Market Definition

Green tires are environmentally friendly tires designed using sustainable materials and low rolling resistance technologies to reduce fuel consumption and carbon emissions. They are built to improve vehicle efficiency while maintaining performance, safety, and durability standards.

Applications of green tires include passenger vehicles, commercial trucks, and electric vehicles, where energy efficiency and environmental compliance are priorities. Automotive manufacturers, tire producers, and fleet operators adopt green tires to lower operational costs, meet regulatory emission standards, and promote sustainable mobility solutions.

Green Tires Market Overview

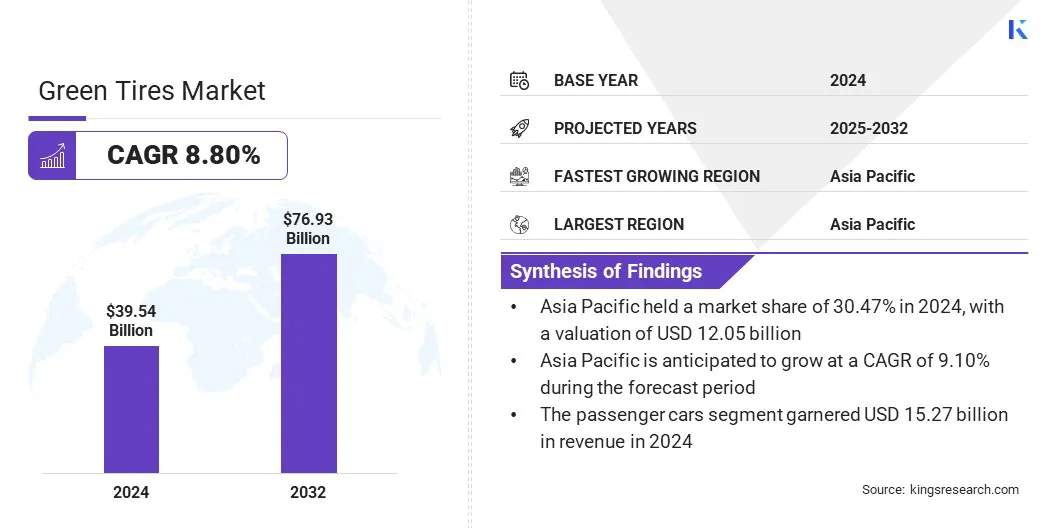

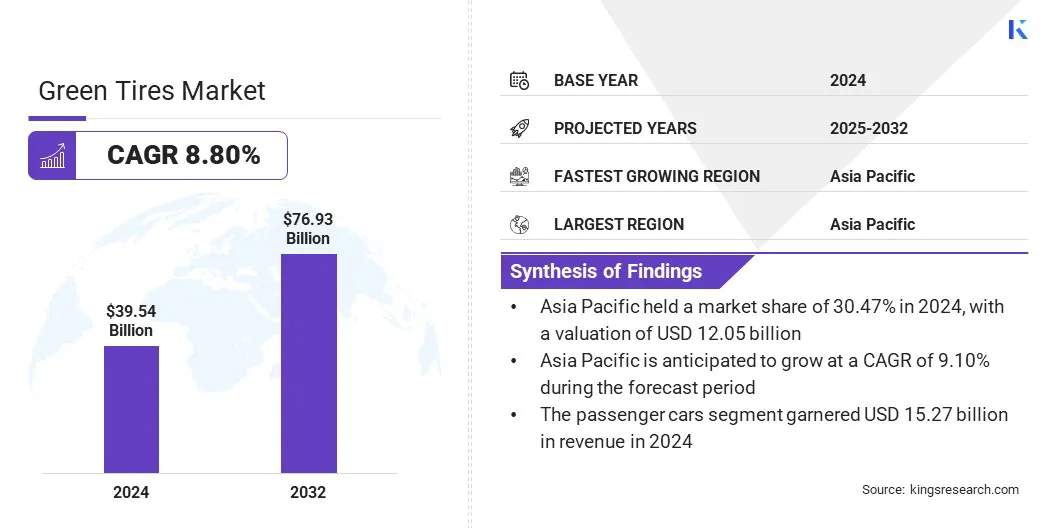

The global green tires market size was valued at USD 39.54 billion in 2024 and is projected to grow from USD 42.62 billion in 2025 to USD 76.93 billion by 2032, exhibiting a CAGR of 8.80% over the forecast period.

The growth of the market is driven by the rising adoption of electric and hybrid vehicles, which require tires with low rolling resistance to enhance battery efficiency and extend vehicle range. Integration of smart tire technologies, such as embedded sensors for monitoring pressure and wear, further supports performance optimization and market expansion.

Key Highlights

- The green tires industry size was valued at USD 39.54 billion in 2024.

- The market is projected to grow at a CAGR of 8.80% from 2025 to 2032.

- Asia Pacific held a market share of 30.47% in 2024, with a valuation of USD 12.05 billion.

- The passenger cars segment garnered USD 15.27 billion in revenue in 2024.

- The on-road segment is expected to reach USD 56.77 billion by 2032.

- The OEM segment secured the largest revenue share of 59.32% in 2024.

- North America is anticipated to grow at a CAGR of 8.88% over the forecast period.

Major companies operating in the green tires market are Pirelli & C. S.p.A., Bridgestone Americas, Inc., MICHELIN, The Goodyear Tire & Rubber Company, Nokian Tyres plc, Continental AG, JK Tyre & Industries Ltd. Inc., GRI Tires, Hankook Tire & Technology, APOLLO TYRES LTD, THE YOKOHAMA RUBBER CO., LTD., Toyo Tire Corporation, KUMHO TIRE CO., INC., MRF Ltd., CEAT Limited.

Strict environmental regulations are driving the growth of the market. Governments across major economies are implementing policies aimed at reducing CO₂ emissions from the transportation sector.

In April 2024, the European Union adopted the Euro 7 regulation to set limits on tire wear particle emissions as part of the environmental transition. These mandates are prompting tire manufacturers to adopt eco-friendly materials such as silica-based compounds and natural rubber that improve fuel efficiency. For instance, Evonik offers green truck tires that are designed to improve wet grip and reduce rolling resistance by up to 20%.

Regulatory frameworks promoting circular economy practices are also encouraging companies to enhance tire recyclability and minimize waste generation. Global initiatives such as the European Union’s Green Deal and the U.S. Environmental Protection Agency’s emission standards are accelerating sustainable manufacturing in the tire industry.

In May 2024, the Council of the EU formally adopted stricter CO₂ emission standards for heavy-duty vehicles, setting new targets of 45% reduction by 2030, 65% by 2035, and 90% by 2040.

Market Driver

Growth in Electric and Hybrid Vehicles

Growth in electric and hybrid vehicle adoption is driving the expansion of the green tires market. Electric vehicles require tires that minimize rolling resistance to improve battery efficiency and extend driving range. Market players are developing specialized green tires using advanced tread designs and lightweight materials to meet these performance needs.

- In June 2024, ZC Rubber unveiled its EV-specific tyre series at The Tire Cologne 2024, Germany. These EV-Ready versions of the Westlake ZuperAce Z-007 and Goodride Solmax 1 include tread compound technologies optimised for reduced rolling resistance, improved performance, and enhanced label grades for wet grip, noise, and fuel efficiency.

The rapid production of EVs across major regions such as Asia Pacific, Europe, and North America is further increasing the demand for sustainable tire solutions. Leading tire producers are investing in research to enhance traction, durability, and energy efficiency suitable for the higher torque characteristics of EVs.

Market Challenge

Limited Raw Material Availability

A key challenge affecting the green tires market is the restricted availability of sustainable raw materials required for production. Dependence on natural rubber and specialized bio-based inputs soybean oil creates supply chain vulnerabilities. Seasonal fluctuations, regional concentration of suppliers, and limited large-scale production capacity further constrain material availability and increase costs.

To address this challenge, market players are investing in alternative renewable materials, expanding local sourcing networks, and forming partnerships with biotechnology firms to enhance supply reliability. These strategies are supporting scalability and ensuring consistent access to sustainable inputs for green tire manufacturing.

- In July 2025, Continental increased the use of silica from rice husk ash and recycled carbon black in its tire materials. The company reported that renewable and recycled materials made up about 26% of the raw materials in its tires in 2024 and aims for over 40% by 2030. Use of rice husk silica is intended to reduce dependence on traditionally mined silica (quartz sand), and thus address raw material supply constraints.

Market Trend

Integration of Smart Tire Technologies

A key trend in the green tires market is the integration of smart tire technologies to enhance safety and operational efficiency. Manufacturers are embedding sensors within tire structures to continuously monitor pressure, temperature, and tread wear.

- In September 2024, Continental launched a new version of its digital tire management solution called ContiConnect Pro. It is designed to provide a comprehensive overview of tire condition for fleets, including automated warnings and recommendations. This technology enables fleet operators to monitor key tire data such as air pressure, temperature, and tread depth in real time.

Real-time data collected from these sensors is supporting predictive maintenance and reducing the likelihood of blowouts or uneven wear. Fleet operators and consumers are using connected tire systems to track rolling resistance, improving vehicle energy efficiency and extending tire life. Advancements in sensor miniaturization and wireless connectivity are further enabling seamless integration with vehicle telematics and IoT platforms.

Green Tires Market Report Snapshot

|

Segmentation

|

Details

|

|

By Vehicle Type

|

Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Two-Wheelers & Motorbikes

|

|

By Application

|

On-Road, Off-Road

|

|

By Sales Channel

|

OEM, Aftermarket

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), and Two-Wheelers & Motorbikes): The passenger cars segment earned USD 15.27 billion in 2024 due to the high production and sales volume of passenger vehicles, which drives strong demand for low rolling resistance and fuel-efficient tires.

- By Application (On-Road and Off-Road): The on-road segment held 74.57% of the market in 2024, due to the high demand from passenger cars, commercial vehicles, and electric vehicles, which prioritize fuel efficiency and low rolling resistance..

- By Sales Channel (OEM and Aftermarket): The OEM segment is projected to reach USD 44.64 billion by 2032, owing to automakers increasingly equipping new vehicles with low rolling resistance and sustainable tires to meet regulatory fuel efficiency standards and consumer demand for eco-friendly mobility..

Green Tires Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific green tires market share stood around 30.47% in 2024 in the global market, with a valuation of USD 12.05 billion. This dominance is due to the increasing adoption of electric and hybrid vehicles across the region. In 2024, the International Energy Agency (IEA) reported that electric car sales in China exceeded 11 million units. The expanding electric vehicle industry is creating a steady requirement for specialized green tires across Asia Pacific.

In addition, the rising urbanization and improved infrastructure support electric mobility, which is further boosting the green tire demand. Moreover, governments and vehicle manufacturers in this region are actively promoting low-emission transport solutions, which is further driving the demand for tires with low rolling resistance.

The green tires industry in North America is poised for a CAGR of 8.88% over the forecast period. This growth is driven by the presence of large commercial and logistics fleets across this region. The rapid expansion of e-commerce, delivery services, and transportation sectors is boosting the demand for fuel-efficient vehicles.

To lower operating costs and enhance fuel economy, fleet operators are increasingly adopting green tires. In response, tire manufacturers in this region are developing tailored solutions for heavy-duty and light commercial vehicles to meet this rising demand.

- In April 2025, Bridgestone Americas introduced a commercial tire featuring 70% recycled and renewable materials, achieving ISCC PLUS certification. The tire is based on the M870 radial model for waste collection fleets, using circular synthetic rubber, natural rubber, recycled carbon black, and renewable materials.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) have established regulations encouraging the use of low rolling resistance tires to improve fuel efficiency. For instance, the EPA's Verified Diesel Technology Program recognizes tires that meet specific rolling resistance criteria, contributing to fuel savings.

- The European Union (EU) adheres to the EU Tire Labelling Regulation (EC) No 1222/2009, which requires tires to be labeled with information on fuel efficiency, wet grip, and external rolling noise. This regulation aims to provide consumers with clear information to make informed choices about tire performance.

- In China, the Ministry of Industry and Information Technology has introduced standards promoting the use of low rolling resistance tires in both passenger and commercial vehicles. These standards are part of China's broader strategy to reduce fuel consumption and emissions in the transportation sector.

- South Korea has implemented a tire labeling system based on the United Nations Economic Commission for Europe (UNECE) Regulation No. 117, requiring tires to display information on rolling resistance and wet grip. Additionally, the government provides credits for vehicles equipped with low rolling resistance tires, contributing to improved fuel economy and reduced greenhouse gas emissions.

Competitive Landscape

Market players are adopting strategies such as increased research and development and strategic partnerships to remain competitive in the green tires industry. Companies are investing in advanced materials research to enhance tire performance while reducing environmental impact.

Collaborations with bio-based material suppliers and biorefineries are helping manufacturers scale production of sustainable tire components. Technological advancements in renewable fillers and low rolling resistance compounds are being prioritized to meet evolving regulatory and consumer demands.

- In June 2024, UPM Biochemicals and Nokian Tyres introduced a concept tire incorporating UPM BioMotion Renewable Functional Fillers (RFF). RFFs are lignin-based renewable fillers intended to replace a portion of traditional CO₂-intensive fillers (like carbon black and precipitated silica). The partnership involves scaling production via UPM’s Leuna biorefinery and aims to increase the proportion of renewable materials in Nokian’s tires by 2030.

Top Key Companies in Green Tires Market:

- Pirelli & C. S.p.A.

- Bridgestone Americas, Inc.

- MICHELIN

- The Goodyear Tire & Rubber Company

- Nokian Tyres plc

- Continental AG

- JK Tyre & Industries Ltd. Inc.

- GRI Tires

- Hankook Tire & Technology

- APOLLO TYRES LTD

- THE YOKOHAMA RUBBER CO., LTD.

- Toyo Tire Corporation

- KUMHO TIRE CO., INC.

- MRF Ltd.

- CEAT Limited

Recent Developments (Product Launch)

- In January 2025, Tokai Carbon, Bridgestone, Kyushu University, and Okayama University launched a project to develop eco Carbon Black (eCB) extracted from end-of-life tyres and other polymer products. It aims to produce eCB with reinforcement performance comparable to virgin carbon black, targeting a demonstration plant capacity of 5,000 tons/year by fiscal 2032.

- In September 2024, Nokian Tyres signed a development agreement with Reselo AB to further refine Reselo Rubber, a bio-based raw material extracted from birch bark residue from the pulp, paper, and plywood industries. Laboratory testing indicated that Reselo Rubber has the potential to replace some fossil-based rubbers while maintaining performance for tire applications.