Market Definition

The market focuses on electrically powered heating systems that operate below 1,000 volts to generate thermal energy for water and space heating within commercial buildings. These systems are valued for their high efficiency, emissions-free operation, compact integration, and compliance with modern building standards.

The report covers segmentation by capacity, product type, end user, and region. Applications span space and hot water heating, process heating, and load management in facilities such as hospitals, offices, educational institutions, hotels, and retail environments.

Low Voltage Commercial Electric Boiler Market Overview

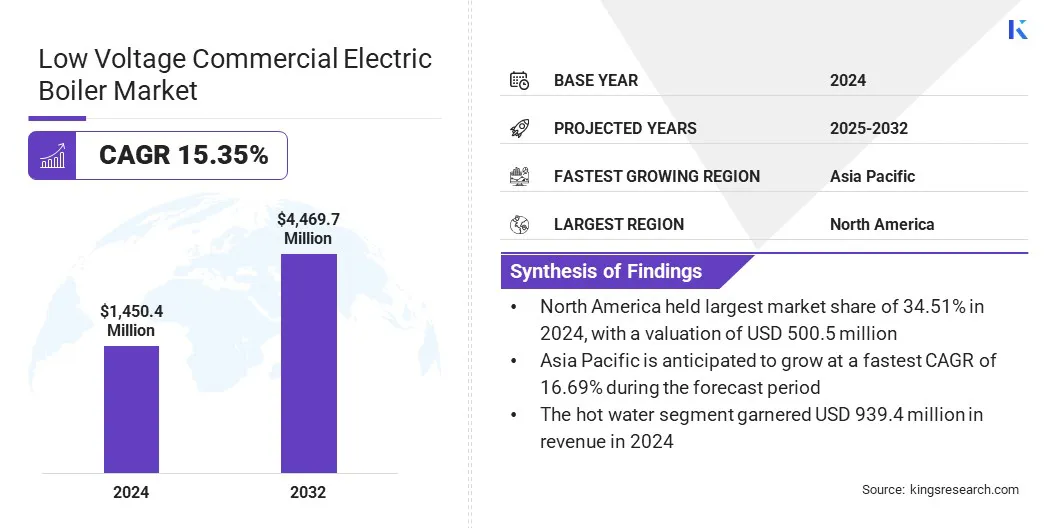

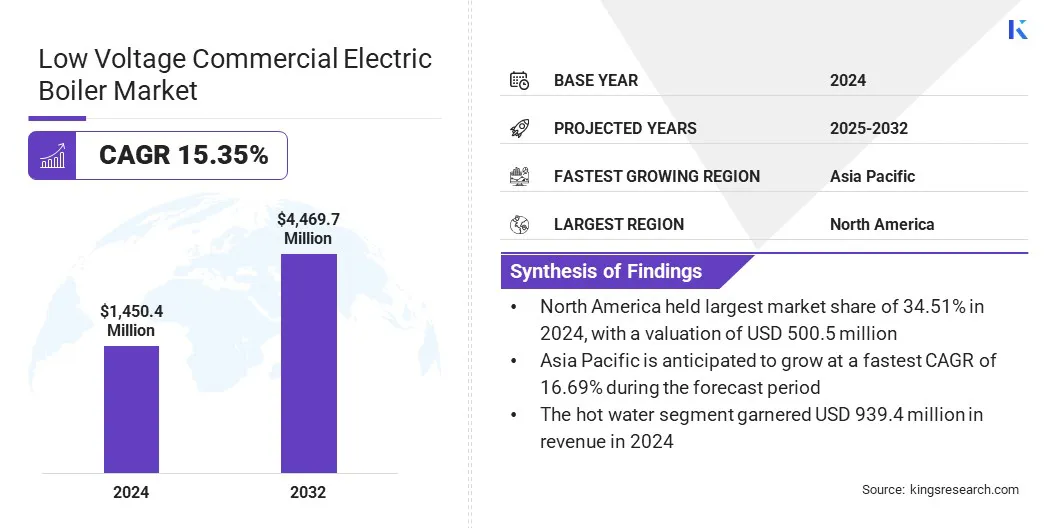

According to Kings Research, the global low voltage commercial electric boiler market size was valued at USD 1,450.4 million in 2024 and is projected to grow from USD 1,645.3 million in 2025 to USD 4,469.7 million by 2032, exhibiting a CAGR of 15.35% over the forecast period.

The market is driven by the expansion of commercial infrastructure and the rising need for efficient heating solutions in modern buildings. Adoption of modular boilers combined with AI-driven control systems is enhancing operational efficiency and supporting the transition toward low-emission commercial heating.

Key Market Highlights:

- The low voltage commercial electric boiler industry size was valued at USD 1,450.4 million in 2024.

- The market is projected to grow at a CAGR of 15.35% from 2025 to 2032.

- North America held a market share of 34.51% in 2024, with a valuation of USD 500.5 million.

- The > 2.5 - 10 MMBtu/hr segment garnered USD 397.4 million in revenue in 2024.

- The Hot Water segment is expected to reach USD 2,759.8 million by 2032.

- The Healthcare Facilities segment secured the largest revenue share of 22.80% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 16.69% over the forecast period.

Major companies operating in the low voltage commercial electric boiler market are Bosch Industriekessel GmbH, Cleaver-Brooks, LAARS Heating Systems Co., Precision Boilers, Lochinvar, Reimers Electra Steam, Inc., Fulton, Electro Industries, Inc., Dunkirk, Chromalox, ACV Excellence in Hot Water, Atlantic Boilers, Babcock Wanson, Bradford White Corporation, and Cerney S.A.U.

Decarbonization and electrification initiatives are driving the growth of the market. Carbon-neutrality targets are driving governments and organizations to shift from fossil-fuel boilers to electric alternatives. This transition is strengthening due to the integration of renewable energy sources such as solar and wind, which make electricity-based heating more sustainable.

Commercial facilities are increasingly prioritizing low-emission systems to meet regulatory standards and sustainability goals. Manufacturers are responding to this demand by developing advanced low voltage boilers that offer higher efficiency and easier integration with building management systems.

- In May 2025, Con Edison initiated a project to deploy electric boilers as part of its 2024 Steam Decarbonization Study. The project aims to reduce greenhouse gas emissions by improving thermal efficiency and integrating renewable energy sources. This initiative supports the objectives of the New York State Climate Leadership and Community Protection Act (CLCPA).

What drives growth in the market?

Expansion of commercial infrastructure is driving the growth of the low voltage commercial electric boiler market. Increasing construction of offices, hospitals, educational institutions, and hotels is creating a higher demand for reliable heating systems. In April 2024, the U.S. Department of Energy released a guidance document on space heating electrification for large commercial buildings.

The document highlights that space heating accounts for approximately 25% of all commercial building energy consumption annually, with 95% of this energy derived from fossil fuels. It emphasizes the importance of transitioning to electric alternatives to achieve decarbonization goals. This is encouraging developers to adopt low-emission electric boilers that meet energy efficiency standards.

The integration of low voltage commercial electric boilers helps facilities reduce operational costs while supporting sustainability goals. Growing awareness about environmental impact and regulatory pressure is further motivating building owners to prefer electric heating solutions.

- In March 2025, the Renewable Thermal Collaborative (RTC) released an Electrification Action Plan. The plan identifies industrial heat pumps, electric boilers, and thermal battery systems as key technologies to replace fossil fuel-powered technologies in industrial processes. It aims to significantly reduce emissions by 2030 through the adoption of these technologies.

What issues arise from grid limitations and voltage fluctuations?

A key challenge for the low voltage commercial electric boiler market is the inadequate capacity of existing electrical grids in some regions. Limited grid infrastructure and frequent voltage fluctuations reduce the efficiency and reliability of large-scale electric boiler installations.

These constraints hinder adoption, particularly in areas with growing commercial and institutional heating demands. In December 2024, the North American Electric Reliability Corporation (NERC) issued a warning about rising grid reliability risks.

The 2024 Long-Term Reliability Assessment highlighted that "122,000 megawatts (MW) of dispatchable generation retiring over the next ten years amid surging electricity demand driven by data centers, electrification, and industrial growth" could exacerbate grid strain.

To address this challenge, market players are developing energy-efficient boiler systems, integrating smart load management solutions, and collaborating with utility providers to strengthen local power networks. These measures are enabling more stable operation and supporting broader deployment of low voltage electric boilers.

- In 2024, the U.S. Department of Energy's Grid Modernization Strategy outlined the development of new tools and technologies. The strategy focuses on "developing new tools and technologies to measure, analyze, predict, protect, and control the grid of the future," aiming to support the integration of clean energy sources and electrification efforts.

What are the key trends shaping the market?

A key trend in the market is the adoption of modular boilers combined with AI-driven control systems. Modular designs are enabling facilities to adjust heating capacity efficiently according to changing building demands.

- In October 2024, Johnson Controls launched the PENN System 550, a modular electronic control solution for commercial refrigeration and HVAC systems. The system can regulate temperature, pressure, and humidity with A2L refrigerant leak detection and mitigation functionality built in. This launch reflects the industry's response to the challenges posed by existing grid limitations.

AI-enabled controls are analyzing real-time energy consumption and automatically optimizing boiler output for consistent comfort. This adjustment is reducing energy waste and lowering operational costs across commercial buildings. Integration with IoT platforms is allowing facility managers to monitor performance remotely and schedule predictive maintenance.

- In October 2024, Miura launched Miura Connect 2.0, an upgraded system for industrial and commercial boilers. The platform provides real-time monitoring, predictive maintenance, and data analytics for operational efficiency. It supports modular boiler setups and AI-enabled control for adjusting heating output.

Low Voltage Commercial Electric Boiler Market Report Snapshot

|

Segmentation

|

Details

|

|

By Capacity

|

≤ 0.3 - 2.5 MMBtu/hr, > 2.5 - 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/hr

|

|

By Product

|

Hot Water, Steam

|

|

By End User

|

Healthcare Facilities, Offices, Educational Institutions, Retail Stores, Lodgings, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Capacity (≤ 0.3 - 2.5 MMBtu/hr, > 2.5 - 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, and > 100 - 250 MMBtu/hr): The > 2.5 - 10 MMBtu/hr segment earned USD 397.4 million in 2024 due to its optimal balance of heating capacity, energy efficiency, and suitability for a wide range of commercial applications.

- By Product (Hot Water and Steam): The Hot Water segment held 64.77% of the market in 2024, due to its widespread use in commercial heating and water supply applications, offering high efficiency, ease of installation, and compatibility with modern energy management systems.

- By End User (Healthcare Facilities, Offices, Educational Institutions, Retail Stores, Lodgings, and Others): The Healthcare Facilities segment is projected to reach USD 1,133.0 million by 2032, owing to the high demand for reliable, continuous, and energy-efficient heating and hot water systems essential for patient care and facility operations.

What is the Low Voltage Commercial Electric Boiler Market scenario in North America and Asia-Pacific?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

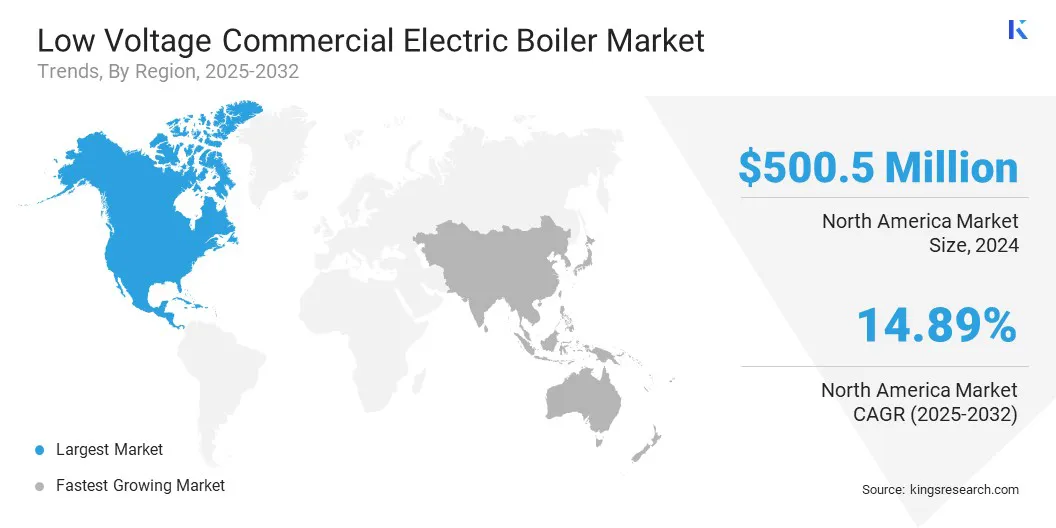

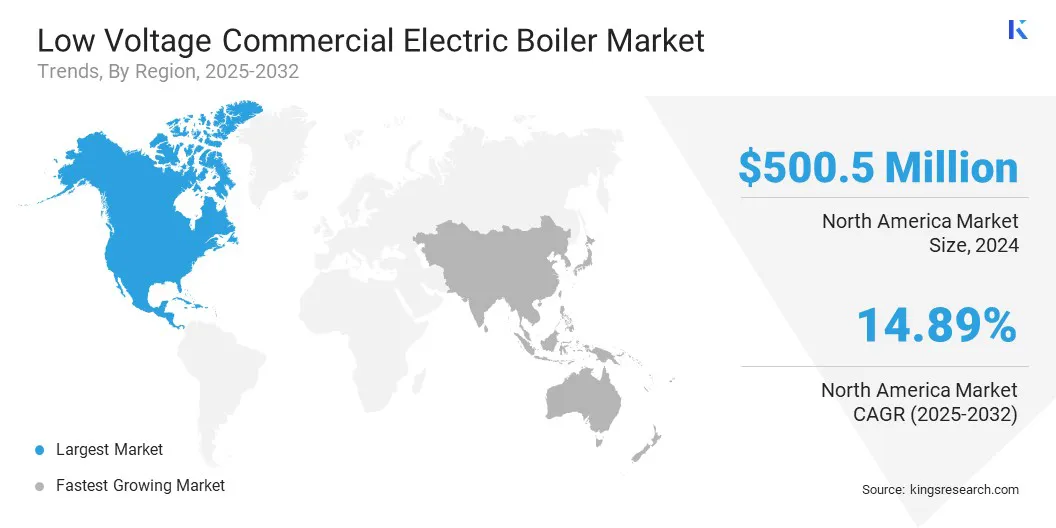

The North America low voltage commercial electric boiler market share stood around 34.51% in 2024 in the global market, with a valuation of USD 500.5 million. This dominance is due to the increasing implementation of strict energy-efficiency regulations in commercial buildings.

To comply with these standards, commercial property developers and facility managers are actively upgrading heating systems. In the U.S., the Department of Energy (DOE) has implemented energy conservation standards for commercial packaged boilers, mandating higher efficiency levels for new installations.

For instance, the DOE's final rule, effective from January 2023, requires compliance with updated energy conservation standards for commercial packaged boilers, promoting the use of more efficient heating systems.

Energy audits and mandatory efficiency certifications are further driving the replacement of conventional boilers with modern alternatives. Retrofitting projects enable businesses to meet current energy codes efficiently. Rising awareness of lifecycle cost savings is encouraging commercial operators to adopt low-voltage electric boilers as a long-term investment in operational efficiency.

- In June 2024, Acme Engineering introduced electrode steam boilers that operate at existing distribution voltages of 4.16 kV to 25 kV, achieving up to 99.9% efficiency in converting energy into heat. These systems support the transition to electric heating solutions, reducing reliance on fossil fuels and aligning with energy efficiency goals.

The low voltage commercial electric boiler market in Asia Pacific is poised for significant CAGR of 16.69% over the forecast period. This growth is due to the rapid urbanization and expansion of commercial infrastructure across Asia Pacific. New commercial buildings, offices, hotels, and industrial facilities are being constructed to meet the rising demand for urban services.

These developments require modern, efficient heating systems that can be installed quickly and operated reliably. Low-voltage electric boilers are increasingly preferred for their compact design and easy integration into new construction projects. Growing investments in large-scale commercial complexes and mixed-use developments are driving the adoption of energy-efficient heating solutions.

- In August 2025, the International Finance Corporation (IFC) and Ayala Land, Inc. (ALI) strengthened their partnership to advance green and resilient building initiatives in the Philippines. IFC provided a second sustainability-linked loan (SLL) of up to USD 225 million to ALI to support the development of Greenbelt 1 in Makati and Ayala Malls Evo City in Cavite.

Regulatory Frameworks

- In the U.S., the Energy Policy and Conservation Act (EPCA) authorizes the Department of Energy (DOE) to set energy efficiency standards for commercial water heating equipment, including electric boilers. The DOE periodically reviews and updates these standards to ensure energy conservation.

- In the European Union, the Low Voltage Directive (2014/35/EU) establishes safety requirements for electrical equipment within certain voltage limits, including electric boilers. Manufacturers must ensure compliance to affix the CE mark, indicating conformity with EU safety, health, and environmental requirements.

- In China, the GB 50054-2011 standard specifies the design and installation requirements for low-voltage electrical installations, including electric boilers. This code ensures personal and property safety, energy conservation, and reliable electrical installations in construction, extension, and renovation projects.

- In India, the Bureau of Energy Efficiency (BEE) sets standards for energy performance, including for electric boilers, to promote energy efficiency in industries. The National Building Code of India (NBC) provides guidelines for the installation and operation of heating systems, influencing the adoption of electric boilers.

- In Japan, the Energy Conservation Act mandates the use of energy-efficient equipment, including electric boilers, in commercial and industrial applications. The Industrial Safety and Health Act sets safety standards for equipment used in industrial settings, including electric boilers

Competitive Landscape

Market players are adopting strategies such as research and development, technological advancements, and strategic partnerships to remain competitive in the low voltage commercial electric boiler market. Companies are investing in innovative product designs to improve energy efficiency and reduce emissions.

Collaborations with technology providers and construction firms help expand market reach and integrate smart controls. Upgrading existing product lines with advanced features allows businesses to meet evolving regulatory and sustainability requirements.

- In May 2024, Lochinvar launched the LECTRUS Light Commercial Electric Boiler. This product is designed to support the transition to electrification and decarbonization in commercial heating systems. It offers versatility and efficiency, aligning with the growing demand for low-emission heating solutions.

List of Key Companies in Low Voltage Commercial Electric Boiler Market:

- Bosch Industriekessel GmbH

- Cleaver-Brooks

- LAARS Heating Systems Co.

- Precision Boilers

- Lochinvar

- Reimers Electra Steam, Inc.

- Fulton

- Electro Industries, Inc.

- Dunkirk

- Chromalox

- ACV Excellence in Hot Water

- Atlantic Boilers

- Babcock Wanson

- Bradford White Corporation

- Cerney S.A.U.

Recent Developments

- In November 2024, Siemens AG introduced an advanced electric boiler system for large-scale commercial buildings. This system aims to optimize energy consumption and support the electrification of heating systems in commercial settings.

- In January 2024, Acme Engineering Products, Inc. showcased its advanced electric steam and hot water boilers at the AHR Expo. The company highlighted how these zero-emission, economical boilers can deliver maximum heating and kilowatts in a minimum spatial footprint.

- In December 2023, Clayton Industries introduced the V-Series Electric Boiler. The V-Series offers high-performance steam generation without the need for fossil fuel connections or exhaust stacks. Its compact, plug-and-play configuration makes it ideal for operations with limited space.