Market Definition

Wetware computers are computational systems that use living biological components such as neurons, brain organoids, or other cellular structures for information processing. Unlike conventional silicon-based architectures, they utilize the adaptive signaling, parallel processing, and plasticity of biological tissues to enable advanced learning, real-time problem-solving, and complex pattern recognition.

Positioned at the convergence of neuroscience, biotechnology, and computing, wetware computers represent a potential paradigm shift in artificial intelligence, biomedical research, and brain–machine interface development.

Wetware Computers Market Overview

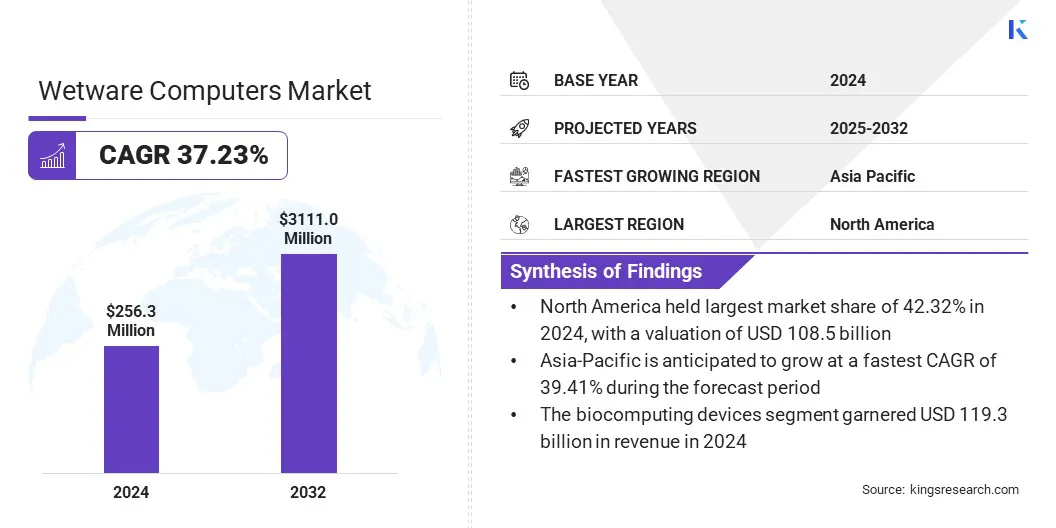

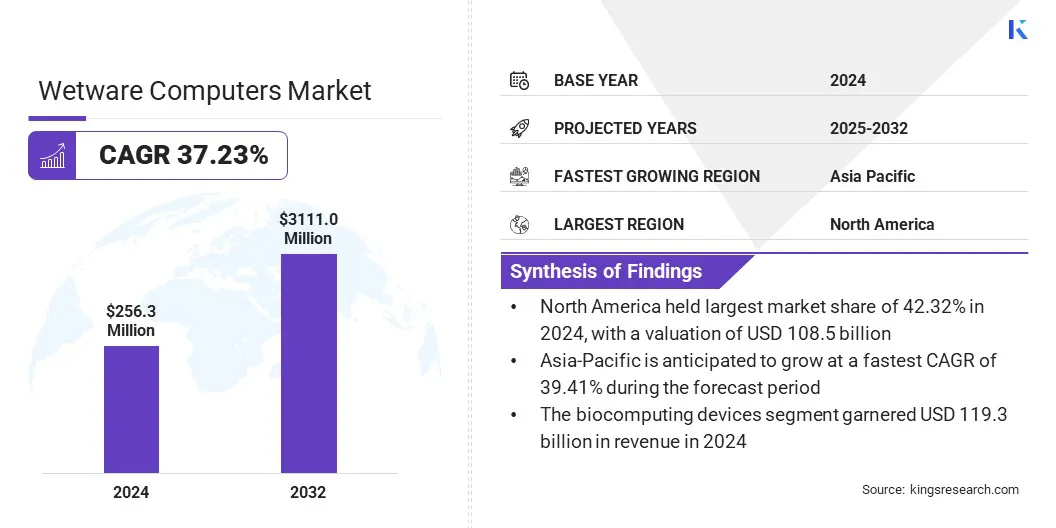

The global wetware computers market size was valued at USD 256.3 million in 2024 and is projected to grow from USD 339.4 million in 2025 to USD 3,111.0 million by 2032, exhibiting a CAGR of 37.23% over the forecast period.

This growth is driven by rapid advancements in neuroscience, synthetic biology, and brain–machine interface technologies. Rising demand for adaptive, energy-efficient, and intelligent computing systems is further accelerating investment in wetware computing.

Major companies operating in the wetware computers market are FinalSpark and Cortical Labs Pte Ltd. The market currently features limited commercial activity, as most other participants remain focused on fundamental research and prototype development.

Key Market Highlights:

- The wetware computers industry size was recorded at USD 256.3 million in 2024.

- The market is projected to grow at a CAGR of 37.23% from 2025 to 2032.

- North America held a market share of 42.32% in 2024, with a valuation of USD 108.5 million.

- The biocomputing devices segment garnered USD 119.3 million in revenue in 2024.

- The medical & healthcare segment is expected to reach USD 1,549.9 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 39.41% during the forecast period.

This reflects the early-stage nature of wetware computing, where only a few entities have progressed beyond laboratory validation toward functional and scalable applications.

The growing demand for alternatives to silicon-based architectures is prompting both research institutions and technology companies to invest heavily in wetware computing. Rising computational needs in artificial intelligence, big data analytics, and real-time decision-making are encouraging efforts to create biologically inspired platforms capable of adaptive and energy-efficient processing.

To enhance market demand, organizations are focusing on improving scalability, reproducibility, and integration with existing digital infrastructure. Research institutes are developing more stable organoid and neuron-based systems, while companies are exploring hybrid bio-silicon models that combine the strengths of biological adaptability with the reliability of traditional processors.

- In May 2023, DNAstack and its partners launched Neuroscience AI, a federated platform that advances collaborative neuroscience research. The initiative enables privacy-preserving, AI-powered insights across distributed data networks, granting researchers access to larger and more diverse datasets.

Market Driver

Growing Complexity of AI and Data Workloads

The increasing reliance on artificial intelligence, machine learning, and big data analytics is directly driving demand for more powerful and energy-efficient computing systems. Existing silicon-based architectures are struggling with scalability, creating a performance bottleneck for industries that depend on real-time processing and continuous learning.

Wetware computers overcome these constraints by enabling higher computational throughput with lower energy costs. This makes them highly attractive for organizations seeking to expand AI deployment at scale, thereby accelerating adoption and fueling market growth.

Market Challenge

Scalability and Reproducibility of Biological Systems

A key challenge in the wetware computers market is the scalability of biological neural systems into stable and reproducible computing platforms. Living neurons and organoid tissues are inherently variable and highly sensitive to culture conditions, which can lead to inconsistent performance across different systems.

This unpredictability limits the ability to establish reliable standards, reducing confidence in their commercial adoption, due to market’s current early-stage status, where most efforts are concentrated on experimental validation and prototype development.

To address this, researchers are working on improved bioengineering techniques that enhance the stability and longevity of neural cultures. Industry players are also exploring hybrid bio-silicon models and advanced monitoring frameworks to maintain controlled environments, ensuring greater reproducibility and operational reliability in wetware computing applications.

Market Trend

Convergence of Neuroscience and Computing

A key trend shaping the wetware computers market is the integration of neuroscience research with advanced computing disciplines. Innovations in brain–computer interfaces, organoid intelligence, and neural tissue engineering are accelerating the development of systems that utilize living neurons for computation.

Research institutions and startups are increasingly collaborating across biotechnology, computing, and cognitive science to design platforms that can process information in ways traditional architectures cannot.

This convergence is positioning wetware computing as a frontier technology for next-generation artificial intelligence, with growing interest from sectors such as defense, healthcare, and advanced analytics.

Wetware Computers Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Biocomputing Devices, Neural Interface Systems, Bio-molecular Computing, Hybrid Wetware-Digital Systems

|

|

By Application

|

Medical & Healthcare, Defense & Security, Robotics & Autonomous Systems, Research & Academia, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Biocomputing Devices, Neural Interface Systems, Bio-molecular Computing, and Hybrid Wetware-Digital Systems): The biocomputing devices segment earned USD 119.3 million in 2024 driven by rising demand for bioengineered computing models for healthcare and drug discovery.

- By Application (Medical & Healthcare, Defense & Security, Robotics & Autonomous Systems, Research & Academia, and Others): The medical & healthcare held 51.21% of the market in 2024, due to growing adoption of bio-computational systems for precision medicine.

Wetware Computers Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America wetware computers market share stood at 42.32% in 2024, with a valuation of USD 108.5 million in the global market. This dominance is driven by a strong ecosystem of research institutions, biotechnology firms, and technology companies actively exploring next-generation computing.

The region benefits from significant government and private sector investments in frontier technologies, particularly in neuroscience, artificial intelligence, and advanced computing platforms.

Federal funding through agencies such as the National Institutes of Health (NIH), the Defense Advanced Research Projects Agency (DARPA), and the National Science Foundation (NSF) is supporting exploratory programs that align closely with wetware computing principles, including neural tissue engineering, organoid intelligence, and brain–computer interfaces. This policy and funding support are expected to drive the market demand over the forecast period.

Asia-Pacific is poised for significant growth at a robust CAGR of 39.41% over the forecast period. The regional growth is supported by expanding biotechnology and life sciences sectors. Governments in China, Japan, and South Korea are investing in advanced computing and neuroscience research as part of broader innovation agendas, creating a favorable environment for wetware-related initiatives.

Public funding programs targeting organoid studies, bioengineering, and AI integration provide the foundation for exploratory research in bio-computing.

The region also benefits from a growing base of technology users and industries adopting artificial intelligence at scale, which increases long-term demand for computing models that can deliver higher efficiency and adaptability.

Academic institutions and research labs are beginning to explore bio-inspired computing approaches, while biotechnology startups are gradually entering the space through collaborations with universities and corporate partners.

Regulatory Frameworks

- The U.S. Food and Drug Administration (FDA) would likely regulate wetware computing applications through medical device and biologics frameworks, requiring extensive preclinical and clinical validation for healthcare use.

- The European Medicines Agency (EMA) supervises the use of biologics and medical devices that integrate biological material, while ethical use of human tissues falls under the Oviedo Convention. Hybrid bio-digital platforms involving genetically modified tissues may be subject to EU GMO directives, following the precedent set by the 2018 ECJ ruling. Compliance with GDPR further applies to sensitive neurodata generated by wetware systems.

- In China, the Pharmaceuticals and Medical Devices Agency (PMDA) regulates biomedical applications of wetware systems.

Competitive Landscape

Major players in the wetware computers market are advancing growth through focused R&D, hybrid platform development, and strategic collaborations with research institutes.These efforts are reflective of the market’s current early-stage status, where most activities are still research-driven and aimed at overcoming fundamental technical challenges.

By integrating biological neurons with silicon-based architectures, companies are addressing scalability and reliability challenges while enhancing computational efficiency. These efforts are aligning with industry needs for sustainable, high-performance computing solutions that can support artificial intelligence, big data analytics, and real-time decision-making.

- In March 2025, Australian startup Cortical Labs launched the world’s first commercially available biological computer powered by lab-grown human brain cells. Named CL-1, the biocomputer integrates living neurons with silicon chips to create a synthetic biological intelligence system.

Key Companies in Wetware Computers Market: