Market Definition

Nutritional yeast is a deactivated yeast strain, typically Saccharomyces cerevisiae, produced through controlled fermentation. It is rich in protein, fiber, and essential vitamins, particularly B-complex vitamins. It is widely used as a flavor enhancer and nutritional additive in food, beverage, and dietary supplement applications, aligning with the growing demand for plant-based and fortified food products.

Nutritional Yeast Market Overview

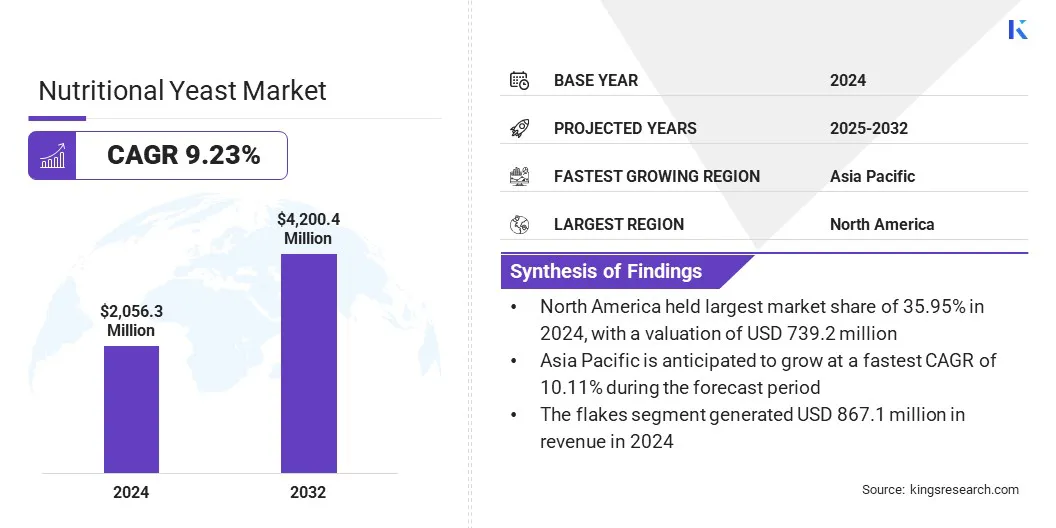

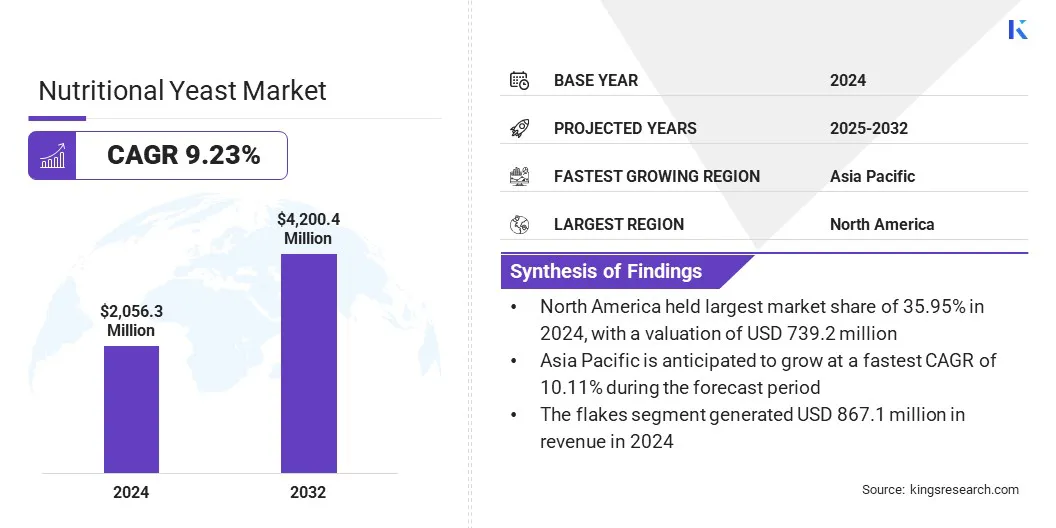

According to Kings Research, the global nutritional yeast market size was valued at USD 2,056.3 million in 2024 and is projected to grow from USD 2,236.8 million in 2025 to USD 4,200.4 million by 2032, exhibiting a CAGR of 9.23% during the forecast period.

This growth is driven by increasing consumer preference for natural, transparent, and additive-free food products. Rising awareness of ingredient origin and nutritional content is further increasing demand for clean-label nutritional yeast.

Key Market Highlights:

- The nutritional yeast industry size was recorded at USD 2,056.3 million in 2024.

- The market is projected to grow at a CAGR of 9.23% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 739.2 million.

- The conventional segment generated USD 1,278.0 million in revenue in 2024.

- The flakes segment is expected to reach USD 1,752.6 million by 2032.

- The dietary supplements segment is anticipated to witness the fastest CAGR of 9.39% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 10.11% through the projection period.

Major companies operating in the global nutritional yeast market are Lesaffre International, Alltech, AngelYeast Co., Ltd., Associated British Foods plc, Novozymes A/S, Archer Daniels Midland Company, Leiber GmbH, Bragg Live Food Products, LLC, Lallemand Inc., NOW Foods, Bob’s Red Mill Natural Foods, Frontier Co-op, Marigold Health Foods Limited, and Solgar Inc.

The market is influenced by the rapid expansion of plant-based and vegan food consumption across global markets. Nutritional yeast is increasingly recognized as a vital ingredient in vegan and vegetarian diets due to its protein and vitamin profile, particularly Vitamin B12.

The shift toward sustainable and animal-free nutrition enhances its use in dairy alternatives, snacks, and ready-to-eat meals, positioning nutritional yeast as a preferred flavoring and fortification component in the growing plant-based food segment.

- In September 2025, Clean Food Group acquired the assets of Algal Omega 3, gaining one million liters of fermentation capacity to expand yeast-derived oil production. The acquisition strengthens the company’s position in sustainable yeast-based ingredient manufacturing and enhances its ability to produce high-quality, fermentation-driven nutritional components for food applications.

How is the expansion of retail stores and e-commerce channels influencing the market?

The expanding availability of nutritional yeast across modern retail outlets and digital platforms is driving the growth of the nutritional yeast market. Wider distribution through supermarkets, health food chains, and e-commerce channels is enhancing product accessibility and consumer engagement.

Manufacturers are leveraging online retail networks for broader product reach, brand differentiation, and direct consumer interaction. The online marketplace further enables targeted promotions and flexible product positioning, boosting adoption among health-conscious consumers in both developed and emerging economies.

- In April 2024, Bragg expanded its nutritional yeast portfolio with the launch of Roasted Garlic and Smoky BBQ flavored seasonings across Publix stores nationwide. The launch strengthens Bragg’s retail presence and aligns with rising consumer demand for plant-based, nutrient-rich, and clean-label vegan food products.

How does quality inconsistency across fermentation strains pose a challenge to the growth of the nutritional yeast market?

Quality inconsistency across fermentation strains remains a significant challenge to market expansion. Variations in microbial composition influence flavor, aroma, nutrient concentration, and overall product stability.

Manufacturers face difficulties in achieving uniform taste and nutritional quality across production batches, affecting brand reliability and consumer perception. This inconsistency also limits large-scale adoption in food and supplement manufacturing, where standardization is critical for formulation consistency and regulatory compliance.

To address this challenge, companies are investing in controlled fermentation systems, strain optimization, and process standardization. Advanced biotechnological methods are enabling consistent yield, improved nutrient retention, and reproducible flavor characteristics across production cycles.

What influence does the shift toward advanced fortified nutritional yeast formulations have on overall market trends?

Product innovation in fortified nutritional yeast is emerging as a notable trend as manufacturers improve nutrient density and expand consumer appeal. Formulations enriched with Vitamin B12, folate, and minerals address dietary deficiencies common in plant-based diets.

The growing demand for fortified foods prompts producers to develop specialized formulations targeting vegan and functional food markets. These advancements enhance nutritional value, broaden end-use applications, and reinforce nutritional yeast’s position as a versatile, health-oriented ingredient across the global food and supplement industries.

- In May 2025, Angel Yeast introduced the Feravor series, a flavored nutritional yeast solution available in Floral-Fruity and Butter variants. The series utilizes patented microbial strains to enhance natural aroma and flavor development in bakery applications, supporting clean-label production and reducing dependency on artificial additives.

Nutritional Yeast Market Report Snapshot

|

Segmentation

|

Details

|

|

By Nature

|

Conventional, Organic

|

|

By Form

|

Flakes, Powder, Paste

|

|

By Application

|

Food & Beverages, Foodservice, Dietary Supplements, Cosmetics & Personal Care, Animal Feed, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Nature (Conventional and Organic): The conventional segment generated USD 1,278.0 million in revenue in 2024, mainly due to strong consumer reliance on affordable, widely available nutritional yeast products across mainstream food and retail channels.

- By Form (Flakes, Powder, and Paste): The powder segment is poised to record a CAGR of 9.35% through the forecast period, propelled by its easy integration into formulations and growing application in dietary supplements and functional foods.

- By Application (Food & Beverages, Foodservice, Dietary Supplements, Cosmetics & Personal Care, Animal Feed, and Others): The food & beverages segment is estimated to hold a share of 29.94% by 2032, fueled by increasing use of nutritional yeast in plant-based, clean-label, and fortified food products.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America nutritional yeast market accounted for a share of 35.95% in 2024, valued at USD 739.2 million. This dominance is attributed to the strong consumer inclination toward fortified food products and the increasing popularity of vegan and plant-derived nutrition.

Expanding production capacities and technological advancements in fermentation processes are enhancing product quality and consistency across manufacturers. The presence of established health food brands and widespread retail penetration has further strengthened accessibility. Rising demand for clean-label and natural ingredients continues to bolster regional market expansion.

- In March 2025, Goldie’s Superfoods launched an organic, non-fortified, high-protein nutritional yeast formulation, establishing a new standard in clean, plant-based pantry staples. The product targets health-conscious, plant-based, and dairy-free consumers seeking natural and minimally processed nutritional alternatives.

The Asia-Pacific nutritional yeast industry is projected to grow at a CAGR of 10.11% over the forecast period. This growth is propelled by the growing influence of Western dietary habits and rising awareness of nutrient-rich, plant-based alternatives among consumers. Increasing disposable incomes and rapid growth of the food processing sector are boosting demand for fortified and functional ingredients.

Manufacturers are investing in product localization and cost-effective distribution strategies to capture emerging consumer segments. Expanding vegan product portfolios and continuous innovation in ingredient formulation are supporting regional market expansion.

- In March 2025, Angel Yeast showcased its core solution portfolio at an industry exhibition, featuring China’s first approved microbial protein and advanced functional yeast innovations. The company highlighted natural flavor enhancers and fermentation-based nutritional elements, reinforcing its focus on clean-label yeast extract solutions aligned with global health and sustainability trends.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) Regulations govern the safety and labeling of nutritional yeast, ensuring food-grade quality and compliance with nutritional claim standards.

- In the EU, the European Food Safety Authority (EFSA) Regulation (EC) No 178/2002 supervises food safety and ingredient approval. It defines permissible yeast strains, fortification limits, and labeling requirements for nutritional yeast used in food and supplements.

- In Canada, the Canadian Food Inspection Agency (CFIA) Food and Drug Regulations oversee the composition, nutrient fortification, and labeling standards of nutritional yeast. They aim to maintain transparency and consumer safety within the food supply chain.

- In Australia and New Zealand, the Food Standards Australia New Zealand (FSANZ) Standard 1.3.1 regulates food additives and processing aids. It controls permissible fortification substances and yeast strain usage in nutritional yeast products.

- In India, the Food Safety and Standards Authority of India (FSSAI) Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011 governs yeast-based products, ensuring compliance with hygiene, labeling, and additive use standards applicable to fortified food ingredients.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) Food Sanitation Act enforces safety evaluations and manufacturing approvals for yeast-derived food ingredients, ensuring product safety and consumer protection.

Competitive Landscape

Key players operating in the nutritional yeast market are emphasizing product innovation, capacity expansion, and portfolio diversification to strengthen their competitive position. Companies are developing fortified and flavored variants to align with evolving consumer demand for clean-label and high-nutrition products.

Strategic investments in research and fermentation technology aim to improve strain consistency and product quality. Expansion of manufacturing facilities and partnerships across distribution networks is strengthening market reach and operational efficiency.

Leading participants are focusing on mergers, acquisitions, and collaborations to enhance their production capabilities, secure raw material supply chains, and consolidate presence across multiple application segments.

- In June 2024, Aplicaciones Biologicas a la Nutricion S.L. (ABN) partnered with Leiber GmbH to expand its presence in the European nutritional yeast industry. The collaboration focuses on developing innovative food and feed solutions derived from brewers’ yeast, enhancing product value across human nutrition and animal feed applications.

List of Key Companies in Nutritional Yeast Market:

- Lesaffre International

- Alltech

- AngelYeast Co., Ltd.

- Associated British Foods plc

- Novozymes A/S

- Archer Daniels Midland Company

- Leiber GmbH

- Bragg Live Food Products, LLC

- Lallemand Inc.

- NOW Foods

- Bob’s Red Mill Natural Foods

- Frontier Co-op

- Marigold Health Foods Limited

- Solgar Inc.

Recent Developments

- In September 2025, Revyve raised approximately USD 26 million in Series B funding, bringing its total capital to over USD 43 million. The investment supports the commercialization of its functional yeast proteins that replicate egg properties in bakery, sauces, and plant-based foods, advancing clean-label innovation in the nutritional yeast and alternative protein segment.

- In August 2025, Lesaffre invested in its Algist Bruggeman yeast production facility in Ghent to enhance manufacturing efficiency and product quality. The expansion supports the company’s capability to produce high-purity nutritional yeast, meeting advanced quality standards and strengthening its position in the global yeast-based nutrition segment.

- In June 2025, Lesaffre and Zilor established a joint venture combining Biospringer by Lesaffre and Biorigin to develop advanced nutritional yeast derivatives and savory ingredient solutions. The collaboration enhances their collective capabilities to deliver high-value, natural yeast-based ingredients for global food and feed markets, emphasizing innovation and customer-focused product development.

- In March 2025, Asahi Group Foods entered a strategic partnership with Leiber GmbH to expand its yeast business across Europe. The collaboration integrates Asahi’s yeast cultivation expertise with Leiber’s processing technologies, accelerating innovation in yeast extract and functional ingredient development.

- In March 2024, Foods Alive launched two new nutritional yeast blends—Zesty and Nacho—to diversify its flavor portfolio. The launch caters to the growing consumer demand for versatile, plant-based seasoning options, strengthening the brand’s presence in the nutritional yeast-based food segment.