Market Definition

Compressed natural gas (CNG) powertrain systems utilize natural gas as the primary fuel source to operate engines with reduced environmental impact. These systems integrate engines, fuel tanks, injectors, transmissions, exhaust systems, and control units to ensure efficient and reliable vehicle performance.

They are deployed across passenger, light, and heavy commercial vehicles, as well as specialized fleets in transportation, logistics, and industrial sectors, supporting energy diversification and regulatory compliance in emission reduction.

CNG Powertrain Market Overview

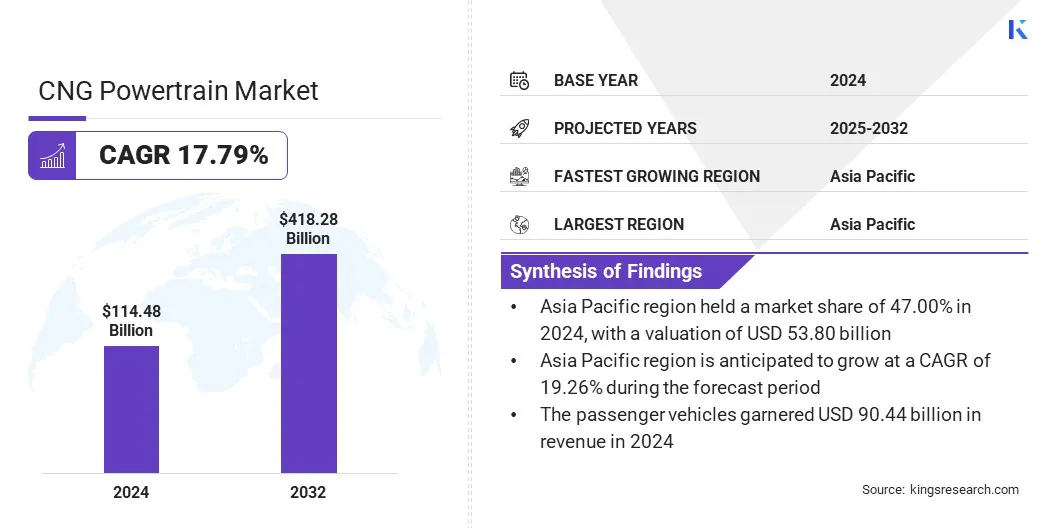

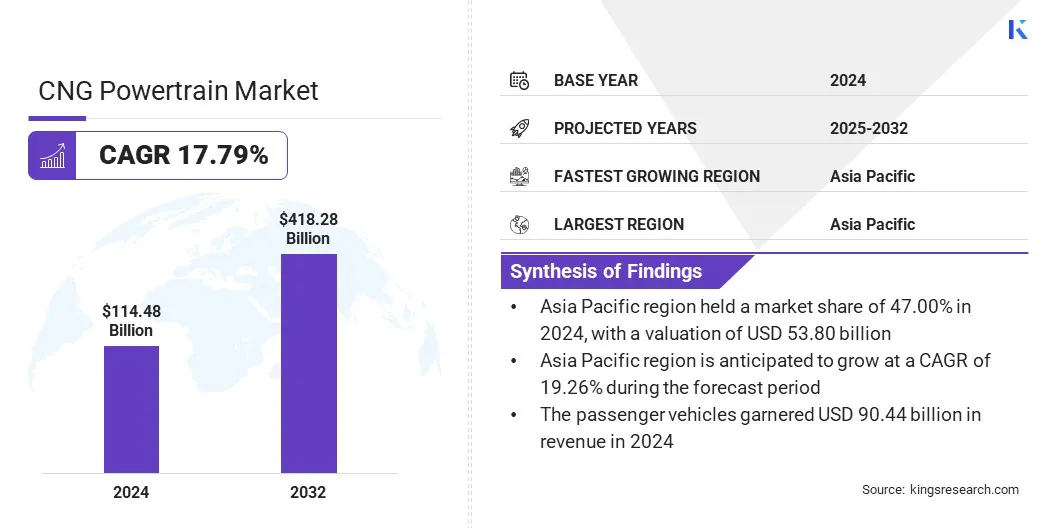

According to Kings Research, the global CNG powertrain market size was valued at USD 114.48 billion in 2024 and is projected to grow from USD 132.94 billion in 2025 to USD 418.28 billion by 2032, exhibiting a CAGR of 17.79% during the forecast period.

This growth is fueled by the growing demand for fuel-efficient vehicles, as rising fuel costs and environmental concerns accelerate the shift toward alternative fuel technologies. Advancements in turbocharged CNG engines are further improving vehicle performance, fuel efficiency, and emission control, strengthening the competitiveness of CNG vehicles against conventional engines.

Key Market Highlights:

- The CNG powertrain industry size was recorded at USD 114.48 billion in 2024.

- The market is projected to grow at a CAGR of 17.79% from 2025 to 2032.

- Asia Pacific held a share of 47.00% in 2024, valued at USD 53.80 billion.

- The engine segment garnered USD 43.50 billion in revenue in 2024.

- The passenger vehicles segment is expected to reach USD 334.16 billion by 2032.

- The front wheel drive (FWD) segment is projected to generate USD 262.93 billion by 2032.

- The mono-fuel segment is likely to reach USD 323.79 billion by 2032.

- The transportation segment garnered USD 70.98 billion in revenue in 2024.

- Europe is anticipated to grow at a CAGR of 17.51% over the forecast period.

Major companies operating in the CNG powertrain market are Robert Bosch GmbH, Shigan Quantum Technologies Limited, Cummins Inc., AB Volvo, Hyundai Motor Company, Maruti Suzuki India Limited, Iveco Group Company, Scania, Renault Group, TATA Motors, HINDUJA GROUP, Mahindra&Mahindra Ltd., Volkswagen, Ford Motor Company, and Allison Transmission, Inc.

Companies are developing integrated CNG powertrain solutions and optimized refueling strategies for fleet operations, including buses, taxis, and commercial delivery vehicles. These solutions are being provided to meet the growing demand for cleaner and cost-efficient fuel alternatives in fleet transportation.

The adoption of CNG-powered fleets is improving operational efficiency, reducing fuel costs, and lowering emissions in urban and intercity transport networks. This approach is promoting broader deployment of CNG vehicles across the commercial sector.

- In June 2024, Cummins secured an order to supply 244 L9N CNG engines to Solaris Bus & Coach for ATAC’s bus fleet in Rome. The L9N Euro 6 engines deliver 320 hp with ultra-low emission technology and a three-way catalyst system to reduce NOx and particulate matter while maintaining diesel-like performance. The engines are being used in Urbino 12 and Urbino 18 bus models to support clean, cost-effective urban transportation.

Market Driver

Growing Demand for Fuel-Efficient Vehicles

The expansion of the CNG powertrain market is fueled by the increasing demand for fuel-efficient vehicles. Rising fuel costs and environmental concerns are prompting consumers and fleet operators to adopt vehicles with higher mileage and lower operating expenses.

CNG powertrains provide a cost-effective alternative to conventional petrol and diesel engines by delivering better fuel efficiency and reduced carbon emissions. This growing preference for economical and sustainable transportation solutions is boosting the adoption of the CNG powertrain across both passenger and commercial vehicle segments.

- In September 2024, Maruti Suzuki India Limited launched the Epic New Swift S-CNG, offering fuel efficiency of 32.85 km/kg across three variants, including V, V(O), and Z. Powered by the Z-series Dual VVT engine, the model delivers 101.8 Nm torque, reduced CO2 emissions, and a 5-speed manual gearbox.

Market Challenge

High Initial Cost of CNG Powertrain Systems

A significant challenge impeding the expansion of the CNG Powertrain market is the high upfront cost of CNG engines and associated components compared to conventional fuel systems. This cost barrier discourages small and mid-sized vehicle manufacturers and fleet operators from adopting CNG technology.

To mitigate this challenge, companies are reducing costs through modular engine designs and large-scale production. Moreover, governments are offering subsidies and incentives to make CNG vehicles more affordable and boost wider adoption.

Market Trend

Development of Turbocharged CNG Engines

The CNG powertrain market is witnessing a notable trend toward the development of turbocharged CNG engines. Manufacturers are improving these engines to enhance performance, fuel efficiency, and emission control.

These advancements enable CNG vehicles to achieve power levels comparable to conventional engines, increasing their applicability in both passenger and commercial segments. Enhanced engine efficiency also extends vehicle range and lowers operating costs, supporting wider adoption of CNG powertrains across urban and intercity transportation networks.

- In September 2024, Tata Motors launched the Nexon iCNG, India’s first turbocharged CNG vehicle, and updated the Nexon.ev range with a 45 kWh battery pack. The Nexon iCNG features a 1.2L turbocharged engine producing 100 PS and 170 Nm torque, with automatic petrol-CNG switching and advanced safety systems. The Nexon.ev offers an extended range of 350–370 km in real-world conditions and faster charging at 1.2C.

CNG Powertrain Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Engine, Fuel Injector, Transmission, Fuel Tank, Exhaust System, Control Unit

|

|

By Vehicle Type

|

Passenger Vehicles (Sedans, Hatchbacks, SUVs), Commercial Vehicles (Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV))

|

|

By Drive Type

|

Front Wheel Drive (FWD), Rear Wheel Drive (RWD), All-Wheel Drive (AWD)

|

|

By Fuel Type

|

Mono-fuel, Bi-fuel

|

|

By Application

|

Transportation, Logistics, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Engine, Fuel Injector, Transmission, Fuel Tank, and Exhaust System, and Control Unit): The engine segment earned USD 43.50 billion in 2024, primarily due to the rising adoption of CNG engines for fuel efficiency and emission compliance.

- By Vehicle Type (Passenger Vehicles and Commercial Vehicles): The passenger vehicles segment held a share of 79.00% in 2024, mainly attributed to strong consumer demand for affordable and cleaner mobility solutions.

- By Drive Type (Front Wheel Drive (FWD), Rear Wheel Drive (RWD), and All-Wheel Drive (AWD)): The front wheel drive (FWD) segment is projected to reach USD 262.93 billion by 2032, owing to its widespread use in compact and mid-sized vehicles.

- By Fuel Type (Mono-fuel and Bi-fuel): The mono-fuel segment is projected to reach USD 323.79 billion by 2032, owing to increasing preference for dedicated CNG-powered vehicles.

- By Application (Transportation, Logistics, and Industrial): The transportation segment earned USD 70.98 billion in 2024, largely due to the expanding use of CNG fleets in urban and intercity travel.

CNG Powertrain Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific CNG powertrain market share stood at 47.00% in 2024, valued at USD 53.80 billion. This dominance is reinforced by robust infrastructure development and government initiatives supporting CNG refueling stations.

Extensive networks of CNG stations in countries such as India and China are enabling wider adoption of CNG vehicles in both passenger and commercial segments. These measures are increasing vehicle accessibility and fueling convenience, which is driving continued demand for CNG powertrains and reinforcing the region’s market dominance.

- In March 2024, India inaugurated 201 CNG stations across 17 states, developed by 15 City Gas Distribution entities of the GAIL group across 52 geographical areas. The addition of these stations aims to expand access to cleaner fuel, support urban and industrial consumption, and promote the adoption of CNG vehicles.

The Europe CNG powertrain industry is poised to grow at a significant CAGR of 17.51% over the forecast period. The growth is propelled by the strong adoption of CNG in public transport systems across major cities. Governments and municipal authorities are investing in expanding CNG bus fleets and upgrading refueling infrastructure to meet emission reduction targets.

These initiatives are boosting demand for CNG powertrain components and prompting manufacturers to increase production capacity and develop advanced engines, positioning Europe as a key market for or CNG powertrains.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates CNG powertrains under the Clean Air Act through emission and fuel economy standards. These rules require manufacturers to comply with limits on greenhouse gases and criteria pollutants, ensuring that vehicles meet strict performance benchmarks before market entry.

- In Europe, the European Commission enforces CNG vehicle compliance under Regulation (EC) No. 715/2007, covering emissions for passenger and commercial fleets, establishing a harmonized framework across member states.

- In India, the Ministry of Road Transport and Highways (MoRTH) oversees CNG vehicle regulations under the Central Motor Vehicle Rules (CMVR). The framework specifies type approval, fuel system safety, and emission standards aligned with Bharat Stage VI norms.

- In Japan, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) regulates CNG vehicles under the Road Transport Vehicle Act emission norms.

Competitive Landscape

Key players in the global CNG powertrain market are forming strategic collaborations to advance hybrid and combustion powertrain components and systems. Companies are engaging in joint research and development programs to co-design CNG-adapted engines and hybrid control software.

Manufacturers are entering co-development agreements to integrate CNG storage modules with transmission and exhaust architectures. Companies are establishing supplier-OEM partnerships to align component specifications and accelerate production readiness. They are forming joint ventures for shared manufacturing of high-pressure fuel tanks and control units.

- In May 2024, Renault Group and Geely officially launched HORSE Powertrain Limited, a London-based joint venture with equal ownership. The company develops, produces, and sells hybrid and combustion powertrain solutions, including engines, transmissions, hybrid systems, and batteries, supporting alternative fuels such as ethanol, methanol, LPG, CNG, and hydrogen.

List of Key Companies in CNG Powertrain Market:

- Robert Bosch GmbH

- Shigan Quantum Technologies Limited

- Cummins Inc.

- AB Volvo

- Hyundai Motor Company

- Maruti Suzuki India Limited

- Iveco Group Company

- Scania

- Renault Group

- TATA Motors

- HINDUJA GROUP

- Mahindra&Mahindra Ltd.

- Volkswagen

- Ford Motor Company

- Allison Transmission, Inc.

Recent Developments

- In January 2025, Cummins Group in India launched its HELM engine platforms at the Bharat Mobility Global Expo, introducing the L10 engine, B6.7N natural gas engine, and advanced hydrogen Fuel Delivery System with Type IV storage vessels. The platforms offer flexible powertrain solutions across diesel, CNG/LNG, and hydrogen fuels, integrating advanced engines with next-generation components for commercial vehicles.