Market Definition

Gas chromatography comprises analytical instruments and systems used to separate, identify, and quantify volatile and semi-volatile compounds across various samples. It includes gas chromatographs, columns, detectors, autosamplers, and associated software designed to ensure precise separation and accurate analysis.

By transporting compounds through a column using an inert carrier gas, the technique differentiates substances based on their chemical properties and retention times. Gas chromatography ensures reliable, high-resolution results for applications in pharmaceuticals, environmental testing, food and beverage analysis, petrochemicals, and forensic investigations, preserving the accuracy and integrity of analytical data.

Gas Chromatography Market Overview

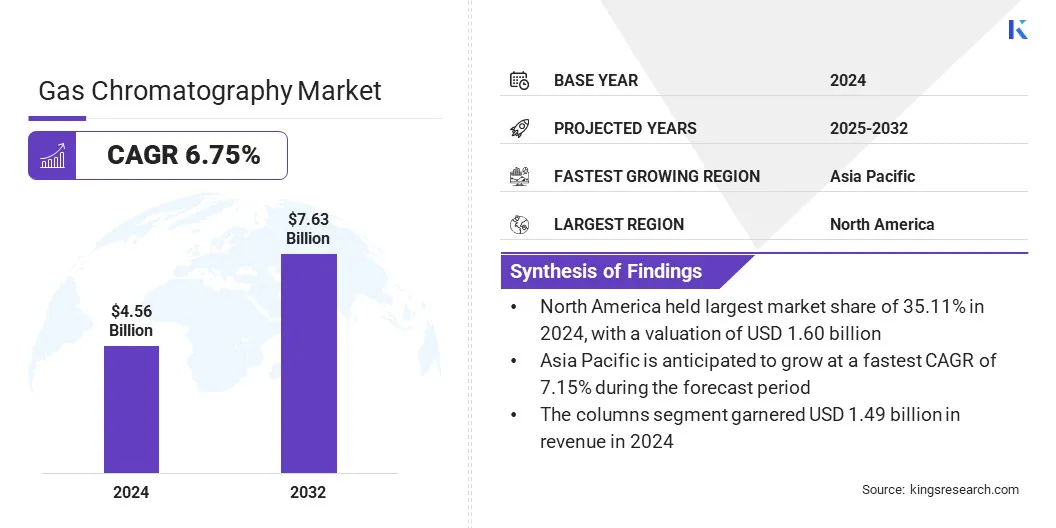

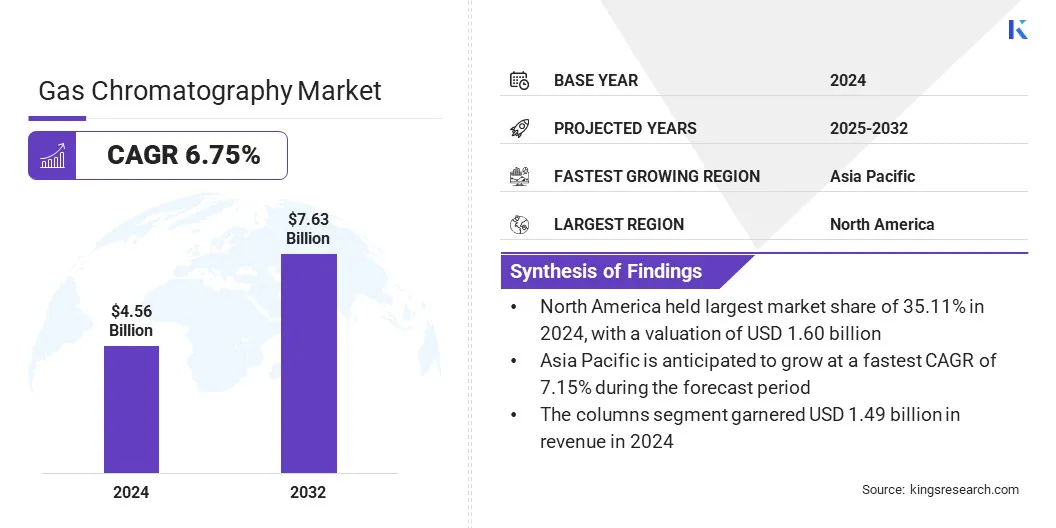

The global gas chromatography market size was valued at USD 4.56 billion in 2024 and is projected to grow from USD 4.83 billion in 2025 to USD 7.63 billion by 2032, exhibiting a CAGR of 6.75% during the forecast period.

Market growth is driven by increasing demand for precise analytical testing in pharmaceuticals, food and beverage, environmental monitoring, and petrochemicals. Rising regulatory requirements and the adoption of advanced GC technologies are further fueling market growth and investment opportunities.

Key Highlights:

- The gas chromatography industry size was recorded at USD 4.56 billion in 2024.

- The market is projected to grow at a CAGR of 6.75% from 2025 to 2032.

- North America held a share of 35.11% in 2024, valued at USD 1.60 billion.

- The columns segment garnered USD 1.49 billion in revenue in 2024.

- The pharmaceutical & biotechnology segment is expected to reach USD 2.44 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 7.15% over the forecast period.

Major companies operating in the gas chromatography market are Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Shimadzu Corporation, PerkinElmer, Bruker, DH Life Sciences, LLC., Merck KGaA, LECO Corporation, Restek Corporation, SCION Instruments, JEOL Ltd., DANI Instruments S.p.A., GL Sciences Inc., Ellutia Ltd, and Trajan Scientific and Medical.

The market is influenced by the growing demand for high-precision analytical testing across pharmaceuticals, food and beverage, environmental monitoring, and petrochemical industries. Increasing regulatory emphasis on product quality, safety, and compliance is prompting laboratories to adopt advanced GC and GC–MS systems.

Key players are also launching automated, high-throughput, and smart instrumentation solutions, integrating AI-enabled software, autosamplers, and compact modular designs. These innovations enhance analytical accuracy, reduce human error, and improve laboratory efficiency, leading to the widespread adoption across multiple sectors.

- In May 2025, Agilent Technologies Inc. upgraded its Agilent 8850 Gas Chromatograph (GC) with enhanced compatibility for single and triple quadrupole mass spectrometry (MS) systems and supporting tools to improve laboratory productivity. The compact 8850 GC is among the fastest and smallest benchtop GC/MS systems available, specifically designed for laboratories requiring high-speed performance in a space-saving format.

What is driving the growing demand for gas chromatography systems across pharmaceuticals, environmental monitoring, and food safety testing?

A key factor propelling the growth of the gas chromatography market is the rising need for precise and reliable analytical testing across diverse industries. The expansion of the pharmaceutical and biotechnology sectors is leading to the rising demand for advanced GC systems to ensure accurate identification and quantification of compounds, supporting drug development, quality control, and regulatory compliance.

Moreover, stringent environmental regulations and increasing requirements for food and beverage safety are creating a strong need for high-resolution analysis of chemical residues, contaminants, and additives. This growing reliance on accurate, high-throughput analytical instruments is fueling widespread adoption of gas chromatography technologies across healthcare, environmental monitoring, food, and petrochemical industries.

- In June 2024, Agilent Technologies introduced the 7010D Triple Quadrupole GC/MS System for food and environmental testing and the ExD Cell for the 6545XT LC/Q-TOF system serving biopharma research, showcasing its innovation in gas chromatography and mass spectrometry.

A key challenge impeding the growth of the market is the high capital and operational costs associated with advanced GC systems. Procuring and maintaining high-precision instruments, including GC–MS and automated sample preparation units, requires substantial upfront investment, specialized maintenance, and skilled personnel, which can limit adoption, particularly among small and mid-sized laboratories.

To address this challenge, market players are developing cost-effective, energy-efficient, and modular GC systems, integrating automation to reduce manual intervention, and offering comprehensive service packages. They are also investing in training programs, local support infrastructure, and strategic partnerships to enhance accessibility, improve operational efficiency, and boost wider adoption across pharmaceutical, environmental, and food testing sectors.

How are automation and smart instrumentation influencing the gas chromatography market?

A key trend shaping the market is the growing adoption of automated and smart instrumentation. Laboratories are integrating robotic autosamplers, automated sample preparation systems, and AI-enabled data analysis software to enhance precision, efficiency, and throughput.

These innovations reduce human error, ensure reliable and reproducible results, and support compliance with stringent regulatory standards. The deployment of advanced GC systems is fueling the adoption across pharmaceuticals, environmental testing, food and beverage analysis, and biopharmaceutical research.

- In April 2025, Shimadzu Scientific Instruments introduced a comprehensive lineup of compact gas chromatography (GC) systems based on the Brevis GC‑2050 model. Equipped with a full range of detectors, injectors, and sample preparation devices, the model is designed to support diverse analytical applications across multiple industries.

Gas Chromatography Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Columns, Detectors, Autosamplers, Flow Management Systems, Data Management & Software

|

|

By Application

|

Pharmaceutical & Biotechnology, Environmental Testing, Food & Beverage, Oil & Gas, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Columns, Detectors, Autosamplers, Flow Management Systems, and Data Management & Software): The columns segment earned USD 1.49 billion in 2024, mainly driven by increasing demand for high-precision separations in pharmaceuticals, food safety testing, and environmental analysis.

- By Application (Pharmaceutical & Biotechnology, Environmental Testing, Food & Beverage, Oil & Gas, and Others): The pharmaceutical & biotechnology segment held a share of 29.32% in 2024, fueled by rising demand for high-precision analytical testing in drug development, quality control, and regulatory compliance.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global gas chromatography market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America gas chromatography market share stood at 35.11% in 2024, valued at USD 1.60 billion. This dominance is reinforced by strong demand from the pharmaceutical, biotechnology, and food testing sectors. Regional players are introducing advanced GC and GC–MS systems featuring automation, smart instrumentation, and high-throughput capabilities.

Moreover, stringent regulatory standards enforced by agencies such as the U.S. Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) are fueling the adoption of high-precision GC instruments for quality control, environmental monitoring, and contaminant analysis. Rising investments in biopharmaceutical research, vaccine development, and environmental safety programs are further supporting regional market expansion.

The Asia-Pacific gas chromatography industry is estimated to grow at a CAGR of 7.15% over the forecast period. This growth is mainly propelled by the expansion of the pharmaceutical, food and beverage, environmental, and petrochemical industries. Growing adoption of GC and GC–MS systems across countries such as China, Japan, India, and South Korea for quality control, contaminant analysis, and research applications is fueling demand.

Rising investments in automated and compact GC systems are enhancing laboratory efficiency and enabling real-time field analysis. Additionally, increasing R&D activities, government initiatives to support scientific research, and the expansion of local manufacturing capabilities are contributing to regional market expansion.

Regulatory Frameworks

- In North America, the U.S. Food and Drug Administration (FDA) and the U.S. Environmental Protection Agency (EPA) regulate the use of gas chromatography instruments and analytical laboratories to ensure data accuracy, method validation, and compliance with environmental and pharmaceutical testing standards.

- In Europe, the European Medicines Agency (EMA) and the European Food Safety Authority (EFSA) set requirements for analytical testing, including GC and GC–MS methods, to ensure quality control in pharmaceuticals, food safety, and environmental monitoring.

- In China, the National Medical Products Administration (NMPA) and the Ministry of Ecology and Environment enforce rules for analytical testing using GC systems in pharmaceuticals, environmental monitoring, and food safety, including mandatory method validation and adherence to national pharmacopoeia requirements.

- Globally, the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), ISO standards, and the Codex Alimentarius Commission provide guidance on analytical method validation, instrument calibration, and data integrity, promoting harmonization and best practices for GC applications across multiple industries.

Competitive Landscape

Leading players operating in the gas chromatography industry are focusing on technological innovation, system optimization, and strategic collaborations. Manufacturers are investing in automated, compact, and energy-efficient GC and GC–MS systems to enhance laboratory efficiency, reduce operational costs, and improve analytical accuracy.

Companies are also expanding production capabilities and regional distribution networks to cater to growing demand across pharmaceuticals, environmental testing, food and beverage, and petrochemical sectors. Additionally, partnerships with research institutions, regulatory bodies, and service providers are fostering integrated analytical solutions and accelerating the adoption of advanced GC technologies.

- In January 2025, Shimadzu Corporation introduced seven advanced gas chromatography (GC) systems, including the compact, high-performance Brevis GC‑2050 model. The launch aims to address the growing demand for gas analysis driven by the expanding green energy sector and carbon neutrality initiatives.

Key Companies in Gas Chromatography Market:

- Agilent Technologies, Inc.

- Thermo Fisher Scientific Inc.

- Shimadzu Corporation

- PerkinElmer

- Bruker

- DH Life Sciences, LLC.

- Merck KGaA

- LECO Corporation

- Restek Corporation

- SCION Instruments

- JEOL Ltd.

- DANI Instruments S.p.A.

- GL Sciences Inc.

- Ellutia Ltd

- Trajan Scientific and Medical.

Recent Developments

- In September 2025, Japan-based Shimadzu introduced the FluxEdge GC System, incorporating its proprietary FluxEdge trace gas sampling and switching technology. Designed for integration with Shimadzu’s latest gas chromatographs, the system enables high-speed, reliable gas analysis using minimal sample volumes.