Market Definition

Conducting polymers are unique plastics that can conduct electricity. They have the flexibility of ordinary polymers but share the conductive nature of metals, which makes them suitable for use in electronics, sensors, and energy devices.

Polyaniline, polypyrrole, and polythiophene are a few conducting polymers that are widely used in electronics, energy storage, sensors, and biomedical devices.

The report covers major factors driving this market's growth along with key companies operating in this market. It also covers various trends and regulatory frameworks that are expected to play a key role in shaping the market over the forecast period.

Conducting Polymers Market Overview

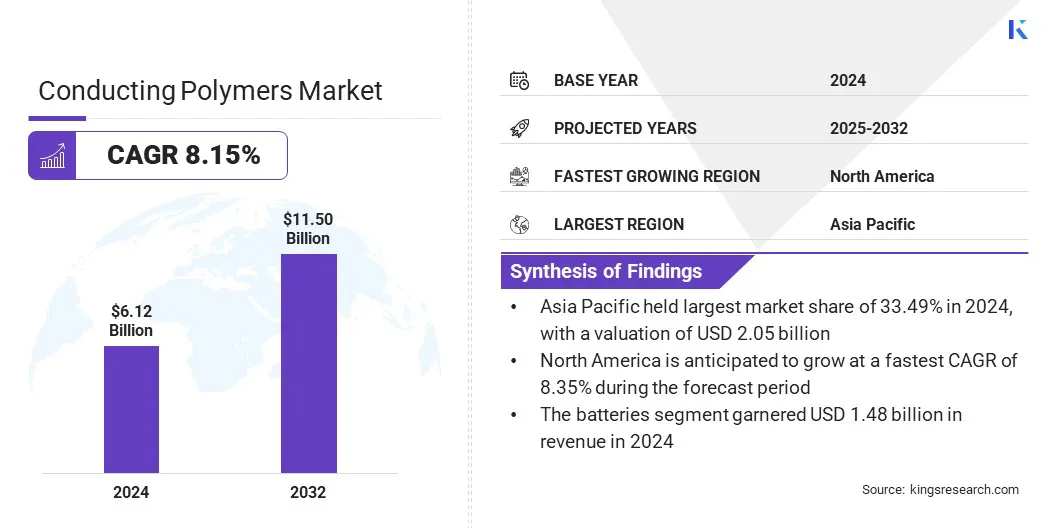

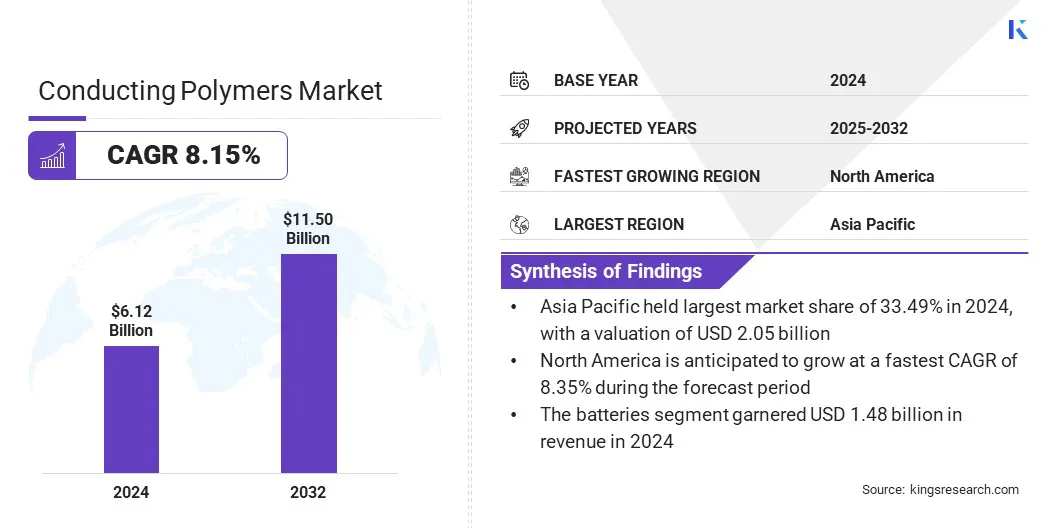

According to Kings Research, the global conducting polymers market size was valued at USD 6.12 billion in 2024 and is projected to grow from USD 6.60 billion in 2025 to USD 11.50 billion by 2032, exhibiting a CAGR of 8.15% over the forecast period.

This growth is driven by increasing investments in organic electronics and smart materials. Advancements in flexible displays, sensors, and energy storage are accelerating the adoption of conducting polymers across healthcare, automotive, and electronics.

Key Market Highlights:

- The conducting polymers industry was recorded at USD 6.12 billion in 2024.

- The market is projected to grow at a CAGR of 8.15% from 2025 to 2032.

- Asia Pacific held a share of 33.49% in 2024, valued at USD 2.05 billion.

- The polyaniline segment generated USD 1.72 billion in revenue in 2024.

- The actuators & sensors segment is anticipated to witness the fastest CAGR of 8.30% over the forecast period.

- North America is anticipated to grow at a CAGR of 8.35% through the projection period.

Major companies operating in the conducting polymers market are 3M, Agfa-Gevaert Group, Celanese Corporation, Heraeus Group, Premix Group, Lehmann&Voss&Co., Parker Hannifin Corp., Avient Corporation, SABIC, RTP Company, Lubrizol, Merck, Solvay, Rieke Metals, LLC, and Covestro AG.

The use of polyaniline in antistatic coatings is gaining pace due to its conductivity, environmental stability, and cost-effectiveness. These properties have positioned it as a preferred material in electronics packaging, industrial equipment, and protective coatings.

Rising demand for advanced antistatic solutions to safeguard sensitive devices and components has also strengthened the application scope of polyaniline. Its compatibility with diverse substrates and ability to function under varied conditions continue to strengthen its industrial significance and market growth potential.

Market Driver

Enhanced Electrical Conductivity and Process ability of Polythiophene-Based Materials

A key factor boosting the progress of the conducting polymers market is the electrical conductivity and process ability of polythiophene-based materials as they deliver stability, flexibility, and performance in organic photovoltaics, light-emitting diodes, and thin-film transistors.

They can be used with multiple fabrication techniques which makes them ideal for electronics and energy-related applications. Continuous research in material engineering has also optimized their conductivity levels, expanding their usage across industrial and consumer electronics segments.

Market Challenge

Limited Durability of Polypyrrole in Harsh Environments

A major challenge facing the conducting polymers market is the low stability of polypyrrole in adverse environments. Exposure to humidity, temperature variations, and corrosive agents can hamper its performance in energy storage and sensor applications.

Therefore, manufacturers are developing composite materials, protective coatings, and hybrid systems to enhance durability while maintaining conductivity. Industry players are also investing in advanced synthesis methods to make polypyrrole more stable for commercial applications.

Market Trend

Increasing Integration of Conducting Polymers in Green Materials

A notable trend influencing the market is their integration into sustainable solutions. Conducting polymers are lightweight, recyclable, and energy-efficient alternatives to traditional materials. In line with rising environmental compliance and corporate sustainability initiatives, their role in eco-friendly coatings, renewable energy devices, and biodegradable electronics is expanding.

Therefore, growing focus on sustainable practices and rising consumer preference for green products are accelerating the use of conducting polymers in sustainable manufacturing practices.

Conducting Polymers Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Polyaniline, Polypyrrole, Polythiophene, Polyacetylene, Others

|

|

By Application

|

Batteries, Capacitor, Actuators & sensors, Anti-static packaging, Solar energy, Panel display, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Polyaniline, Polypyrrole, Polythiophene, Polyacetylene, and Others): The polyaniline segment generated USD 1.72 billion in revenue in 2024, mainly due to its extensive use in antistatic coatings, corrosion protection, and electronic devices that demand stable conductive properties.

- By Application (Batteries, Capacitor, Actuators & sensors, Anti-static packaging, Solar energy, Panel display, and Others): The actuators & sensors segment is poised to record a CAGR of 8.30% over the forecast period, fueled by rising adoption of conducting polymers in flexible electronics, biomedical devices, and automation technologies.

Conducting Polymers Market Regional Analysis

The global market has been segmented on the basis of region into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The Asia Pacific market stood at 33.49% in 2024, valued at USD 2.05 billion in the conducting polymers market. This share can be attributed to the rising demand for lightweight, cost-effective, and conductive materials across applications in electronics, packaging, energy storage, and medical devices.

Many key players are adopting conducting polymers in their product portfolios to expand their capabilities to various industrial applications.

- Henkel’s Loctite portfolio features conductive materials and dielectric inks designed for advanced printed electronics. The company supports partners in developing industrial applications using conducting polymers. Henkel plans to introduce industry-first silver inks and highly conductive variants derived from recycled silver raw materials.

Expanding industrial automation, supportive government initiatives promoting industrial innovation and expanding R&D activities focused on high-performance composites are further strengthening the market position across the region.

Strong manufacturing capabilities, increasing investments in advanced materials, and increased use of polymer-based technologies have also boosted regional demand.

- In September 2025, Panasonic Group announced the commencement of commercial production of its Conductive Polymer Tantalum Solid Capacitors (POSCAP) models 50TQT33M and 63TQT22M. It is designed for power circuits in laptops and tablets, these 3 mm ultra-low-profile capacitors deliver high capacitance and withstand voltage, enabling efficient high-output power delivery via USB Type-C connectors.

The North America market is set to grow at a CAGR of 8.35% over the forecast period. This growth is driven by extensive research and development, expanding scope of conducting polymers in electronics, and their adoption as sustainable materials. Further, their growing use in sensors, actuators, and energy storage systems is aiding their regional growth.

- In January 2023, Celanese Corporation showcased its portfolio of polymer solutions for the healthcare industry that includes Zytel Polyamide, Hytrel Thermoplastic Polyester Elastomer, Crastin Polybutylene Terephthalate, and Micromax materials. These polymers are applied in medical devices, surgical instruments, drug delivery systems, and diagnostic equipment, ensuring durability, biocompatibility, and performance consistency in critical healthcare applications.

Regulatory Frameworks

- In EU, Regulation (EC) No. 1907/2006 (REACH) oversees registration, evaluation, authorization, and restriction of chemicals. It requires manufacturers and importers of substances (including polymers) to provide safety data and assess risks. REACH enforces the safe use of conducting polymers, mandates disclosure of potentially hazardous monomers or additives, and restricts substances that pose risks to human health or environment.

- In China, Environmental Protection Law of the People’s Republic mandates that all entities comply with standards for pollutant discharge, conduct environmental impact assessments, and adopt measures to reduce environmental pollution. Conducting polymer production involving emissions, waste, or hazardous by-products falls under its supervision.

Competitive Landscape

Key players operating in the conducting polymers market are expanding product portfolios primarily by strengthening their research and development capabilities.

They are working on improving polymer stability, scalability, and processing efficiency. Companies are also partnering with research institutions and other companies to improve their technological expertise and global reach. Further, they are undergoing capacity expansion and securing supply chains to meet the increasing demand.

- In June 2025, LyondellBasell, Premix, and Maillefer developed a recyclable power cable system. The solution uses high-performance polypropylene, advanced compounding, and cable manufacturing technology and delivers a robust PP-based alternative for MV and HV cable insulation and semiconductive screens, replacing conventional XLPE systems.

List of Key Companies in Conducting Polymers Market:

- 3M

- Agfa-Gevaert Group

- Celanese Corporation

- Heraeus Group

- Premix Group

- Lehmann&Voss&Co.

- Parker Hannifin Corp.

- Avient Corporation

- SABIC

- RTP Company

- Lubrizol

- Merck

- Solvay

- Rieke Metals, LLC

- Covestro AG

Recent Developments (Agreements)

- In May 2024, Premix, Inc. secured a USD 79.9 billion contract from the U.S. Department of Defense, in collaboration with the Department of Health and Human Services, to establish a new plastic compound manufacturing facility in North Carolina. The manufacturing facility will enhance production capacity and support strategic material supply requirements.