Market Definition

The market focuses on technologies that enable precise detection, tracking, and management of aircraft and ground movements within airport environments. Systems include surveillance radars, surface movement radars, precision approach radars, and weather radars that support safe navigation and operational continuity.

The market covers type, range, and applications required to maintain reliable air traffic control functions. Its scope extends to modernization programs, regulatory compliance, and performance enhancements across global airport infrastructure.

Commercial Airport Radar System Market Overview

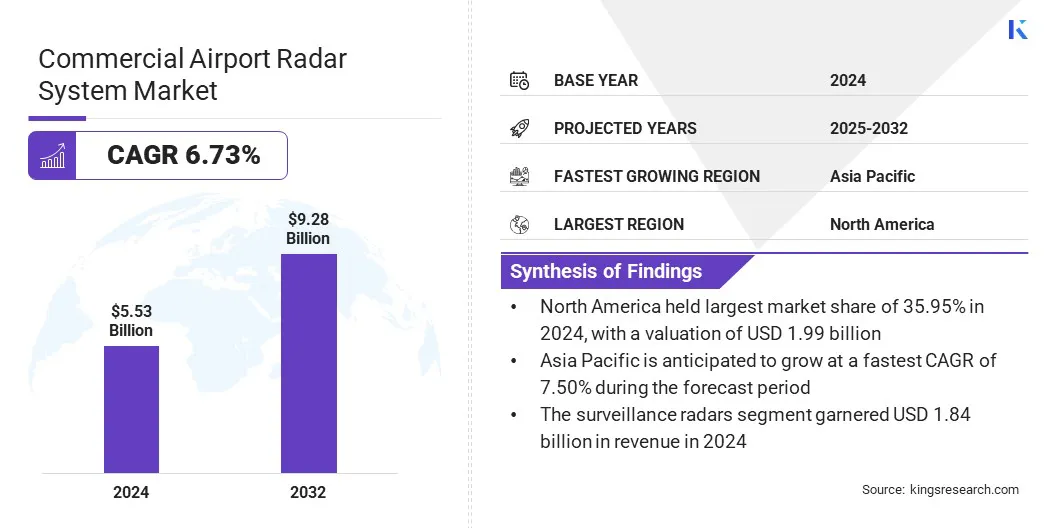

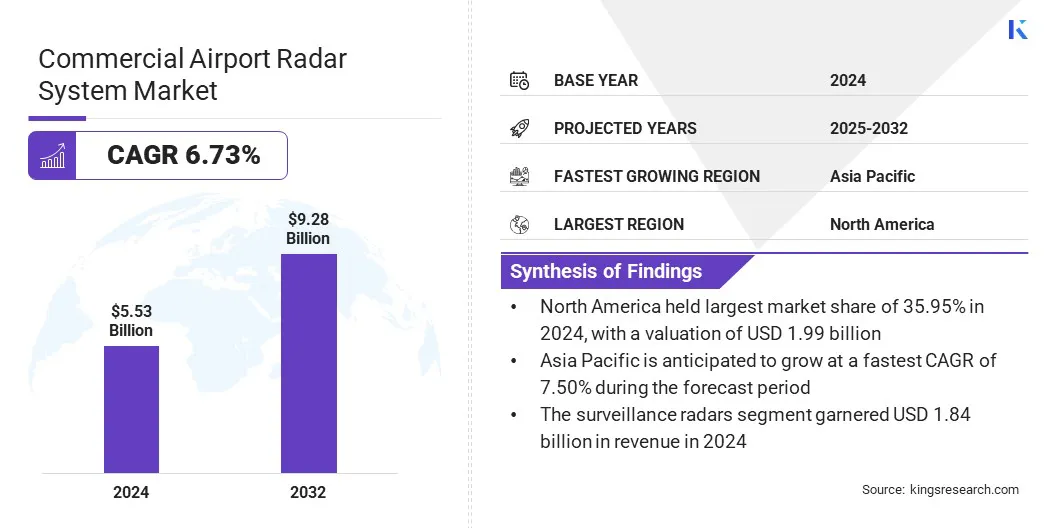

The global commercial airport radar system market size was valued at USD 5.53 billion in 2024 and is projected to grow from USD 5.88 billion in 2025 to USD 9.28 billion by 2032, exhibiting a CAGR of 6.73% during the forecast period.

This growth is driven by airports adopting AI-enhanced radar platforms to strengthen situational awareness and automate traffic assessment. AI optimizes radar data interpretation and improves operational response times, supporting safer and more efficient airport operations.

Key Market Highlights:

- The commercial airport radar system industry was recorded at USD 5.53 billion in 2024.

- The market is projected to grow at a CAGR of 6.73% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 1.99 billion.

- The surveillance radars segment garnered USD 1.84 billion in revenue in 2024.

- The medium-range segment is expected to reach USD 3.55 billion by 2032.

- The wind shear detection segment is anticipated to witness the fastest CAGR of 6.94% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 7.50% through the projection period.

Major companies operating in the commercial airport radar system market are Thales, Indra Sistemas, S.A., Honeywell International Inc., Northrop Grumman, RTX Corporation, TERMA, Frequentis AG, BAE Systems, Leonardo S.p.A., NEC Corporation, Hensoldt AG, Detect Inc., Easat Radar Systems Limited, Vaisala, and Shoghi Communications Ltd.

Expansion of remote tower implementations using radar-based monitoring is driving modernization in airport operations by enabling centralized oversight of multiple airfields. Radar systems provide consistent surveillance accuracy, supporting remote decision-making, runway visibility assessment, and efficient traffic sequencing.

Growing demand for cost-effective tower operations is encouraging airports and air navigation service providers (ANSPs) to adopt radar-enabled remote configurations, which reduce staffing requirements while maintaining safety compliance.

Increasing investments by airport authorities and government aviation agencies in digital communication networks are enhancing radar data transmission reliability, positioning remote tower solutions as a scalable and efficient option for regional and low-traffic airports seeking to upgrade control capabilities.

- In July 2025, the Polish Air Navigation Services Agency selected Saab to supply a digital tower solution for Warsaw Modlin Airport, supported by an operations centre in Warsaw. The deployment improves operational flexibility and availability, supports remote traffic management in all weather conditions, and provides a scalable framework for future airport expansions.

What is driving the increased adoption of commercial airport radar systems?

Rising airport modernization initiatives are driving the adoption of advanced radar systems, as authorities upgrade aging infrastructure to manage increasing air traffic and meet stringent safety requirements. Modernization programs focus on enhancing surveillance coverage, real-time situational awareness, and response capabilities during adverse weather.

Operators are replacing legacy radars with digital, long-range, and high-resolution systems that integrate with broader air traffic management workflows. Moreover, increasing investments by airport authorities and government aviation agencies in performance reliability, regulatory compliance, and minimizing operational disruptions are further supporting the adoption of commercial airport radar systems.

- In April 2025, Indra will produce and install advanced 3D primary and MSSR secondary radars across ten NATS sites to strengthen national airspace monitoring. The systems integrate wind turbine interference-mitigation technology, supporting renewable energy expansion while maintaining flight safety and aligning with NATS’ environmental objectives.

What factors limit the rapid adoption of commercial airport radar systems?

High capital expenditure and complex integration requirements restrict rapid adoption of commercial airport radar systems, particularly in airports operating with constrained budgets or legacy infrastructure. Procurement involves significant investment in advanced sensors, installation, calibration, and long-term maintenance.

Integration with existing air traffic systems often demands customized configurations, extended deployment timelines, and specialized technical expertise. These factors increase overall project risk for operators and delay modernization initiatives, creating financial and operational barriers that influence procurement decisions across small and medium-sized airports.

To address this challenge, market players address these challenges by implementing phased deployment strategies, forming vendor partnerships that provide lifecycle support, adopting modular radar architectures, and leveraging government-backed funding mechanisms to manage costs and simplify system integration.

A key trend driving the commercial airport radar system market is the transition toward digitally enabled airport operations, which increases reliance on radar systems that integrate with analytics platforms, automation tools, and networked control architectures. Digital ecosystems allow continuous monitoring of airspace and ground movements, supporting faster decision-making and coordinated workflows.

Radar-derived data improves traffic prediction, runway incursion alerts, and weather-related risk assessments. With digital transformation, airports are increasingly adopting predictive analytics, AI-assisted decision-making, and integrated traffic management systems, which place higher demands on radar resolution, data throughput, and interoperability.

Modern radar systems must support real-time data sharing across multiple platforms, comply with emerging cybersecurity protocols, and enable scalable updates to accommodate evolving operational requirements. Additionally, the push toward autonomous ground vehicles and unmanned aerial systems at airports further emphasizes the need for advanced radar capabilities that provide precise situational awareness, minimize operational delays, and enhance overall safety standards.

Commercial Airport Radar System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Surveillance Radars, Surface Movement Radars, Precision Approach Radars, Weather Radars

|

|

By Range

|

Short-range, Medium-range, Long-range

|

|

By Application

|

Air traffic control, Surface movement monitoring, Precision approach & landing, Weather monitoring, Wind shear detection, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Surveillance Radars, Surface Movement Radars, Precision Approach Radars, and Weather Radars): The surveillance radars segment generated USD 1.84 billion in 2024, due to rising deployment of advanced detection systems supporting continuous monitoring, higher traffic density, and increased airport investments in surveillance upgrades.

- By Range (Short-range, Medium-range, and Long-range): The short-range segment is poised to record a CAGR of 6.76% through the forecast period, propelled by increasing demand for ground movement monitoring, runway safety enhancements, and efficient tracking of aircraft during terminal-area operations.

- By Application (Air traffic control, Surface movement monitoring, Precision approach & landing, Weather monitoring, Wind shear detection, and Others): The air traffic control segment is estimated to hold a share of 21.55% by 2032, fueled by expanding radar integration requirements, rising traffic management complexity, and continuous upgrades to enhance operational coordination within controlled airspace.

What is the market scenario in North America and Asia Pacific region?

Based on region, the global commercial airport radar system market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 35.95% of the commercial airport radar system market in 2024, reaching a valuation of USD 1.99 billion. This dominance is attributed to continuous upgrades across major airports seeking improved surveillance accuracy, enhanced surface movement monitoring, and higher operational reliability. Authorities are replacing legacy radar installations with advanced long-range and multi-sensor systems to manage increasing traffic density and evolving safety mandates.

Market growth in the region is driven by targeted investments from airport authorities and air navigation service providers in digital air traffic management platforms, radar system upgrades, and runway expansion projects. These stakeholders are allocating capital toward automated surveillance, surface movement monitoring, and integrated radar architectures to support rising traffic volumes, meet safety regulations, and sustain long-term infrastructure modernization programs.

- In August 2025, Thales was selected by the Cayman Islands Airports Authority (CIAA) to modernize and upgrade air-traffic-control infrastructure across the Cayman aviation network. The project will introduce advanced surveillance, communication and navigation systems to enhance safety, efficiency and situational awareness for both civilian and commercial flight operations.

Asia Pacific commercial airport radar system industry is projected to grow at a CAGR of 7.50% over the forecast period, driven by rapid airport expansion, increasing passenger throughput, and strengthening investment in aviation safety infrastructure. Rising air traffic in countries such as China, India, and Southeast Asian nations is fueling demand for advanced surveillance and air traffic management solutions.

Governments in this region are prioritizing the modernization of existing radar networks and deployment of multi-sensor systems to enhance operational efficiency and safety. Additionally, airport authorities and air navigation service providers across the region are adopting digital air traffic management platforms and automated radar solutions, enabling real-time data sharing and more informed operational decision-making.

National aviation regulators and government-backed airport operators are expanding regional connectivity and international airport development programs, which is driving higher procurement of advanced radar systems and accelerating technology upgrades.

- In December 2025, Thales collaborated with Novatis, initiated an upgrade of the radar station at Senai International Airport under the Civil Aviation Authority of Malaysia (CAAM). The project enhances approach and regional surveillance capabilities through the deployment of the RSM NG radar, enabling seamless aircraft tracking across Peninsular Malaysia and East Malaysia.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) Radar Engineering and Performance Standards govern technical requirements for airport radar systems. It establishes performance, reliability, and safety criteria essential for deployment and integration within the national air traffic management infrastructure.

- In the UK, the Civil Aviation Authority (CAA) Surveillance Systems Regulation supervises radar system installation and operation. It outlines compliance parameters for surveillance accuracy, electromagnetic compatibility, and operational coordination within controlled airspace.

- In Germany, the Luftfahrt-Bundesamt (LBA) Air Traffic Surveillance Directive oversees radar performance and certification. It mandates standardized detection capabilities, continuous monitoring functions, and adherence to defined equipment testing protocols.

- In Australia, the Civil Aviation Safety Authority (CASA) Air Navigation Surveillance Requirements enforces operational guidelines for airport radar systems. It defines functional specifications, maintenance obligations, and integration standards supporting safe airspace surveillance and traffic management.

- In Japan, the Civil Aviation Bureau (JCAB) Air Traffic Surveillance Standards regulates radar system deployment and modernization. It directs conformity with national safety frameworks, precision monitoring expectations, and technology alignment within airport infrastructure planning.

Competitive Landscape

Key players in the commercial airport radar system industry are focusing on enhancing product portfolios, improving radar precision, and strengthening system interoperability to sustain competitive positioning. Companies are investing in research programs aimed at boosting detection accuracy, weather resilience, and data processing speeds.

Key players are also emphasizing cybersecurity and modular system designs to address evolving airport modernization and automation requirements. Market participants are pursuing geographic expansion through strategic contracts, long-term service agreements, and establishing local support capabilities.

- In December 2025, Hensoldt agreed to supply Rheinmetall’s air defence division with SPEXER radars for ground-based defence systems. These radars will support target detection and tracking for the Skyranger 30 and the HoWiSM laser-based drone defence system, which Rheinmetall and MBDA expect to reach full operational capability by 2029.

Key Companies in Commercial Airport Radar System Market:

- Thales

- Indra Sistemas, S.A.

- Honeywell International Inc.

- Northrop Grumman

- RTX Corporation

- TERMA

- Frequentis AG

- BAE Systems

- Leonardo S.p.A.

- NEC Corporation

- Hensoldt AG

- Detect Inc.

- Easat Radar Systems Limited

- Vaisala

- Shoghi Communications Ltd.

Recent Developments (Product Launch)

- In June 2025, Thales introduced the RSM NG / IFF secondary surveillance radar designed to deliver simultaneous civil and military air traffic data through a secure, segregated architecture. The system complies with NATO, ICAO, and ADS-B identification standards, supporting advanced surveillance requirements in shared airspace environments.

- In May 2025, Vaisala introduced AviMet 10, an upgraded aviation weather management system integrating advanced sensors, observation platforms, communication units, and software. The solution delivers real-time weather intelligence to strengthen operational decision-making essential for maintaining safe and efficient flight operations across airport environments.