Market Definition

Healthcare compliance software is a digital solution that helps organizations efficiently manage regulatory requirements, internal policies, and risk mitigation processes. It enables automated tracking, documentation, and reporting, ensuring adherence to healthcare standards and reducing compliance risks.

Key applications include auditing, training management, license tracking, and policy enforcement, supporting operational efficiency, governance, and regulatory compliance. Hospitals, clinics, and healthcare service providers leverage these solutions to streamline workflows, maintain accountability, and meet regional and international regulations.

Healthcare Compliance Software Market Overview

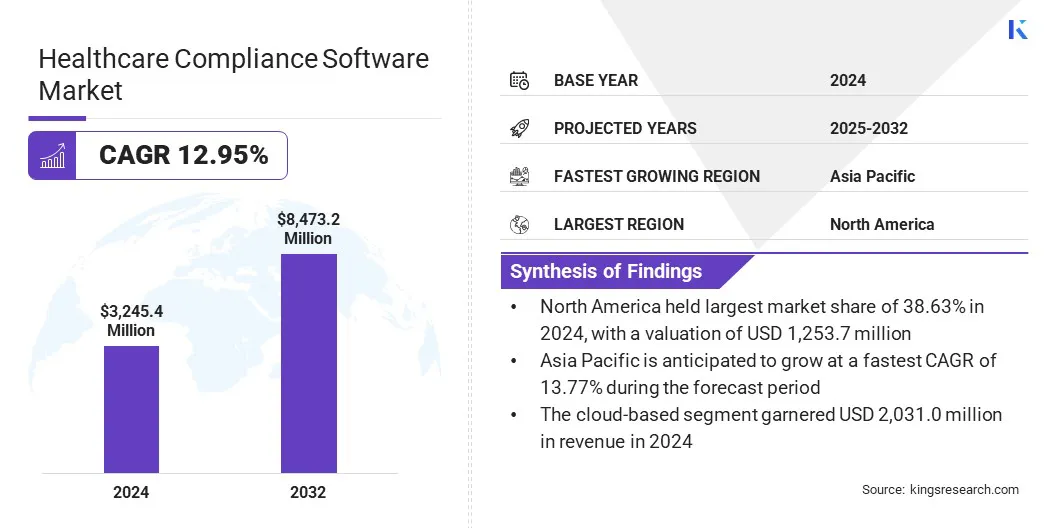

The global healthcare compliance software market size was valued at USD 3,245.4 million in 2024 and is projected to grow from USD 3,611.9 million in 2025 to USD 8,473.2 million by 2032, exhibiting a CAGR of 12.95% during the forecast period.

Market growth is mainly fueled by the growing need for advanced digital platforms that simplify compliance processes, enhance reporting precision, and support informed decision-making in healthcare settings. Wider adoption of automated tracking, analytics, and cloud-based compliance solutions is further boosting operational efficiency, governance, and regulatory adherence.

Key Highlights

- The healthcare compliance software industry size was valued at USD 3,245.4 million in 2024.

- The market is projected to grow at a CAGR of 12.95% from 2025 to 2032.

- North America held a share of 38.63% in 2024, valued at USD 1,253.7 million.

- The cloud-based segment garnered USD 2,031.0 million in revenue in 2024.

- The medical billing and coding segment is expected to reach USD 1,474.6 million by 2032.

- The specialty clinics segment is anticipated to witness the fastest CAGR of 13.38% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 13.77% through the projection period.

Major companies operating in the healthcare compliance software market are Radar Healthcare Inc., MedTrainer, Compliancy Group LLC, GE HealthCare, NAVEX Global, Inc., Epic Systems Corporation, HealthStream, Sprinto, VComply Technologies, Inc., HEALTHICITY, LLC., Ideagen ConvergePoint, Cabot Technology Solutions, Chetu Inc., ScienceSoft Corporation, and Folio3 Software Inc.

The growing focus by healthcare providers, regulators, and accreditation bodies on patient safety, risk management, and policy enforcement is boosting the integration of healthcare compliance software into core operational processes. Additionally, ongoing technological advancements in compliance solutions by software providers, along with strategic initiatives and digital transformation efforts by organizations, are aiding market growth.

- In April 2023, HITRUST completed a compliance reporting pilot supporting Microsoft's Global Healthcare Compliance Scale Initiative. The program aims to streamline organizations' compliance reporting and accelerate global healthcare solution adoption by providing standardized compliance insights.

Market Driver

Rising Focus on Patient Safety & Risk Management

The growth of the healthcare compliance software market is fueled by organizations’ increasing focus on patient safety and risk management. According to the World Health Organization, approximately one in ten patient’s experiences harm during healthcare, contributing to over 3 million deaths annually globally, with up to 4% mortality in low- to middle-income countries from unsafe medical practices.

These platforms enable automated tracking, monitoring, and reporting of compliance activities, ensuring adherence to regulatory standards and internal policies. Hospitals, clinics, and other healthcare providers are increasingly adopting these tools to mitigate operational risks, enhance care quality, and maintain accountability.

Adoption is further boosted by regulatory mandates, accreditation requirements, and the strategic focus on reducing errors and legal exposure, strengthening organizational resilience and care standards.

Market Challenge

Complex Integration with Legacy Systems

Complex integration with legacy systems poses a significant barrier to the growth of the healthcare compliance software market. Many healthcare organizations rely on electronic health records, billing, and operational systems that were not designed for compliance workflows or analytics. Integrating compliance software requires custom interfaces, extensive data migration, and ongoing maintenance, leading to increased implementation time and costs.

Smaller providers with limited IT resources face major challenges, creating a gap with larger institutions. Hospitals and clinics also require accurate, real-time, and auditable data to meet regulatory standards, while the shortage of skilled personnel further complicates integration and software adoption.

To overcome these constraints, organizations are increasingly exploring modular software solutions, cloud-based platforms, and professional services for integration and deployment. These approaches aim to simplify system compatibility, reduce implementation complexity, and accelerate the adoption of healthcare compliance solutions across organizations of all sizes.

Market Trend

Integration of Artificial Intelligence & Advanced Analytics

The healthcare compliance software market is experiencing a significant shift toward cloud-based platforms with advanced analytics and artificial intelligence. These solutions enable automated tracking, real-time monitoring, and predictive risk analysis, improving adherence to regulatory standards and internal policies. They are particularly valuable for hospitals, clinics, and multi-location healthcare networks managing large volumes of complex compliance data.

Adoption of intelligent compliance tools improves workflow efficiency, reduces manual effort, ensures data accuracy, and supports strategic operational decision-making. Cloud-based and AI-powered platforms are becoming essential for effective governance, risk management, and high-quality patient care.

- In March 2025, Streamline Healthcare Solutions partnered with Eleos Health to integrate AI-powered documentation and compliance tools into its SmartCare EHR platform. The collaboration is intended to streamline clinical workflows, reduce administrative workload, and enhance efficiency for behavioral health and human services providers.

Healthcare Compliance Software Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

On-premise, and Cloud-based

|

|

By Category

|

Policy and Procedure Management, Auditing Tools, Training Management and Tracking, Medical Billing and Coding, License, Certificate, and Contract Tracking, Incident Management, Accreditation Management, and Other Categories

|

|

By End Use

|

Hospitals, Specialty Clinics, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (On-premise and Cloud-based): The cloud-based segment earned USD 2,031.0 million in 2024, primarily due to its scalability, remote accessibility, and ability to provide real-time compliance monitoring.

- By Category (Policy and Procedure Management, Auditing Tools, Training Management and Tracking, Medical Billing and Coding, License, Certificate, and Contract Tracking, Incident Management, Accreditation Management, and Other Categories): The medical billing and coding segment held a share of 16.24% in 2024, boosted by the growing need for accurate revenue cycle management and compliance with healthcare regulations.

- By End Use (Hospitals, Specialty Clinics, and Others): The hospitals segment is projected to reach USD 4,750.7 million by 2032, owing to increasing regulatory requirements, the complexity of compliance management, and the adoption of digital solutions to enhance patient safety and operational efficiency.

Healthcare Compliance Software Market Regional Analysis

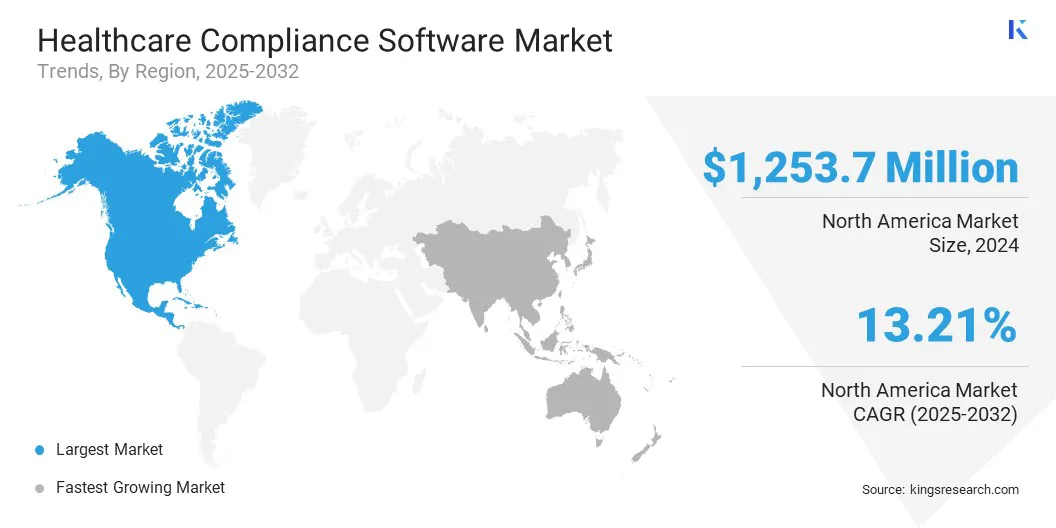

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America healthcare compliance software market share stood at 38.63% in 2024, valued at USD 1,253.7 million. This dominance is reinforced by widespread adoption of advanced healthcare IT systems, strong investments in digital transformation, and a well-established network of hospitals and specialty clinics.

The regional market further benefits from stringent regulatory frameworks and a growing emphasis on patient safety, risk management, and data security, which are driving adoption of compliance solutions.

Supportive policies, extensive collaborations between healthcare providers and technology vendors, and the presence of major software developers further strengthen growth prospects. Continuous advancements in cloud computing, artificial intelligence, and analytics are further spurring regional market growth.

- In September 2025, Tech Mahindra partnered with Abacus Insights to strengthen U.S. healthcare data compliance. The collaboration focuses on deploying Centers for Medicare & Medicaid Services (CMS) interoperability solutions that simplify payer data management, improve secure data sharing, and reduce administrative complexities in the healthcare system.

Asia Pacific healthcare compliance software industry is set to grow at a CAGR of 13.77% over the forecast period. This growth is fueled by the rapid digitalization of healthcare systems, increasing regulatory oversight, and rising adoption of healthcare compliance software across hospitals, specialty clinics, and other healthcare providers.

Expanding healthcare infrastructure highlights the need for cloud-based platforms and advanced analytics to improve data accuracy, ensure regulatory adherence, and streamline compliance processes. Additionally, government-led healthcare initiatives, along with collaborations between regional providers and global technology vendors, are supporting software adoption and digital infrastructure development.

Furthermore, organizations are prioritizing real-time monitoring, automated reporting, and data-driven decision-making, supported by workforce training and technological advancements, to drive long-term adoption. The expansion of digital healthcare ecosystems and increasing emphasis on patient safety and operational efficiency are further propelling regional market growth.

Regulatory Frameworks

- In the U.S., the Health Insurance Portability and Accountability Act (HIPAA) regulates the privacy and security of patient health information. It establishes standards to protect electronic protected health information (ePHI) and ensures confidentiality, integrity, and availability of healthcare data, making it highly relevant for healthcare compliance software.

- In the European Union, the General Data Protection Regulation (GDPR) governs the processing of personal and health data. It mandates strict data protection measures, ensuring compliance software can securely manage patient information and adhere to privacy standards.

- In Australia, the My Health Records Act 2012 monitors the management of patient health records. It mandates secure handling of electronic health information, reinforcing the need for compliant software solutions in healthcare organizations.

Competitive Landscape

Companies operating in the healthcare compliance software industry are maintaining competitiveness through investments in cloud-based platforms, advanced analytics, and strategic partnerships and acquisitions. They are implementing compliance software for automated tracking, real-time monitoring, and regulatory adherence to support operations across hospitals, specialty clinics, and other healthcare providers.

Market players are expanding offerings with AI-driven analytics, workflow automation, and integrated reporting solutions to address operational requirements and evolving healthcare regulations.

Moreover, they are establishing regional support centers and collaborating with technology vendors and consulting firms to facilitate adoption and enhance the effectiveness of compliance initiatives. Additionally, companies are providing training programs, technical support, and real-time monitoring features to improve efficiency and sustain competitive positioning.

- In June 2025, Baker Tilly, in partnership with MediSpend, launched stewardshipNOW, a complianceNOW suite solution for life sciences. The platform automates grants, sponsorships, charitable contributions, and investigator-initiated research funding, ensuring regulatory adherence, transparency, and operational efficiency.

Top Key Companies in Healthcare Compliance Software Market:

- Radar Healthcare Inc.

- MedTrainer

- Compliancy Group LLC

- GE HealthCare

- NAVEX Global, Inc.

- Epic Systems Corporation

- HealthStream

- Sprinto

- VComply Technologies Inc.

- HEALTHICITY, LLC.

- Ideagen ConvergePoint

- Cabot Technology Solutions

- Chetu Inc.

- ScienceSoft Corporation

- Folio3 Software Inc.

Recent Developments (M&A)

- In October 2023, AHIMA acquired HCPro and its brands from Simplify Compliance to enhance its healthcare information and education offerings. The acquisition strengthens AHIMA’s capabilities in compliance, revenue cycle management, and education. HCPro continues to operate as a for-profit, wholly-owned subsidiary, including brands such as DecisionHealth, ACDIS, NAHRI, and AHCC.