Market Definition

The market involves medical procedures, devices, and consumables used to selectively separate and collect leukocytes from whole blood while returning the remaining components to circulation. This process enables the targeted removal or collection of white blood cells for therapeutic and research purposes.

Leukapheresis systems support applications such as management of hematologic disorders, treatment of autoimmune conditions, and preparation of cellular material for advanced therapies and clinical research. These technologies rely on controlled centrifugation, filtration, and automated flow systems to ensure efficiency, safety, and reproducibility.

Leukapheresis plays a critical role in cell therapy development, immunology research, and oncology studies by enabling precise leukocyte isolation across hospitals, blood centers, and academic research settings.

Leukapheresis Market Overview

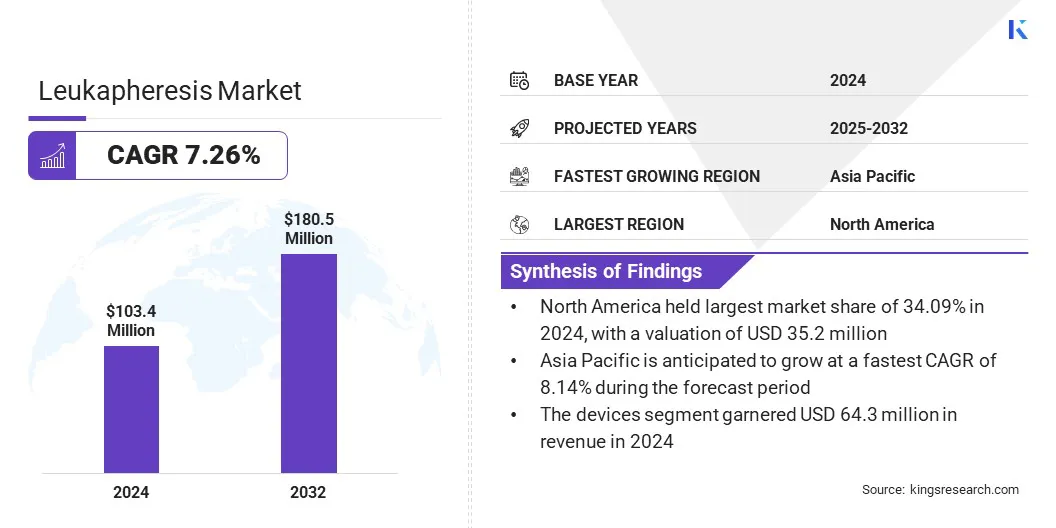

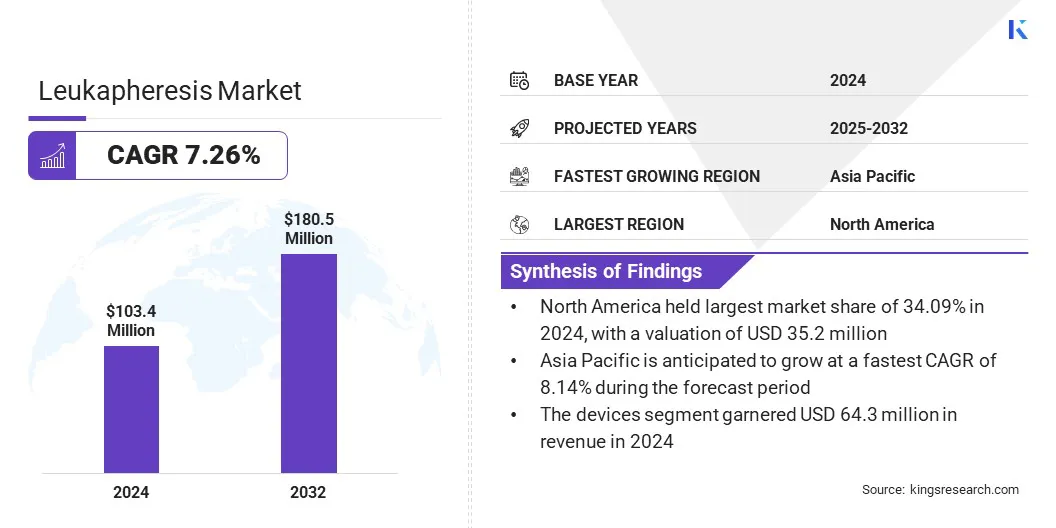

The global leukapheresis market size was valued at USD 103.4 million in 2024 and is projected to grow from USD 110.5 million in 2025 to USD 180.5 million by 2032, exhibiting a CAGR of 7.26% over the forecast period. Market growth is driven by increasing use of targeted blood processing for selective leukocyte removal in therapeutic and research settings.

Rising utilization of leukapheresis in hematologic and autoimmune disease management is supporting precise leukocyte control and standardized treatment delivery. Moreover, Expanding integration of leukapheresis into clinical protocols, supported by growing procedure volumes and advancing apheresis technologies is further driving market growth.

Key Market Highlights:

- The leukapheresis industry was recorded at USD 103.4 million in 2024.

- The market is projected to grow at a CAGR of 7.26% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 35.2 million.

- The devices segment garnered USD 64.3 million in revenue in 2024.

- The therapeutic segment is expected to reach USD 102.7 million by 2032.

- The blood centers segment is anticipated to witness the fastest CAGR of 7.45% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 8.14% through the projection period.

Major companies operating in the leukapheresis market are Terumo Corporation, Fresenius Kabi USA, LLC, Haemonetics Corporation, Asahi Kasei Group, Miltenyi Biotec, Macopharma, B. Braun SE, Medica SPA, Charles River Laboratories, ZenBio, Inc., Adacyte Therapeutics, Sysmex Corporation, AllCells, Lonza Group AG, and Cerus Corporation.

The increasing prevalence of hematologic and autoimmune disorders is driving demand for leukapheresis procedures across therapeutic settings. Rising incidence of conditions such as leukemia, lymphoma, and multiple sclerosis is increasing reliance on targeted leukocyte removal and collection therapies.

Expanding diagnostic awareness, earlier disease detection, and longer treatment durations are further increasing procedure volumes. Growing integration of leukapheresis into standardized hospital and blood center care pathways is reinforcing its role in managing chronic and treatment-intensive patient populations.

- In October 2025, Marker Therapeutics reported the treatment of its first patient under the OTS program. Initial clinical evaluation focuses on AML and MDS indications. This development highlights increasing dependence on leukapheresis-based T-cell collection to enable scalable immunotherapy manufacturing and support clinical advancement in hematologic oncology programs.

What is driving the integration of mobile-based leukapheresis centers in the leukapheresis market?

Expansion of mobile based leukapheresis centers is supported by the need to extend specialized blood processing capabilities beyond centralized hospital settings. Flexible deployment enables on site leukocyte collection for clinical trials, donor initiatives, and patients located in remote or underserved areas. This approach minimizes travel requirements, accelerates scheduling, and improves participation rates.

Pharmaceutical sponsors and research institutions increasingly rely on mobile platforms to streamline trial operations, ensure sample consistency, and support decentralized care models, strengthening scalable and cost efficient outreach across advanced therapeutic programs globally.

- In May 2025, BBG Advanced Therapies, a subsidiary of BioBridge Global, introduced a mobile leukapheresis center designed to conduct leukapheresis collections for cell and gene therapy starting materials. This mobile unit expands community-based access to immune cell collection services, supporting both cancer patients and healthy donors across a broad geographic service area.

What factors are limiting the availability of skilled personnel in the leukapheresis market?

Availability of qualified professionals remains constrained due to the specialized technical competencies required for leukapheresis procedures. Operation demands precise system handling, strict protocol compliance, and continuous patient monitoring, which limits workforce entry. Training programs remain limited in scale, while certification requirements extend onboarding timelines.

Smaller healthcare facilities and emerging regions face additional barriers due to inadequate training infrastructure. Increasing system sophistication and regulatory oversight further elevate skill thresholds, restricting workforce flexibility and slowing service expansion across therapeutic and research oriented leukapheresis environments globally.

To address this challenge, manufacturers and healthcare providers invest in structured training programs, standardized protocols, and automation enabled systems. Digital monitoring, remote support tools, and simplified device interfaces reduce operator dependency, improve procedural consistency, and support workforce scalability across diverse clinical environments worldwide sustainably long-term.

What is driving increased use of leukapheresis in cell and gene therapy development?

Growing adoption of cell and gene therapies is driving increased use of leukapheresis across research, clinical, and commercial manufacturing stages. Advanced therapies such as CAR-T, stem cell treatments, and immune-engineered products require consistent, high-quality leukocyte collection to ensure cell viability, process standardization, and regulatory compliance.

Expanding clinical pipelines, rising therapy approvals, and increasing manufacturing capacity are further elevating procedural demand. As a result, biopharmaceutical companies are incorporating leukapheresis early in therapy development to support scalability, supply chain reliability, and global commercialization of cell-based therapies.

- In December 2025, SCTbio and Fortrea announced a strategic collaboration to align GMP manufacturing and clinical research capabilities for cell based therapies. The agreement focuses on coordinated development planning, accelerated study execution, and integrated operational workflows. This partnership reflects increasing collaboration between CDMOs and CROs to support efficient cell therapy development, strengthen program execution, and improve end to end delivery across the clinical lifecycle.

Leukapheresis Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Devices, Disposables

|

|

By Application

|

Therapeutic, Research

|

|

By End User

|

Hospitals & Clinics, Blood Centers, Academic & Research Institutes, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Devices, Disposables): The devices segment generated USD 64.3 million in revenue in 2024, mainly due to rising installation of automated leukapheresis systems, expanding hospital infrastructure, growing cell therapy programs, and replacement demand.

- By Application (Therapeutic, Research): The research segment is poised to record a CAGR of 7.39% through the forecast period, propelled by expanding oncology studies, immunology research, clinical trial activity, and increased funding for research.

- By End User (Hospitals & Clinics, Blood Centers, Academic & Research Institutes, and Others): The hospitals and clinics segment is estimated to hold a share of 32.93% by 2032, fueled by high procedure volumes, infrastructure, skilled personnel availability, and integration of leukapheresis into care

Leukapheresis Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America leukapheresis market accounted for a 34.09% share in 2024, valued at USD 35.2 million, supported by strong procedural volumes and early adoption of advanced apheresis technologies. Market growth is driven by mature healthcare infrastructure, widespread availability of automated leukapheresis systems, and integration of procedures across hospitals, blood centers, and research institutions.

A high concentration of cell and gene therapy programs, active clinical trials, and translational research further support consistent demand for leukocyte collection. Additionally, regulatory clarity, established reimbursement pathways, and continuous investments in system upgrades, consumables, and workforce training reinforce procedural adoption and revenue stability in the region.

- In December 2025, Galapagos NV reported updated Phase 2 results from the ATALANTA-1 study of its CD19 CAR T-cell therapy. Data highlighted efficient leukapheresis and rapid cell processing, where 26 pretreated patients underwent collection and most received fresh infusions within seven days, underscoring leukapheresis reliability in advanced cell therapy workflows.

Asia Pacific leukapheresis industry is set to grow at a CAGR of 8.14% over the forecast period, supported by expanding healthcare capacity and rising focus on advanced therapeutic procedures. Increasing diagnosis of hematologic and immune related disorders drives procedural demand across hospitals and specialty centers. Research activity continues to expand due to growing investments in oncology, immunology, and regenerative medicine programs.

Pharmaceutical and biotechnology companies are strengthening clinical development pipelines, increasing requirements for consistent leukocyte collection. Adoption of automated systems and disposable kits improves procedural efficiency and safety. Expansion of academic research institutes and contract research activity further supports sustained growth momentum, positioning the region as a high potential contributor to future market expansion.

Regulatory Frameworks

- In the U.S., the Code of Federal Regulations Title 21 (21 CFR Parts 600–680) governs blood and blood component collection. It establishes standards for leukapheresis device use, donor safety, processing controls, and biologics compliance.

- In the EU, the EU Blood Directive (Directive 2002/98/EC) regulates blood and blood component activities. It defines quality, safety, and traceability requirements directly applicable to leukapheresis procedures and consumables.

Competitive Landscape

Market participants are focusing on broadening product portfolios for devices and disposables to meet evolving therapeutic and research needs. Key strategies emphasize advancing automation, closed-system designs, and digital monitoring to comply with regulatory and operational standards. Companies are scaling manufacturing capacity and enhancing supply chain resilience to accommodate growing procedural volumes.

Collaborations with research institutions, clinical trial sponsors, and healthcare providers remain central to market penetration efforts. Investments in system reliability, workflow integration, and compliance readiness continue, while geographic expansion, localized service support, and workforce training help strengthen presence in high-growth regions and maintain competitive positioning in the technology-driven and highly regulated market.

Key Companies in Leukapheresis Market:

- Terumo Corporation

- Fresenius Kabi USA, LLC

- Haemonetics Corporation

- Asahi Kasei Group

- Miltenyi Biotec

- Macopharma

- Braun SE

- Medica SPA

- Charles River Laboratories

- ZenBio, Inc.

- Adacyte Therapeutics

- Sysmex Corporation

- AllCells

- Lonza Group AG

- Cerus Corporation