surge in a number of product returns from online purchases and is further fueled by numerous factors such as consumer convenience, easy return policies, and a wide range of online product offerings.

Furthermore, e-commerce companies are investing heavily in advanced reverse logistics solutions to streamline returns management, enhance customer experience, and reduce costs associated with product returns. The increasing adoption of sustainable practices in e-commerce reverse logistics is likely to contribute significantly to the growth of the segment over the forecast period.

Reverse Logistics Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific Reverse Logistics Market share stood around 36.25% in 2023 in the global market, with a valuation of USD 193.28 billion. This dominance is attributed to the robust growth of the e-commerce sector, leading to the surging demand for efficient reverse logistics solutions to manage product returns and optimize supply chain operations.

Additionally, growing awareness regarding environmental sustainability is prompting companies in Asia-Pacific to adopt advanced reverse logistics practices, including recycling and responsible disposal of returned products. Moreover, favorable government initiatives and increased investments in infrastructure are supporting the growth of the Asia-Pacific reverse logistics market.

- Logistics has been consistently contributing approximately 7.4% of GDP to Singapore’s economy.

North America is set to experience significant growth, registering a CAGR of 6.86% through the estimated timeframe. This considerable growth is driven by several key factors including the region's well-established e-commerce landscape and high consumer expectations regarding returns management.

This has created a robust demand for advanced reverse logistics solutions. Companies in North America are increasingly focusing on enhancing customer experience, reducing return-related costs, and improving sustainability practices, thereby fostering the widespread adoption of innovative reverse logistics technologies and strategies.

- The UPS Worldport, situated in Louisville, processes over 400,000 packages per hour and is one of the world's largest automated sorting facilities.

Competitive Landscape

The reverse logistics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Reverse Logistics Market

- Blue Dart Express Limited

- Core Logistic Private Limited.

- DHL International GmbH

- FedEx

- Kintetsu World Express, Inc

- RLG Systems AG

- United Parcel Service of America, Inc.

- DB SCHENKER

- SAFEXPRESS

- YUSEN LOGISTICS CO., LTD.

Key Industry Developments

- March 2024 (Partnership): Vitesco Technologies forged a strategic partnership with DHL Supply Chain as their Lead Logistics Partner (LLP). This collaboration, which commenced in March 2024, centralized logistics management for Vitesco Technologies' twelve European locations through DHL's LLP Center of Excellence in Warsaw, Poland. Around 100,000 transport movements within the supply chain were coordinated by DHL, which constituted a notable portion of Vitesco Technologies' freight volume. The partnership aimed to enhance sustainability, resilience, and efficiency by optimizing transport routes and reducing greenhouse gas emissions through the implementation of innovative logistics strategies.

- March 2024 (Launch): Blue Dart, a prominent express air and distribution firm in South Asia, unveiled a Unified Shipping API Software Platform. This platform addressed the logistic needs of Micro, Small, and Medium Enterprises (MSMEs) and Large Enterprises in India. It digitized First Mile Dispatches, thereby enhancing operational efficiency. Through a partnership with eShipz.com, Blue Dart integrated advanced dispatch tools for seamless connectivity with sales platforms and order management systems.

The Global Reverse Logistics Market is Segmented as:

By Return Type

- Recalls

- Commercial and B2B Returns

- Repairable Returns

- End-of-Use Returns

By Service

- Transportation

- Warehousing

- Data Management and Tracking

- Replacement Management

- Others

By End-User Industry

- E-commerce

- Automotive

- Consumer Electronics

- Healthcare

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America