Market Definition

In-vitro diagnostics (IVD) contract manufacturing involves outsourcing the design, development, and production of diagnostic devices, reagents, and consumables to specialized manufacturers. It enables companies to leverage advanced technologies, regulatory expertise, and scalable manufacturing capabilities.

This service supports the manufacturing of molecular diagnostics, immunoassays, clinical chemistry, and point-of-care testing products. Its importance is growing as diagnostic providers focus on reducing costs, accelerating product launches, and meeting stringent quality and compliance standards worldwide.

IVD Contract Manufacturing Market Overview

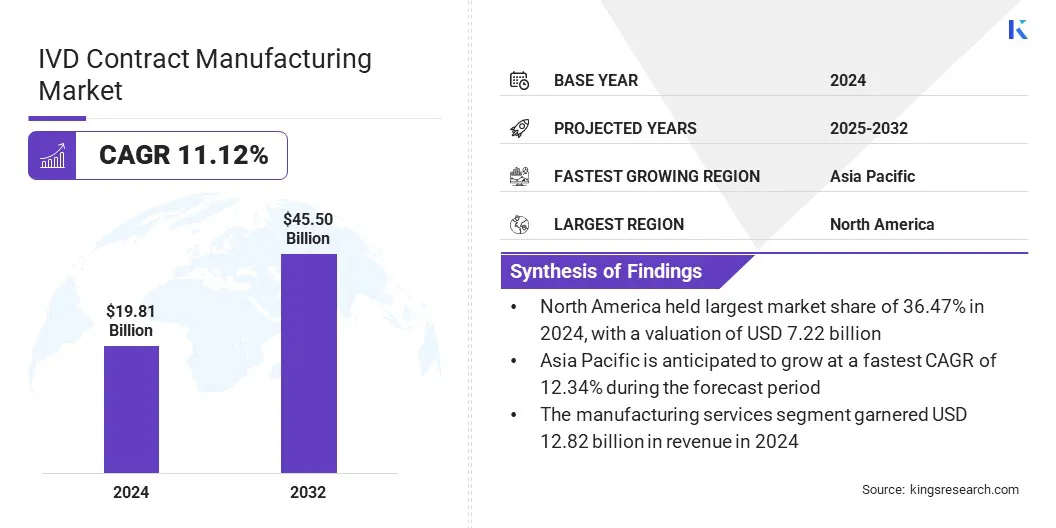

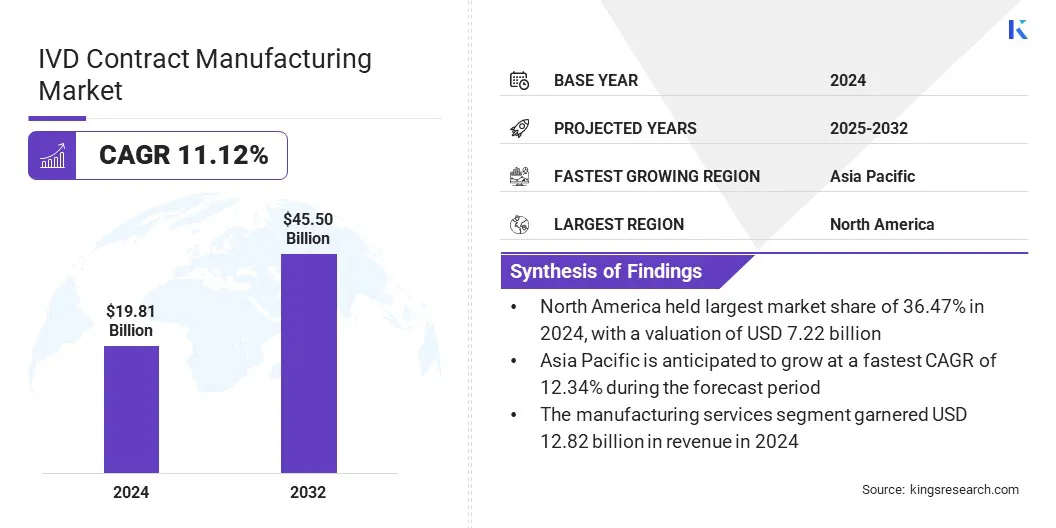

According to Kings Research, the global IVD contract manufacturing market size was valued at USD 19.81 billion in 2024 and is projected to grow from USD 21.75 billion in 2025 to USD 45.50 billion by 2032, exhibiting a CAGR of 11.12% during the forecast period.

This growth is driven by the increasing complexity of diagnostic technologies and a shift toward cost-effective outsourcing models among in-vitro diagnostics manufacturers. Rising demand for molecular diagnostics, immunoassays, and point-of-care testing solutions is fueling adoption across healthcare and research applications.

Key Market Highlights:

- The IVD contract manufacturing industry size was USD 19.81 billion in 2024.

- The market is projected to grow at a CAGR of 11.12% from 2025 to 2032.

- North America held a share of 36.47% in 2024, valued at USD 7.22 billion.

- The manufacturing services segment garnered USD 12.82 billion in revenue in 2024.

- The reagents segment is expected to reach USD 18.20 billion by 2032.

- The research & academic institutes segment is anticipated to witness the fastest CAGR of 11.81% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 12.34% through the projection period.

Major companies operating in the IVD contract manufacturing market are Thermo Fisher Scientific Inc., Merck KGaA, Danaher Corporation, Jabil Inc., Flex Medical Solutions Ltd, Celestica Inc., Sanmina Corporation, Benchmark Electronics, Inc., Invetech, Meridian Bioscience, Inc., Avioq, Inc., TCS Biosciences, Savyon Diagnostics, BD, and Cenogenics Corporation.

Surging emphasis on regulatory compliance, quality assurance, and scalable production is supporting broader engagement of contract manufacturing partners. Additionally, advancements in automation, strategic collaborations, and integrated service offerings are propelling continued market expansion.

- In July 2025, ClearNote Health received UK Conformity Assessed (UKCA) marking for its Avantect pancreatic cancer in-vitro diagnostic test. The approval enables its commercial launch in the UK and marks the company’s transition from laboratory-developed assays to regulated diagnostics. The Avantect test analyzes circulating cell-free DNA using epigenomic and genomic sequencing, supporting global expansion and enhancing early pancreatic cancer detection.

How is growing demand for precise diagnostic solutions driving market growth?

The IVD contract manufacturing market is witnessing significant growth, mainly due to growing demand for precise diagnostic solutions and the rising complexity of modern assays.

Laboratories, healthcare providers, and research institutions increasingly require scalable, reliable, and regulatory-compliant production services for molecular diagnostics, immunoassays, and point-of-care tests.

For instance, in March 2024, the FDA granted 510(k) clearance for Luminex Molecular Diagnostics’ NxTAG Respiratory Pathogen Panel v2, a next-generation sequencing assay that identifies multiple respiratory pathogens in a single test, highlighting the need for advanced manufacturing capabilities.

Moreover, diagnostic companies are increasingly partnering with contract manufacturers to accelerate product development, reduce costs, and ensure regulatory compliance. Continued advancements in automation, assay development technologies, and integrated service offerings are further supporting sustained market growth.

How are intellectual property risks influencing the IVD contract manufacturing market?

Intellectual property protection risks pose a significant challenge to the progress of the market. Outsourcing production exposes sensitive assays, formulations, and technologies to potential misuse or unauthorized access, creating risks for diagnostic companies.

These risks can result in competitive disadvantages, financial losses, and damage to trust between clients and manufacturers, particularly for smaller or emerging firms.

Ensuring secure handling of intellectual property requires robust legal agreements, strict confidentiality protocols, and careful selection of manufacturing partners. However, limited oversight and enforcement across multiple sites increase exposure to potential breaches.

To mitigate these risks, companies are increasingly investing in secure production processes, advanced data protection systems, and stringent contractual safeguards. These measures aim to strengthen IP security, maintain competitive advantage, and support long-term growth in the contract manufacturing sector.

How is the integration of advanced automation and digital technologies transforming this market?

The in‑vitro diagnostics contract manufacturing market is experiencing a notable trend toward the adoption of automation and digital technologies, along with increasing demand for precise, scalable diagnostic solutions across healthcare, research, and point-of-care settings.

Automated production systems and digital quality management platforms are being optimized for higher throughput, enhanced accuracy, and streamlined regulatory compliance, while smart manufacturing facilities are being designed to handle increasing volumes of complex diagnostic products.

This shift has accelerated as diagnostic companies aim to reduce time-to-market, improve operational efficiency, and ensure product consistency. Contract manufacturers, technology providers, and research institutions are investing in automated workflows, high-throughput platforms, and integrated digital solutions to scale production capabilities.

Continuous adoption of automation and digital technologies is expected to boost productivity, reduce costs, and foster significant market growth over the forecast period.

- In May 2025, Tempus received U.S. FDA 510(k) clearance for its RNA-based Tempus xR in‑vitro diagnostic device, a next-generation sequencing assay for detecting gene rearrangements in solid tumors. The device analyzed RNA from formalin-fixed paraffin-embedded tumor samples and supported oncology drug development by identifying gene fusions and molecular pathways. This clearance highlighted Tempus’ focus on advancing precision medicine through AI-driven diagnostics and integrated data solutions.

IVD Contract Manufacturing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service Type

|

Manufacturing Services, Research & Development (R&D) Services, and Packaging Services

|

|

By Product Type

|

Reagents, Diagnostic Devices & Instruments, Assay Kits, and Consumables

|

|

By End User

|

Pharmaceutical & Biotechnology Companies, Hospitals & Clinical Laboratories, and Research & Academic Institutes

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service Type (Manufacturing Services, Research & Development (R&D) Services, and Packaging Services): The manufacturing services segment earned USD 12.82 billion in 2024, primarily due to increasing demand for high-precision diagnostic production and large-scale outsourcing by IVD companies.

- By Product Type (Reagents, Diagnostic Devices & Instruments, Assay Kits, and Consumables): The reagents segment held a share of 42.56% in 2024, propelled by their essential role in molecular diagnostics, immunoassays, and routine laboratory testing.

- By End User (Pharmaceutical & Biotechnology Companies, Hospitals & Clinical Laboratories, and Research & Academic Institutes): The pharmaceutical & biotechnology companies segment is projected to reach USD 22.03 billion by 2032, owing to increasing outsourcing of diagnostic production and growing demand for advanced assays and personalized medicine solutions.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America IVD contract manufacturing market share stood at 36.47% in 2024, valued at USD 7.22 billion. Strong healthcare infrastructure, the presence of leading diagnostic companies, and high adoption of advanced molecular and point-of-care diagnostics are further boosting this expansion.

The regional market further benefits from significant investments in research and development, automation, and quality management systems, which are enhancing manufacturing efficiency and scalability. Strategic collaborations between domestic and global players, along with supportive regulatory frameworks, further strengthen growth prospects.

Continuous advancements in assay technologies, production automation, and integrated digital solutions position North America as a key hub for IVD contract manufacturing.

- In April 2025, Roche invested USD 50 billion in the U.S. over five years to expand its pharmaceutical and diagnostics operations. The plan included new and upgraded manufacturing sites in Indiana, Pennsylvania, Massachusetts, and California, along with an R&D center in Massachusetts dedicated to AI-driven research in cardiovascular, renal, and metabolic disease.

Asia Pacific IVD contract manufacturing market is set to grow at a CAGR of 12.34% over the forecast period. This growth is fueled by rising demand for advanced diagnostic solutions, increasing outsourcing of production, and the expansion of contract manufacturing capabilities.

The regional sector further benefits from supportive government policies, investments in healthcare infrastructure, and collaborations between local and international diagnostic companies.

The presence of a large patient population and growing adoption of molecular and point-of-care diagnostics are creating strong opportunities for high-precision assay production. Additionally, advancements in automation, digital quality management, and high-throughput manufacturing are fostering innovation, aiding regional market expansion.

Regulatory Frameworks

- In the U.S., 21 CFR Part 809 regulates in‑vitro diagnostic devices. It establishes requirements for labeling, performance standards, and premarket approval or clearance, ensuring that IVD contract manufacturers produce safe and effective diagnostic products compliant with FDA standards.

- In the EU, Regulation (EU) 2017/746 governs in‑vitro diagnostic devices. It establishes requirements for risk classification, conformity assessment, clinical evidence, and post-market surveillance, ensuring that IVD products meet safety, performance, and quality standards throughout their lifecycle.

Competitive Landscape

Companies operating in the in‑vitro diagnostics contract manufacturing market are maintaining competitiveness through investments in advanced automation, high-throughput production systems, and digital quality management platforms.

They are focusing on expanding manufacturing capacity and enhancing operational efficiency to meet growing demand for molecular diagnostics, immunoassays, and point-of-care testing solutions.

Key players are broadening their service portfolios to include assay development, regulatory support, packaging, and integrated end-to-end manufacturing, supported by strategic partnerships, mergers, and collaborations with diagnostic developers.

- In January 2025, Revvity and Element Biosciences collaborated to develop an in‑vitro diagnostic (IVD) workflow for neonatal sequencing. The partnership integrated Revvity’s automated newborn sequencing technology with Element’s AVITI system to deliver a comprehensive end-to-end solution for newborn screening. A research-use-only (RUO) version was launched, with regulatory approval for clinical use planned.

Firms are increasingly focusing on forming collaborations with healthcare providers, research institutions, and technology vendors to expedite product development and minimize commercialization timelines. Additionally, companies are enhancing technical expertise, implementing digital monitoring systems, and leveraging automation and smart manufacturing solutions to sustain a competitive advantage.

List of Key Companies in IVD Contract Manufacturing Market:

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Danaher Corporation

- Jabil Inc.

- Flex Medical Solutions Ltd

- Celestica Inc.

- Sanmina Corporation

- Benchmark Electronics, Inc.

- Invetech

- Meridian Bioscience, Inc.

- Avioq, Inc.

- TCS Biosciences

- Savyon Diagnostics

- BD

- Cenogenics Corporation

Recent Developments

- In January 2025, Akoya Biosciences appointed Argonaut Manufacturing Services as its manufacturing partner for developing in vitro diagnostic (IVD) assays. The collaboration builds on their existing partnership, leveraging Argonaut’s cGMP and ISO 13485-certified capabilities to support diagnostic product scale-up and commercialization in regulated markets.