Market Definition

The market refers to the integration of people, processes, and technologies across an organization through interconnected digital platforms, enabling seamless data exchange and coordinated decision-making. The report covers segmentation by component, type, application, and region.

Applications of connected enterprise span manufacturing automation, supply chain optimization, enterprise asset management, infrastructure monitoring, and customer experience enhancement across industries such as manufacturing, retail, healthcare, and information technology.

Connected Enterprise Market Overview

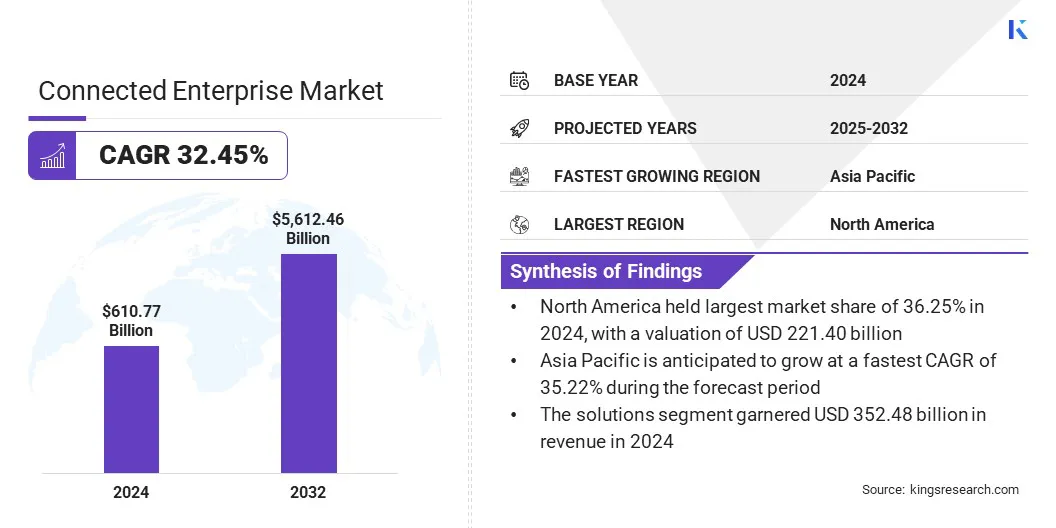

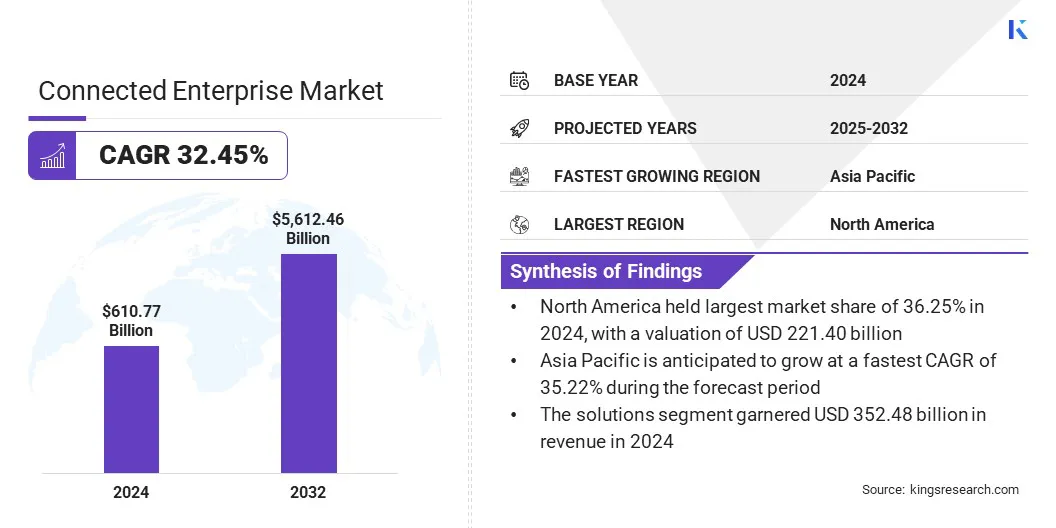

The global connected enterprise market size was valued at USD 610.77 billion in 2024 and is projected to grow from USD 784.90 billion in 2025 to USD 5,612.46 billion by 2032, exhibiting a CAGR of 32.45% over the forecast period.

The market is driven by the expansion of smart manufacturing and Industry 4.0 initiatives, which enable real-time monitoring, automation, and operational efficiency across industries. Integration of edge computing with artificial intelligence enhances network performance and decision-making, supporting faster, data-driven enterprise operations and driving market adoption.

Key Highlights

- The connected enterprise industry size was valued at USD 610.77 billion in 2024.

- The market is projected to grow at a CAGR of 32.45% from 2025 to 2032.

- North America held a market share of 36.25% in 2024, with a valuation of USD 221.40 billion.

- The solutions segment garnered USD 352.48 billion in revenue in 2024.

- The manufacturing execution system (MES) segment is expected to reach USD 972.41 billion by 2032.

- The manufacturing segment secured the largest revenue share of 28.66% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 35.22% over the forecast period.

Major companies operating in the connected enterprise market are Microsoft, Cisco Systems, Inc, IBM, Honeywell International Inc., General Electric Company, PTC, Inc., Robert Bosch GmbH, SAP SE, Oracle Corporation, Verizon Communications, Inc., Wipro Limited, Ericsson, Capgemini, Accenture, and Amazon Web Services.

Rapid digital transformation across industries is driving the growth of the market. Enterprises are increasingly implementing Internet of Things (IoT), Artificial Intelligence (AI), and automation technologies to optimize workflows and resource utilization.

Integration of connected systems such as IoT-enabled devices, enterprise resource planning (ERP) software, customer relationship management (CRM) platforms, and industrial control systems is enabling real-time monitoring and predictive maintenance in sectors such as manufacturing, logistics, and utilities.

Companies are leveraging data-driven insights to improve production efficiency, supply chain visibility, and customer experience. Growing investment in digital infrastructure and cloud-based platforms is supporting seamless connectivity across organizational networks.

- In September 2024, Rockwell Automation launched its Smart Manufacturing Suite, a comprehensive platform integrating IoT, AI, and automation technologies. This suite is designed to optimize workflows, enhance resource utilization, and enable real-time monitoring and predictive maintenance in manufacturing environments.

What are the key drivers boosting the connected enterprise?

Growth of smart manufacturing and Industry 4.0 is strengthening the expansion of the connected enterprise market. Manufacturing facilities are increasingly integrating connected systems across production floors, assembly lines, and supply chains to improve process visibility and efficiency.

- In April 2025, Hexagon launched its Digital Factory as-a-service. The initiative provides manufacturers globally with millimetre-accurate, current 3D simulations of their factory layouts, whether existing or in planning stages.

Deployment of Industrial Internet of Things (IIoT) devices and intelligent sensors is enabling real-time monitoring of equipment performance and energy consumption. Automation and advanced analytics are supporting predictive maintenance and data-driven decision-making in factory operations. Adoption of digital twins and cloud-based management platforms is enhancing production flexibility and reducing downtime.

- In May 2024, Zoomlion Heavy Industry introduced a 3D digital twin platform at a concrete batching plant in Hubei Province, China. The platform includes real-time virtual inspections, equipment monitoring, fault early detection, and dashboards covering production, maintenance, raw material tracking, inventory, and logistics scheduling.

How are cybersecurity risks limiting market growth?

A key challenge in the connected enterprise market is the growing risk of data security and privacy breaches. Expanding connectivity across industrial systems, cloud networks, and IoT platforms exposes enterprises to cyberattacks and unauthorized data access. These vulnerabilities can disrupt operations, compromise sensitive information, and damage organizational trust.

To address this challenge, market players are implementing advanced encryption frameworks, deploying AI-based threat detection systems, and strengthening network segmentation to safeguard enterprise data. These efforts are enhancing system resilience and ensuring regulatory compliance in increasingly digitalized business environments.

- In August 2024, Actelis Networks announced a strategic partnership to launch an AI-Powered Cybersecurity SaaS for IoT Networks. The solution (under its “Cyber Aware Networking” architecture) integrates into its networking devices for edge-based monitoring of IoT sensors and devices.

How is AI adoption shaping market trends?

A key trend in the connected enterprise market is the integration of edge computing with artificial intelligence to enhance network performance and decision-making. Enterprises are deploying AI algorithms at edge nodes to process data locally, reducing latency and bandwidth usage.

Real-time analytics at the network edge are enabling faster detection of operational anomalies and automated responses to critical events. Industrial, retail, and logistics organizations are leveraging these capabilities to optimize workflows, improve resource allocation, and enhance service delivery. Combining edge computing and AI is supporting autonomous decision-making, minimizing reliance on centralized systems for routine tasks.

- In March 2025, HCLTech launched HCLTech Insight, an agentic AI-powered smart manufacturing solution built on Google Cloud / Vertex AI and other platforms. It offers real-time anomaly detection through interactive dashboards and virtual assistance, targeting sectors like automotive, electronics, and aerospace.

Connected Enterprise Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Solutions, Services

|

|

By Type

|

Manufacturing Execution System (MES), Customer Experience Management, Enterprise Infrastructure Management, Asset Performance Management, Remote Monitoring System

|

|

By Application

|

Manufacturing, IT & Telecommunications, Retail & E-commerce, Banking, Financial Services, and Insurance (BFSI), Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Solutions and Services): The solutions segment earned USD 352.48 billion in 2024 due to its ability to provide integrated platforms and software that streamline operations, enhance real-time decision-making, and improve efficiency across diverse industrial and enterprise applications.

- By Type (Manufacturing Execution System (MES), Customer Experience Management, Enterprise Infrastructure Management, Asset Performance Management, and Remote Monitoring System): The manufacturing execution system (MES) segment held 22.40% of the market in 2024, due to its ability to provide real-time monitoring, control, and optimization of production processes.

- By Application (Manufacturing, IT & Telecommunications, Retail & E-commerce, Banking, Financial Services, and Insurance (BFSI), Healthcare, and Others): The manufacturing segment is projected to reach USD 1,592.20 billion by 2032, owing to the widespread adoption of smart factories, real-time monitoring, and automation technologies that enhance operational efficiency and productivity.

What is the market scenario in North America and Asia-Pacific?

Based on region, the global connected enterprise market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America connected enterprise market share stood around 36.25% in 2024 in the global market, with a valuation of USD 221.40 billion. This dominance is due to the rapid integration of Industrial Internet of Things (IIoT) technologies across manufacturing and logistics sectors.

Companies such as Rockwell Automation, Honeywell, and General Electric are integrating connected sensors, control systems, and analytics platforms to optimize production and supply chain operations. These firms are deploying IIoT-enabled systems that link machinery and equipment across facilities, enabling continuous monitoring and predictive insights.

- In April 2025, Rockwell Automation and AWS expanded their collaboration to make Rockwell’s industrial automation software, such as FactoryTalk Hub, DataMosaix industrial DataOps, and Fiix CMMS available via AWS Marketplace. This allows cloud-based platforms integration for manufacturing and logistics companies to leverage analytics and connected systems in their operations.

The region’s strong base of automation and control technology providers supports the widespread adoption of these connected systems. Manufacturing facilities are using predictive maintenance and data analytics to reduce downtime and enhance throughput.

The market in Asia Pacific is expected to have a CAGR of 35.22% over the forecast period. This growth is due to the rapid expansion of smart manufacturing initiatives and industrial automation programs. In March 2024, the Beijing Municipal Bureau of Economy and Information Technology announced plans to add 100 smart factories and digital workshops between 2024 and 2026.

Industries in this region are increasingly adopting connected machines, sensors, and monitoring platforms to enhance efficiency and reduce operational losses. Governments and enterprises are collaborating to build digital factories that integrate real-time analytics and automated control systems.

- In October 2024, the Government of Singapore launched the Advanced Manufacturing Centre of Innovation (AMCOI) under EnterpriseSG. The AMCOI brings together local institutes to provide resources in areas such as robotics & autonomous technology, data science & analytics, AI, and additive manufacturing to help advance, test and commercialize manufacturing solutions.

The manufacturing sector is further moving toward data-driven decision-making through connected enterprise solutions. Companies are investing in industrial IoT networks to improve equipment performance and production visibility.

Regulatory Frameworks

- The U.S. Department of Commerce has finalized rules under the Information and Communications Technology and Services (ICTS) Supply Chain regulations, prohibiting transactions involving connected vehicle technologies from foreign adversaries, including China and Russia. Effective from March 17, 2025, these rules restrict the import and sale of certain connected vehicles and key components, such as Vehicle Connectivity Systems and Automated Driving Systems, to protect national security and citizen privacy.

- The European Union's Data Act, effective from September 12, 2025, grants users control over data generated by their connected devices, like smartwatches and cars. This regulation unlocks opportunities for small businesses to utilize this data to develop innovative after-sales services, promoting data sharing and competition within the digital economy.

- China has implemented stringent data regulations for connected vehicles, including the requirement for security reviews before cross-border data transfers. The Ministry of Industry and Information Technology has introduced new standards for connected vehicles, focusing on data security and software upgrades.

- Japan's Telecommunications Business Act regulates telecommunications services, including those provided by connected enterprises. Businesses offering such services must obtain the appropriate licenses or registrations, ensuring compliance with national standards and promoting fair competition in the telecommunications sector.

Competitive Landscape

Market players are adopting strategies such as research and development, strategic partnerships, and technological advancements to remain competitive in the connected enterprise industry. Companies are investing in R&D to develop advanced platforms that can integrate information technology and operational technology seamlessly.

Partnerships with industrial clients and technology providers help in creating tailored solutions for diverse operational needs. Technological advancements, including edge computing and machine learning, are being applied to improve real-time decision-making and automation.

- In July 2024, NTT DATA launched Ultralight Edge AI Platform, a fully managed solution for industrial settings, which processes data locally at edge nodes to enable real-time decisions. The platform is aimed at the convergence of IT/OT systems, harmonizing data from diverse IoT sensors and devices with lightweight ML models for automation and anomaly detection.

Key Companies in Connected Enterprise Market:

- Microsoft

- Cisco Systems, Inc.

- IBM

- Honeywell International Inc.

- General Electric Company

- PTC, Inc.

- Robert Bosch GmbH

- SAP SE

- Oracle Corporation

- Verizon Communications, Inc.

- Wipro Limited

- Ericsson

- Capgemini

- Accenture

- Amazon Web Services

Recent Developments

- In September 2025, PTC launched the Arena AI Assistant, a tool designed to accelerate product lifecycle management (PLM) and quality management system (QMS) workflows. The Onshape-Arena Connection enables mechanical engineers to seamlessly manage the release, revision, and change management processes between computer-aided design (CAD) and PLM systems. This integration aims to streamline product development and simplify collaboration with supply chain partners.

- In January 2025, Siemens introduced its “Industrial Copilot for Operations”, which operates close to machines and integrates with its Industrial Edge ecosystem. It is intended to run AI tasks near production floors to facilitate real-time decision-making, reduce downtime, and enhance operations in discrete and process manufacturing.

- In July 2024, Honeywell showcased the expansion of its Honeywell Forge IoT platform to leverage AI capabilities across its extensive network of connected devices. The enhanced platform aims to provide businesses with improved data analytics and automation capabilities, facilitating smarter decision-making processes.

- In May 2024, Fortinet launched FortiAI, a generative AI IoT security assistant. The solution enables secure proxying of AI connections through Fortinet data centers and enhances threat detection by applying AI models closer to network edges. The launch adds generative AI capabilities to Fortinet’s suite, aiming to strengthen network security operations for enterprise and IoT environments.

- In March 2024, Cisco unveiled the Cisco Board Pro G2, an AI-fueled and touch-enabled collaboration device, and the Cisco Desk Phone 9800 Series, designed to bring a modern and personalized productivity hub to any desk, aimed at enhancing productivity in hybrid work settings. These purpose-built devices are designed to deliver modernized collaboration experiences, integrating seamlessly with Cisco's Webex platform.