Market Definition

The market encompasses technologies, software, and services for tracking, monitoring, and optimizing medical assets within healthcare facilities. It includes systems such as RFID, RTLS, IoT, and analytics platforms that provide real-time visibility of equipment, supplies, and personnel.

These solutions enhance operational efficiency, reduce asset loss, ensure regulatory compliance, and improve patient safety through data-driven asset lifecycle management.

Healthcare Asset Management Market Overview

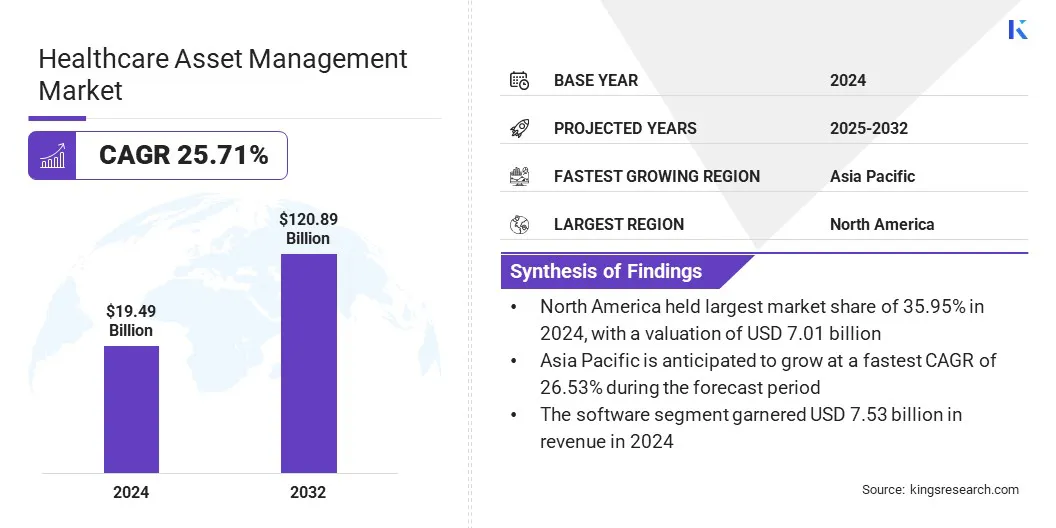

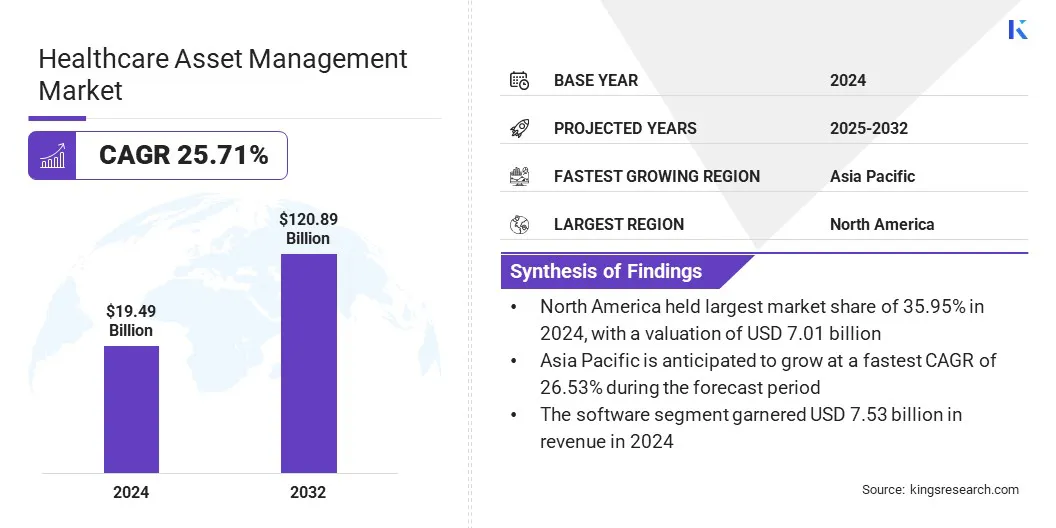

The global healthcare asset management market size was valued at USD 19.49 billion in 2024 and is projected to grow from USD 24.37 billion in 2025 to USD 120.89 billion by 2032, exhibiting a CAGR of 25.71% during the forecast period.

This growth is driven by the integration of AI and analytics that enable predictive maintenance, automate asset tracking, and optimize utilization. These capabilities improve decision-making and reduce operational inefficiencies.

Key Highlights:

- The healthcare asset management industry size was recorded at USD 19.49 billion in 2024.

- The market is projected to grow at a CAGR of 25.71% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 7.01 billion.

- The software segment garnered USD 6.30 billion in revenue in 2024.

- The radio-frequency identification (RFID) segment is expected to reach USD 31.75 billion by 2032.

- The laboratories and diagnostic centers segment is anticipated to witness the fastest CAGR of 25.66% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 26.53% through the projection period.

Major companies operating in the healthcare asset management market are AiRISTA Flow, CenTrak, Inc., Novanta Inc., Sonitor Technologies, Accruent, Securitas Healthcare LLC, Zebra Technologies Corp., General Electric Company, IBM Corporation, Siemens, Infor, Accenture, HID Global Corporation, CCL Healthcare, and Prometheus Group.

Technological advancements in real-time location systems (RTLS) are significantly improving asset visibility and management in healthcare settings. Enhanced precision through ultra-wideband (UWB), Wi-Fi, and Bluetooth low energy (BLE) enables accurate tracking of medical equipment and staff movement.

Healthcare facilities are leveraging these systems to minimize equipment loss, improve utilization rates, and streamline workflows. Continuous progress in RTLS software, hardware, and data analytics is improving automation and efficiency, highlighting the growing importance of technological advancements in RTLS for modern healthcare operations.

- In March 2025, CenTrak expanded its RTLS portfolio by launching an integrated plug-and-play Bluetooth low energy platform. The solution supports efficient management of asset tracking, staff safety, and other healthcare applications. By offering a unified, interoperable location technology platform, CenTrak reinforced its competitive positioning.

How is government involvement contributing to the adoption of healthcare asset management solutions?

Government support for digital transformation across the healthcare sector is boosting the adoption of asset management technologies. Policy initiatives, funding programs, and regulatory reforms are prompting healthcare providers to implement connected systems that improve operational transparency and asset utilization.

Governments are prioritizing data integration, interoperability, and infrastructure modernization to enhance service delivery. Strategic investments in digital healthcare platforms under national health missions and technology-driven frameworks are strengthening the digital ecosystem and accelerating digital transformation in healthcare asset management.

- In April 2025, Bharat Petroleum Corporation Limited (BPCL) launched the BPCL Sports Scholarship Initiative to support the development of national sports talent. The program provides financial assistance to Indian athletes aged 13 to 25 across multiple sports, including Athletics, Badminton, Cricket, and Hockey. Selected athletes receive a monthly stipend, sports gear, and tournament expense coverage to advance their training and performance.

How does the lack of interoperability impact digital adoption in healthcare asset management?

Integration complexity with legacy systems remains a significant challenge impeding the progress of the healthcare asset management market. Many healthcare organizations rely on outdated IT infrastructures that lack interoperability with modern asset management platforms. These limitations hinder data synchronization, delay system implementation, and increase operational inefficiencies.

The absence of standardized communication protocols and varying software architectures further complicates integration efforts, restricting seamless connectivity between devices and management systems across facilities.

To address this challenge, healthcare providers are adopting middleware solutions, open APIs, and modular platforms that enhance interoperability between legacy and modern systems. These approaches enable seamless data exchange, reduce implementation barriers, improve scalability, and ensure smooth integration across healthcare asset management networks.

Why are IoT-enabled tracking devices becoming essential in modern healthcare infrastructure?

IoT-enabled tracking devices are emerging as a key trend in the healthcare asset management market due to their ability to provide accurate, real-time insights into asset status and performance. Their predictive capabilities enable healthcare organizations to optimize resource allocation and streamline maintenance operations.

Integration of connected sensors improves asset traceability, ensuring continuous performance monitoring and reduced operational inefficiencies. The increasing deployment of IoT-enabled asset tracking devices strengthens connectivity, data accuracy, and predictive capabilities, highlighting their pivotal role in next-generation healthcare asset management frameworks.

- In February 2025, Novanta Inc. partnered with Identiv, Inc. to accelerate the adoption of RFID-enabled solutions for medical device manufacturers. The collaboration integrates Identiv’s advanced RFID inlays and tags with Novanta’s ThingMagic reader modules and APIs, creating a unified platform that simplifies product development and enhances integration for medical device OEMs.

Healthcare Asset Management Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Technology

|

Radio-Frequency Identification (RFID), Real-Time Location Systems (RTLS), Bluetooth Low Energy (BLE), Ultrasound & Infrared Systems

|

|

By End User

|

Hospitals and Clinics, Laboratories and Diagnostic Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, and Services): The software segment generated USD 7.53 billion in revenue in 2024, mainly due to rising adoption of cloud-based asset management platforms that improve operational efficiency, compliance, and decision-making across healthcare facilities.

- By Technology (Radio-Frequency Identification (RFID), Real-Time Location Systems (RTLS), Bluetooth Low Energy (BLE), and Ultrasound & Infrared Systems): The real-time location systems (RTLS) segment is poised to record a CAGR of 26.14% through the forecast period, propelled by increasing demand for precise asset tracking and workflow optimization in hospital environments.

- By End User (Hospitals and Clinics, Laboratories and Diagnostic Centers, and Others): The hospitals and clinics segment is estimated to hold a share of 41.72% by 2032, fueled by large-scale infrastructure modernization and growing reliance on automated asset management systems for operational control.

What is the market scenario in North America and Asia Pacific region?

Based on region, the global healthcare asset management market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America healthcare asset management market accounted for a share of 35.95% in 2024, valued at USD 7.01 billion. This dominance is attributed to the early adoption of advanced RFID, RTLS, and IoT technologies in hospitals and diagnostic centers. Healthcare providers in the region have increasingly deployed automated tracking systems to manage high-value assets, minimize equipment downtime, and ensure regulatory compliance.

Continuous investments in cloud-based asset management platforms, a strong presence of technology vendors, and integration of AI-driven analytics further reinforce North America’s dominance in healthcare asset visibility and digital infrastructure.

- In August 2025, Sonitor and Tagnos announced a strategic merger to integrate Sonitor’s advanced SonitorONE RTLS infrastructure with Tagnos’s intelligent software platform. This integration delivers a unified solution that enhances healthcare operations by streamlining asset tracking, optimizing patient flow, and improving staff safety through high-precision location and workflow intelligence technologies.

The Asia-Pacific healthcare asset management industry is set to grow at a CAGR of 26.53% over the forecast period, fueled by expanding healthcare infrastructure and increasing digital adoption across medical facilities. Hospitals and laboratories are actively investing in RFID, RTLS, and IoT technologies to improve operational efficiency and asset traceability.

Rapid urbanization, government initiatives supporting healthcare modernization, and growing private sector participation are accelerating technology deployment. Rising awareness of asset lifecycle optimization and integration of cloud-based platforms for advanced healthcare asset management solutions are boosting operational efficiency, enhancing asset traceability, and supporting digital transformation in healthcare facilities.

Regulatory Frameworks

- In the U.S., the Health Insurance Portability and Accountability Act (HIPAA) governs patient data privacy and security. It mandates healthcare organizations to ensure secure handling of asset-generated data, including IoT and RFID tracking information.

- In the EU, the General Data Protection Regulation (GDPR) enforces strict data protection and transparency requirements. It governs the management of digital asset data, ensuring compliance in storage, tracking, and transmission across connected systems.

- In Canada, the Personal Health Information Protection Act (PHIPA) regulates the collection, use, and disclosure of personal health data. It ensures that healthcare asset management systems adhere to privacy standards while integrating digital tracking tools.

- In Japan, the Act on the Protection of Personal Information (APPI) oversees the management of sensitive data within healthcare institutions. It directs hospitals to implement secure digital asset tracking systems and maintain transparency in data processing practices.

- In Australia, the Privacy Act 1988 supervises the management of health-related data and mandates compliance with the Australian Privacy Principles. It supports the adoption of secure asset management technologies across healthcare facilities.

- In India, the Digital Personal Data Protection Act (DPDP Act) governs the protection of digital health information. It enforces responsible data handling within healthcare asset management platforms using IoT, RFID, and cloud-based technologies.

Competitive Landscape

Key players operating in the healthcare asset management industry are emphasizing strategic expansion, product diversification, and technological innovation to maintain competitiveness. They are focusing on developing scalable, cloud-based platforms to support multi-site operations and enhance data interoperability. Investment in R&D is prioritized to advance predictive maintenance and real-time monitoring capabilities.

Firms are also expanding managed service offerings, improving global distribution networks, and aligning product strategies with digital transformation initiatives within healthcare ecosystems. Companies are strengthening their portfolios through partnerships, mergers, and acquisitions aimed at integrating complementary technologies such as IoT, RTLS, and AI analytics.

- In August 2025, HID Global Corporation acquired Intelligent Observation to help healthcare facilities reduce hospital-acquired infections through enhanced hand hygiene compliance. This acquisition expands HID’s healthcare RTLS portfolio, strengthening its capability to address evolving operational and safety requirements across healthcare environments.

Key Companies in Healthcare Asset Management Market:

- AiRISTA Flow

- CenTrak, Inc.

- Novanta Inc.

- Sonitor Technologies

- Accruent

- Securitas Healthcare LLC

- Zebra Technologies Corp.

- General Electric Company

- IBM Corporation

- Siemens

- Infor

- Accenture

- HID Global Corporation

- CCL Healthcare

- Prometheus Group

Recent Developments (Product Launch)

- In September 2024, Oracle introduced the RFID for Replenishment solution as part of Oracle Fusion Cloud Supply Chain & Manufacturing to optimize healthcare inventory management. Integrated with technologies from Avery Dennison, Terso Solutions, and Zebra Technologies, the solution automates inventory tracking, updates stock levels, and initiates restocking to ensure accurate supply availability and improved operational efficiency.

- In June 2024, AiRISTA launched Sofia 7.2, an advanced RTLS platform designed for AI-enabled IoT environments. The platform supports new RTLS devices, offers cost-effective BLE-only tags, and upgrades the G3 gateway for BLE beaconing and Wi-Fi bridging, providing improved connectivity and location accuracy.