Market Definition

Durable medical equipment (DME) refers to devices designed for repeated use in healthcare settings or at home to support patients with medical conditions or disabilities. These include mobility aids, respiratory devices, and monitoring systems that assist in improving quality of life, facilitating recovery, and ensuring effective management of chronic illnesses under medical supervision.

Durable Medical Equipment Market Overview

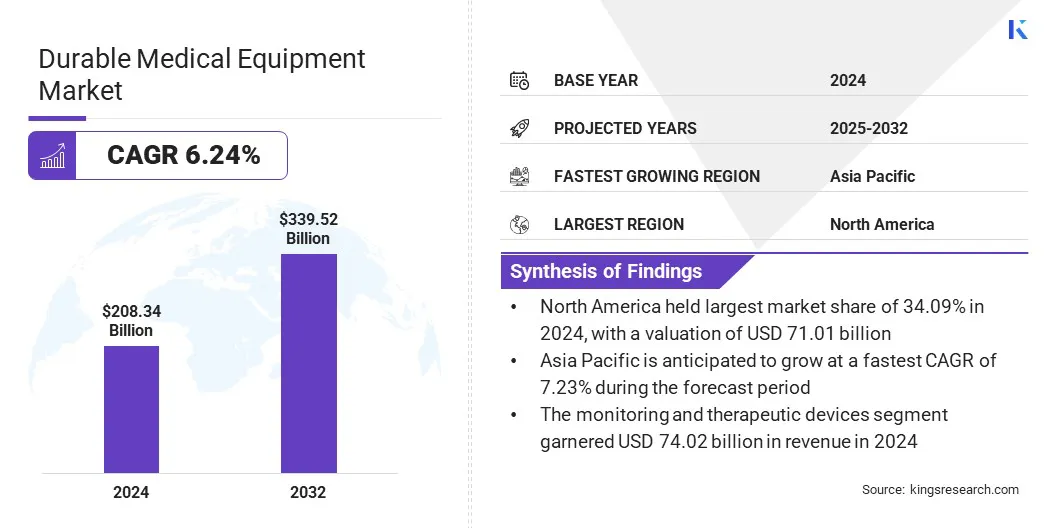

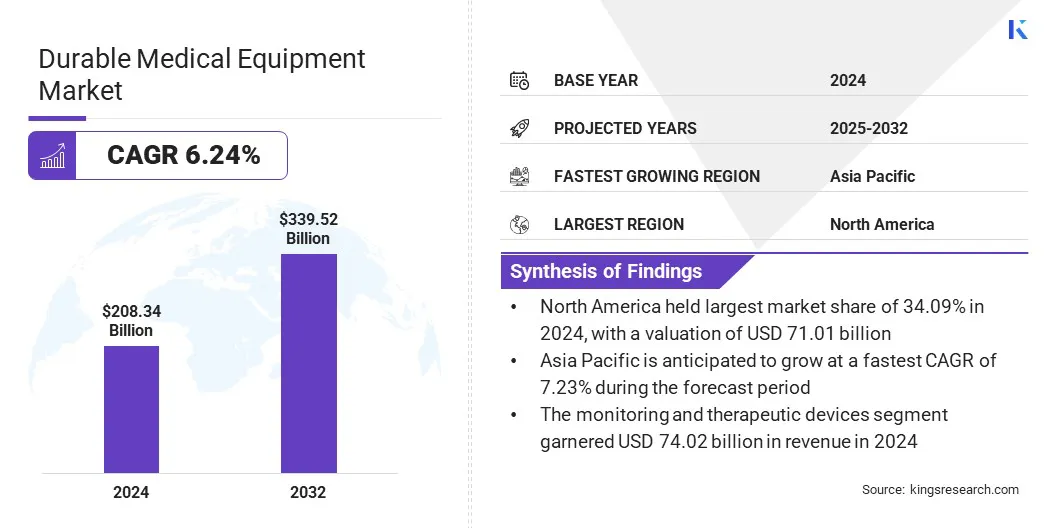

The global durable medical equipment market size was valued at USD 208.34 billion in 2024 and is projected to grow from USD 220.80 billion in 2025 to USD 339.52 billion by 2032, exhibiting a CAGR of 6.24% during the forecast period. This growth is driven by the rising preference for home-based treatment and self-care among patients. Increasing prevalence of chronic diseases has also led to the adoption of compact and user-friendly medical equipment.

Key Highlights:

- The durable medical equipment industry was recorded at USD 208.34 billion in 2024.

- The market is projected to grow at a CAGR of 6.24% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, valued at USD 71.01 billion.

- The monitoring and therapeutic devices segment generated USD 74.02 billion in 2024.

- The ambulatory surgical centers segment is anticipated to witness fastest CAGR of 6.54% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 7.23% through the projection period.

Major companies operating in the durable medical equipment market are Medtronic, Johnson & Johnson Services, Inc., Stryker, Abbott, Koninklijke Philips N.V., Baxter, Fresenius Medical Care, Medline Industries, Inc., Cardinal Health, Resmed, Invacare Corporation, Sunrise Medical, Masimo Corporation, Becton, Dickinson and Company, and Mindray DS USA, Inc.

Significant technological progress in assistive and therapeutic equipment is reshaping the market. Integration of advanced sensors, robotics, and AI-based systems are improving precision, patient comfort, and rehabilitation outcomes.

Innovations such as AI-enabled respiratory systems and telehealth-integrated monitoring devices are making chronic disease management better and home-based healthcare services accessible. Manufacturers are focusing on developing equipment that enables better mobility, automated control, and personalized therapy. These innovations reduce manual interventions, ensuring consistent therapeutic performance across homes and healthcare institutions.

- In January 2024, WHO reported that over 2.5 billion individuals require one or more assistive products. With an ageing population and the rise of non-communicable diseases, the demand is expected to reach 3.5 billion people by 2050.

Market Driver

Government Support for Home Healthcare and Reimbursement Policies

A key factor supporting the progress of the durable medical equipment market is the increasing government focus on strengthening home healthcare and reimbursement frameworks. Policy initiatives promoting accessible medical equipment and insurance coverage are allowing more patients to choose home-based treatment.

Favorable reimbursement and funding programs are encouraging hospitals, clinics, and patients to adopt advanced medical equipment. This policy environment continues to enhance affordability and accessibility of durable medical devices worldwide.

- In February 2025, the Indian government provided technical and financial assistance to the States and Union Territories to strengthen public healthcare, including recruitment of healthcare professionals in rural areas and addressing infrastructure gaps. Proposals submitted through Programme Implementation Plans (PIPs) under the National Health Mission receive financial approval via Records of Proceedings (RoPs) based on available resources.

Market Challenge

Limited Access to Durable Equipment in Rural Healthcare Facilities

A major challenge limiting the growth of the market is the restricted access to advanced medical equipment in rural healthcare facilities. Inadequate distribution networks, supply chain inefficiencies, and high cost have constrained the availability of essential equipment. Healthcare institutions in remote regions face procurement delays and maintenance issues, impacting care quality and hindering market penetration.

To address this, manufacturers and policymakers are focusing on local production, rural healthcare partnerships, and public–private initiatives. Expansion of regional distribution channels and government-led healthcare infrastructure programs is improving access to durable medical equipment in underserved areas.

Market Trend

Rising Adoption of Smart Monitoring and Connectivity Features in DME

A notable trend influencing the durable medical equipment market is the growing use of smart monitoring and connectivity features. Integration of Internet of Things (IoT) and cloud-based platforms is enabling real-time data tracking, predictive maintenance, and remote patient management.

Healthcare providers are using connected equipment to optimize treatment and monitor patient outcomes. These technological developments are improving healthcare digitization and clinical decision-making across homecare and hospital settings.

- In July 2024, CareCentrix launched DME Navigator, a next-generation benefits management solution, developed with a technology-enabled health services company. It streamlines workflow, optimizes usage for health plans, and also improves payment accuracy.

Durable Medical Equipment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Personal Mobility Devices, Monitoring and Therapeutic Devices, Bathroom Safety Devices, Others

|

|

By End-Use

|

Hospitals, Ambulatory surgical centers, Homecare setting, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Personal Mobility Devices, Monitoring and Therapeutic Devices, Bathroom Safety Devices, and Others): The monitoring and therapeutic devices segment generated USD 74.02 billion in 2024, mainly due to growing prevalence of chronic diseases, increased homecare adoption, and advancements in connected and user-friendly therapeutic equipment.

- By End-Use (Hospitals, Ambulatory surgical centers, Homecare setting, and Others): The ambulatory surgical centers segment is projected to grow at a CAGR of 6.54% through the forecast period, supported by rising outpatient procedures, cost-efficient surgical services, and increasing demand for minimally invasive interventions.

Durable Medical Equipment Market Regional Analysis

The market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America durable medical equipment market stood at 34.09% in 2024, valued at USD 71.01 billion. This dominance is attributed to strong healthcare infrastructure, increased use of advanced medical technologies, and extensive reimbursement frameworks.

- In November 2024, Centers for Medicare & Medicaid Services (CMS) projects that Medicare payments to Home Health Agencies (HHAs) in CY 2025 will increase by 0.5%, equivalent to USD 85 million, compared to CY 2024, reflecting continued support for home healthcare services.

The demand for homecare solutions, mobility aids, and smart monitoring devices has intensified due to aging populations and rising prevalence of chronic conditions. The market has witnessed significant investment in research, product innovation, and distribution networks. Expansion of home-based healthcare continues to drive equipment use across hospitals, clinics, and patient households.

- In February 2025, NYC Health + Hospitals’ NYC Care program launched a durable medical equipment (DME) benefit across all its facilities. The program allows ambulatory care providers to prescribe low- or no-cost DME to eligible patients, through its exclusive partner, AdaptHealth, a network of full-service medical equipment providers.

The Asia Pacific durable medical equipment industry is set to grow at a CAGR of 7.23% over the forecast period. Increasing incidence of chronic diseases, rising healthcare expenditure, and expanding homecare infrastructure are key factors supporting growth. Companies are focusing on introducing advanced equipment, improving distribution channels, and forming strategic partnerships to enhance market expansion.

Urbanization and growing healthcare awareness are also driving adoption of mobility aids, monitoring systems, and therapeutic devices. Rising government support for healthcare modernization and reimbursement frameworks further promotes market expansion.

Regulatory Frameworks

- In the U.S., the FDA Medical Device Regulations govern the safety, efficacy, and quality of medical devices, ensuring that DME meets established standards before market approval.

- In the EU, MDR 2017/745 regulates the design, manufacture, and marketing of medical devices, including DME, ensuring device safety, clinical evaluation, and post-market surveillance to protect patient health.

- In Canada, the Medical Devices Regulations enforce safety, effectiveness, and licensing requirements for durable medical equipment. They govern device classification, quality systems, and post-market surveillance.

- In Australia, the TGA Regulatory Framework governs the approval, supply, and monitoring of medical devices, including DME. It ensures compliance with safety, performance, and quality standards for domestic and imported equipment.

Competitive Landscape

Key players in the market are implementing strategies to sustain competitiveness and support growth. Companies are expanding production capacities, investing in research and development, and launching new product lines. Strategic acquisitions, partnerships, and collaborations are widening distribution networks and market reach.

Focus on digital integration, smart monitoring technologies, and home-use solutions remains central to innovation. Companies are also prioritizing operational efficiency, regional expansion, and targeted marketing to maintain market share, improve production capabilities, and adapt to evolving industry dynamics.

- In October 2024, WellSky acquired Bonafide, expanding its presence in Durable Medical Equipment (DME)/Home Medical Equipment (HME) and allowing providers to manage operations compliantly, efficiently, and profitably. The integration improves workflow, streamlines ordering, and enhances administrative processes for DME/HME companies.

Top Key Companies in Durable Medical Equipment Market:

- Medtronic

- Johnson & Johnson Services, Inc.

- Stryker

- Abbott

- Koninklijke Philips N.V.

- Baxter

- Fresenius Medical Care

- Medline Industries, Inc.

- Cardinal Health

- Resmed

- Invacare Corporation

- Sunrise Medical

- Masimo Corporation

- Becton, Dickinson and Company

- Mindray DS USA, Inc.

Recent Developments (Product Launch)

- In March 2024, Stryker introduced two new products: the LIFEPAK CR2 automated external defibrillator (AED) for cardiac care and an Evacuation Chair for emergency patient movement. The LIFEPAK CR2 features high-quality CPR and rapid shocks during sudden cardiac arrest, while the Evacuation Chair ensures safe, efficient patient movement.

- In January 2024, Sunrise Medical launched the Switch-It Vigo head control, a wireless, proportional device enabling users to operate power wheelchairs through subtle and intuitive head movements. Developed by Now Technologies LTD, which joined Sunrise Medical in 2022, Vigo expands the Switch-It product line of advanced wheelchair control solutions.