Market Definition

Peripheral interventions are minimally invasive procedures used to diagnose and treat diseases affecting blood vessels outside the heart and brain, including peripheral artery disease (PAD), venous thromboembolism (VTE), aneurysms, and carotid artery disease.

These procedures use catheter-based devices such as angioplasty balloons, stents, atherectomy systems, and guidewires to restore blood flow, remove blockages, and widen narrowed arteries. They serve as a less invasive alternative to open surgery, enabling shorter hospital stays and faster recovery.

Peripheral Interventions Market Overview

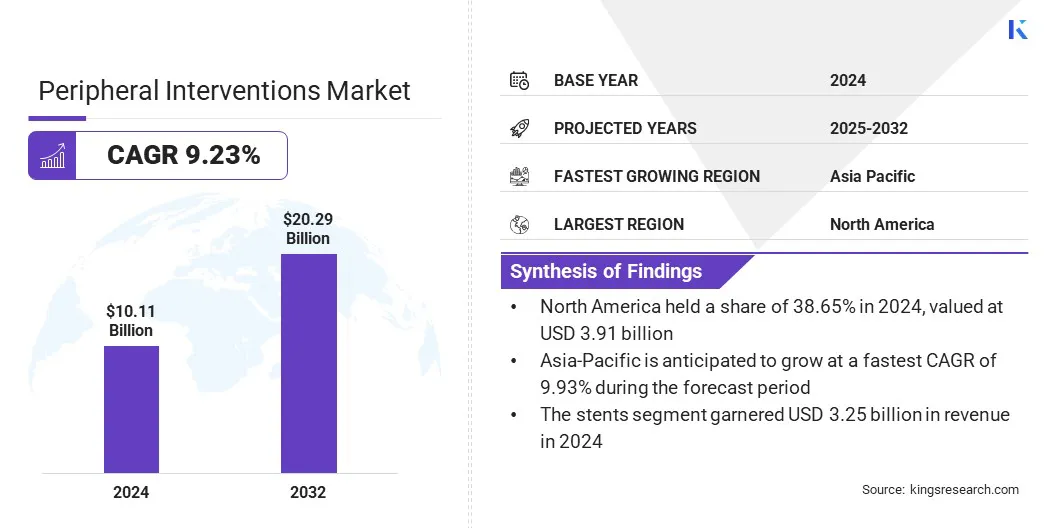

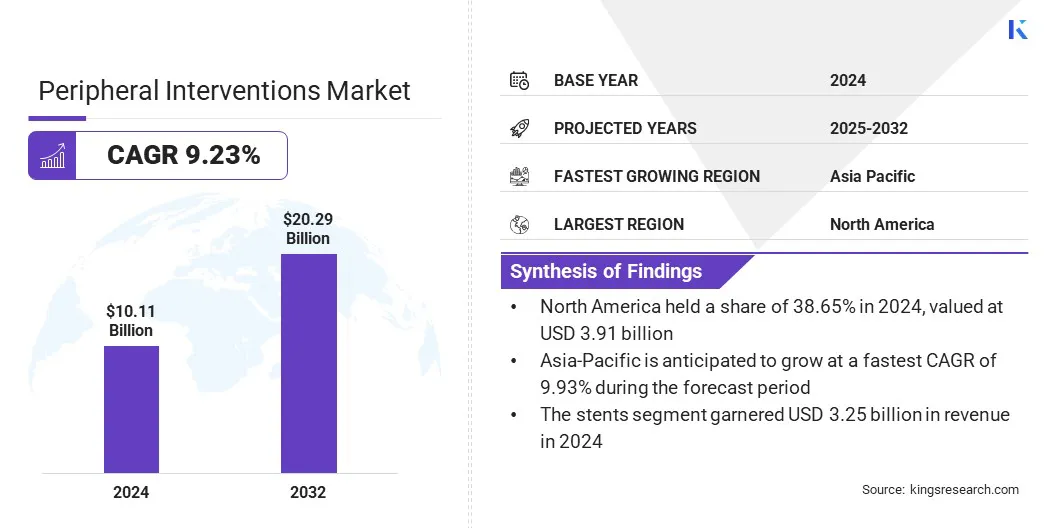

The global peripheral interventions market size was valued at USD 10.11 billion in 2024 and is projected to grow from USD 10.93 billion in 2025 to USD 20.29 billion by 2032, exhibiting a CAGR of 9.23% during the forecast period.

This notable growth is fueled by the rising prevalence of vascular diseases and advancements in minimally invasive technologies enhancing treatment precision and outcomes. The market is further influenced by expanding healthcare infrastructure supporting the adoption of catheter-based therapies.

Key Highlights:

- The peripheral interventions industry size was recorded at USD 10.11 billion in 2024.

- The market is projected to grow at a CAGR of 9.23% from 2025 to 2032.

- North America held a share of 38.65% in 2024, valued at USD 3.91 billion.

- The stents segment garnered USD 3.25 billion in revenue in 2024.

- The peripheral artery disease treatment segment is expected to reach USD 11.67 billion by 2032.

- The hospitals and surgical centers segment is anticipated to witness the fastest CAGR of 9.12% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 9.93% through the projection period.

Major companies operating in the peripheral interventions market are Boston Scientific Corporation, Medtronic, Abbott, TERUMO CORPORATION, B. Braun SE, Biotronik, W. L. Gore & Associates, Inc., Johnson & Johnson, Cordis., Merit Medical Systems., OrbusNeich Medical Group Holdings Limited, Teleflex Incorporated., AngioDynamics., Cook Medical LLC, and Getinge.

Market expansion is fueled by the growing demand for safer, less invasive vascular procedures, supported by an aging population and rising cases of chronic diseases such as diabetes and hypertension. In response, leading players are investing in R&D for next-generation peripheral devices, expanding clinical trials, and introducing innovative minimally invasive solutions.

Companies are refining commercialization strategies for advanced catheters, stents, and imaging-guided systems while strengthening partnerships with hospitals and specialty vascular centers to improve accessibility and accelerate adoption.

- In December 2024, Terumo Interventional Systems (TIS), a division of Terumo Corporation, announced the launch and commercial availability of its R2P NaviCross peripheral support catheter in the U.S. The 200 cm catheter expands Terumo’s radial-to-peripheral (R2P) portfolio and features a double-braided stainless-steel design that improves trackability and torque control, ensuring optimal performance in complex peripheral interventions.

A key factor fueling the expansion of the market is the growing prevalence of vascular disorders, including peripheral artery disease, venous thromboembolism, and carotid artery disease.

Rising incidences of these conditions, driven by aging populations, lifestyle-related risk factors, and chronic diseases such as diabetes, are increasing the demand for minimally invasive, catheter-based procedures. Additionally, the need for precise, safe, and effective treatment options is fueling the adoption of advanced devices such as drug-coated balloons, stents, and atherectomy systems across hospitals and specialized vascular centers.

- According to the European Society of Cardiology, peripheral arterial and aortic diseases (PAAD) affect approximately 113 million people aged 40 and above globally, with nearly 43% in low- and middle-income countries. The global prevalence stands at 1.5%, increasing significantly with age, reaching 15–20% among those over 70 and 20–30% in individuals aged 80 and above.

How do capital investment and operational expenses impact the adoption of advanced vascular devices?

A key challenge restraining the growth of the peripheral interventions market is the high cost of advanced vascular devices and procedures. Procuring and maintaining precision instruments such as drug-coated balloons, stents, and atherectomy systems requires substantial capital investment, while skilled personnel and specialized training further increase operational expenses. These cost barriers can limit adoption, particularly among small and mid-sized hospitals or clinics.

To address this challenge, market players are focusing on developing cost-effective, modular, and energy-efficient devices, offering service and training programs, and forming strategic partnerships to enhance accessibility and boost wider adoption across healthcare facilities.

What trends are shaping the adoption of minimally invasive and catheter-based technologies in peripheral interventions?

A key trend influencing the peripheral interventions market is the growing adoption of minimally invasive and catheter-based technologies. Hospitals and vascular centers are increasingly integrating angioplasty balloons, stents, and atherectomy systems to improve procedural precision, reduce risks, and shorten patient recovery times. These innovations enhance treatment efficiency, patient safety, and clinical outcomes, supporting rising adoption across healthcare facilities.

- In June 2024, Boston Scientific entered a definitive agreement to acquire Silk Road Medical, a company specializing in transcarotid artery revascularization (TCAR) devices. The acquisition, valued at approximately USD 1.16 billion, strengthens Boston Scientific’s peripheral vascular portfolio. Silk Road Medical’s TCAR platform represents a significant advancement in vascular medicine, improving stroke prevention and treatment outcomes for patients with carotid artery disease.

Peripheral Interventions Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Angioplasty Balloons, Stents, Atherectomy Devices, Embolic Protection Devices, Catheters & Guidewires, Others

|

|

By Application

|

Peripheral Artery Disease Treatment, Venous Thromboembolism, Aneurysm Repair, Carotid Artery Disease, Others

|

|

By End Use

|

Hospitals and Surgical Centers, Ambulatory Surgical Centers, Specialty Clinics

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Angioplasty Balloons, Stents, Atherectomy Devices, Embolic Protection Devices, Catheters & Guidewires, and Others): The stents segment earned USD 3.25 billion in 2024, mainly driven by their widespread adoption in minimally invasive peripheral procedures and high efficacy in maintaining vessel patency.

- By Application (Peripheral Artery Disease Treatment, Venous Thromboembolism, Aneurysm Repair, Carotid Artery Disease, and Others): The peripheral artery disease treatment segment held a share of 54.34% in 2024, mainly fueled by the increasing prevalence of PAD among aging populations and rising awareness of catheter-based, minimally invasive interventions.

- By End Use (Hospitals and Surgical Centers, Ambulatory Surgical Centers, and Specialty Clinics): The hospitals and surgical centers segment is projected to reach USD 13.60 billion by 2032, owing to well-established infrastructure, access to advanced interventional devices, and the ability to perform complex peripheral procedures safely and efficiently.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global peripheral interventions market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America peripheral interventions market share stood at 38.65% in 2024, valued at USD 3.91 billion. This dominance is reinforced by the high prevalence of peripheral artery disease (PAD), venous thromboembolism, and carotid artery disease in the region.

Advanced healthcare infrastructure, widespread access to state-of-the-art hospitals and specialty vascular centers, and strong reimbursement frameworks are further supporting the adoption of peripheral intervention devices. Additionally, key players in the market are strengthening their portfolios through strategic acquisitions and partnerships to capture a larger share of the growing patient base.

Companies are introducing advanced catheter-based systems, stents, atherectomy devices, and drug-coated balloons through these initiatives, contributing significantly to regional market expansion.

- In January 2025, Medtronic expanded its presence in the U.S. carotid sector through an exclusive distribution agreement with Contego Medical. Under this agreement, Medtronic became the sole U.S. distributor for Contego’s portfolio of commercially available products, enhancing its carotid and peripheral vascular revascularization offerings.

The Asia-Pacific peripheral interventions industry is set to grow at a robust CAGR of 9.93% over the forecast period. This growth is propelled by increasing awareness of minimally invasive procedures and the expansion of healthcare infrastructure, including specialty vascular centers and tertiary hospitals, which are fostering the adoption of peripheral intervention devices.

Regional market growth is further fueled by technological advancements, including drug-coated balloons, bioresorbable stents, and advanced imaging-guided systems, which enhance procedural precision and patient outcomes. Additionally, government initiatives and healthcare investments in countries such as China and India are improving accessibility and affordability, enabling wider deployment of catheter-based therapies and strengthening the region’s market potential.

Regulatory Frameworks

- In the U.S., the FDA regulates peripheral intervention devices, including stents, catheters, and drug-coated balloons, ensuring safety, efficacy, and quality through rigorous premarket approvals, 510(k) clearances, and post-market surveillance requirements.

- In the EU, the European Medicines Agency (EMA) and relevant national competent authorities oversee peripheral vascular devices under the Medical Device Regulation (MDR 2017/745), requiring conformity assessments, clinical evaluation, and CE marking for market access.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) regulates vascular intervention devices, requiring stringent clinical evaluation and approvals before commercialization, while supporting post-market monitoring to maintain device safety.

- Globally, organizations such as the International Organization for Standardization (ISO) and the International Medical Device Regulators Forum (IMDRF) provide guidance on device standards, safety, and clinical evaluation, promoting harmonization and best practices across regions.

Competitive Landscape

Leading players operating in the peripheral interventions industry are focusing on technological innovation, portfolio expansion, and strategic collaborations to meet rising demand for minimally invasive vascular therapies.

Companies are conducting global clinical trials and post-market studies to validate safety, efficacy, and long-term outcomes, facilitating FDA and regulatory approvals and wider adoption across hospitals and specialty vascular centers. Additionally, companies are strengthening distribution networks, offering training programs, and forming partnerships to improve accessibility, enhance procedural efficiency, and boost market growth.

- In January 2024, W. L. Gore & Associates received FDA approval for its lower-profile GORE VIABAHN VBX Stent Graft, featuring the longest balloon-expandable stent (79 mm), the widest diameter range, and multiple 6 Fr compatible configurations to enhance versatility in complex peripheral interventions.

Key Companies in Peripheral Interventions Market:

- Boston Scientific Corporation

- Medtronic

- Abbott

- TERUMO CORPORATION

- Braun SE

- Biotronik

- L. Gore & Associates, Inc.

- Johnson & Johnson

- Cordis

- Merit Medical Systems.

- OrbusNeich Medical Group Holdings Limited

- Teleflex Incorporated.

- AngioDynamics

- Cook Medical LLC

- Getinge

Recent Developments

- In April 2024, Cook Medical secured a contract with the U.S. Department of Defense to supply implants, including the Zilver PTX drug-eluting peripheral stent, Zenith aortic endografts, and other implantable vascular devices.

- In July 2025, Medtronic entered an exclusive U.S. distribution agreement with Japan-based Future Medical Design Co., Ltd. (FMD) for specialty and workhorse peripheral guidewires. Under this agreement, Medtronic introduced the first 400 cm, 0.018" peripheral guidewire available in the U.S., expanding its portfolio for transradial access procedures in the treatment of peripheral arterial disease (PAD).