Market Definition

The market comprises technologies, services, and platforms that streamline patient access to healthcare services, insurance benefits, and treatment support programs. These solutions facilitate appointment scheduling, eligibility verification, benefits investigation, prior authorization, financial counseling, and patient cost estimation to improve operational workflows and reduce administrative burdens.

The report covers segmentation based on solution type, deployment model, end user, and geographic region. Patient access solutions are applied in hospitals, clinics, specialty practices, and health systems to enhance patient experience, accelerate care delivery, ensure accurate reimbursement, and optimize revenue cycle performance across diverse healthcare settings.

Patient Access Solutions Market Overview

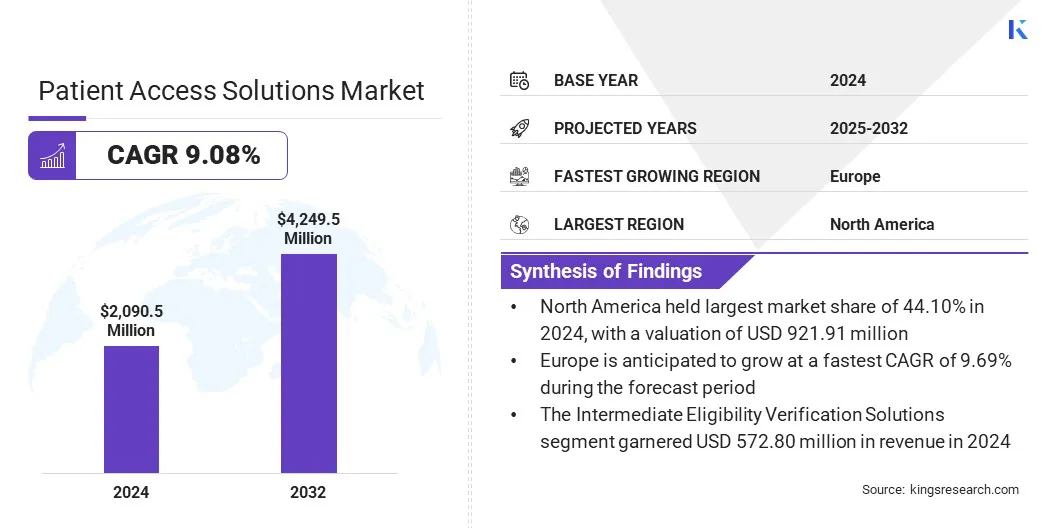

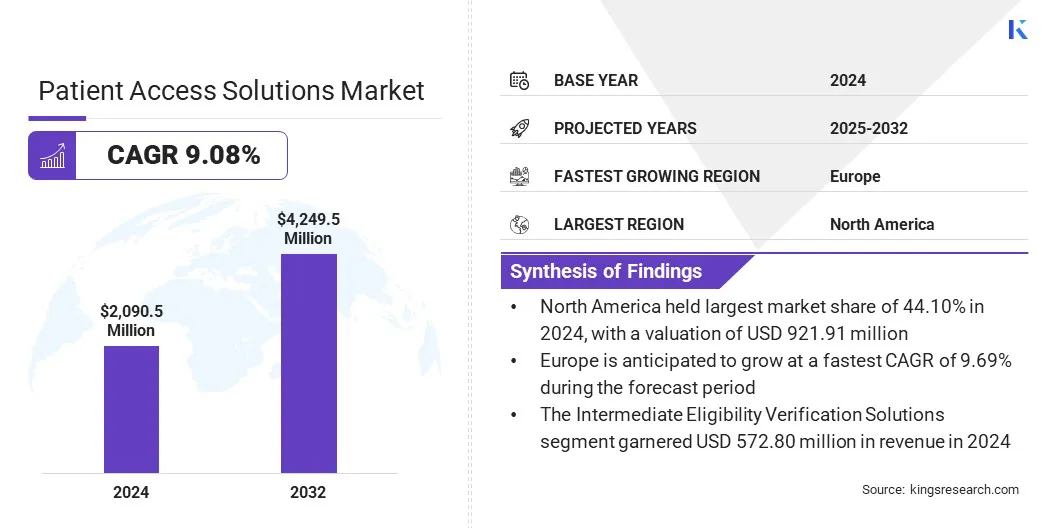

The global patient access solutions market size was valued at USD 2090.5 million in 2024 and is projected to grow from USD 2,260.4 million in 2025 to USD 4,249.5 million by 2032, exhibiting a CAGR of 9.08% over the forecast period.

The growth of the market is driven primarily by rising regulatory requirements for healthcare data accuracy and payer compliance. Additionally, rising demand to simplify insurance verification and prior authorization processes is driving adoption by improving operational efficiency and patient experience.

Key Market Highlights:

- The patient access solutions industry size was recorded at USD 2090.5 million in 2024.

- The market is projected to grow at a CAGR of 9.08 % from 2025 to 2032.

- North America held a share of 44.10% in 2024, valued at USD 921.91 million.

- The prior authorization solutions segment garnered USD 547.71 million in revenue in 2024.

- The software component segment is expected to reach USD 2,867.35 million by 2032.

- The cloud-based deployment is anticipated to witness the fastest CAGR of 9.31 % over the forecast period.

- Europe is anticipated to grow at a CAGR of 9.69 % through the projection period.

Major companies operating in the patient access solutions market are MEDHOST, Cerner Corporation, TransUnion LLC, KYRUUS, United BioSource LLC, GAFFEY Healthcare, Stericycle Inc., FormFast, Cardinal Health, McKesson, AccuReg, Yosi Health, QGenda, Zocdoc, and Solv Health.

Key market players are investing heavily in R&D, targeted at developing next-generation digital platforms. These efforts focus on greater automation, enhanced interoperability, AI-driven decision support, and real-time integration with electronic health records (EHR) and payment systems.

Companies are expanding system capabilities to incorporate eligibility verification, authorization management, price estimation, and patient engagement tools targeted primarily at reducing payment reimbursement denials and enhancing cash flow.

- In May 2025, Omilia and SpinSci Technologies formed a strategic partnership to deliver one of the first unified solutions combining enterprise-grade Conversational AI with deep, native EHR integration. The joint platform enables intelligent, human-like self-service across phone, web, and mobile channels, thus helping patients schedule appointments, manage prescriptions, and complete follow-ups without human assistance.

What is Driving the Rising Demand for Patient Access Solutions?

Increasing administrative complexity in healthcare systems such as insurance workflows and electronic health record (EHR) management is placing a growing operational burden on providers. This is driving the adoption of advanced patient access and automation solutions.

Moreover, rising patient expectations for faster, more transparent care, combined with the broader shift toward digital health tools, including seamless scheduling, clear financial communication, and EHR integration are further boosting demand for patient access platforms.

- In November 2025, Amazon Web Services launched an agentic AI integrated with Amazon Connect to support patient verification and appointment management for healthcare providers. The solution enables autonomous, self-service verification through real-time integration with electronic health records, reducing reliance on complex customization and manual IT workflows.

What are the key challenges faced by the Patient Access Solutions market?

The market faces challenges related to complex healthcare administration and fragmented operational workflows. Patient access functions are frequently distributed across multiple teams and systems, leading to inefficiencies in scheduling, insurance eligibility verification, and prior authorization processes.

These inefficiencies contribute to higher claim denial rates, revenue leakage for healthcare providers, and lower patient satisfaction. To address these challenges, market players are investing in integrated platforms, workflow automation, interoperability with EHR systems, and data-driven tools to streamline front-end revenue cycle operations.

What Innovative Trends Are Driving the Patient Access Solutions Market?

The market is experiencing accelerated innovation, driven by increasing demand for automation, digital transformation, and improved patient engagement. Healthcare organizations are adopting AI-enabled eligibility verification, automated prior authorization, and predictive analytics to reduce administrative workload and minimize claim denials.

In addition, the adoption of cloud-based platforms, robotic process automation for repetitive tasks, and real-time communication tools is improving reimbursement timelines and enhancing operational efficiency for healthcare providers.

- In August 2025, GuideWell deployed an AI-powered platform to modernize its prior authorization processes and reduce administrative burden across revenue cycle operations. In partnership with Cisco, the company implemented cloud-based robotic process automation to handle tasks such as form completion, data entry, and eligibility verification, enabling AI agents to manage a majority of cases end to end.

Patient Access Solutions Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Intermediate Eligibility Verification Solutions, Prior Authorization Solutions, Scheduling Solutions, Registration & Intake Solutions, Others.

|

|

By Solution

|

Software, Services

|

|

By Deployment

|

On-Premise, Cloud, Hybrid

|

|

By End Use

|

Healthcare Providers, Pharmaceutical Manufacturers, Specialty Pharmacies, Payers/Health Plans, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Intermediate Eligibility Verification Solutions, Prior Authorization Solutions, Scheduling Solutions, Registration & Intake Solutions, and Others). The prior authorization solutions represent the fastest-growing segment and are projected to register a CAGR of 9.27% during the forecast period. This growth is driven by stricter payer requirements, increasing administrative complexity within healthcare systems, and rising demand for automation that shortens approval timelines and reduces denial rates.

- By Component (Software and Services). The software segment dominates the component category due to the rising adoption of digital platforms, which streamline scheduling, eligibility verification, prior authorization, and patient onboarding processes

- By Deployment (On-Premise, Cloud-Based, and Hybrid). The cloud-based segment accounts for 9.31% of the market share due to its scalability, lower upfront infrastructure costs, seamless system upgrades.

- By End Use (Healthcare Providers, Pharmaceutical Manufacturers, Specialty Pharmacies, Payers/Health Plans, and Others). The healthcare providers segment accounts for 8.79% of the market share due to the rising demand for efficient patient onboarding, insurance verification, eligibility checks, and prior authorization

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global patient access solutions market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America patient access solutions market accounted for a 44.10% share in 2024, valued at USD 921.91 million. market growth in the region is supported by a mature healthcare ecosystem, increasing adoption of digital health technologies, and stricter regulatory requirements related to patient data accuracy and revenue cycle management. These factors are contributing to greater administrative complexity and driving demand for advanced patient access solutions.

For instance, a large majority of U.S. hospitals now enable patients to view, download, and transmit electronic health information, with foundational patient access capabilities adopted by over 80% of facilities. Moreover, the regulatory landscape in North America is a key driver of the market, as federal mandates increasingly require healthcare providers to ensure accurate, standardized, and portable patient data.

Initiatives such as the 21st Century Cures Act accelerate adoption by obligating organizations to enable secure electronic access to health information, thereby increasing compliance complexity and driving demand for advanced patient access and data management solutions.

The Asia-Pacific patient access solutions industry is anticipated to grow at a CAGR of 7.85%, over the forecast period. This growth is driven by rapid expansion of healthcare infrastructure, increasing patient volumes, and large-scale digitization initiatives across China, India, Japan, and South Korea.

Rising investments in healthcare modernization, including digital appointment scheduling, AI-driven triage systems, online patient registration, and automated insurance eligibility verification, are further supporting market growth across the region.

Regulatory Frameworks

- The Health Insurance Portability and Accountability Act (HIPAA) establishes federal standards protecting sensitive health information from disclosure without patients’ consent. The HIPAA Privacy Rule governs how covered entities comprising healthcare providers, health plans, and healthcare clearinghouses, utilize and disclose protected health information (PHI) in addition to granting individuals rights over their data. The act permits certain disclosures without patient authorization for treatment, payment, healthcare operations, and specific public interest purposes with further protection of electronic PHI (e-PHI) by requiring covered entities to ensure confidentiality, integrity, and availability of data, safeguard against threats, prevent improper use or disclosure, and ensure workforce compliance.

- The CMS Interoperability and Prior Authorization Rules (CMS-0057-F) are targeted at improving health information exchange and modernizing prior authorization processes to reduce administrative burden and enhance patient-centered care. The rule is targeted towards data-sharing requirements and policies that streamline communication among patients, providers, and payers in addition to allowing enforcement discretion for HIPAA-covered entities implementing FHIR-based prior authorization APIs, easing requirements related to the X12 278 transaction standard.

- The European Health Data Space Regulation (EHDS) establishes a unified framework regarding the exchange and use of electronic health data across the EU, supporting both primary usage (healthcare delivery) by enabling citizens and health professionals to access and share health data across borders, and secondary use (research, innovation, policymaking, and regulatory purposes) under strict safeguards, in addition with creating a harmonized market for secure, interoperable (EHRs).

- The My Health Record System (Australia) establishes the role of the System Operator, the registration framework for individuals and healthcare organizations, and a robust privacy and security structure, thus setting strict rules for collecting, using, and disclosing health information and outlining penalties for improper handling of data.

Competitive Landscape

Leading players in the patient access solutions industry are focusing on workflow automation, data integration, and expansion of digital service offerings to meet growing demand for efficient and patient-centric healthcare access. Companies are advancing interoperable platforms, telehealth capabilities, and patient support programs to support regulatory compliance, strengthen patient engagement, and improve treatment outcomes.

- In March 2025, Philips selected AWS as its preferred cloud provider to improve patient outcomes, innovate digital health solutions, reduce infrastructure costs, thus enabling faster product development, AI-powered workflows, and improved patient care across its healthcare offerings.

- In January 2025, Diatech Pharmacogenetics expanded collaboration with Merck Serono Middle East Ltd. to improve patient access to RAS biomarker testing in Middle East and Africa (MEA).

Key Companies in Patient Access Solutions Market:

- MEDHOST

- Oracle Health

- TransUnion LLC

- KYRUUS, Inc.

- United BioSource LLC

- Netsmart Technologies, Inc.

- Stericycle Inc.

- Intellistack, LLC

- Cardinal Health

- McKesson Corporation

- AccuReg

- Optum, Inc.

- Yosi, Yosi, Inc

- QGenda, LLC

- Zocdoc, Inc.

- SolvHealth

Recent Developments

- In November 2025: Datavant formed a strategic partnership with United BioSource Corporation (UBC) to strengthen patient access solutions for pharmaceutical organizations. The collaboration introduced Enhanced Patient Access Programs to streamline clinical research operations, and improve patient outcomes by uniting real-world data, access insights, and comprehensive patient-support capabilities.

- In August 2025: Doceree introduced a suite of AI-powered solutions, which representing a unified, context-intelligent ecosystem designed to define the future of how pharmaceutical brands engage with healthcare professionals.

- In August 2024: SoundHound AI, Inc. launched an AI agent MUSC Health which is powered by its Amelia Patient Engagement solution. The AI agent of MUSC Health, Emily, leverages Amelia’s integration with Epic to enable personalized, simplified, and efficient patient self-service.

- In June 2024: Infinx Healthcare introduced Intelligent Payer Mapping, an AI driven software within its Patient Access Plus suite. The feature automates and standardizes payer data mapping to improve accuracy in patient eligibility checks and revenue cycle workflows.

- In April 2024, CareMetx acquired PX Technology to reshape patient access to specialty medications and drive efficiency across healthcare ecosystem. The acquisition combines CareMetx’s high-touch patient support services with PX Technology’s advanced digital access solutions.,

- In April 2024, Innovaccer Inc. has launched a new AI-powered solution called Comet for patient access centers. It is designed to change traditional call centers into intelligent, always-available digital entry points for patient care. The platform uses 24/7 omnichannel AI agents, real-time AI copilots, and two-way EMR connectivity to improve access to care.