Market Definition

Secondary macronutrients, such as calcium, magnesium, and sulfur, support healthy crop growth and soil balance. They facilitate nutrient uptake, enzyme activation, and chlorophyll formation, ensuring stronger plant structure and productivity. The market covers cereals, oilseeds, pulses, fruits, and vegetables across diverse agricultural systems.

Farmers and fertilizer manufacturers use secondary macronutrients to improve crop yield quality, correct soil deficiencies, and maintain long-term agricultural sustainability.

Secondary Macronutrients Market Overview

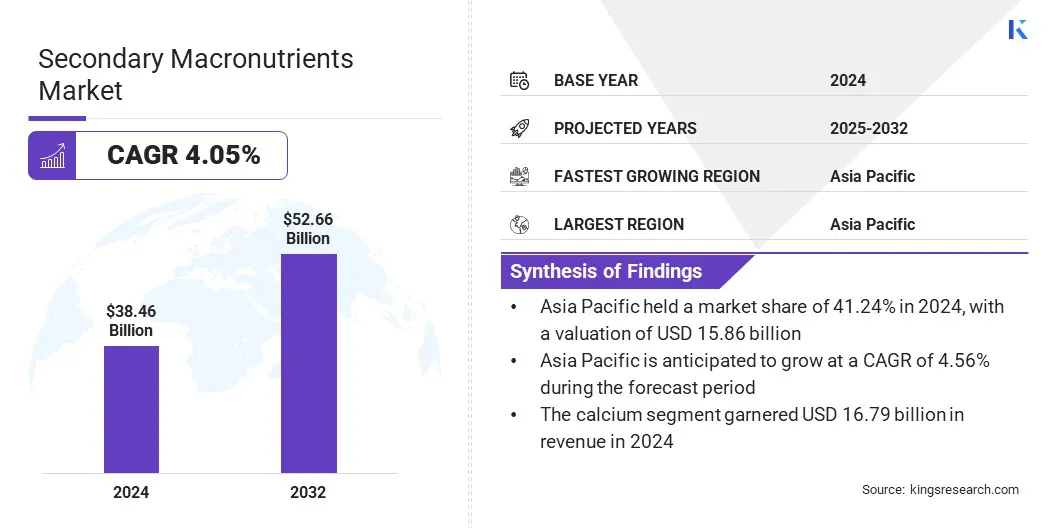

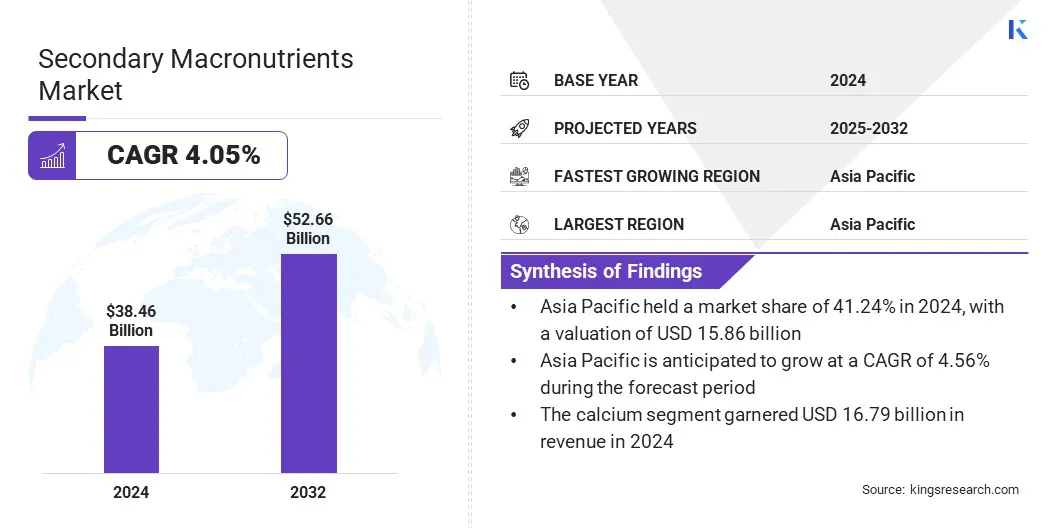

According to Kings Research, the global secondary macronutrients market size was valued at USD 38.46 billion in 2024 and is projected to grow from USD 39.87 billion in 2025 to USD 52.66 billion by 2032, exhibiting a CAGR of 4.05% over the forecast period.

The growth of the market is driven by the expansion of high-value crop cultivation across horticultural and cash crop sectors. The integration of precision agriculture tools also supports market growth by improving nutrient application and optimizing soil fertility management.

Key Market Highlights:

- The secondary macronutrients industry size was valued at USD 38.46 billion in 2024.

- The market is projected to grow at a CAGR of 4.05% from 2025 to 2032.

- Asia Pacific held a market share of 41.24% in 2024, with an estimate of USD 15.86 billion.

- The calcium segment generated USD 16.79 billion in revenue in 2024.

- The cereals & grains segment is expected to reach USD 19.01 billion by 2032.

- The dry segment secured the largest revenue share of 64.72% in 2024.

- The fertigation is expected to grow at a CAGR of 5.06% over the forecast period.

- North America is projected to grow at a CAGR of 4.16% over the forecast period.

Major companies operating in the secondary macronutrients market are Yara, ICL, The Mosaic Company, Nutrien, Haifa Negev Technologies Ltd, EuroChem, OCP Group, Coromandel International Ltd, Kingenta, SQM, Bayer Group, TIMAC AGRO, Compass Minerals, Fertiberia, and Huma Inc.

Government initiatives promoting balanced fertilization are stimulating the growth of the market. Agricultural departments in several countries are introducing subsidies to encourage the use of calcium, magnesium, and sulfur-based fertilizers alongside primary nutrients.

Extension programs and farmer training sessions are being conducted to spread awareness about the importance of secondary nutrients in improving soil health and crop productivity. Public sector research institutions are also supporting demonstrations and field trials that highlight the agronomic benefits of secondary macronutrients.

- The Nutrient Based Subsidy (NBS) scheme for Kharif 2024 in India includes three new fertilizer grades fortified with secondary and primary nutrients. The new grades include NPK (11-30-14) fortified with Magnesium, Zinc, Boron, and Sulfur; Urea-SSP Complex (5-15-0-10); and SSP (0-16-0-11) fortified with Magnesium, Zinc, and Boron.

Market Driver

Expansion of High-Value Crop Cultivation

The increasing cultivation of high-value crops is primarily driving the growth of the secondary macronutrients market. Farmers are focusing on horticultural and cash crops such as fruits, vegetables, coffee, and cotton that require balanced nutrition for optimal yield and quality.

These crops have higher nutrient demands, making secondary macronutrients like calcium, magnesium, and sulfur essential for improving plant growth and productivity.

- In June 2024, Coromandel International launched Paramfos Plus, a magnesium-fortified complex grade fertilizer. The formulation includes 16% Nitrogen, 20% Phosphorus, 13% Sulfur, and 0.6% Magnesium and is used for vegetables, horticultural crops, fruit-bearing plants, cotton, and others.

The growing export-oriented production of fruits and vegetables is encouraging the use of specialized fertilizers to meet international quality standards. The rising profitability of high-value crops compared to staple grains is also motivating farmers to invest in nutrient-efficient fertilization practices.

Market Challenge

Limited Awareness in Developing Regions

A significant challenge for the secondary macronutrients industry is the lack of awareness among farmers about the importance of secondary nutrients.

Many smallholders in developing regions continue prioritizing nitrogen, phosphorus, and potassium (NPK), assuming these are sufficient for optimal crop growth. This imbalance can cause nutrient deficiencies, reduce yield quality, and degrade health over time.

To address this, market players are conducting farmer training programs, collaborating with agricultural extension services, and promoting soil testing initiatives to show the benefits of balanced nutrient application.

These efforts are improving knowledge transfer and encouraging wider adoption of secondary macronutrient fertilizers in emerging agricultural markets.

Market Trend

Integration of Precision Agriculture Tools

A key trend in the secondary macronutrients market is the use of precision agriculture tools to improve nutrient application. Farmers are adopting soil mapping, GPS-based sensors, and variable-rate applicators to assess nutrient variability across fields. These technologies allow targeted delivery of calcium, magnesium, and sulfur based on real-time soil and crop data.

Improved accuracy in nutrient placement improves crop uptake and minimizes nutrient losses to the environment. Agritech solution providers are partnering with fertilizer manufacturers to develop integrated systems that align fertilization strategies with data-driven insights.

- In November 2024, the Nebraska Public Service Commission awarded grants to Taylor Farms General Partnership and Nick Herbig for the adoption of GPS-enabled and GPS-guided drones in precision agriculture. These drones provide accurate mapping and variable-rate application of fertilizers, improving nutrient application and reducing environmental impact.

Secondary Macronutrients Market Report Snapshot

|

Segmentation

|

Details

|

|

By Nutrient Type

|

Calcium, Magnesium, Sulfur

|

|

By Crop Type

|

Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Others

|

|

By Form

|

Dry, Liquid

|

|

By Mode of Application

|

Soil Application, Foliar Application, Fertigation

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Nutrient Type (Calcium, Magnesium, and Sulfur): The calcium segment earned USD 16.79 billion in 2024 due to its critical role in improving cell wall strength, soil structure, and fruit quality.

- By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others): The cereals & grains segment held 38.56% of the market in 2024, due to the high nutrient demand of staple crops such as wheat, maize, and rice.

- By Form (Dry and Liquid): The dry segment is projected to reach USD 33.04 billion by 2032, owing to its higher nutrient concentration, longer shelf life, and cost-effective storage and transportation advantages for large-scale farming operations.

- By Mode of Application (Soil Application, Foliar Application, and Fertigation): The fertigation segment is poised for significant growth at a CAGR of 5.06% over the forecast period, attributed to its ability to deliver nutrients directly through irrigation systems, ensuring uniform distribution and higher nutrient use efficiency.

Secondary Macronutrients Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The Asia Pacific secondary macronutrients market share stood at 41.24% in 2024 in the global market, with a valuation of USD 15.86 billion. Active promotion of balanced fertilization programs by regional governments is a primary driver in Asia Pacific.

Subsidies and extension services encourage farmers to include secondary nutrients alongside primary fertilizers. Regional agricultural authorities are also incentivizing the use of fortified fertilizers in high-value crops. These initiatives are creating a stable market environment for secondary macronutrient suppliers.

Moreover, the increasing focus on crops that meet strict international quality standards is boosting the market growth. Export-oriented horticultural and vegetable crops require uniform size, firmness, and nutrient content. In 2023–24, India's exports of processed food were USD 7,701.66 million including USD 986.32 million in fruits and USD 828.26 million in vegetables.

Secondary macronutrients play a critical role in improving shelf life and post-harvest quality. Hence, producers are investing in nutrient management strategies to enhance marketability and secure better prices.

The secondary macronutrients industry in North America is poised for significant CAGR of 4.16% over the forecast period. This growth is due to the widespread use of precision agriculture technologies across North American farms. Farmers are using GPS-guided equipment, soil sensors, and data analytics to optimize nutrient application.

- In December 2024, the U.S. Economic Research Service (ERS) reported that 68% of large-scale crop-producing farms used technologies such as yield monitors, yield maps, and soil maps. The use of precision agriculture technologies increases sharply with farm size, with small family farms having the lowest rates of use within each technology category.

Agricultural service providers are supporting farmers in the integration of liquid and foliar secondary macronutrients into these systems. The growing reliance on technology-driven farming practices is steadily boosting the demand for secondary macronutrient products.

Regulatory Frameworks

- The U.S. follows the Fertilizer Control Act, administered by the Environmental Protection Agency (EPA), which mandates the registration of fertilizers containing secondary macronutrients to ensure quality and safety. The act requires fertilizers to meet specific labeling and performance standards.

- The European Union implements the Fertilising Products Regulation (EU) 2019/1009, which sets the rules for selling fertilizers containing secondary macronutrients in the market. Manufacturers have to declare secondary nutrient content if present in significant amounts. The regulation ensures safety, labeling, and performance standards, allowing free movement of fertilizing products across member states.

- China requires fertilizers containing secondary macronutrients to be registered with the Ministry of Agriculture and Rural Affairs. Products must meet technical standards and undergo evaluation to ensure quality and safety. Water-soluble fertilizers containing calcium and magnesium must comply with defined concentration and pH levels.

- India regulates fertilizers under the Fertilizer Control Order (FCO), managed by the Ministry of Chemicals and Fertilizers, which governs the manufacture, distribution, and sale of fertilizers containing secondary macronutrients. The FCO defines nutrient tolerance levels for sulfur, calcium, and magnesium to maintain quality. India also implements the Nutrient-Based Subsidy Scheme to promote balanced fertilization.

- Japan enforces the Fertilizer Control Act to regulate the manufacture and sale of fertilizers containing secondary macronutrients, ensuring product quality and safety. The Ministry of Agriculture, Forestry and Fisheries (MAFF) requires registration of fertilizers, demonstrating effectiveness and compliance before marketing. Japan’s regulations mandate adherence to official specifications and application standards.

Competitive Landscape

Market players are adopting strategies such as product innovation, technological advancements, and partnerships to remain competitive in the secondary macronutrients market. These approaches aim to improve product offerings and production, and to meet the evolving needs of the agricultural sector.

By focusing on research and development, companies can introduce new formulations that address specific nutrient deficiencies in crops. Collaborations with industry partners ease the sharing of expertise and resources, leading to the development of advanced fertilizer solutions.

- In December 2024, Grupa Azoty introduced eNpluS, a granular fertilizer combining nitrogen with sulfur and calcium. It can be used on vegetable and fruit crops, cereals, root crops, and legumes.

List of Key Companies in Secondary Macronutrients Market:

- Yara

- ICL

- The Mosaic Company

- Nutrien

- Haifa Negev technologies LTD

- EuroChem

- OCP Group

- Coromandel International Ltd.

- Kingenta

- SQM

- Bayer Group

- TIMAC AGRO

- Compass Minerals

- Fertiberia

- Huma, Inc.

Recent Developments

- In February 2024, ICL acquired Nitro 1000. ICL is an Israel-based minerals and chemicals company, and Nitro 1000 is a Brazil-based biotechnology company specializing in biological products for agriculture. This acquisition strategically expands ICL's portfolio to include biological products, such as secondary macronutrients.