Market Definition

Sleep apnea implants are surgically implanted medical devices designed to treat obstructive sleep apnea (OSA) by stimulating airway muscles or nerves, or by structurally supporting the upper airway to prevent collapse during sleep.

The market encompasses implantable neurostimulation systems, airway support implants, related surgical procedures, and supporting technologies that serve patients unable to tolerate or benefit from conventional treatments such as CPAP or oral appliances.

Sleep Apnea Implants Market Overview

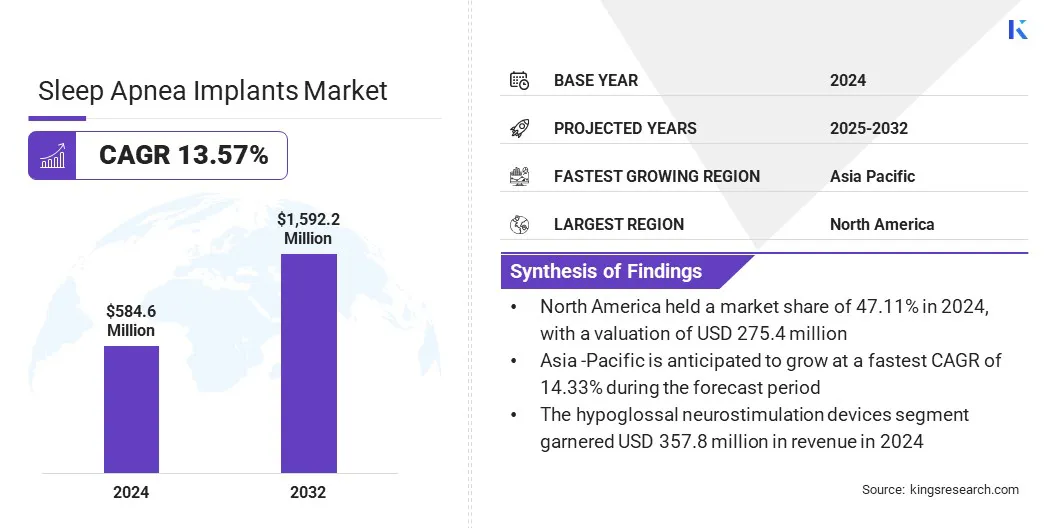

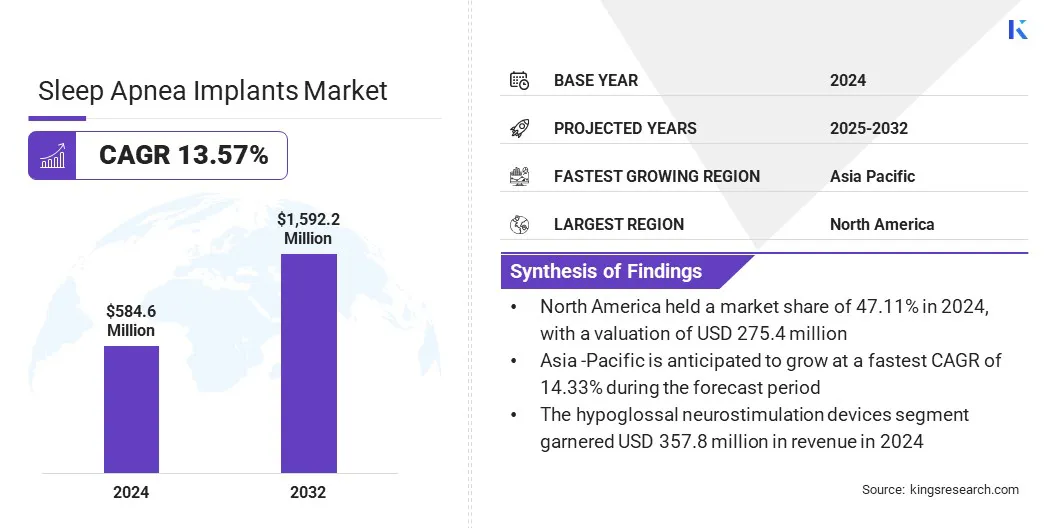

The global sleep apnea implants market size was valued at USD 584.6 million in 2024 and is projected to grow from USD 653.3 million in 2025 to USD 1,592.2 million by 2032, exhibiting a CAGR of 13.57% over the forecast period.

This growth is attributed to the rising prevalence of obesity, which is increasing the risk of obstructive sleep apnea and expanding the affected population. Increasing screening programs and public health initiatives by governments are further supporting early diagnosis and the adoption of effective treatment options.

Key Highlights:

- The sleep apnea implants industry size was recorded at USD 584.6 million in 2024.

- The market is projected to grow at a CAGR of 13.57% from 2025 to 2032.

- North America held a share of 47.11% in 2024, valued at USD 275.4 million.

- The hypoglossal neurostimulation devices segment garnered USD 357.8 million in revenue in 2024.

- The obstructive sleep apnea segment is expected to reach USD 978.5 million by 2032.

- The ambulatory surgical centers segment is anticipated to witness the fastest CAGR of 14.79% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 14.33% over the forecast period.

Major companies operating in the sleep apnea implants market are Inspire Medical Systems, Inc, Nyxoah SA, ZOLL Medical Corporation, Medtronic SpA, LivaNova PLC, Siesta Medical, Inc, Linguaflex, Inc, Resmed Corp, BMC Medical Co., Ltd., and CLEVELAND MEDICAL DEVICES INC.

The growing aging population is driving the need for advanced sleep apnea implants to improve treatment outcomes and enhance the quality of life for patients with obstructive sleep apnea (OSA). Age-related physiological changes and health conditions are raising the prevalence of sleep-disordered breathing. This growing need is driving manufacturers to develop and adopt innovative implantable therapies that enhance comfort and ensure long-term efficacy of sleep apnea management.

- According to the United Nations, by the mid‑2030s, there will be 265 million individuals aged 80 and older globally.

Market Driver

Rising Prevalence of Obesity

A major driver in the sleep apnea implants market is the rising prevalence of obesity, which is significantly increasing the risk of obstructive sleep apnea (OSA). The rise in obesity is expanding the population with OSA and fueling demand for effective treatment options. This is encouraging the development of implantable neurostimulation devices to provide long‑term, patient‑friendly therapy that improves treatment adherence and enhances patient outcomes.

- The World Health Organization (WHO) reported that 2.5 billion adults aged 18 years and older were overweight in 2022, including 890 million living with obesity.

Market Challenge

High Cost of Implants and Surgical Procedures

A key challenge impeding the growth of the sleep apnea implants market is the high cost of implants and surgical procedures. Implantable neurostimulation systems require advanced technology, specialized surgical expertise, and post‑operative care, all of which increase overall treatment expenses. These financial barriers can slow the adoption of implantable therapies and limit access to innovative sleep apnea treatments.

To address this challenge, market players are actively investing in R&D to create cost‑effective devices and streamlined surgical techniques. Companies are forming strategic partnerships with hospitals and healthcare providers to improve affordability and expand access to sleep apnea implant therapies.

Additionally, manufacturers are focusing on innovation to enhance device efficiency and durability to deliver long‑term value and drive broader adoption of implantable solutions for obstructive sleep apnea.

Market Trend

Development of Next Generation Implantable Devices

A key trend in the sleep apnea implants market is the development of next‑generation implantable devices that integrate advanced neurostimulation with digital health capabilities.

Manufacturers are incorporating features such as wireless connectivity, Bluetooth patient control, and physician programming to enable personalized therapy management. These innovations are improving patient adherence, comfort, and treatment outcomes for individuals with moderate-to-severe obstructive sleep apnea.

- In August 2024, Inspire Medical Systems received FDA approval for its Inspire V system, a next‑generation neurostimulation therapy for obstructive sleep apnea. The system includes Bluetooth patient remote control and physician programming for personalized, convenient treatment management.

Sleep Apnea Implants Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Hypoglossal Neurostimulation Devices, Phrenic Nerve Stimulators, Palatal Implants, Others

|

|

By Indication

|

Obstructive Sleep Apnea, Central Sleep Apnea

|

|

By End User

|

Hospitals, Ambulatory Surgical Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Hypoglossal Neurostimulation Devices, Phrenic Nerve Stimulators, Palatal Implants, and Others): The hypoglossal neurostimulation devices segment earned USD 357.8 million in 2024 due to growing demand for minimally invasive, patient‑friendly sleep apnea treatments.

- By Indication (Obstructive Sleep Apnea and Central Sleep Apnea): The obstructive sleep apnea segment held 65.43% of the market in 2024, driven by its higher prevalence and increasing diagnosis rates.

- By End User (Hospitals, Ambulatory Surgical Centers, and Others): The hospitals segment is projected to reach USD 897.3 million by 2032, owing to greater availability of advanced surgical facilities and specialized expertise.

Sleep Apnea Implants Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America sleep apnea implants market share stood at 47.11% in 2024 in the global market, valued at USD 275.4 million. This dominance is driven by the rising prevalence of obstructive sleep apnea (OSA) due to increasing obesity rates and an aging population. Growing intolerance and low compliance with CPAP therapy are creating strong demand for alternative treatment solutions.

Advancements in neurostimulation and minimally invasive implant technologies are improving patient comfort and outcomes for sleep apnea patients. Additionally, regional market players are pursuing strategic product launches, partnerships, and technological innovations to enhance treatment options and expand market reach, thereby driving market growth.

- In August 2025, Nyxoah launched its Genio sleep apnea implant in the U.S. following FDA approval. It is a battery‑free, smartphone‑controlled hypoglossal nerve stimulation system that offers an alternative to CPAP therapy for moderate-to-severe obstructive sleep apnea.

Asia Pacific is set to grow at a CAGR of 14.33% over the forecast period. This growth is driven by the rising prevalence of sleep apnea across Asia Pacific, fueled by urbanization, lifestyle changes, and increasing obesity rates.

Increasing investments from public healthcare systems and private hospitals, along with supportive government initiatives, are improving access to advanced treatment options across the region. Growing medical tourism in destinations such as Singapore and Thailand is further stimulating adoption of innovative implantable therapies.

Awareness efforts led by healthcare providers and research institutions are improving early detection of sleep apnea and driving timely adoption of effective treatments. Additionally, the development of next-generation implant technologies into regional healthcare systems is broadening treatment availability across the region.

- In February 2024, CU Medicine introduced upper airway stimulation (UAS) for obstructive sleep apnea (OSA) patients in Hong Kong, making it the third location in Asia to offer this procedure after Singapore and Japan. The UAS therapy serves as an alternative treatment for patients who are unable to tolerate or comply with conventional CPAP therapy.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the safety, efficacy, and quality of medical devices, including sleep apnea implants. It oversees premarket approval, clinical trials, manufacturing practices, labeling, and post-market surveillance to ensure devices meet rigorous safety standards and deliver intended benefits while minimizing risks to patients.

- In China, the National Medical Products Administration (NMPA) regulates the registration, safety, quality, and marketing of medical devices, including sleep apnea implants. It oversees clinical trial approval and product registration. The NMPA also monitors manufacturing standards, labeling, and adverse event reporting to ensure compliance with national regulations and safeguard patient safety.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates the safety, quality, and performance of medical devices, including sleep apnea implants. It oversees device approvals and clinical trials. The CDSCO also regulates manufacturing licenses, labeling, and post-market surveillance, working with state authorities to enforce compliance and protect public health while promoting medical innovation.

Competitive Landscape

Major players in the sleep apnea implants industry are expanding their geographic presence to access new patient populations and strengthen thrir market position. They are investing in the development of advanced neurostimulation and minimally invasive implant technologies to improve treatment efficacy, patient comfort, and long-term outcomes.

- In September 2025, Nyxoah expanded its Genio neuromodulation system for obstructive sleep apnea into the Middle East, performing its first successful implant in Abu Dhabi. The company plans further expansion into Dubai and Kuwait to broaden access to its patient centric CPAP alternative.

Top Key Companies in Sleep Apnea Implants Market:

- Inspire Medical Systems, Inc

- Nyxoah SA

- ZOLL Medical Corporation

- Medtronic SpA

- LivaNova PLC

- Siesta Medical, Inc

- Linguaflex, Inc

- Resmed Corp

- BMC Medical Co., Ltd.

- CLEVELAND MEDICAL DEVICES INC.

Recent Developments

- In March 2024, LivaNova reported a positive predictive outcome for its OSPREY trial of the Aura6000 Hypoglossal Nerve Stimulator. The device offers an alternative treatment for moderate-to-severe obstructive sleep apnea.