Market Definition

The market involves the online sale of clothing, footwear, and fashion accessories through digital platforms. It includes products such as tops, bottoms, sportswear, footwear, and various accessories for men, women, and children. The sector serves a wide consumer base by offering convenient access through online stores, marketplaces, and social commerce channels.

E-commerce Apparel Market Overview

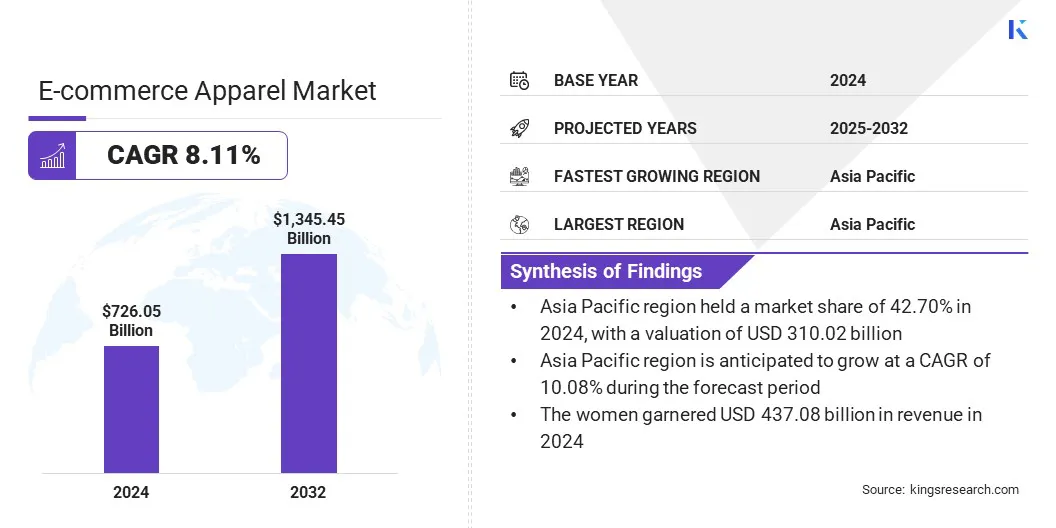

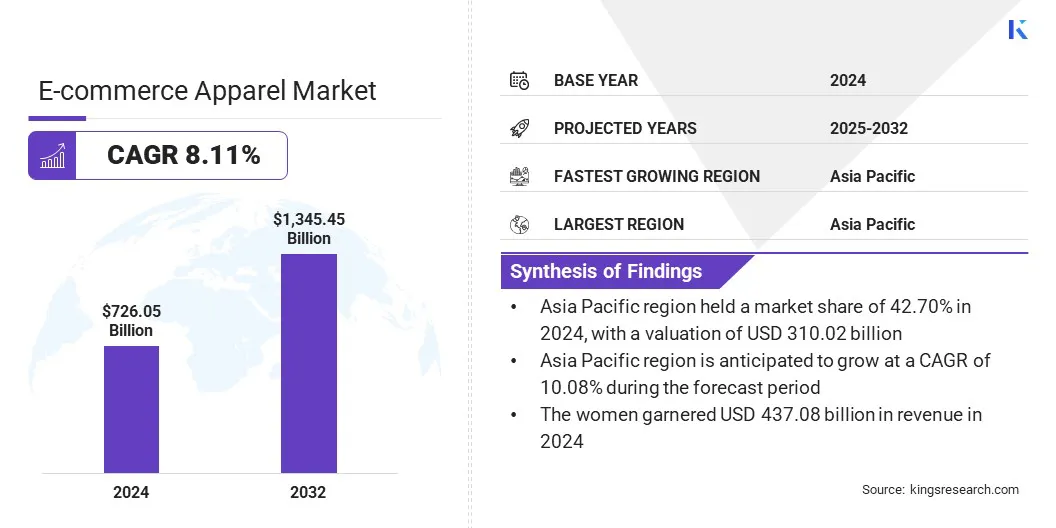

The global e-commerce apparel market size was valued at USD 726.05 billion in 2024 and is projected to grow from USD 779.28 billion in 2025 to USD 1,345.45 billion by 2032, exhibiting a CAGR of 8.11% during the forecast period.

The market is growing due to increasing consumer expectations for faster delivery, which strongly influence purchasing decisions and drive companies to improve their competitive capabilities. The market is further supported by the trend of customization in e-commerce apparel, as consumers increasingly seek personalized products, tailored sizing, and exclusive designs that align with individual preferences.

Key Highlights:

- The e-commerce apparel industry size was recorded at USD 726.05 billion in 2024.

- The market is projected to grow at a CAGR of 8.11% from 2025 to 2032.

- Asia Pacific held a market share of 42.70% in 2024, valued at USD 310.02 billion.

- The tops segment garnered USD 221.45 billion in revenue in 2024.

- The women segment is expected to reach USD 829.80 billion by 2032.

- The online marketplaces segment is expected to reach USD 783.10 billion by 2032.

- North America is anticipated to grow at a CAGR of 7.19% during the forecast period.

Major companies operating in the e-commerce apparel market are Amazon.com, Inc., Alibaba Group Holding Limited, SHEIN, Zalando, Nike, Inc., H&M Group, adidas, Macy’s, Walmart Inc., ASOS, Industria de Diseño Textil, S.A., Eminent, Inc. (Revolve Group), Express, Inc., BOOHOO, and Under Armour, Inc.

Companies are implementing live-stream shopping platforms and influencer campaigns for interactive product demonstrations and real-time consumer engagement. These solutions address the demand for personalized and immersive online shopping experiences, where customers seek guidance and more personalized interactions while making purchases. These initiatives increase brand visibility, drive purchase decisions, and strengthen customer loyalty.

- In September 2024, AnyMind Group launched AnyLive, a GenAI-powered live commerce platform that enables businesses to host live shopping sessions in multiple languages using AI-generated virtual streamers. The platform offers automated live-stream scripts, real-time audience interaction, and seamless integration with major e-commerce and social media platforms, including Amazon, Shopee, Lazada, AliExpress, TikTok Shop, Instagram, YouTube, Facebook, and X.

Market Driver

Growing Demand for Faster Delivery Services

The e-commerce apparel market is driven by the growing demand for faster delivery services, which has become a decisive factor influencing consumer purchasing behavior. Modern consumers expect same-day or next-day delivery, which encourages companies to strengthen logistics and fulfillment infrastructure to remain competitive.

Several players are adopting quick commerce models with hyperlocal fulfillment and rapid last-mile connectivity, ensuring that products reach customers in shorter timeframes. This directly contributes to higher consumer satisfaction, repeat purchases, and overall growth of the online apparel businesses.

- In December 2024, Myntra launched its quick-commerce service, M-Now, offering apparel and lifestyle products within 30 minutes. The platform provides access to over 10,000 styles across fashion, beauty, and lifestyle categories, with plans to expand to more than 100,000 styles in major Indian cities, including Bengaluru, Delhi, Mumbai, and Pune.

Market Challenge

High Product Return Rates in Online Apparel Sales

A major challenge facing the e-commerce apparel market is the high rate of product returns caused by sizing problems, variations in product appearance, and unmet consumer expectations. Frequent returns increase reverse logistics costs, reduce profitability, and create operational inefficiencies for online platforms.

This challenge slows market growth as companies struggle to maintain customer trust while managing added expenses. To address this, businesses are implementing virtual fitting tools, size recommendation systems, and AI-based personalization to reduce mismatches. Market players are also improving product descriptions and using consistent sizing charts to increase accuracy and minimize return rates.

Market Trend

Customization in E-commerce Apparel

The e-commerce apparel market is witnessing a significant shift toward customization in product offerings. This approach enables companies to offer tailored sizing, personalized recommendations, and made-to-order apparel that reflect individual consumer preferences.

The integration of AI-driven tools and digital design platforms further enhances retailers’ ability to deliver precision-based customization at scale. This trend is reshaping consumer purchasing behavior and supporting the evolution of online apparel platforms toward more interactive and demand-driven models.

- In October 2024, Manchester United launched a new direct-to-consumer e-commerce platform powered by SCAYLE, offering a personalized and reliable online shopping experience for its global fan base. The platform features customization options such as 'make your shirt' and 'shop by player,' supports multiple languages and currencies, and delivers fast, mobile-first performance.

E-commerce Apparel Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Tops, Bottoms, Sportswear, Footwear, Accessories (Bags, Belts, Scarves, Others), Others

|

|

By Gender

|

Men, Women, Kids/ Children

|

|

By Distribution Channel

|

Online Marketplaces, Online Brand Stores, Social Commerce

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Tops, Bottoms, Sportswear, Footwear, Accessories, and Others): The tops segment earned USD 221.45 billion in 2024 due to growing consumer preference for casual and versatile clothing that supports every day and professional use.

- By Gender (Men, Women, Kids/ Children): The women segment held 60.20% of the market in 2024, owing to higher spending on apparel, frequent adoption of new fashion trends, and greater engagement with online shopping and social media promotions.

- By Distribution Channel (Online Marketplaces, Online Brand Stores, Social Commerce): The online marketplaces segment is projected to reach USD 783.10 billion by 2032, due to extensive product variety, competitive pricing, and convenience offered to consumers across regions.

E-commerce Apparel Market Regional Analysis

Based on region, the market has been segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific e-commerce apparel market share stood at 42.70% in 2024, with a valuation of USD 310.02 billion in the global market. The dominance is due to rapid adoption of mobile commerce and the expansion of regional digital payment infrastructure, which has accelerated online apparel transactions across China, India, and Southeast Asian nations. This has created a strong ecosystem for online fashion retail, enabling widespread consumer participation and supporting the region’s dominance.

- In June 2025, the International Monetary Fund (IMF) reported that India leads globally in fast payment systems, driven by the Unified Payments Interface (UPI). UPI processed 18.39 billion transactions in June 2025, powering 85% of India’s digital payments and nearly 50% of global digital transactions. The platform handles over 640 million transactions daily, surpassing Visa in transaction volume.

North America is poised to grow at a CAGR of 7.19% over the forecast period. The growth is driven by strategic partnerships and investments made by major market players to expand e-commerce platforms and strengthen supply chain networks. Private sector investments in advanced logistics solutions optimize operational capacity and improve consumer engagement. These initiatives support the region’s growth and bring sustained expansion in online apparel sales.

- In April 2025, eBay expanded its global strategic partnership with Klarna, offering flexible payment options for millions of shoppers in the U.S. The platform enables interest-free installment plans, financing for larger purchases, and a resell feature that allows users to list past purchases with pre-filled details. These solutions support electronics, fashion, and collectibles categories while promoting sustainable consumption.

Regulatory Frameworks

- In the U.S, the Federal Trade Commission (FTC) regulates the e-commerce apparel sector under the Federal Trade Commission Act and the Textile Fiber Products Identification Act, ensuring accurate product labeling, fair advertising, and consumer protection.

- The European Commission enforces regulations under the e-Commerce Directive and the Consumer Rights Directive, overseeing online sales practices, product safety, and transparent information for apparel sold digitally.

- The Ministry of Consumer Affairs and the Bureau of Indian Standards (BIS) regulate online apparel sales under the Consumer Protection Act, 2019, and the Legal Metrology Act, ensuring quality, labeling, and consumer rights.

- In Japan, the Consumer Affairs Agency regulates online clothing sales under the Act on Specified Commercial Transactions, focusing on accurate product information, consumer protection, and dispute resolution.

Competitive Landscape

Key players in the global e-commerce apparel industry are pursuing strategic partnerships with fashion brands, logistics providers, and digital platforms to strengthen their competitive positioning. Companies are collaborating with payment service providers and technology firms to streamline operations and improve digital infrastructure.

Several players are expanding geographically by launching localized online platforms and establishing regional fulfillment networks in emerging and developed markets. They are also forming alliances with social commerce platforms and regional marketplaces to broaden their presence and capture new customer bases.

- In August 2024, Authentic Brands Group partnered with United Legwear & Apparel Co. to relaunch Ted Baker’s e-commerce platforms across the UK, Europe, U.S., and Canada. The platform provides a unified online shopping experience, featuring men’s sportswear, golf apparel, denim, and lifestyle collections. The collaboration integrates digital commerce strategies to boost customer engagement and reflect the brand’s heritage and contemporary style.

Top Key Companies in E-commerce Apparel Market:

- Amazon.com, Inc.

- Alibaba Group Holding Limited

- SHEIN

- Zalando

- Nike, Inc.

- H&M Group

- adidas

- Macy’s

- Walmart Inc.

- ASOS

- Industria de Diseño Textil, S.A.

- Eminent, Inc. (Revolve Group)

- Express, Inc.

- BOOHOO

- Under Armour, Inc.

Recent Developments

- In June 2025, Worldline launched Wero, a European instant payment solution for e-commerce, beginning with Germany and expanding to Belgium in October 2025 and France in early 2026. The platform enables consumers to make account-to-account payments directly through their trusted bank applications, offering buyer protection, consent management, and a frictionless user experience.

- In October 2024, Vakrangee Limited launched its own private label apparel products through the Vakrangee Kendra network. Its pilot phase focuses on men’s apparel, offering trendy, comfortable, and affordable clothing across Franchisee and Master Franchisee outlets. The label aims to expand pan-India and diversify into other consumer categories.

- In July 2024, LPP Logistics launched its second e-commerce warehouse in Romania to support the growing online demand in Southern Europe. The 40,000 sqm facility near Bucharest enables processing of up to 400,000 orders per day and serves Romania, Bulgaria, Serbia, Bosnia and Herzegovina, Greece, and Hungary.