Market Definition

The market comprises technologies and systems designed to separate suspended solids, microorganisms, and dissolved substances from liquids using semi-permeable membranes. These systems operate through pressure-driven processes such as reverse osmosis, ultrafiltration, microfiltration, and nanofiltration.

Membrane filtration enables selective separation based on pore size and molecular weight, delivering consistent purification performance. The market supports critical applications across water and wastewater treatment, food and beverage processing, dairy operations, and industrial separation processes requiring high purity and process efficiency.

Membrane Filtration Market Overview

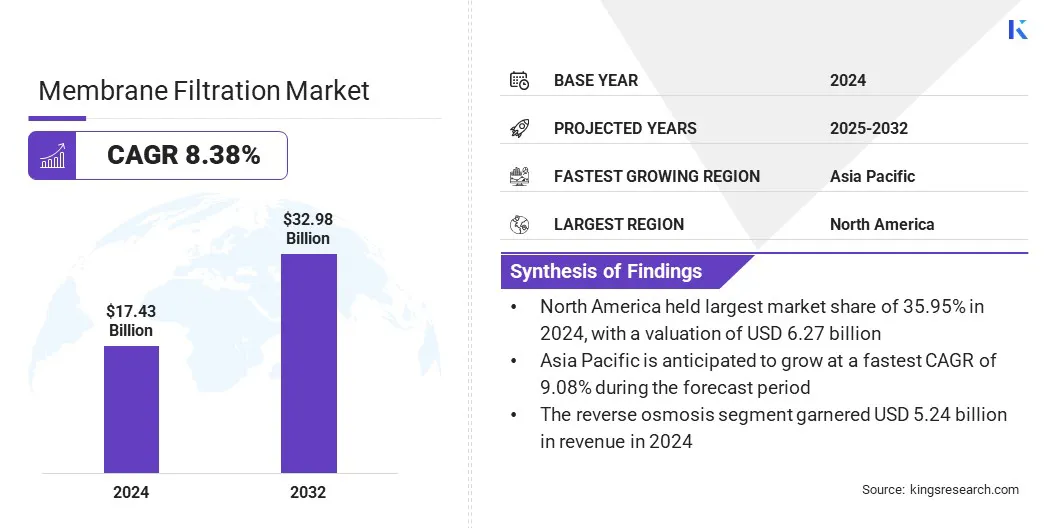

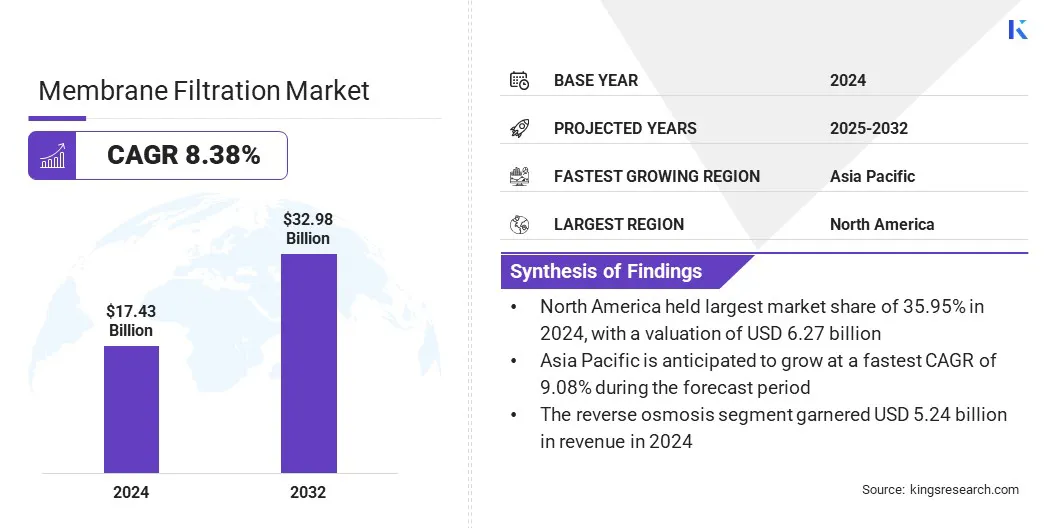

The global membrane filtration market size was valued at USD 17.43 billion in 2024 and is projected to grow from USD 18.78 billion in 2025 to USD 32.98 billion by 2032, exhibiting a CAGR of 8.38% during the forecast period.

Market growth is driven by expanding industrial activity and rapid urban population growth. This trend increases demand for advanced membrane filtration systems across municipal and industrial water infrastructure networks worldwide.

Key Market Highlights:

- The membrane filtration industry was recorded at USD 17.43 billion in 2024.

- The market is projected to grow at a CAGR of 8.38% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 6.27 billion.

- The reverse osmosis segment garnered USD 5.24 billion in revenue in 2024.

- The spiral wound segment is expected to reach USD 13.21 billion by 2032.

- The ceramic segment is anticipated to witness the fastest CAGR of 8.46% over the forecast period.

- The water & wastewater segment is estimated to hold a share of 24.18% by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 9.08% through the projection period.

Major companies operating in the membrane filtration market are 3M, Koch IP Holdings, LLC, GEA Group Aktiengesellschaft, Pall Corporation, Veolia, ALFA LAVAL, SPX FLOW, Inc., DuPont, ProMinent GmbH, Pentair, Porvair Filtration Group, SUEZ SA, TORAY INDUSTRIES, INC., Asahi Kasei Corporation, and Nitto Denko Corporation.

Market growth is driven by the increasing production of biologics, vaccines, and cell-based therapies requiring precise separation and purification processes. Rising regulatory scrutiny on product purity and process consistency strengthens demand for advanced filtration solutions. Manufacturers invest in high-performance membranes to improve yield, scalability, and contamination control across upstream and downstream operations.

Continuous processing adoption further accelerates membrane usage for clarification, concentration, and sterile filtration. These trends reinforce membrane filtration as a critical technology within modern biopharmaceutical manufacturing workflows, supporting drug safety and efficacy.

- In January 2025, Toray Industries, Inc. announced the development of a high-efficiency separation membrane module for biopharmaceutical manufacturing. The module significantly improves filtration performance by minimizing clogging, enhances purification efficiency, and increases product yields beyond 90%. The company plans to supply prototype units for evaluation in gene therapy purification processes, supporting accelerated commercialization efforts.

How Are Water Reuse Initiatives Driving Membrane Filtration Adoption?

Expanding water reuse initiatives are driving the adoption of membrane filtration technologies as water scarcity, contamination risks, and public health concerns intensify across municipal and industrial sectors. Stricter discharge regulations and higher water quality standards enforced by environmental regulators are prompting utilities and industrial operators to deploy advanced treatment solutions capable of meeting reuse requirements.

Municipal water authorities and industries increasingly adopt membrane filtration due to its effectiveness in removing pathogens, dissolved salts, and emerging contaminants from wastewater and process streams.

Investments in treatment infrastructure modernization and government supported recycling and reuse programs further accelerate deployment, positioning membrane filtration as a core technology for delivering consistent, regulatory compliant water across potable reuse, industrial reuse, and environmental discharge applications.

- In November 2025, PPG introduced an ultrafiltration antifouling membrane to its spiral-wound filter portfolio for industrial water treatment. The membrane targets hard-to-treat water containing oily waste and complex contaminants. Its super-hydrophobic surface resists fouling from oil and grease, supporting sustainable filtration, cost-effective treatment, and safe water reuse or disposal across industrial applications.

How do high upfront capital requirements limit membrane filtration adoption among cost-sensitive operators?

High upfront capital requirements limit membrane filtration adoption by increasing financial pressure on cost-sensitive municipal and industrial operators. Equipment procurement, infrastructure upgrades, and process integration demand significant initial spending, while costs for advanced membranes, pressure systems, and control units restrict affordability for small and mid-sized facilities.

Installation complexity raises expenditures further through site-specific engineering and skilled labor needs, slowing deployment in developing regions and budget-constrained applications.

Manufacturers are addressing these constraints by developing modular system designs, improving energy efficiency, and optimizing lifecycle costs. Vendors also offer leasing models and phased deployment options that reduce initial capital exposure, shorten installation timelines, and improve return on investment, supporting gradual adoption among financially constrained end users.

How does the integration of automation and smart monitoring enhance membrane filtration system reliability?

The membrane filtration market is influenced by the rising adoption of advanced membrane technologies that deliver higher selectivity, improved flux rates, and enhanced chemical resistance. Continuous innovation in polymeric and ceramic membranes supports efficient separation across complex industrial and municipal processes.

Industries increasingly adopt next-generation membranes to reduce fouling, lower energy consumption, and extend operational lifecycles. Integration of automation and smart monitoring improves process control and performance consistency. These advancements align membrane systems with digital tools that enable real-time diagnostics, predictive maintenance, and data-driven filtration optimization.

- In November 2024, GEA introduced Smart Filtration CIP and Smart Filtration Flush digital tools, strengthening efficiency across membrane filtration systems. Deployment at a dairy processing facility reduced water use by 48% and energy consumption by 77% during membrane cleaning. Implementation within a new filtration unit exceeded performance targets, demonstrating the role of digital optimization in modernizing membrane filtration operations across food and dairy processing facilities.

Membrane Filtration Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Reverse osmosis, Ultrafiltration, Microfiltration, Nanofiltration

|

|

By Module Design

|

Spiral wound, Tubular systems, Plates & frames and hollow fibers

|

|

By Material

|

Polymeric, Ceramic

|

|

By Application

|

Water & wastewater, Food & beverages, Dairy products, Drinks & concentrates, Wine & beer, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Reverse osmosis, Ultrafiltration, Microfiltration, and Nanofiltration): The reverse osmosis segment generated USD 5.24 billion in revenue in 2024, driven by rising investments by municipal authorities, desalination agencies, and industrial operators in seawater desalination, drinking water treatment, and wastewater reuse projects. High removal efficiency for dissolved salts and contaminants, proven scalability across large-scale facilities, and compliance with stringent water quality regulations continue to support widespread adoption across municipal and industrial applications.

- By Module Design (Spiral wound, Tubular systems, and Plates & frames and hollow fibers): The tubular systems segment is poised to record a CAGR of 8.33% through the forecast period, driven by growing adoption by industrial operators in wastewater treatment, food and beverage processing, chemicals, and mining applications.

- By Material (Polymeric, Ceramic): The polymeric segment is estimated to hold a share of 61.43% by 2032, fueled by high flexibility, cost effectiveness, ease of processing, and supporting large scale deployment across water treatment, food processing, and industrial filtration applications worldwide.

- By Application (Water & wastewater, Food & beverages, Dairy products, Drinks & concentrates, Wine & beer, and Others): The water & wastewater segment is projected to reach USD 7.98 billion by 2032, owing to the increasing urbanization, aging infrastructure replacement, stricter discharge standards, and rising investment in municipal treatment capacity accelerate adoption of membrane systems for drinking water purification.

What is the market scenario in North America and Asia Pacific region?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 35.95% of the membrane filtration market in 2024, with a valuation of USD 6.27 billion, due to the widespread deployment of membrane filtration systems for municipal drinking water treatment, wastewater reuse, industrial process water, and food and beverage filtration applications.

Moreover, the demand is driven by sustained capital investments by municipal utilities, industrial manufacturers, and commercial operators to upgrade treatment infrastructure and meet tightening federal and state water quality regulations.

Regulatory enforcement by environmental and public health agencies related to industrial discharge limits, potable water standards, and reuse mandates is accelerating the adoption of reverse osmosis, ultrafiltration, and nanofiltration technologies. Replacement of aging treatment assets across water utilities and industrial facilities further supports recurring system and membrane demand in this region. These factors are driving the growth of the market across North America.

Asia Pacific membrane filtration industry is set to grow at a CAGR of 9.08% over the forecast period due to increasing industrialization, rapid urban expansion, and rising pressure on water resources. Increasing investments in municipal water treatment capacity and industrial wastewater management are driving large-scale adoption of membrane systems.

Expansion of food and beverage processing, pharmaceuticals, and specialty chemicals manufacturing is further supporting the demand for high-efficiency filtration technologies. Governments and utilities are prioritizing advanced treatment solutions to address water scarcity and pollution challenges, thereby driving market growth in this region.

- In March 2025, Alfa Laval secured a major order for an advanced membrane filtration plant which will be installed at a large-scale industrial fermentation facility in Asia. Valued at approximately USD 8.6 million, the order highlights strong demand for high-capacity membrane filtration systems across diverse industrial processing applications.

Regulatory Frameworks

- In the U.S., the Safe Drinking Water Act (SDWA) regulates drinking water quality standards. It mandates advanced treatment technologies, including membrane filtration, to control contaminants and ensure public health protection.

- In the E.U., the Drinking Water Directive (EU) 2020/2184 governs water quality requirements. It strengthens monitoring obligations and promotes adoption of membrane-based treatment for contaminant removal and water safety compliance.

- In China, the Water Pollution Prevention and Control Law oversees industrial and municipal wastewater discharge. It enforces advanced treatment solutions, accelerating membrane filtration deployment for pollution control and water reuse.

- In India, the Central Pollution Control Board (CPCB) Effluent Discharge Standards regulate wastewater treatment practices. These standards drive demand for membrane filtration systems to meet tightening discharge and reuse norms.

Competitive Landscape

Key players in the membrane filtration industry are focusing on capacity expansion, technology advancement, and portfolio diversification to maintain competitiveness. Companies are actively investing in research and development to enhance membrane durability, fouling resistance, and separation efficiency across applications. Moreover, they are developing modular systems to address varying customer requirements and deployment scales.

- In March 2025, Memsift Innovations, in partnership with the Murugappa Group, announced the commercial launch of the GOSEP ultrafiltration membrane and inaugurated an advanced membrane manufacturing facility. The development supports large-scale production of proprietary membrane chemistry and strengthens the company’s strategic focus on expanding capabilities within the market for water treatment and separation applications.

Key Companies in Membrane Filtration Market:

Recent Developments (Product Launch)

- In June 2024, Asahi Kasei announced the commercial sale of a membrane-based system for producing water for injection, initiated in April 2024. The system uses Microza hollow-fiber membrane technology as an alternative to distillation. The design reduces steam requirements, lowers production costs, and decreases carbon emissions in sterile water manufacturing for pharmaceutical injection preparation.