Market Definition

The software-defined anything (SDx) market refers to the abstraction of physical hardware into programmable software systems that enable dynamic management, configuration, and optimization of IT, networking, and storage resources.

These solutions deliver greater flexibility, scalability, and automation across digital infrastructures, supporting efficient resource utilization and faster service deployment. The scope of SDx extends across data centers, cloud environments, enterprise networks, and storage platforms, enabling centralized control and seamless orchestration of complex operations.

Industries such as telecommunications, enterprise IT, and manufacturing increasingly rely on software-defined architectures to enhance operational efficiency, reduce costs, and accelerate digital transformation.

Software Defined Anything Market Overview

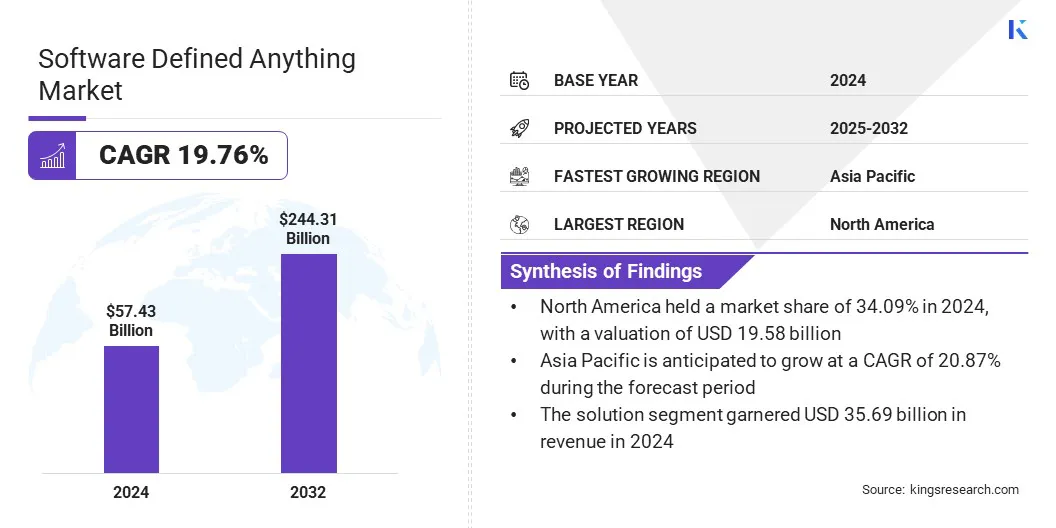

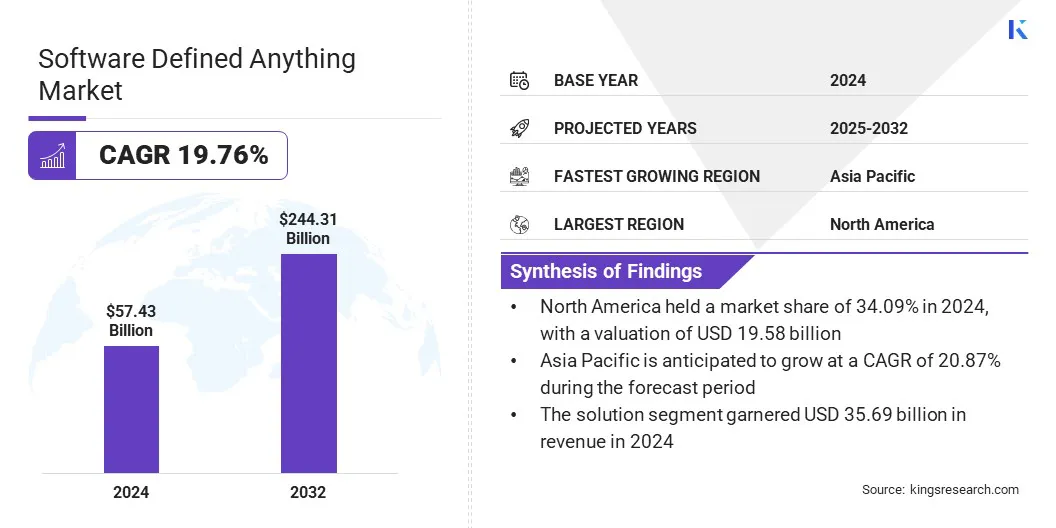

According to Kings Research, the global software defined anything market size was valued at USD 57.43 billion in 2024 and is projected to grow from USD 68.58 billion in 2025 to USD 244.31 billion by 2032, exhibiting a CAGR of 19.76% during the forecast period.

The global software-defined anything market is witnessing rapid growth due to rising demand for flexible, scalable, and cost-efficient IT, networking, and storage solutions across enterprises. Expanding adoption in cloud computing, data centers, and telecommunications is further driving widespread implementation, enabling centralized control and automated management of complex infrastructures.

Key Market Highlights:

- The software defined anything industry size was valued at USD 57.43 billion in 2024.

- The market is projected to grow at a CAGR of 19.76% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, valued at USD 19.58 billion.

- The solution segment garnered USD 35.69 billion in revenue in 2024.

- The service provider segment is expected to reach USD 139.09 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 20.87% through the projection period.

Major companies operating in the software defined anything market are Cisco Systems, Inc., IBM, Microsoft, Juniper Networks, Inc., Hewlett Packard Enterprise Development LP, Dell Inc., Nokia, NetApp, Broadcom, Huawei Technologies Co., Ltd., Fujitsu, IDC, Lenovo, NEC Corporation, and Arista Networks, Inc.

Increasing focus on operational efficiency and digital transformation is encouraging investment in software-defined platforms, aligning with evolving business and technological requirements. Additionally, continuous innovations in software-defined technologies, combined with broader enterprise adoption, are accelerating market expansion.

- In May 2024, Hewlett Packard Enterprise (HPE) advanced data management with software-defined storage and AI-driven automation. It introduced GreenLake Block Storage for AWS and upgraded HPE Alletra MP to support NVMe scaling up to 5.6PB with HPE InfoSight AIOps. The program provided investment protection and operational agility, enabling simplified storage management, improved performance, and reduced total cost of ownership for enterprises.

How are cloud computing & virtualization driving the adoption of software-defined solutions?

The adoption of software-defined solutions is being driven by the rapid expansion of cloud computing and virtualization technologies. These platforms allow organizations to abstract and manage hardware resources efficiently, enabling scalable, flexible, and automated IT, networking, and storage infrastructures.

Enterprises across sectors such as telecommunications, data centers, and enterprise IT are leveraging these technologies to enhance operational efficiency, optimize resource utilization, and accelerate service deployment. Growing focus on digital transformation, cost reduction, and agile infrastructure management is further supporting widespread implementation of software-defined solutions.

- In November 2023, DDN launched Infinia, a next-generation software-defined storage platform for enterprise AI and cloud data management. The platform supports multi-tenant and containerized workflows across edge, data center, and cloud environments.

Why is integrating software-defined solutions with legacy systems a significant challenge for organizations?

Integration with legacy systems poses a major challenge to the adoption of software-defined solutions. Many organizations rely on outdated IT, networking, and storage infrastructures that are not designed for dynamic, software-driven management, making seamless integration difficult.

Ensuring compatibility while maintaining operational continuity often requires complex migration strategies, additional resources, and specialized expertise, which can increase costs and extend deployment timelines. Enterprises across telecommunications, data centers, and enterprise IT must also align new solutions with existing security, compliance, and operational protocols.

To overcome these hurdles, organizations are exploring hybrid architectures, phased migration approaches, and specialized integration tools to enable smoother adoption and maximize the benefits of software-defined platforms.

How is the integration of artificial intelligence (AI) & automation influencing the growth of software-defined solutions?

The software-defined anything market is increasingly benefiting from the integration of artificial intelligence and automation across IT, networking, and storage environments.

This trend is driven by the growing demand for intelligent, self-optimizing, and automated infrastructures that reduce manual intervention and improve operational efficiency. Software-defined platforms are being widely adopted in data centers, telecommunications, and enterprise IT to enable predictive maintenance, real-time workload management, and faster service deployment.

Organizations are leveraging AI and automation to enhance scalability, optimize resource utilization, and support digital transformation initiatives. Continuous innovations in AI-driven automation tools are expanding the capabilities of software-defined solutions, improving performance, reliability, and operational agility.

The growing integration of these technologies is positioning software-defined platforms as essential components for enterprises aiming to achieve efficiency, agility, and sustainable growth in evolving IT landscapes.

- In October 2025, GTT Communications partnered with Insight Enterprises to deploy an AI factory using NVIDIA’s accelerated computing platform. The initiative enables the transition from traditional software-defined networking to AI-driven networking and security-as-a-service. It integrated Dell PowerEdge servers, NVIDIA AI Enterprise software, and Insight’s expertise to improve operational efficiency, enhance customer experience, and support data-driven product development.

Software Defined Anything Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution, and Services

|

|

By End User

|

Service Provider, and Enterprises

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Solution, and Services): The solution segment earned USD 35.69 billion in 2024, due to widespread adoption of software-defined platforms across enterprises.

- By End User (Service Provider, and Enterprises): The service provider held 57.70%% of the market in 2024, due to extensive deployment of software-defined solutions for scalable and automated network management.

Software Defined Anything Market Regional Analysis

Based on region, the global software defined anything market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America software defined anything market share stood at 34.09% in 2024, valued at USD 19.58 billion. This dominance is attributed to rapid digital transformation, increasing deployment of cloud and virtualized infrastructures, and rising demand for scalable, automated IT and networking solutions.

Government and industry initiatives promoting smart cities, advanced telecommunications, and enterprise modernization are further supporting regional market growth.

Additionally, the growing adoption of AI-driven and automated software-defined platforms across enterprises, combined with advancements in platform capabilities, is enhancing operational efficiency and service delivery, thereby driving market growth in the region.

The Asia Pacific software defined anything market is set to grow at a CAGR of 20.87% over the forecast period. This growth is driven by rising demand for scalable, flexible, and automated IT, networking, and storage solutions across industries such as telecommunications, data centers, and enterprise IT.

Expanding adoption of AI-enabled and automated software-defined platforms, along with advancements in platform capabilities, is enhancing operational efficiency, service delivery, and infrastructure management. Additionally, investments in digital transformation initiatives, cloud computing, and virtualization are supporting regional market expansion.

Furthermore, organizations are focusing on integrating intelligent automation, upgrading legacy systems, and strengthening security and compliance to meet evolving technological and business requirements. Increasing need for agile, reliable, and high-performance software-defined solutions further propels market development across the region.

- In July 2024, Tata Elxsi, India, partnered with Wind River to advance its software-defined vehicle development. The company adopted Wind River Studio Developer to streamline DevSecOps processes, improve software workflow efficiency, and support cloud-native SDV development. The collaboration enhanced automation, scalability, and traceability across the software lifecycle, strengthening Tata Elxsi’s capabilities in building software-defined vehicles.

Regulatory Frameworks

- In the European Union, the General Data Protection Regulation (GDPR) regulates the collection, processing, and storage of personal data. It ensures data privacy and security, which is critical for software-defined solutions that handle sensitive enterprise and customer information.

- In the U.S., the Federal Risk and Authorization Management Program (FedRAMP) regulates cloud products and services used by federal agencies. It provides standardized security assessment and continuous monitoring, which impacts software-defined solutions operating in government and public sector deployments.

Competitive Landscape

Companies operating in the global software-defined anything market are sustaining competitiveness through investments in advanced software platforms, AI-driven automation, and strategic collaborations and acquisitions. They are developing comprehensive solutions for IT, networking, and storage infrastructures to meet demands for scalability, efficiency, and operational reliability.

Market players are expanding their offerings with AI-integrated, automated, and multi-vendor compatible platforms to address evolving enterprise requirements and specialized use cases.

Moreover, they are establishing regional operations and partnering with technology providers and service integrators to enhance deployment capabilities and market penetration. Additionally, companies are providing technical support, consulting services, and platform customization to improve performance, streamline adoption, and maintain a strong competitive position.

- In August 2023, Viasat launched the Black ICE Software Defined Radio (SDR) platform to enhance secure military communications. The platform supported flexible waveforms over ELERA L-band and Global Xpress Ka-band networks, featured low size, weight, and power, and included FPGA and OpenAMIP support for intelligence, surveillance, reconnaissance, and command-and-control operations.

List of Key Companies in Software Defined Anything Market:

- Cisco Systems, Inc.

- IBM

- Microsoft

- Juniper Networks, Inc.

- Hewlett Packard Enterprise Development LP

- Dell Inc.

- Nokia

- NetApp

- Broadcom

- Huawei Technologies Co., Ltd.

- Fujitsu

- IDC

- Lenovo

- NEC Corporation

- Arista Networks, Inc.

Recent Developments

- In October 2025, SODA launched its Software Defined Anything (SDx) platform, extending AI-driven development from automotive to marine, aerospace, rail, and agricultural applications. The platform enables efficient design, testing, and operation of software-defined systems with virtual simulation, modular upgrades, and AI optimization.

- In October 2025, LG Electronics joined SDVerse, the automotive industry’s first B2B software marketplace. The company introduced its LG AlphaWare software portfolio to support automakers and suppliers in accelerating the development and deployment of software-defined vehicles, enabling enhanced connectivity, modular updates, and improved vehicle functionality.

- In June 2025, Tata Consultancy Services (TCS) opened two Automotive Delivery Centers in Munich and Villingen-Schwenningen, Germany, and an engineering center in Romania. The center aims to advance software-defined vehicle development by assisting automakers with autonomous driving, infotainment, safety, and connected vehicle technologies.

- In May 2025, HARMAN, a Samsung subsidiary, open-sourced its connected services platform through the Eclipse Foundation. The platform aims to support scalable, cloud-native software-defined vehicle development, enabling secure vehicle-to-cloud connectivity, data management, and streaming applications.