Market Definition

Security service edge (SSE) is a cloud-delivered security framework that integrates secure web gateway (SWG), cloud access security broker (CASB), and zero trust network access (ZTNA) to provide secure access to applications and data from any location.

The SSE market encompasses cloud-based security solutions and services that protect organizations from cyber threats, enforce zero-trust principles, and enable secure access for remote, hybrid, and mobile users. It covers software platforms, managed services, and related technologies adopted across industries to safeguard digital infrastructure in a cloud-first environment.

Security Service Edge Market Overview

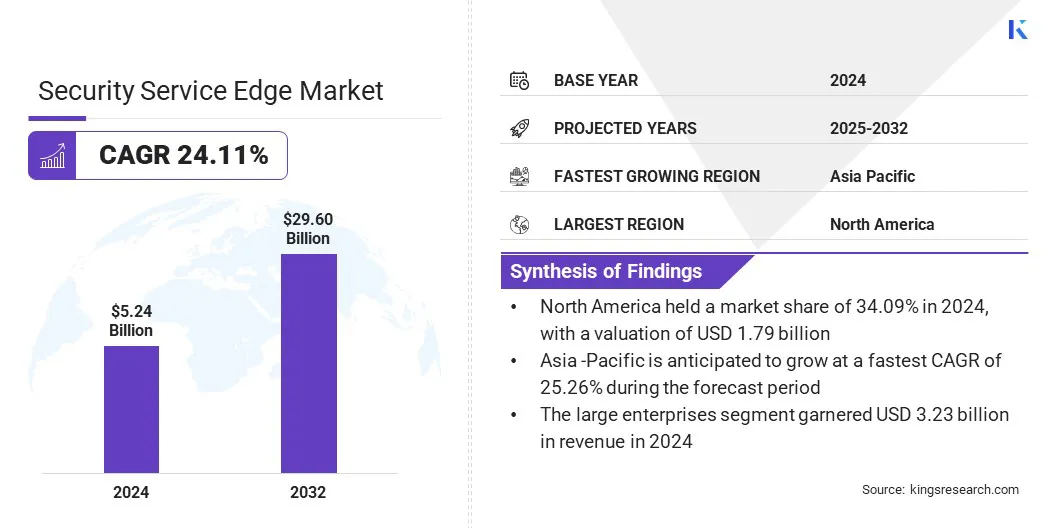

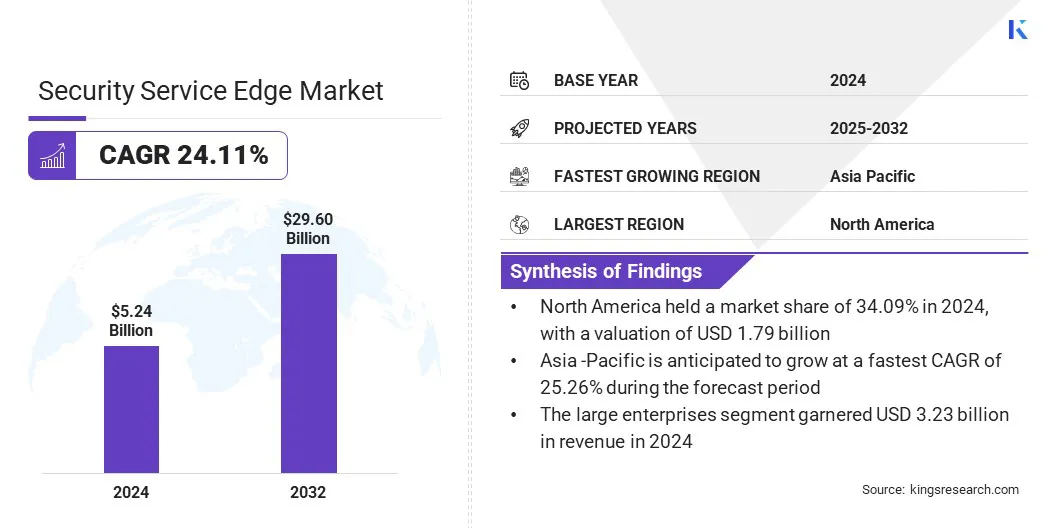

The global security service edge market size was valued at USD 5.24 billion in 2024 and is projected to grow from USD 6.49 billion in 2025 to USD 29.60 billion by 2032, exhibiting a CAGR of 24.11% over the forecast period. This growth is attributed to the rising demand for secure, cloud-delivered access in remote and hybrid work environments.

The integration of artificial intelligence (AI) in security service edge platforms is further enhancing the market by enabling advanced threat detection, automated policy enforcement, and operational efficiency.

Key Market Highlights:

- The security service edge industry size was recorded at USD 5.24 billion in 2024.

- The market is projected to grow at a CAGR of 24.11% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 1.79 billion.

- The solution segment garnered USD 3.02 billion in revenue in 2024.

- The large enterprises segment is expected to reach USD 17.79 billion by 2032.

- The healthcare segment is anticipated to witness the fastest CAGR of 24.28% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 25.26% over the forecast period.

Major companies operating in the security service edge market are Zscaler, Inc, Netskope, Inc, Palo Alto Networks, Inc., Cisco Systems, Inc., Broadcom Inc., BlueAlly, Inc., Cato Networks Ltd, Check Point Software Technologies Ltd, Cloudflare, Inc., Forcepoint LLC, Fortinet, Inc., Hewlett Packard Enterprise Development LP, Menlo Security, Inc., and Open Systems, and Musarubra LLC.

The market is propelled by the growing adoption of cloud security architectures as enterprises are increasingly shifting from traditional data centers to distributed, cloud-native environments. This shift drives demand for integrated SSE solutions that provide secure, seamless access to applications and data across hybrid infrastructures.

Moreover, organizations are prioritizing cloud-delivered SSE services that implement zero-trust principles, strengthen user identity management, and maintain consistent policy enforcement across all users, devices, and locations.

- In March 2024, Lookout, Inc. launched a mid-market edition of its cloud security platform to simplify cloud security for enterprises with 1K–5K employees. This enables automated deployment, zero-trust access, and unified management, reducing complexity while protecting data, devices, and applications from modern cyber threats.

Market Driver

Rising Adoption of Remote and Hybrid Work Models

A key factor propelling the growth of the security service edge industry is the rising adoption of remote and hybrid work models. Organizations are increasingly allowing employees to work from home, branch offices, or other off-site locations, creating a distributed workforce that requires secure and seamless access to applications and data.

SSE solutions enforce zero-trust access, protect endpoints, and secure cloud and on-premises resources across diverse networks. The expansion of remote and hybrid work is accelerating the deployment of SSE platforms and enhancing productivity while strengthening cybersecurity across enterprises.

- In November 2024, Cisco and LTIMindtree strengthened their partnership to enhance secure access for hybrid and remote workforces. LTIMindtree implemented Cisco Secure Access as its Security Service Edge (SSE) solution, securing 80,000 hybrid employees.

Market Challenge

Data Privacy and Regulatory Compliance

A key factor hindering the growth of the security service edge market is data privacy and regulatory compliance. Organizations handle sensitive information across cloud applications and distributed networks, which must comply with strict regulations such as the General Data Protection Regulation (GDPR), the Health Insurance Portability and Accountability Act (HIPAA), and regional data localization laws.

Managing compliance using cloud-delivered security services creates complexity and risk of financial and legal challenges for organizations.

To address this challenge, market players are implementing advanced compliance management tools within their SSE solutions. They are integrating automated policy enforcement and reporting features to ensure adherence to regulations such as GDPR and HIPAA.

Market players are partnering with managed security service providers (MSSPs) to reduce risk and streamline regulatory compliance while maintaining secure access across cloud and hybrid environments.

Market Trend

Integration of AI into SSE Platforms

A key trend shaping the security service edge market is the integration of artificial intelligence (AI) into SSE platforms. AI-enabled SSE solutions analyze user behavior, network traffic, and application access in real time, enabling automated threat detection, policy enforcement, and anomaly response.

This intelligent approach reduces manual intervention, strengthens zero-trust access, and ensures continuous protection across distributed networks and hybrid work environments. The integration of AI enhances operational efficiency, accelerates adoption, and enables enterprises to proactively secure sensitive data.

- In June 2025, Check Point launched a local India-based instance of its Harmony SASE solution. The localized platform allows providers to deliver a unified, AI-driven SSE/SASE solution to Indian enterprises, enabling secure digital transformation and hybrid work support.

Security Service Edge Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solution (Zero Trust Network Access, Cloud secure web gateway, Cloud access security broker, Firewall-as-a-service), Services (Professional, Managed)

|

|

By Organization

|

Small and Medium Enterprises, Large Enterprises

|

|

By Vertical

|

IT & Telecommunications, BFSI, Healthcare, Retail, Manufacturing, Government, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Solution, and Services): The solution segment earned USD 3.02 billion in 2024 due to increasing adoption of cloud-delivered security service edge solutions and zero-trust frameworks.

- By Organization (Small and Medium Enterprises, and Large Enterprises): The large enterprises segment held 61.72% of the market in 2024, due to their extensive hybrid IT infrastructures and growing need for centralized, cloud-based security management.

- By Vertical (IT & Telecommunications, BFSI, Healthcare, and Retail): The IT & telecommunications segment is projected to reach USD 7.19 billion by 2032, owing to rapid digitalization, cloud adoption, and the increasing demand for secure network access across distributed environments.

Security Service Edge Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America security service edge market share stood at 34.09% in 2024, valued at USD 1.79 billion. This dominance is driven by the rising adoption of cloud-based security frameworks in the region.

The growing prevalence of hybrid and remote work models is further fueling demand for SSE solutions to provide secure, seamless access to applications and data across distributed networks. Increasing concerns around cyber threats and data breaches are also propelling demand for advanced threat protection and data loss prevention capabilities.

Additionally, regional players are offering SSE platforms that combine multiple security functions and simplify management, further driving market growth across the region.

- In November 2024, Absolute Security launched its Enterprise Edition SSE platform, combining Safe Connect for Secure Access and the Comply Module for Secure Endpoint. The platform enables enterprises to enforce dynamic Zero Trust Network Access (ZTNA) policies, integrate CASB, SWG, and Data Loss Protection, and deliver always-on resilient security.

Asia Pacific is set to grow at a robust CAGR of 25.26% over the forecast period. This growth is driven by rapid digitalization and cloud adoption across the region. Enterprises in this region are increasingly deploying hybrid IT environments and remote work models, creating a strong demand for cloud-delivered security solutions that protect users, applications, and data.

Stringent data sovereignty and regulatory requirements in countries like India and Singapore are prompting organizations to adopt SSE platforms that ensure compliance while maintaining secure access. In India, key regulations include the Information Technology Act and the Personal Data Protection Bill, and in Singapore, the Personal Data Protection Act (PDPA) governs data privacy.

Increasing cyberattacks and targeted threats in the region are driving enterprises and service providers to invest in advanced security measures, including zero-trust frameworks and threat detection. Additionally, the presence of managed SSE services with AI-assisted monitoring is helping organizations simplify deployment and accelerate SSE adoption across the region.

- In June 2025, HCLTech launched a managed Secure Service Edge (SSE) solution in collaboration with Cisco. The solution integrates Cisco’s Secure Access technology with HCLTech’s managed services, enabling enterprises to secure remote and hybrid work environments and unify multiple security functions into a cloud service. It also leverages AI-assisted threat detection and improves cyber incident response, simplifying security adoption while enhancing protection for corporate resources and AI applications.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) regulates data privacy, cybersecurity practices, and the protection of consumer information. It enforces compliance with laws such as the Gramm-Leach-Bliley Act (GLBA) and the Federal Information Security Management Act (FISMA). SSE providers must ensure secure data handling, breach notification, and transparent privacy policies to meet FTC standards.

- In the U.K., the Information Commissioner’s Office (ICO) enforces data protection, privacy, and cybersecurity under the U.K. General Data Protection Regulation (UK-GDPR) and the Data Protection Act 2018. SSE providers must implement secure authentication, access control, incident reporting, and compliance with cross-border data handling requirements.

- In China, the Cyberspace Administration of China (CAC) oversees network security, personal information protection, and critical infrastructure safeguards. SSE vendors must comply with the Cybersecurity Law, Data Security Law, and Personal Information Protection Law, implementing secure cross-border data transfers, risk assessments, and robust cybersecurity measures for cloud and hybrid networks.

- In India, the Ministry of Electronics and Information Technology (MeitY) governs IT security, digital infrastructure, and sensitive data protection. Providers must adhere to the Information Technology Act, 2000, including rules on data localization, secure access protocols, and regular audits, ensuring compliance for cloud and hybrid deployments.

Competitive Landscape

Major players in the security service edge market are actively enhancing their platforms by integrating zero-trust network access and cloud-delivered security solutions to address hybrid and remote workforce requirements. They are expanding their portfolios through strategic acquisitions and partnerships to strengthen their capabilities in threat detection and unified security management.

Additionally, players are continuously upgrading their platforms to consolidate multiple security functions, such as secure web gateway (SWG) and data loss prevention (DLP), into unified solutions to simplify management and ensure seamless and compliant access across distributed networks and cloud environments.

- In January 2024, SonicWall acquired Banyan Security to strengthen its cloud-security platform. This expands its SSE and ZTNA capabilities, enabling organizations to modernize security and replace legacy architectures for hybrid and remote workforces.

List of Key Companies in Security Service Edge Market:

- Zscaler, Inc

- Netskope, Inc

- Palo Alto Networks, Inc

- Cisco Systems, Inc

- Broadcom Inc

- BlueAlly, Inc

- Cato Networks Ltd

- Check Point Software Technologies Ltd

- Cloudflare, Inc

- Forcepoint LLC

- Fortinet, Inc

- Hewlett Packard Enterprise Development LP

- Menlo Security, Inc

- Open Systems

- Musarubra LLC.

Recent Developments

- In July 2025, Conceal launched the Browser Native Security Service Edge (SSE). The platform replaces legacy VDI, VPN, and SSE solutions, securing access directly through the browser while integrating ZTNA, CASB, SWG, and DLP functionalities. It enables access to cloud and on-premise applications, reduces latency, and protects endpoints from threats in real time.

- In May 2025, Ekinops acquired Olfeo, a French Security Service Edge (SSE) software provider. The acquisition strengthens Ekinops’ SASE portfolio by combining Olfeo’s cybersecurity capabilities with its SD-WAN offerings.

- In May 2024, Cloudflare acquired BastionZero, a zero-trust infrastructure access platform, to enhance Cloudflare One’s SASE capabilities. The acquisition allows Cloudflare to provide centralized zero-trust controls for servers, Kubernetes clusters, and databases, replacing traditional VPN access. It also enables secure and productive management of hybrid IT environments while strengthening the protection of critical infrastructure.

- In January 2024, Kyndryl launched two new security edge services in collaboration with Cisco. The services provide consulting, implementation, and managed Secure Service Edge (SSE) solutions. It also enables enterprises to adopt zero-trust architectures and integrate SD-WAN with SSE.