Market Definition

Decorative coatings are surface finishing solutions applied across residential, commercial, and industrial settings to enhance aesthetics while delivering supplementary protective benefits. These coatings encompass paints, varnishes, stains, and specialty finishes offering matte, gloss, metallic, and textured effects.

Beyond visual appeal, decorative coatings improve surface performance through limited resistance to moisture, abrasion, and environmental exposure. They are widely employed in modern architectural and interior applications, offering versatile design and functionality across diverse materials and construction settings.

Decorative Coatings Market Overview

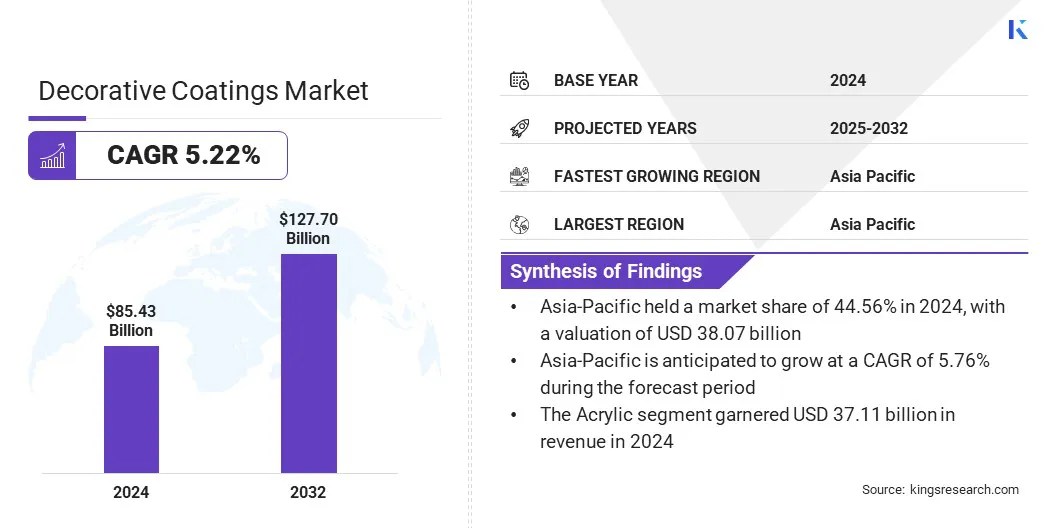

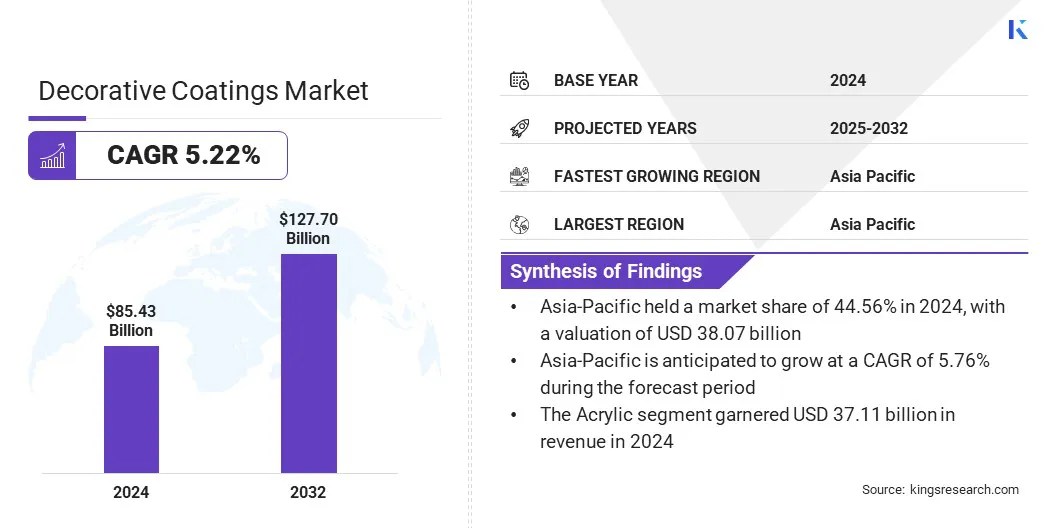

The global decorative coatings market size was valued at USD 85.43 billion in 2024 and is projected to grow from USD 89.48 billion in 2025 to USD 127.7 billion by 2032, exhibiting a CAGR of 5.22% during the forecast period.

This growth is driven by surging construction activity, rising renovation demand, and increased focus on aesthetic enhancements. Product innovations in low-VOC and environmentally sustainable formulations are further boosting demand. Advancements in coating technologies are improving durability, application efficiency, and design versatility, reinforcing their importance across residential, commercial, and industrial segments.

Key Highlights:

- The decorative coatings industry size was recorded at USD 85.43 billion in 2024.

- The market is projected to grow at a CAGR of 5.22% from 2025 to 2032.

- North America held a share of 25.40% in 2024, valued at USD 21.70 billion.

- The acrylic segment garnered USD 37.11 billion in revenue in 2024.

- The emulsions segment is expected to reach USD 48.79 billion by 2032.

- The residential segment is anticipated to witness the fastest CAGR of 5.88% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 5.76% through the projection period.

Major companies operating in the decorative coatings market are The Sherwin-Williams Company, PPG Industries, Inc., Akzo Nobzl N.V., NIPPONPAINT, RPM International, Axalta Coating Systems, LLC, BASF SE, Asian Paints, Kansai Paint Co.,Ltd., Masco Corporation, Hempel A/S, Beckers Group, Berger Paints India, Benjamin Moore & Co., and DAW SE.

The growing consumer preference for visually appealing and high-performance surfaces is creating a strong demand for decorative coatings. Homeowners and commercial developers are seeking coatings that combine design appeal with functionality, such as durability, stain resistance, and easy maintenance.

In response, manufacturers are investing in advanced formulations, innovative textures, and specialty finishes to meet evolving consumer expectations. Companies are also developing customizable color palettes, integrating smart coatings technologies, and enhancing product performance to deliver both aesthetic value and long-term protection, thereby supporting market expansion.

- In September 2025, Nippon Paint Holdings launched an eco-friendly interior decorative coating line for residential applications, focusing on low odor and easy application.

What are the major factors driving market growth?

Rising urbanization is fueling the expansion of the decorative coatings market, as expanding cities increase residential and commercial construction. Builders and developers are relying on these coatings to enhance aesthetic appeal, protect surfaces, and improve durability across new and renovated structures.

Growing urban populations are creating consistent demand for high-quality finishes that combine functionality with visual appeal. Decorative coatings enable better surface protection and long-term performance, supporting modern construction requirements and maintaining design standards, thereby supporting market expansion.

- In October 2024, the U.S. Department of Transportation’s Federal Highway Administration (FHWA) announced USD 62 billion funding for 12 formula programs to support nationwide infrastructure development, including highways, bridges, and urban projects.

What are the major obstacles for this market?

A significant challenge impeding the progress of the decorative coatings market is the volatility of raw material prices, including resins, pigments, solvents, and additives. Fluctuations in crude oil prices and global supply chain disruptions directly affect production costs and profit margins for manufacturers.

This instability creates uncertainty in pricing strategies and can limit investment in innovation or expansion. To mitigate these risks, companies are increasingly exploring alternative bio-based materials, localized sourcing, and strategic supplier partnerships.

Which trends are shaping the market?

A notable trend influencing the decorative coatings market is the growing adoption of eco-friendly and low-VOC (volatile organic compound) formulations. Manufacturers are focusing on water-based and sustainable coatings that minimize environmental impact while meeting regulatory standards. These products provide improved indoor air quality and reduced emissions, addressing consumer and governmental demand for greener building solutions.

Additionally, innovations in bio-based resins, recyclable materials, and energy-efficient production processes are enabling companies to offer coatings that combine environmental responsibility with high performance and aesthetic versatility, propelling market growth.

Decorative Coatings Market Report Snapshot

|

Segmentation

|

Details

|

|

By Resin Type

|

Acrylic, Alkyd, Polyurethane, Vinyl

|

|

By Product Type

|

Emulsions, Wood Coatings, Enamels, Powder Coatings

|

|

By Application

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Resin Type (Acrylic, Alkyd, Polyurethane, and Vinyl): The acrylic segment earned USD 37.11 billion in 2024, mainly due to its high durability, superior color retention, and widespread use in interior and exterior decorative coatings.

- By Product Type (Emulsions, Wood Coatings, Enamels, and Powder Coatings): The emulsions segment held a share of 36.54% in 2024, supported by its ease of application, quick drying properties, and versatility across interior and exterior decorative surfaces.

- By Application (Residential, Commercial, and Industrial): The residential segment is projected to reach USD 62.56 billion by 2032, owing to the growing demand for home renovation, interior aesthetics, and surface protection in urban and suburban housing developments.

What is the market scenario in Asia-Pacific and North America region?

Based on region, the global decorative coatings market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific decorative coatings market share stood at 44.56% in 2024, valued at USD 38.07 billion. This dominance is reinforced by expanding construction activities, rising disposable incomes, and increasing consumer focus on home aesthetics. Rapid urbanization and economic development in countries such as China, India, and Southeast Asian nations are fueling demand for residential and commercial construction, highlighting the need for interior and exterior coatings.

Regional players are focusing on eco-friendly and low-VOC formulations to meet growing environmental regulations and consumer preferences, contributing to regional market expansion.

- For instance, in March 2025, PPG announced plans to build a waterborne automotive coatings manufacturing plant in Samut Prakan, Thailand, aimed at increasing local production of waterborne basecoats and primers to meet growing demand for sustainable coatings in Southeast Asia.

The North America decorative coatings industry is set to grow at a CAGR of 5.05% over the forecast period, propelled by increasing residential and commercial construction, renovation activities, and growing consumer preference for durable, aesthetically appealing finishes. This is leading to the widespread adoption of high-performance coatings with advanced functionalities, such as low-VOC formulations and stain-resistant properties.

Manufacturers are investing in R&D and expanding production capacities to develop eco-friendly and technologically advanced products that comply with stringent environmental regulations. Additionally, urbanization, higher disposable incomes, and growing awareness of sustainable building practices are supporting regional market expansion.

Regulatory Frameworks

- In North America, decorative coatings are regulated by agencies such as the U.S. Environmental Protection Agency (EPA), which enforces limits on volatile organic compounds (VOCs) and other hazardous air pollutants.

- In Europe, the European Chemicals Agency (ECHA) oversees compliance under regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), which governs the use of chemicals in coatings.

- In APAC, China enforces limits on VOC emissions and chemical safety standards through the Ministry of Ecology and Environment.

- In Japan, the PMDA regulates gene therapies, prohibiting germline editing for reproductive purposes while permitting research on non-reproductive cell editing.

- Globally, organizations such as the World Health Organization (WHO) and ISO issue guidelines on safe chemical use, sustainable production practices, and coating standardization to minimize environmental and health impacts.

Competitive Landscape

Major players operating in the decorative coatings industry are focusing on product innovation, sustainability, and geographic expansion to meet growing demand. Companies are developing eco-friendly, low-VOC, and high-performance coatings that combine aesthetic appeal with functional benefits such as durability, stain resistance, and easy application. Investment in R&D and advanced production technologies enables customization of colors, textures, and specialty finishes to meet evolving consumer preferences.

- In May 2024, Axalta Coating Systems launched its Alesta BioCore, derived from non-food organic waste, reducing CO2 emissions by 25% while maintaining the performance of conventional polyester coatings.

Top Key Companies in Decorative Coatings Market:

- The Sherwin-Williams Company

- PPG Industries, Inc.

- Akzo Nobel N.V.

- NIPPONPAINT

- RPM International

- Axalta Coating Systems, LLC

- BASF SE

- Asian Paints

- Kansai Paint Co.,Ltd.

- Masco Corporation

- Hempel A/S

- Beckers Group

- Berger Paints India

- Benjamin Moore & Co.

- DAW SE

Recent Developments

- In April 2023, Sherwin-Williams entered into an agreement to sell its China architectural paint business to Nippon Paint Holdings Co., Ltd. for around USD 1.2 billion.