Market Definition

Skincare packaging refers to the design, development and production of containers and materials used to store, protect, dispense, and present skincare products such as creams, lotions, serums, masks, and cleansers. It ensures product stability, hygiene, and extended shelf life while improving functionality and supporting brand identity.

The market covers primary containers like jars, tubes, bottles, and airless dispensers; secondary packaging such as boxes or sleeves for protection and branding; and tertiary packaging for shipping and storage.

Modern skincare packaging focuses on functionality, safety, and sustainability, incorporating features like airless pumps, recyclable or biodegradable materials, and user-friendly designs, making it a critical component that integrates protection, aesthetics, regulatory compliance, and marketing in the skincare industry.

Skincare Packaging Market Overview

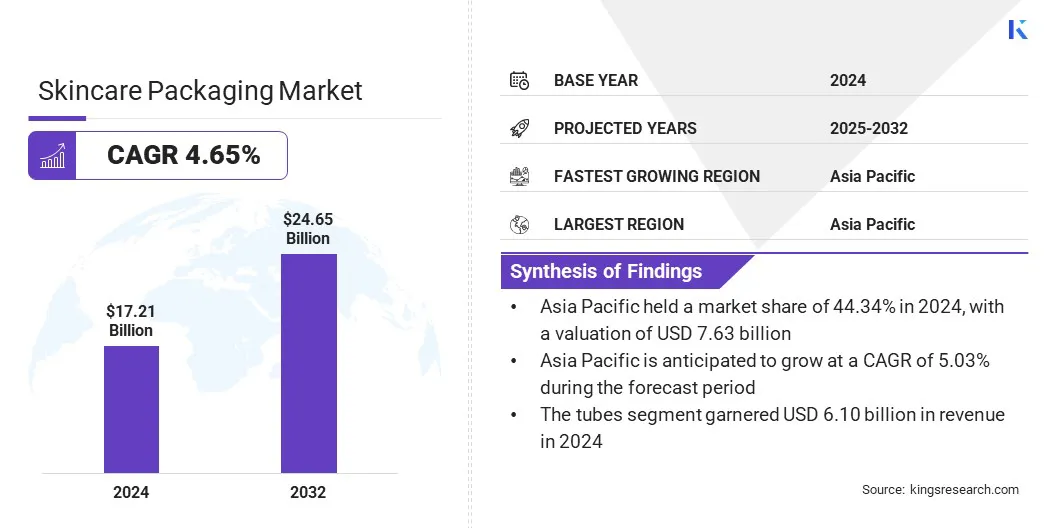

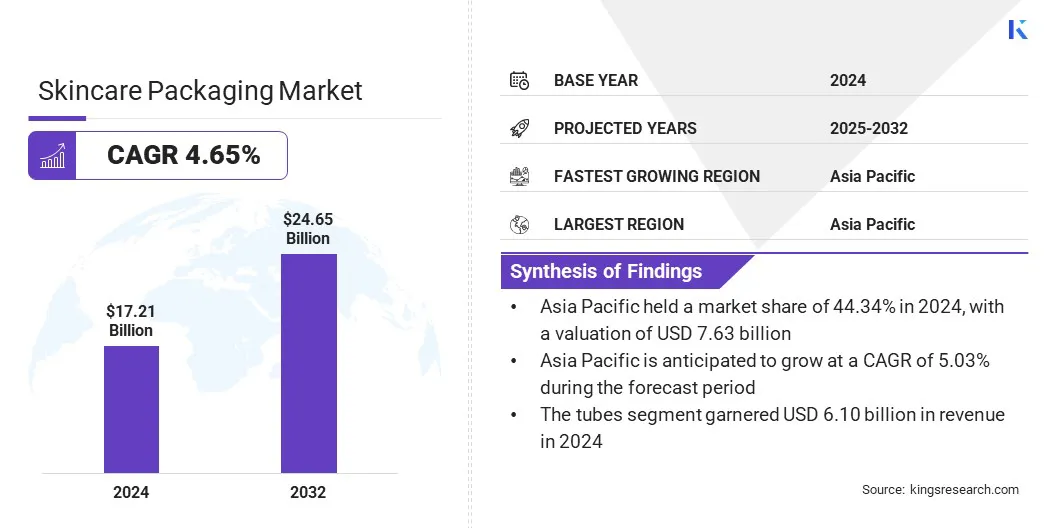

The global skincare packaging market size was valued at USD 17.21 billion in 2024 and is projected to grow from USD 17.94 billion in 2025 to USD 24.65 billion by 2032, exhibiting a CAGR of 4.65% over the forecast period.

Market growth is driven by rising adoption of sustainable, premium, and functional packaging solutions across skincare categories. Innovations in airless pumps, tubes, jars, and eco-friendly materials enhance product protection, hygiene, and user convenience, while strong branding and aesthetic appeal also fuel market growth.

Key Highlights:

- The Skincare Packaging industry size was recorded at USD 17.21 billion in 2024.

- The market is projected to grow at a CAGR of 4.65% from 2025 to 2032.

- North America held a market share of 25.43% in 2024, with a valuation of USD 4.38 billion.

- The tubes segment generated USD 6.10 billion in revenue in 2024.

- The plastic segment is expected to reach USD 13.00 billion by 2032.

- The skin care segment is anticipated to witness fastest CAGR of 5.14% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 5.03% over the forecast period.

Major companies operating in the Skincare Packaging market are Albéa Group, HCP Packaging, Cosmopak, Quadpack, Gerresheimer AG, AptarGroup, Inc., Silgan Holdings Inc, Amcor Plc, Huhtamaki Oyj, Ball Corporation, SKS Bottle & Packaging, Inc., Alpla, Libo Cosmetics Co. Ltd., Rieke, and Mondi.

The market growth is driven by rising demand for recyclable, biodegradable, and refillable materials that reduce environmental impact while maintaining product integrity and consumer appeal. Key players are actively developing packaging using glass, aluminium, and mono-material plastics, which allow durability and recyclability.

Companies are also introducing versatile packaging formats, including bottles, tubes, vials, and sticks, that cater to skincare, serum, and treatment products. Collaborations with brands to adopt these sustainable solutions are expanding market presence, enhancing brand value, and encouraging environmentally responsible manufacturing practices.

- In May 2024, Cosmopak launched the “Waves of Beauty” collection, featuring stock mold options in bottles, tubes, vials, and sticks. The collection highlights the use glass, aluminium, and mono-material plastics, offering sustainable packaging formats suitable for skincare, serums, and treatment products.

What is the major factor driving market growth?

A key factor driving the growth of the skincare packaging market is the rising consumer spends on luxury skincare products. Growing disposable incomes and increasing awareness of premium personal care are encouraging brands to adopt sophisticated and visually appealing packaging solutions such as airless dispensers, glass jars, and elegantly designed tubes.

These innovations improve product functionality, preserve formulation efficacy, and elevate brand perception, making products more attractive to discerning consumers. The emphasis on premium, aesthetically refined packaging strengthens brand differentiation and drives repeat purchases, thereby driving market growth.

What strategies are companies using to overcome cost and operational challenges in skincare packaging?

A key challenge limiting the growth of the skincare packaging market is the high cost associated with advanced and sustainable packaging solutions, including airless dispensers, mono-material tubes, glass jars, and refillable formats.

Premium materials, specialized manufacturing processes, and compliance with eco-friendly standards can increase production and operational expenses for brands, particularly smaller and emerging players.

To address this, companies are exploring collaborations with packaging manufacturers, using scalable production technologies, and adopting modular or stock-based sustainable packaging solutions. These approaches help reduce costs, improve operational efficiency, and encourage wider production of innovative and environmentally responsible skincare packaging across the industry.

What innovations in materials and design are driving growth in skincare packaging?

A key trend shaping the skincare packaging market is the development of sustainable and eco-friendly packaging solutions. Manufacturers are increasingly using recyclable, biodegradable, and refillable materials supported by innovations such as mono-material tubes, airless refillable jars, and reduced-plastic designs.

These developments allow reduced material use, improved recyclability, and greater production efficiency while maintaining product protection and visual appeal. These sustainable packaging initiatives are driving product differentiation, improving brand perception, and influencing purchasing decisions, thereby contributing to the overall growth of the market.

- In September 2024, Albéa introduced its “Polaris” mono-material PP refillable jar for skincare at Luxe Pack Monaco. The jar features an invisible hinge connecting the cap to the base, improving functionality and recyclability while supporting sustainable packaging practices.

Skincare Packaging Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Tubes, Bottles, Jars & Containers, Pumps & Dispensers, Aerosol Cans, Others

|

|

By Material Type

|

Plastic, Glass, Metal, Paper & Cardboard, Others

|

|

By Application

|

Skin Care, Hair Care, Color Cosmetics, Sun Care, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Tubes, Bottles, Jars & Containers, Pumps & Dispensers, Aerosol Cans, and Others): The tubes segment earned USD 6.10 billion in 2024, driven by the rising demand for convenient, lightweight, and hygienic packaging formats that support precise product dispensing and compatibility with travel-size and on-the-go skincare applications.

- By Material Type (Plastic, Glass, Metal, Paper & Cardboard, and Others): The plastic segment held 54.56% of the market in 2024, due to its cost-effectiveness, versatility, and suitability for lightweight, durable, and customizable packaging solutions.

- By Application (Skin Care, Hair Care, Color Cosmetics, Sun Care, and Others): The skin care segment is projected to reach USD 13.90 billion by 2032, owing to the growing consumer focus on personal care, rising demand for premium and sustainable products.

What is the current scenario of the global skincare packaging market?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 44.34% of the global skincare packaging in 2024, with a valuation of USD 7.63 billion. This dominance is driven by personal care awareness, increasing disposable incomes, and growing demand for premium and sustainable skincare products in China, India, Japan, and South Korea.

Rapid urbanization, changing lifestyles, and the expansion of e-commerce and retail channels are fueling the adoption of airless dispensers, refillable jars, glass containers, and mono-material tubes. Packaging manufacturers are partnering with local skincare brands, distributors, and e-commerce platforms to expand market reach and deliver technologically advanced and consumer-friendly packaging solutions.

In North America, the market is projected to grow at a CAGR of 4.80% over the forecast period. The growth is supported by strong beauty and personal care industries, high disposable incomes, and a growing preference for environmentally responsible packaging.

Awareness of sustainability and circular economy practices is encouraging manufacturers to use recyclable, biodegradable, and refillable packaging. Additionally, the rise of e-commerce and direct-to-consumer skincare brands is boosting the need for lightweight, durable, and aesthetically appealing packaging.

Regulatory Frameworks

- In North America, the U.S. Food and Drug Administration (FDA) regulates materials and containers that come into contact with cosmetic and skincare products, enforcing strict guidelines on chemical safety, labeling, and packaging integrity.

- In the European Union, the EU Cosmetics Regulation (EC) No 1223/2009 sets requirements for packaging materials, labeling, and safety assessments, with additional emphasis on recyclability and environmental impact under directives such as the EU Packaging and Packaging Waste Directive.

- In China, the skincare packaging is regulated under the National Medical Products Administration (NMPA), which oversees the safety, labeling, and quality of cosmetic and skincare products, including their packaging materials.

- Globally, government bodies such as the World Health Organization (WHO) and the International Organization for Standardization (ISO) provide guidance on materials, hygiene standards, and manufacturing practices to ensure packaging quality or safety.

Competitive Landscape

Key players in the skincare packaging industry are actively adopting innovative strategies to strengthen their competitive positioning. They are investing in technological advancements such as airless dispensers, smart packaging with QR and NFC integration, and precision applicators that improve product safety, convenience, and user engagement.

Strategic partnerships with skincare brands, retailers, and design studios are driving the co-development of customized packaging solutions tailored to premium and luxury segments.

- In May 2023, Stora Enso, in collaboration with Blue Ocean Closures and AISA, developed the first paperboard tube with a fiber-based closure. This allows brand owners to increase the share of renewable materials in their packaging, marking a significant advancement toward fully sustainable, fiber-based skincare packaging.

Key Companies in Skincare Packaging Market:

- Albéa Group

- HCP Packaging

- Cosmopak

- Quadpack

- Gerresheimer AG

- AptarGroup, Inc.

- Silgan Holdings Inc

- Amcor Plc

- Huhtamaki Oyj

- Ball Corporation

- SKS Bottle & Packaging, Inc.

- Alpla

- Libo Cosmetics Co. Ltd.

- Rieke

- Mondi

Recent Developments

- In May 2024, Cosmopak introduced the “Waves of Beauty” collection, offering stock mold options in bottles, tubes, vials, and sticks. The collection emphasizes eco-forward materials such as glass, aluminium, and mono-material plastics, providing sustainable and versatile packaging formats suitable for skincare, serum, and treatment products.