Market Definition

Luxury handbags are high-end accessories made from superior materials, defined by exceptional craftsmanship, brand reputation, and exclusivity. They combine functionality, aesthetics, and status value. Leading brands position luxury handbags as long-term style investments that reflect personal identity and emphasize design innovation, and material quality.

Luxury Handbags Market Overview

The global luxury handbags market size was valued at USD 25.43 billion in 2024 and is projected to grow from USD 26.80 billion in 2025 to USD 39.82 billion by 2032, exhibiting a CAGR of 5.70% over the forecast period.

This growth is driven by increasing consumer preference for compact and stylish handbags and the growing influence of social media promoting mini and micro handbags for everyday use.

Key Highlights:

- The luxury handbags industry size was recorded at USD 25.43 billion in 2024.

- The market is projected to grow at a CAGR of 5.70% from 2025 to 2032.

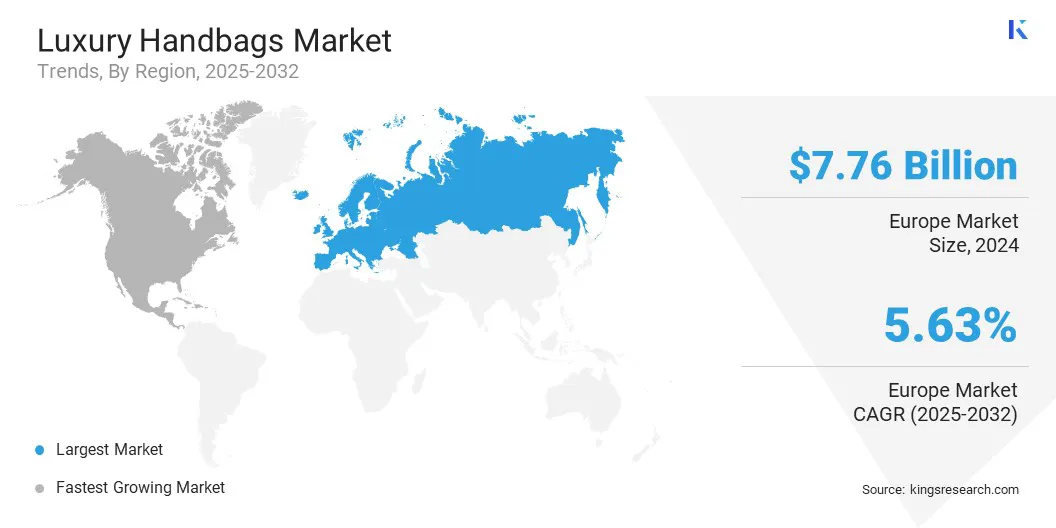

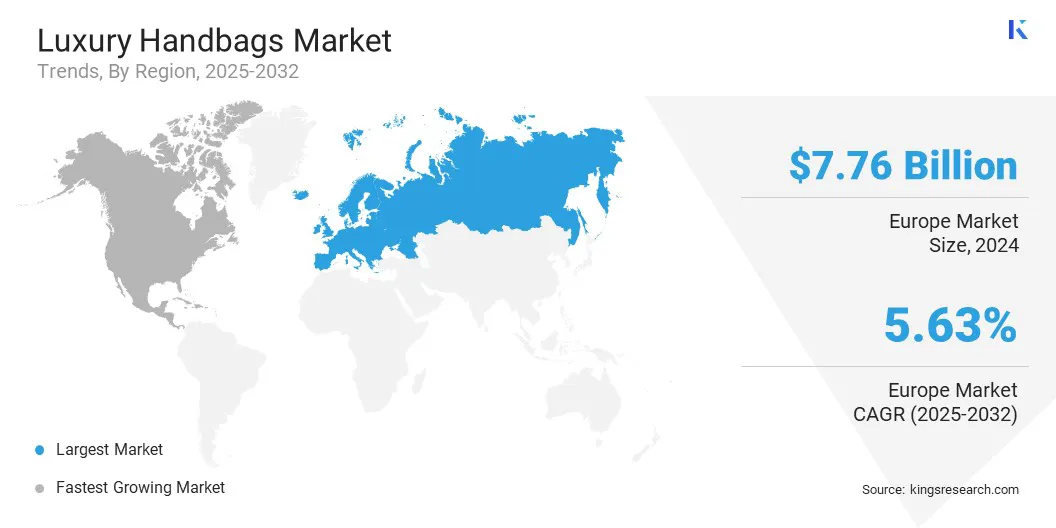

- Europe held a share of 30.52% in 2024, valued at USD 7.76 billion.

- The handbags segment generated USD 8.45 billion in revenue in 2024.

- The leather segment is expected to reach USD 14.18 billion by 2032.

- The online segment is anticipated to witness the fastest CAGR of 5.79% over the forecast period.

- North America is anticipated to grow at a CAGR of 6.35% through the projection period.

Major companies operating in the luxury handbags market are LVMH Moet Hennessy Louis Vuitton SE, Furla S.p.A., GANNI A/S, Giorgio Armani S.p.A., Loeffler Randall, Macy’s, Lacoste, Michael Kors, Tapestry, Inc. (Coach, Inc.), PVH Corp. (Calvin Klein), Kering Group (Guccio Gucci S.p.A.), Hermès, PRADA S.p.a., VALENTINO S.p.A., and Mulberry Company Limited.

Premium craftsmanship is driving the expansion of the market. Artisanal techniques, precise hand-stitching, and detailed finishing enhance durability and elevate perceived value.

Consumers increasingly favor handbags that reflect superior materials, refined construction, and personalization. This focus on craftsmanship reinforces brand positioning, sustains premium pricing, and builds customer loyalty. The use of heritage techniques and skilled craftsmanship preserves exclusivity and underscores each brand’s commitment to quality and precision.

- In December 2023, Heritage Brand launched the Fyra, a handcrafted crossbody sling bag. It is individually carved, painted, and dyed, featuring Swarovski crystal embellishments. The launch reflects the brand’s focus on American-made artisanal luxury with a distinctive design identity.

Why is innovation considered a driver for enhancing usability in luxury handbags?

A key factor propelling the progress of the luxury handbags market is growing innovation in design and functionality. Brands are increasingly introducing convertible styles, adjustable straps, and multi-compartment designs to enhance usability. These design advancements improve convenience while maintaining aesthetic appeal, meeting evolving consumer preferences.

Emphasis on practical features and creative design is strengthening product differentiation and competitive positioning, supported by continuous investment in research, prototyping, and design technology.

How is the increasing circulation of counterfeit handbags hindering the expansion of the luxury handbags sector?

The growing prevalence of counterfeit products poses a major challenge to market expansion. These unauthorized replicas undermine brand exclusivity, erode consumer trust, and lead to significant revenue losses. As counterfeit items increasingly mimic authentic designs and materials, their detection has become increasingly difficult, further restraining market growth.

To address this challenge, companies are implementing advanced authentication technologies, including RFID tags, Blockchain tracking, and digital verification systems, ensuring product genuineness and protecting brand reputation.

How is the trend of using recycled materials impacting consumer purchasing decisions?

A notable trend influencing the luxury handbags market is the integration of recycled materials into production. Brands are actively using recycled leather, fabrics, and sustainable synthetics to meet consumer demand for eco-conscious products.

The use of sustainable materials enhances brand image and aligns with global sustainability initiatives. This trend supports responsible manufacturing practices while maintaining quality standards and design aesthetics. Recycled materials provide a balance between environmental responsibility and luxury appeal, contributing significantly to market expansion.

- In July 2025, Tapestry raised its stake in recycled leather producer Gen Phoenix to 9.9 percent through a USD 15 million financing round. The partnership, initiated in 2022, supports Coach’s Coachtopia line, which utilizes at least 50 percent recycled leather fibers from Gen Phoenix to attract Gen-Z consumers.

Luxury Handbags Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Handbags, Backpacks, Wallets, Others

|

|

By Material

|

Nylon, Leather, Cotton, Synthetic

|

|

By Distribution Channel

|

Supermarkets/Hypermarkets, Specialty Stores, Company-owned Websites, Duty-Free Stores, Online

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Handbags, Backpacks, Wallets, and Others): The handbags segment generated USD 8.45 billion in revenue in 2024, mainly due to growing consumer demand for premium designs, increased brand visibility, and rising preference for compact and functional luxury handbags.

- By Material (Nylon, Leather, Cotton, and Synthetic): The nylon segment is poised to record a CAGR of 5.94% through the forecast period, propelled by its durability, lightweight properties, and increasing use in casual and travel-oriented luxury handbags.

- By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Company-owned Websites, Duty-Free Stores, and Online): The supermarkets/hypermarkets segment is estimated to hold a share of 26.70% by 2032, fueled by broad product availability, competitive pricing strategies, and the rising preference for purchasing luxury handbags through multi-brand retail channels.

What is the market scenario in Europe and North America region?

Based on region, the global luxury handbags market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Europe luxury handbags market share stood at 30.52% in 2024, valued at USD 7.76 billion. This dominance is attributed to the rising consumer demand for premium and designer handbags, increasing adoption of sustainable and high-quality materials, and the expansion of retail and e-commerce channels across urban and premium shopping districts.

The regional market is further characterized by strong brand recognition, a growing demand for sustainable and high-quality materials, and sustained consumer interest in limited-edition and exclusive handbag collections.

The North America luxury handbags industry is set to grow at a CAGR of 6.35% over the forecast period. Market growth is driven by rising disposable incomes, strong demand for both contemporary and classic designs, and the expansion of online and direct-to-consumer retail channels.

Consumers are increasingly favoring mini and micro handbags, reflecting a shift toward functional and fashion-forward styles. Investments in product innovation, targeted marketing, and digital engagement are further propelling market expansion. The region also benefits from strong brand penetration across both physical retail and e-commerce platforms.

- In March 2025, Michael Kors launched its Amazon storefront to boost its digital retail presence. This move aligns with the region’s growing luxury handbags segment, fueled by the rapid rise of e-commerce and consumer spending.

Regulatory Frameworks

- In the EU, the REACH Regulation (Registration, Evaluation, Authorization and Restriction of Chemicals) governs the use of chemicals in consumer products. It ensures that materials used in handbags, including leather treatments and dyes, meet safety and environmental standards, supporting compliance and sustainable manufacturing practices.

- In the U.S., the Consumer Product Safety Improvement Act (CPSIA) oversees the safety of consumer goods. It enforces limits on hazardous substances in materials, ensuring handbags meet safety requirements for consumers.

- In Japan, the Household Goods Quality Labeling Act (HGQLA) regulates labeling and material disclosure for consumer products. It mandates clear information on handbag composition, origin, and safety, enhancing transparency and consumer confidence.

- In Australia, the Australian Competition and Consumer Commission (ACCC) Product Safety Regulations control the safety and quality of consumer goods. It enforces compliance with standards regarding materials, labeling, and chemical use in handbags to ensure consumer protection.

Competitive Landscape

Key players operating in the luxury handbags industry are enhancing their physical retail presence through flagship stores and exclusive boutiques in key locations. They are strengthening e-commerce capabilities and digital marketing initiatives to expand consumer reach.

Product portfolios are being diversified with innovative designs, limited-edition releases, and customizable offerings. Strategic collaborations with designers, influencers, and lifestyle brands are reinforcing brand positioning, while operational efficiency and supply chain optimization are ensuring timely production and distribution.

- In June 2025, Rebag collaborated with Luxury Stores at Amazon to offer nearly 30,000 curated pre-owned designer handbags, jewelry, and watches. The partnership expands Rebag’s reach while promoting sustainable shopping and supporting circularity in the luxury sector by extending the lifecycle of high-end products.

Key Companies in Luxury Handbags Market:

- LVMH Moet Hennessy Louis Vuitton SE

- Furla S.p.A.

- GANNI A/S

- Giorgio Armani S.p.A.

- Loeffler Randall

- Macy’s

- Lacoste

- Michael Kors

- Tapestry, Inc. (Coach, Inc.)

- PVH Corp. (Calvin Klein)

- Kering Group (Guccio Gucci S.p.A.)

- Hermès

- PRADA S.p.a.

- VALENTINO S.p.A.

- Mulberry Company Limited