Market Definition

The market comprises products designed for athletic performance, physical training, and recreational activities. It includes equipment, apparel, protective gear, accessories, and related consumables catering to various sports disciplines.

The market serves both professional and amateur users through specialty stores, supermarkets, and online platforms. Market growth is driven by increasing health awareness, rising sports participation, and the integration of technology into fitness and athletic products.

Sporting Goods Market Overview

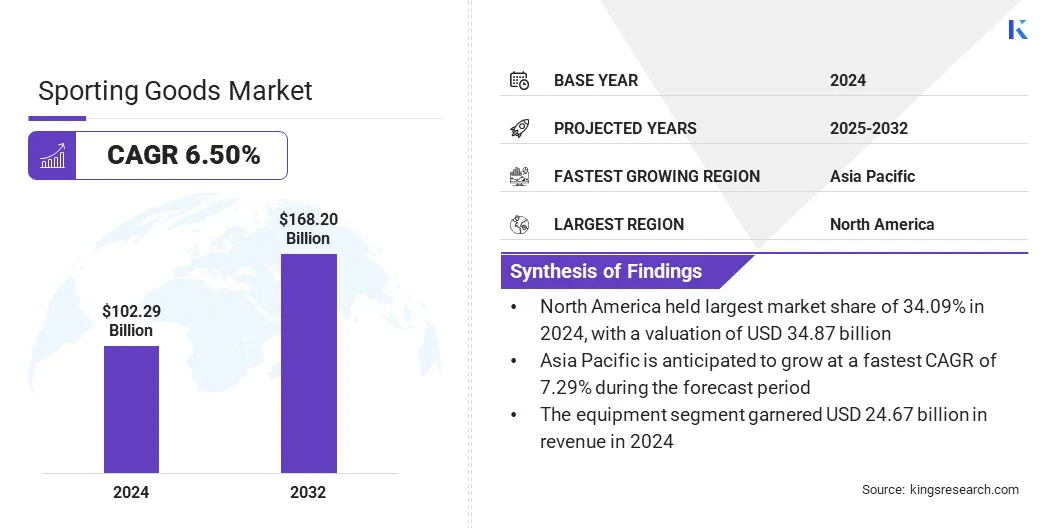

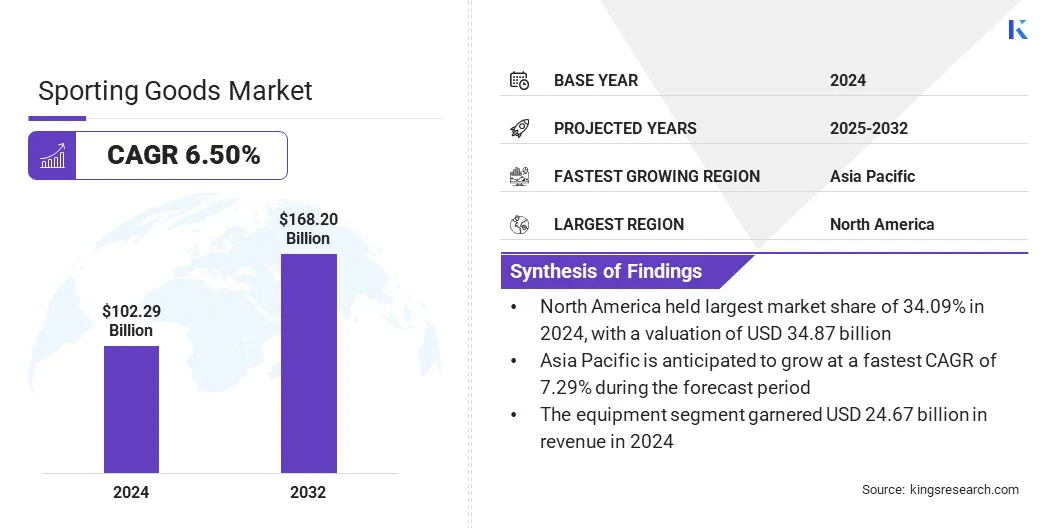

The global sporting goods market size was valued at USD 102.29 billion in 2024 and is projected to grow from USD 108.24 billion in 2025 to USD 168.20 billion by 2032, exhibiting a CAGR of 6.50% during the forecast period.

This growth is driven by rising awareness of sports-related injuries and advancements in lightweight, impact-resistant materials. Manufacturers are incorporating carbon fiber and EVA foam to enhance protection and comfort.

Key Highlights:

- The sporting goods industry size was recorded at USD 102.29 billion in 2024.

- The market is projected to grow at a CAGR of 6.50% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 34.87 billion.

- The equipment segment garnered USD 24.67 billion in revenue in 2024.

- The outdoor sports segment is expected to reach USD 55.38 billion by 2032.

- The women segment is anticipated to witness the fastest CAGR of 6.41% over the forecast period.

- The specialty stores segment is projected to hold a share of 29.96% in 2032.

- Asia Pacific is anticipated to grow at a CAGR of 7.29% through the projection period.

Major companies operating in the sporting goods market are adidas AG, Nike, Inc., Amer Sports, Puma SE, Under Armour Inc., ASICS Corporation, Decathlon, New Balance, Columbia Sportswear Company, VF Corporation, Yonex Co., Ltd., Callaway Golf Company, Mizuno Corporation, lululemon, and Hanesbrands Inc.

The growing consumer inclination toward comfort-focused apparel and health-oriented lifestyles is influencing the demand for athleisure apparel. The convergence of fitness and casual wear has led brands to design versatile clothing suited for both workouts and daily activities.

Rapid urbanization, expanding gym memberships, and the rise of remote work are further supporting this trend. The global demand for apparel that combines style, flexibility, and performance is fueling significant market expansion within the athleisure apparel category.

- In March 2025, Hanes launched Hanes Moves, making it first cross-category expansion into the athleisure. The collection features athletic-inspired innerwear and apparel for men, women, and children, strengthening the brand’s presence in performance-oriented lifestyle wear.

How are government programs influencing participation in sports activities and boosting demand for sporting goods?

Government initiatives focusing on sports promotion and public health are driving higher participation levels. Investments in facility development, community programs, and youth training centers are supporting active lifestyles.

Additionally, integrating physical education into academic institutions and conducting awareness campaigns have increased engagement in sports activities, creating a strong demand for performance apparel, protective gear, and fitness equipment across diverse consumer segments.

- In July 2025, the government approved the National Sports Policy (NSP) 2025 to reshape the sporting ecosystem. The policy focuses on expanding infrastructure, developing skilled sports personnel, and promoting competitive leagues across rural and urban regions to strengthen national sports programs and enhance widespread participation.

- Similarly, in September 2025, the government reduced GST on sports goods and toys from 12% to 5%, making them more affordable for youth and athletes. The reform aims to boost participation in sports and recreational activities, fostering broader engagement and supporting the holistic development of the nation’s young population.

Why does the proliferation of counterfeit products pose a major compliance challenge to the expansion of the sporting goods market?

The growing presence of counterfeit sporting goods creates substantial regulatory and operational complexities for industry participants. Unregulated sales channels and imitation products hinder the enforcement of safety, quality, and certification standards.

Manufacturers face increasing risks related to warranty claims and product liability, as counterfeit items often evade compliance checks. This undermines supply chain integrity and complicates monitoring mechanisms, making it difficult to maintain consistent adherence to international manufacturing regulations.

To address this challenge, manufacturers are deploying advanced product authentication technologies such as RFID tagging, blockchain-based supply chain tracking, and AI-powered counterfeit detection. Strengthening distribution partnerships and implementing digital verification systems ensures transparency, reinforces consumer confidence, and safeguards brand integrity.

Technological advancements are reshaping the sporting goods industry through the adoption of intelligent products equipped with integrated data capabilities. Embedded sensors and connected devices provide users with precise performance insights, improving training accuracy and engagement.

Manufacturers are prioritizing innovation by merging athletic functionality with digital analytics, enabling real-time monitoring and personalized feedback. This is creating new growth avenues across fitness, wellness, and performance-focused product segments.

- In June 2025, M2MMA and Green Hill Sports entered a five-year partnership to integrate AI and smart technology into combat sports. The collaboration focuses on developing sensor-embedded protective gear that transmits real-time data to enhance athlete protection.

Sporting Goods Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Equipment, Apparel, Protective Gears, Accessories, Consumables, Others

|

|

By Sport Type

|

Outdoor Sports, Indoor Sports, Adventure Sports, Others

|

|

By End User

|

Men, Women, Kids

|

|

By Distribution Channel

|

Specialty stores, Supermarkets/Hypermarkets, Department & Discount stores, Online

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Equipment, Apparel, Protective Gears, Accessories, Consumables, and Others): The equipment segment generated USD 24.67 billion in revenue in 2024, mainly due to rising participation in organized sports, increased gym memberships, and growing demand for advanced training equipment.

- By Sport Type (Outdoor Sports, Indoor Sports, Adventure Sports, and Others): The indoor sports segment is poised to record a CAGR of 6.60% through the forecast period, propelled by expanding urban infrastructure, year-round accessibility, and rising interest in fitness-focused indoor activities.

- By End User (Men, Women, and Kids): The men segment is estimated to hold a share of 40.05% by 2032, fueled by growing involvement in competitive sports, fitness awareness, and higher expenditure on premium athletic products.

- By Distribution Channel (Specialty stores, Supermarkets/Hypermarkets, Department & Discount stores, and Online): The specialty stores segment is projected to reach USD 50.40 billion by 2032, boosted by personalized service offerings, access to exclusive brands, and consumer demand for expert product guidance.

What is the market scenario in North America and Asia Pacific region?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America sporting goods market stood at 34.09% in 2024, valued at USD 34.87 billion. This dominance is attributed to the rising consumer participation in organized sports, expanding fitness club memberships, and the rapid adoption of advanced training equipment and wearable technology.

Robust retail networks, combined with the widespread presence of established brands, reinforced sales across online and offline platforms. Increasing consumer preference for sustainable sportswear and premium performance gear further positioned North America as a key market for sporting goods.

- In April 2024, The DICK’S Sporting Goods Foundation announced a USD 2 million grant initiative to commemorate the tenth anniversary of its Sports Matter Program. Funded through DSG’s giveback program, the initiative allocates 1% of DSG brand sales over the year to support youth sports participation and community athletic development.

The Asia-Pacific sporting goods industry is set to grow at a CAGR of 7.29% over the forecast period, supported by increasing youth participation in fitness and recreational sports. Expanding urban populations, a rising focus on active lifestyles, and higher spending on health-oriented products are boosting demand for sporting goods.

The growing influence of digital fitness platforms and the rise of domestic sports leagues are increasing equipment and apparel consumption. Rapid e-commerce expansion and local manufacturing advancements are further propelling regional market progress.

Regulatory Frameworks

- In the U.S., the Consumer Product Safety Improvement Act (CPSIA) governs the manufacturing and distribution of sporting goods. It ensures that all sports equipment, apparel, and protective gear meet safety and labeling standards to minimize consumer injury risks.

- In the EU, the General Product Safety Directive (GPSD) regulates the safety compliance of consumer goods, including sporting equipment. It mandates manufacturers to assess product risks and maintain traceability throughout the supply chain.

- In China, the Product Quality Law enforces strict oversight on production standards for sporting goods. It focuses on product testing, certification, and quality control to prevent counterfeit and substandard products in the domestic market.

- In Japan, the Consumer Product Safety Act supervises the sale and import of sports equipment and protective accessories. It requires safety labeling and product recall mechanisms to safeguard consumer interests.

- In Canada, the Canada Consumer Product Safety Act (CCPSA) directs manufacturers and importers of sporting goods to comply with mandatory safety standards and report product defects that may pose health or injury hazards.

- In Australia, the Competition and Consumer Act (CCA) oversees product safety regulations for sporting goods. It ensures that all equipment and apparel sold meet quality and durability benchmarks before market entry.

Competitive Landscape

Key players operating in the sporting goods industry are prioritizing digital transformation, strategic mergers, and product innovation to maintain competitiveness. They are expanding manufacturing capabilities and enhancing supply chain efficiency to meet fluctuating global demand. Product portfolios are being diversified through the introduction of sustainable materials and connected sports equipment.

Investment in research and development remains a central focus to support continuous innovation and performance improvement. Partnerships with sports organizations and e-commerce platforms are being leveraged to strengthen market reach, while targeted marketing initiatives are aligning with evolving consumer lifestyles and preferences across equipment, apparel, footwear, protective gear, and accessories.

- In May 2025, DICK’S Sporting Goods, Inc. entered into a definitive agreement to acquire Foot Locker, Inc. The merger is intended to leverage complementary strengths, enhance omnichannel capabilities, expand sneaker offerings, and reinforce the company’s position in the sports retail sector.

Key Companies in Sporting Goods Market:

- adidas AG

- Nike, Inc.

- Amer Sports

- Puma SE

- Under Armour Inc.

- ASICS Corporation

- Decathlon

- New Balance

- Columbia Sportswear Company

- VF Corporation

- Yonex Co., Ltd.

- Callaway Golf Company

- Mizuno Corporation

- lululemon

- Hanesbrands Inc.

Recent Developments (Partnerships/Product Launch)

- In November 2025, Nike introduced the N7 Collection featuring updated designs of the Pegasus 41 and V5 RNR models. The release expands Nike’s performance running portfolio through footwear engineered for comfort, supported by complementary apparel suited for varied training conditions.

- In October 2025, PUMA extended its partnership with HYROX through 2030. As part of the agreement, PUMA will supply official NITRO-powered sportswear, serve as the exclusive title partner for the HYROX World Championships, and appoint three elite HYROX athletes as global ambassadors.

- In February 2025, Target Corporation formed a strategic partnership with Champion to launch an exclusive activewear and sporting goods line. The collection features modernized designs inspired by Champion’s classic style, offering high-quality, trend-focused apparel for both adults and children.