Market Definition

A solar light tower is an off-grid lighting system that uses photovoltaic panels to convert solar energy into electricity. It integrates solar modules, battery storage, and LED or high-intensity light fixtures mounted on adjustable masts.

Commonly used at construction sites, mining operations, events, and emergency applications, it offers a sustainable alternative to diesel-powered towers by reducing fuel consumption and operational emissions.

Solar Light Tower Market Overview

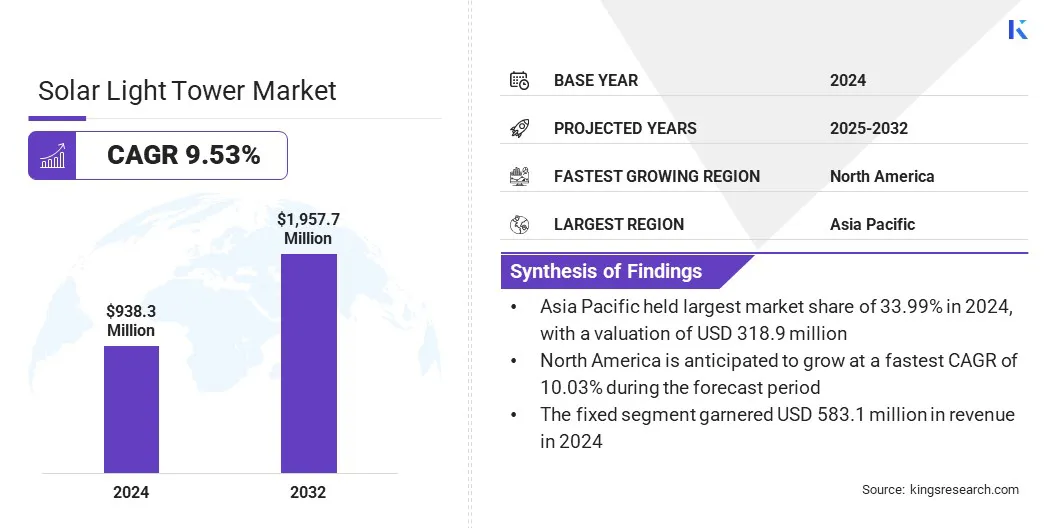

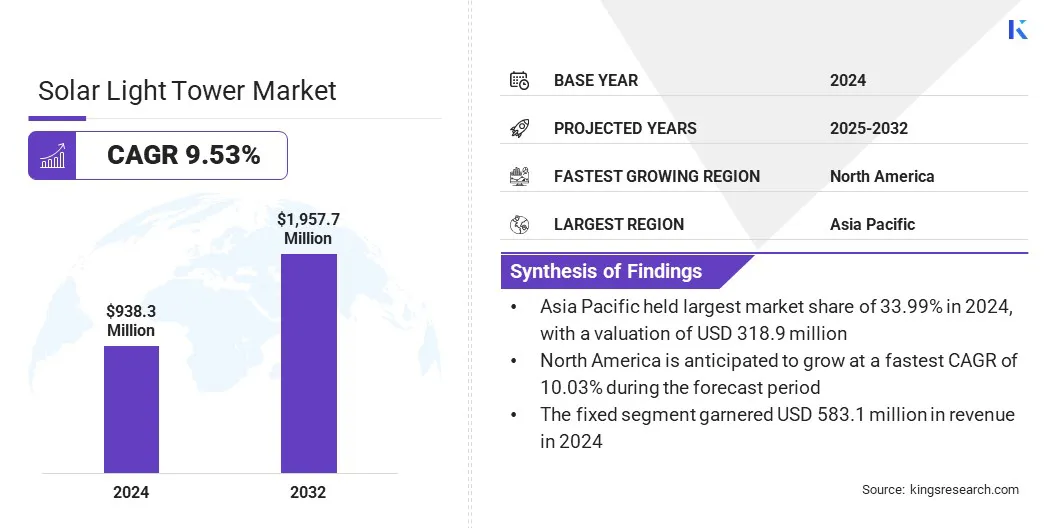

According to Kings Research, the global solar light tower market size was valued at USD 938.3 million in 2024 and is projected to grow from USD 1,023.4 million in 2025 to USD 1,957.7 million by 2032, exhibiting a CAGR of 9.71% during the forecast period.

This growth is driven by favorable government initiatives supporting renewable energy adoption and sustainable infrastructure development. Public procurement policies promoting low-emission equipment deployment are accelerating the adoption of solar-powered light towers globally.

Key Market Highlights:

- The solar light tower industry size was recorded at USD 938.3 million in 2024.

- The market is projected to grow at a CAGR of 9.71% from 2025 to 2032.

- Asia Pacific held a share of 33.99% in 2024, valued at USD 318.9 million.

- The fixed segment garnered USD 583.1 million in revenue in 2024.

- The manual segment is expected to reach USD 1,114.5 million by 2032.

- The high pressure sodium segment is anticipated to witness the fastest CAGR of 9.84% over the forecast period.

- The construction segment is predicted to hold a share of 24.29% by 2032.

- North America is anticipated to grow at a CAGR of 10.03% through the projection period.

Major companies operating in the global solar light tower market are Atlas Copco Group, Olikara Lighting Towers Pvt Ltd., Wanco Inc., Ver-Mac, Teksan, Generac Power Systems, Inc., Renco Industrial, Fuelfix Pty Ltd., Terex Corporation, TRIME s.r.l., Oceania International LLC (Greenshine New Energy), Shenzhen Luxman Light CO.,Ltd, OPTRAFFIC, Zhejiang Valiant Power Technology Co.,Ltd, and ARMORLOGIX.

Market growth is fueled by expanding construction, oil and gas, and mining activities across remote and off-grid locations. Large-scale infrastructure projects demand reliable, sustainable, and low-maintenance lighting solutions, creating strong demand for solar light towers.

These units offer continuous illumination without fuel dependency, making them suitable for operations in isolated regions. Enhanced deployment flexibility, longer battery life, and easy mobility position solar light towers as essential equipment for contractors and infrastructure developers seeking cost efficiency and environmental compliance.

- In July 2025, Inlux Solar shipped its All-In-Two Solar Street Light JAGUAR (AIT5) to Zambia. Featuring dual-mode operation and 120W output, the system’s durability and high efficiency highlight advancements applicable to solar light tower designs for large-scale infrastructure and roadway illumination.

What factors are driving the adoption of high-efficiency LED modules in the solar light tower market?

Advancements in LED technology, characterized by higher luminous efficacy, lower power consumption, and extended operational life, are fueling market growth. High-efficiency LED modules have become integral to modern solar light towers, improving energy utilization and brightness consistency.

These systems enhance lighting coverage while reducing overall maintenance costs, supporting continuous use in construction, mining, and emergency projects. The shift toward LED-integrated solar towers aligns with global sustainability goals and enhances performance reliability across industries requiring durable and energy-efficient mobile lighting systems.

- In October 2025, LEDVANCE installed an advanced LED lighting system at the iconic Osterdeich stadium, meeting top UEFA standards. The project underscores the company’s expertise in high-performance illumination technologies applicable to solar light towers for large-scale outdoor and event lighting.

How do high procurement costs hinder market expansion and adoption in developing regions?

The integration of photovoltaic modules, advanced batteries, and control systems increases initial procurement costs compared to diesel-based alternatives, which is impeding the expansion of the solar light tower market.

Budget constraints among small and medium contractors restrict large-scale deployment, particularly in developing regions. Despite long-term savings in fuel and maintenance, the initial expenditure continues to hinder market penetration, delaying adoption among price-sensitive sectors relying on temporary or short-term lighting solutions.

To address this challenge, manufacturers and financing institutions are introducing lease-based models, rental programs, and government-backed subsidy schemes that reduce purchase barriers and promote broader adoption of solar light towers.

How is the IoT integration trend transforming the monitoring and management of solar light towers?

The solar light tower market is influenced by the growing integration of smart control systems that enable real-time monitoring and remote management of solar light towers. IoT connectivity allows operators to track performance, battery status, and fault alerts through cloud-based dashboards.

Automated scheduling and predictive maintenance features enhance operational efficiency and minimize downtime. The adoption of IoT-enabled systems improves energy optimization and extends equipment life, reinforcing the shift toward intelligent and connected lighting solutions in industrial and infrastructure applications worldwide.

- In September 2025, Inlux Solar introduced an IoT-integrated solar street light featuring advanced LORA technology, enhancing secure communication and durability. This innovation reflects technological progress shaping solar light tower connectivity, performance monitoring, and remote management across industrial and infrastructure applications.

Solar Light Tower Market Report Snapshot

|

Segmentation

|

Details

|

|

By Deployment

|

Fixed, Portable

|

|

By Lifting

|

Manual, Hydraulic

|

|

By Light Source

|

Metal Halide, High Pressure Sodium, LED, Combination

|

|

By End User

|

Construction, Oil & Gas, Mining, Events & Entertainment, Military & Defense, Infrastructure & Utilities, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Deployment (Fixed and Portable): The fixed segment generated USD 583.1 million in revenue in 2024, mainly due to rising deployment in infrastructure and utility projects requiring continuous, stationary lighting for long-duration operations.

- By Lifting (Manual and Hydraulic): The hydraulic segment is poised to record a CAGR of 9.78% through the forecast period, propelled by increasing demand for quick deployment, enhanced safety, and reduced manual handling in large-scale sites.

- By Light Source (Metal Halide, High Pressure Sodium, LED, and Combination): The metal halide segment is estimated to hold a share of 32.93% by 2032, fueled by continued use in high-intensity industrial applications demanding strong illumination over wide operational areas.

- By End User (Construction, Oil & Gas, Mining, Events & Entertainment, Military & Defense, Infrastructure & Utilities, and Others): The construction segment is projected to reach USD 475.6 million by 2032, owing to growing infrastructure development, extended night-time operations, and higher adoption of renewable-powered lighting across major projects.

What is the market scenario in Asia Pacific and North America region?

The Asia Pacific solar light tower market stood at 33.99% in 2024, valued at USD 318.9 million. This dominance is attributed to the rapid infrastructure development, expanding mining and construction activities, and ongoing industrialization across developing economies. The transition from diesel-powered light towers to solar-based systems is boosting adoption among commercial and industrial users.

Regional manufacturers are strengthening regional supply chains and expanding local assembly operations to meet the rising demand for cost-efficient and sustainable lighting solutions. Moreover, increasing investment in renewable energy and government initiatives promoting clean technology deployment continue to position the region as a leading market for solar light towers.

- In 2025, India surpassed Japan to become the world’s third-largest solar energy producer, generating 108,494 GWh of solar power, according to the International Renewable Energy Agency (IRENA). This significant capacity expansion reinforces the country’s solar infrastructure base, supporting increased deployment of solar light towers across industrial and infrastructure projects.

The North America solar light tower market is set to grow at a CAGR of 10.03% over the forecast period. This expansion is fueled by increasing adoption of off-grid and hybrid lighting systems in construction, mining, and emergency response operations.

Strong environmental regulations and a shift toward carbon-free infrastructure are prompting organizations to replace conventional light towers with solar-powered units.

Continuous product innovation focused on higher battery efficiency and improved control systems is strengthening market competitiveness. Key players are focusing on developing integrated lighting and communication systems to align with the growing demand for safety-oriented infrastructure.

- In June 2025, Florida Memorial University appointed Transportation Solutions & Lighting (TS&L) to implement a campus-wide safety upgrade using advanced emergency tower systems. The initiative reflects growing demand for integrated, energy-efficient lighting and communication technologies relevant to solar light towers deployed in public safety and infrastructure applications.

Regulatory Frameworks

- In the EU, the Renewable Energy Directive (EU) 2018/2001 governs renewable energy integration and mandates member states to increase the share of renewables in total energy consumption. It promotes the use of solar-based technologies, encouraging public and private sectors to adopt solar light towers for sustainable infrastructure projects.

- In the U.S., the Energy Policy Act of 2005 regulates energy efficiency standards and promotes renewable energy adoption across industrial and infrastructure sectors. It enforces tax incentives and procurement policies that favor solar-powered equipment, indirectly supporting market expansion for solar light towers.

- In India, the National Solar Mission (Jawaharlal Nehru National Solar Mission) supervises the deployment of solar energy technologies and sets capacity targets for renewable generation. It directs government and private agencies to implement solar-powered systems in industrial and public infrastructure, boosting the adoption of solar light towers in large-scale projects.

- In Canada, the Clean Fuel Regulations (SOR/2022-140) govern carbon emission reduction measures and prompt industries to transition toward low-emission and renewable-powered solutions. It supports the replacement of diesel-based lighting with solar systems to align with national decarbonization goals.

- In Australia, the Renewable Energy (Electricity) Act 2000 oversees renewable energy certificates and enforces compliance for organizations generating or consuming renewable electricity. It supports the integration of solar energy technologies, including solar light towers, across construction and resource industries operating in remote areas.

Competitive Landscape

Key companies operating in the solar light tower market are focusing on strategic collaborations, product diversification, and regional expansion to strengthen their competitive positions. Several players are investing in research and development to enhance battery performance, increase solar module efficiency, and integrate automated mast and remote monitoring systems.

Expansion of production facilities and partnerships with distributors is leading to reduced delivery time. Companies are emphasizing fleet electrification and hybrid system development to cater to varied operational environments. Mergers, acquisitions, and long-term contracts with equipment rental providers are also being utilized to secure consistent revenue streams and customer retention.

- In October 2025, Janta Power secured a USD 5.5 million seed round led by MaC Venture Capital and Collab Capital to commercialize its patented 3D photovoltaic tower technology, supporting large-scale deployment across industrial facilities, telecom infrastructure, and off-grid lighting applications, including solar light tower systems.

List of Key Companies in Solar Light Tower Market:

- Atlas Copco Group

- Olikara Lighting Towers Pvt Ltd.

- Wanco Inc.

- Ver-Mac

- Teksan

- Generac Power Systems, Inc.

- Renco Industrial

- Fuelfix Pty Ltd.

- Terex Corporation

- TRIME s.r.l.

- Oceania International LLC (Greenshine New Energy)

- Shenzhen Luxman Light CO.,Ltd

- OPTRAFFIC

- Zhejiang Valiant Power Technology Co.,Ltd

- ARMORLOGIX

Recent Developments (Product Launches)

- In March 2025, Atlas Copco launched its second-generation solar-powered light towers, HiLight MS 4 and MS 5, emphasizing enhanced efficiency and reliability. These models advance performance and sustainability across construction, mining, oil and gas, and event applications, underscoring the company’s continued progress in solar lighting solutions.