Market Definition

The market focuses on medical, behavioral, and neuromodulation approaches designed to manage involuntary motor and vocal tics associated with the neurological disorder. The report covers segmentation by treatment type, disease type, drug class, end use, and region.

Growth is supported by advancements in neuropharmacology, increasing diagnostic accuracy, and expanding access to multidisciplinary care. Applications span hospitals, specialty clinics, and research institutions, where patients receive pharmacological therapy and behavioral interventions.

Tourette Syndrome Treatment Market Overview

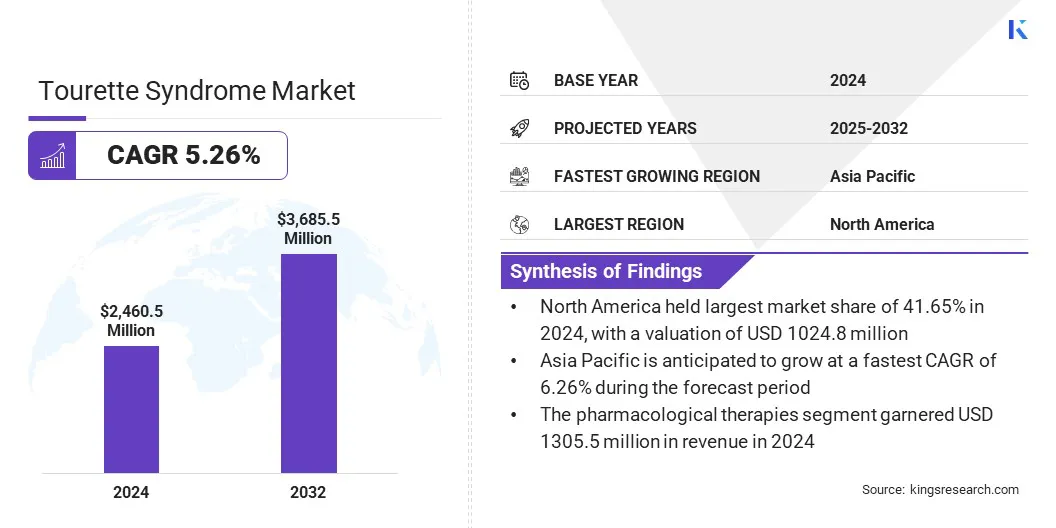

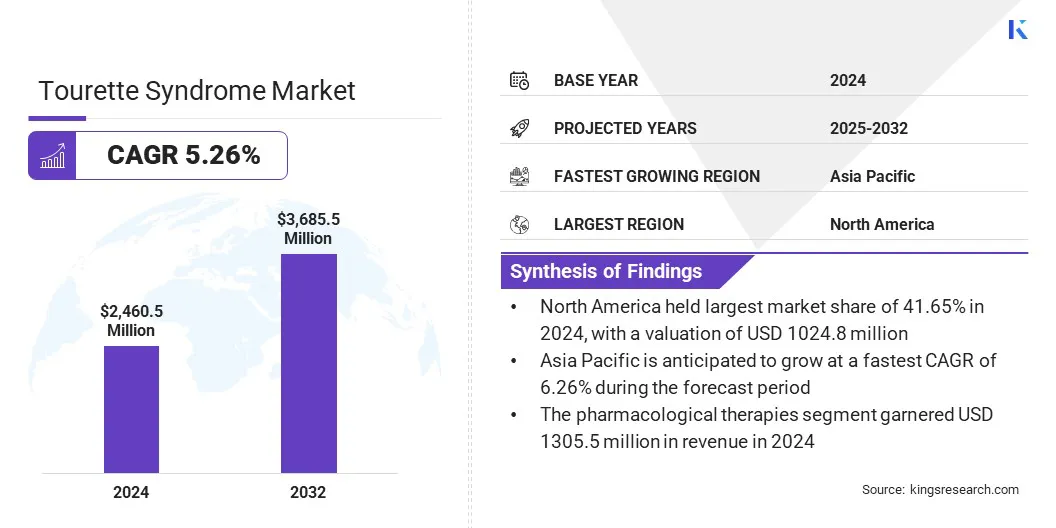

According to Kings Research, the global Tourette syndrome treatment market size was valued at USD 2,460.5 million in 2024 and is projected to grow from USD 2,573.5 million in 2025 to USD 3,685.5 million by 2032, exhibiting a CAGR of 5.26% over the forecast period.

The market is driven by advancements in neuropharmacology that are improving drug efficacy and tolerability through precision targeting of dopamine and serotonin pathways. Additionally, a growing focus on gene and neuromodulation research is expanding therapeutic possibilities by addressing the underlying neurological mechanisms of the disorder.

Key Market Highlights:

- The tourette syndrome treatment industry size was valued at USD 2,460.5 million in 2024.

- The market is projected to grow at a CAGR of 5.26% from 2025 to 2032.

- North America held a market share of 41.65% in 2024, with a valuation of USD 1,024.80 million.

- The pharmacological therapies segment garnered USD 1,306.5 million in revenue in 2024.

- The motor tics segment is expected to reach USD 2,285.4 million by 2032.

- The atypical antipsychotics segment secured the largest revenue share of 47.34% in 2024.

- The specialty clinics segment is poised for a robust CAGR of 5.75% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.26% over the forecast period.

Major companies operating in the tourette syndrome treatment market are Emalex Biosciences, Inc., Neurocrine Biosciences, Inc., SciSparc, AbbVie Inc., Medtronic, AstraZeneca, Bausch Health Companies Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Otsuka Pharmaceutical Co., Ltd., Johnson & Johnson, Eli Lilly and Company, Boehringer Ingelheim International GmbH, Catalyst Pharmaceuticals, Inc., and Reviva Pharmaceuticals Holdings, Inc.

Rising prevalence and diagnosis rates of Tourette syndrome are driving the growth of the Tourette Syndrome Treatment industry. Increasing awareness among healthcare professionals and families is leading to earlier detection and intervention. Advancements in diagnostic tools and better clinical understanding are allowing physicians to identify the condition more accurately.

Expanding mental health programs and public health campaigns are encouraging patients to seek evaluation for tic-related disorders. Growing data collection and epidemiological studies are revealing higher numbers of undiagnosed or misdiagnosed cases, contributing to increasing treatment demand.

- In July 2025, the U.S. Centers for Disease Control and Prevention (CDC) reported that approximately 1 in 50 children aged 5–14 years has Tourette syndrome or a persistent tic disorder.

What are the major factors driving the tourette syndrome treatment market growth?

Advancements in neuropharmacology are driving the growth of the market. Development of next-generation antipsychotics and neuroactive compounds is improving the management of tics and associated behavioral symptoms. Pharmaceutical companies are focusing on creating drugs that target dopamine and serotonin pathways more precisely to minimize side effects.

Clinical trials for vesicular monoamine transporter 2 (VMAT2) inhibitors and other novel molecules are showing promising outcomes in symptom reduction. Increasing collaboration between research institutions and biotechnology firms is accelerating innovation in central nervous system drug discovery.

- In April 2024, Emalex Biosciences announced positive Phase 3 trial results for ecopipam, a novel dopamine D1 receptor antagonist for the treatment of Tourette syndrome. The study demonstrated statistically significant improvement in tic severity among pediatric and adult patients compared to placebo.

How is the price volatility affecting the market growth?

A key challenge limiting the growth of the Tourette syndrome treatment market is the high cost associated with advanced therapeutic options.

Emerging interventions such as deep brain stimulation (DBS) and precision-targeted medications require significant procedural investment and long-term clinical follow-up. These expenses limit accessibility for patients in low- and middle-income regions, where healthcare coverage for neurological disorders remains limited.

To address this challenge, market players are working on developing cost-effective neuromodulation systems, expanding clinical trials to improve treatment efficiency, and collaborating with healthcare providers to introduce flexible reimbursement models. These initiatives are helping improve affordability and access to advanced therapies for Tourette syndrome patients.

- In September 2024, SciSparc Ltd. received FDA clearance to begin a Phase IIb clinical trial of SCI-110, its investigational drug candidate for adults with Tourette Syndrome. The trial is to be randomized and double-blind, conducted across multiple institutions, including Yale Child Study Center (USA), Hannover Medical School (Germany), and Tel Aviv Sourasky Medical Center (Israel).

What are the major trends in this market?

A key trend in the Tourette syndrome treatment market is the growing focus on gene and neuromodulation research to target the underlying neurological mechanisms of the disorder. Researchers are exploring gene-editing technologies such as CRISPR to identify and modify genetic factors associated with tic development.

- In April 2025, researchers at Rutgers University utilized CRISPR/Cas9 to engineer mice with mutations in genes associated with Tourette syndrome. These genetically modified mice exhibited motor tics and sensorimotor gating deficits, reproducing key behavioral phenotypes of Tourette syndrome. The study indicates that these mice are a highly useful model to study the neurobiology of Tourette disorder and to test new medications.

Neuromodulatory techniques, including transcranial magnetic stimulation and deep brain stimulation, are being refined to regulate abnormal neural activity in affected brain regions. Clinical studies are further expanding to evaluate the safety, efficacy, and long-term impact of these interventions on tic severity and patient quality of life.

Tourette Syndrome Treatment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Treatment Type

|

Pharmacological Therapies, Behavioral Therapies, Deep Brain Stimulation (DBS), Others

|

|

By Disease Type

|

Motor Tics, Vocal Tics

|

|

By Drug Class

|

Typical Antipsychotics, Atypical Antipsychotics, Others

|

|

By End Use

|

Hospitals, Specialty Clinics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Treatment Type (Pharmacological Therapies, Behavioral Therapies, Deep Brain Stimulation (DBS), and Others): The pharmacological therapies segment earned USD 1,306.5 million in 2024, due to the widespread use of antipsychotic and neuroactive drugs that provide proven efficacy in controlling tics and associated behavioral symptoms.

- By Disease Type (Motor Tics and Vocal Tics): The motor tics segment held 63.52% of the market in 2024, due to their higher clinical prevalence and greater demand for pharmacological and behavioral interventions to manage socially disruptive symptoms.

- By Drug Class (Typical Antipsychotics, Atypical Antipsychotics, and Others): The atypical antipsychotics segment is projected to reach USD 1,795.8 million by 2032, owing to their improved efficacy in managing tics and associated behavioral symptoms, along with a lower incidence of side effects compared to traditional antipsychotics.

- By End Use (Hospitals, Specialty Clinics, and Others): The specialty clinics segment is poised for significant growth at a CAGR of 5.75% through the forecast period, attributed to the availability of multidisciplinary care, access to trained neurologists and therapists, and the ability to provide comprehensive behavioral, pharmacological, and neuromodulation therapies in a single facility.

What is the tourette syndrome treatment market scenario in North America and Asia-Pacific region?

The North America Tourette syndrome treatment market share stood around 41.65% in 2024 in the global market, with a valuation of USD 1,024.8 million. This dominance is due to the establishment of dedicated clinics and treatment centers for Tourette syndrome. Neurologists and behavioral therapists have increased their capacity to manage complex tic disorders.

Collaboration between hospitals and research institutions has improved patient access to multidisciplinary care, allowing patients to receive coordinated treatment from neurologists, psychiatrists, and behavioral therapists in a single care plan.

Advanced treatment facilities also provide combined behavioral and pharmacological therapy programs. Access to trained specialists encourages more patients to seek professional care.

- In September 2024, the National Tourette Syndrome Association designated Overlook Medical Center in Summit, New Jersey, as one of its Centers of Excellence. The center offers a comprehensive approach to treatment, including behavioral therapy, pharmacological interventions, and surgical options such as deep brain stimulation.

The tourette syndrome treatment industry in Asia Pacific is poised for a significant CAGR of 6.36% over the forecast period. This growth is due to the ongoing development of specialized neurological and pediatric facilities. Healthcare centers are increasingly equipped to manage complex tic disorders with multidisciplinary approaches.

Investments in clinic networks and treatment centers have enhanced access to professional care across urban and semi-urban areas.

The availability of trained neurologists, psychologists, and therapists supports the comprehensive management of Tourette syndrome and encourages patients to pursue consistent, long-term treatment. Improvements in healthcare infrastructure collectively strengthen the system and drive growth in the regional market.

- In August 2025, Epworth HealthCare in Australia expanded its multidisciplinary care model for Tourette syndrome (TS) to include neurologists, occupational therapists, and speech pathologists across multiple locations. This integrated approach aims to provide comprehensive care for patients with TS.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the approval of medications for TS. Currently, haloperidol, pimozide, and aripiprazole are FDA-approved for treating tics associated with TS. The FDA has authorized expanded access programs for investigational therapies, such as Emalex Biosciences' ecopipam, indicating a growing interest in novel treatments.

- In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) administers the approval of medications for TS. The National Institute for Health and Care Excellence (NICE) evaluates the cost-effectiveness of new treatments, influencing reimbursement decisions within the National Health Service (NHS).

- In Germany, the Federal Institute for Drugs and Medical Devices (BfArM) oversees the approval of medications for TS. The German statutory health insurance system reimburses approved treatments, including pharmacological and behavioral therapies. The Institute for Quality and Efficiency in Health Care (IQWiG) assesses the added benefit of new treatments over existing options, influencing reimbursement decisions.

- China's National Medical Products Administration (NMPA) supervises the approval of medications for TS. The regulatory process includes stringent clinical trial requirements to ensure safety and efficacy.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) is responsible for the approval of medications for TS. The regulatory process emphasizes rigorous clinical trials to ensure the safety and efficacy of treatments. The Japanese healthcare system provides universal coverage for approved therapies, facilitating patient access

Competitive Landscape

Market players are adopting increased research and development, strategic partnerships, and technological advancements to remain competitive in the Tourette syndrome treatment market.

Companies are investing in innovative therapies and devices to enhance treatment efficacy and patient outcomes. Continuous improvement of device features, such as real-time monitoring and personalization, strengthens product differentiation.

- In January 2024, Medtronic received U.S. Food and Drug Administration (FDA) approval for its Percept RC Deep Brain Stimulation (DBS) system. This rechargeable neurostimulator is the latest addition to the Medtronic Percept product line, which includes the Percept PC neurostimulator, BrainSense technology, and SenSight directional leads.

Key Companies in Tourette syndrome treatment market:

- Emalex Biosciences, Inc.

- Neurocrine Biosciences, Inc.

- Sci Sparc.

- AbbVie Inc.

- Medtronic

- AstraZeneca

- Bausch Health Companies Inc.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Johnson & Johnson

- Eli Lilly and Company.

- Boehringer Ingelheim International GmbH

- Catalyst Pharmaceuticals, Inc.

- Reviva Pharmaceuticals Holdings, Inc.

Recent Developments

- In October 2025, Emalex Biosciences received FDA authorization for an Expanded Access Program (EAP) for ecopipam, allowing physicians to request the drug for Tourette syndrome patients who have not responded to, or cannot obtain, other approved treatments.

- In October 2024, Noema Pharma commenced dosing the first patients in a global Phase 2b study evaluating gemlapodect (NOE-105) for Tourette syndrome. Gemlapodect is a first-in-class investigational therapy targeting specific neurotransmitter pathways implicated in TS.