Market Definition

Cloud native storage is a modern storage approach designed for containerized applications and microservices. It enables dynamic provisioning, automated scaling, and seamless integration with cloud-native platforms.

It supports distributed and resilient workloads while ensuring high availability, portability, and efficient resource use across cloud environments. The market encompasses software-defined storage (SDS) solutions, persistent storage for containers, and services that optimize data availability, security, and management in hybrid and multi-cloud environments.

Cloud Native Storage Market Overview

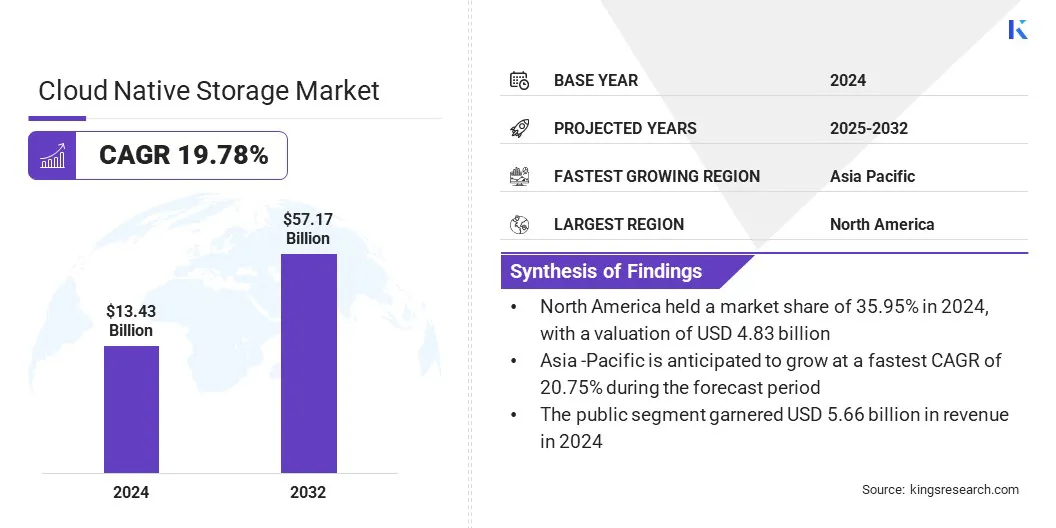

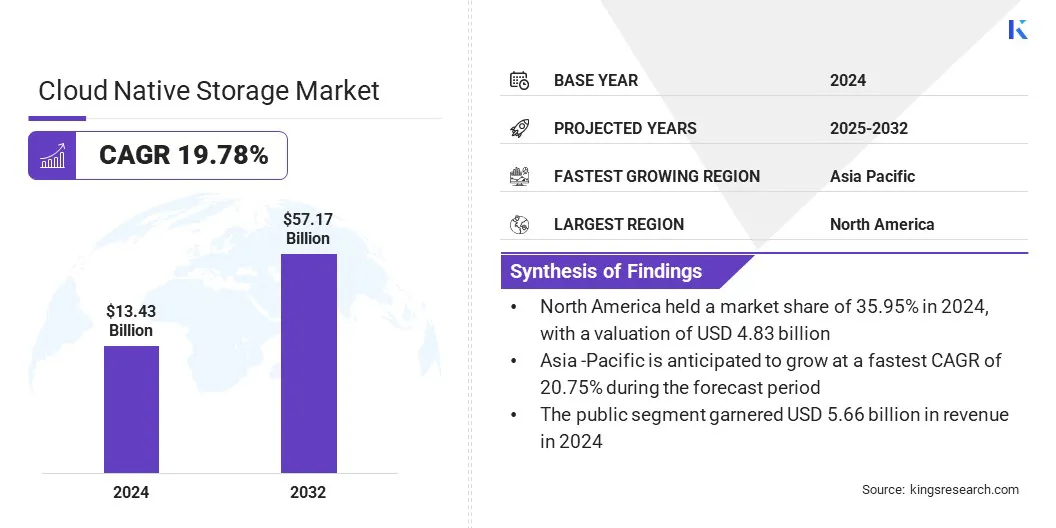

The global cloud native storage market size was valued at USD 13.43 billion in 2024 and is projected to grow from USD 16.05 billion in 2025 to USD 57.17 billion by 2032, exhibiting a CAGR of 19.78% over the forecast period.

Market growth is driven by the rising demand for scalable and flexible storage infrastructure to support large and complex workloads. The increasing enterprise shift toward hybrid and multi-cloud environments is further accelerating the adoption of cloud-native storage solutions across industries such as healthcare, BFSI, and media and entertainment.

Key Highlights:

- The cloud native storage industry size was recorded at USD 13.43 billion in 2024.

- The market is projected to grow at a CAGR of 19.78% from 2024 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 4.83 billion.

- The object storage segment garnered USD 4.86 billion in revenue in 2024.

- The public segment is expected to reach USD 23.85 billion by 2032.

- The data archiving segment is anticipated to witness the fastest CAGR of 20.37% over the forecast period.

- The BFSI segment held a share of 23.13% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 20.75% over the forecast period.

Major companies operating in the cloud native storage market are Amazon Web Services, Inc, Microsoft Corporation, Google LLC, Alibaba Group Holding Limited, Pure Storage, Inc, NetApp Inc, Dell Inc, Hewlett Packard Enterprise Development LP, SUSE Group, MinIO, Inc, Cloudian, Inc, Cohesity, Inc, Nutanix, Inc, IBM Corporation, and Huawei Corporation.

The growing demand for scalable and cost-efficient management of unstructured data is driving the adoption of cloud-native storage solutions. Market players are offering high-performance platforms with adaptive scalability and rapid deployment capabilities. These solutions are simplifying the management of distributed data and enabling organizations to meet the increasing requirements of unstructured workloads.

- In September 2024, Qumulo launched Cloud Native Qumulo (CNQ) on Amazon Web Services (AWS), delivering the world’s first cloud-native unstructured data system. CNQ provides an enterprise-proven, multi-protocol platform that enables scalable and cost-efficient management of unstructured data.

Market Driver

Increasing Adoption of Cloud Services

A key factor propelling the growth of the cloud native storage market is the increasing adoption of cloud services across public and private sectors. Organizations are rapidly shifting workloads to cloud environments to achieve scalability, cost efficiency, and business agility.

This transition is generating massive volumes of distributed data that require advanced storage platforms capable of ensuring resilience and seamless interoperability. The growing reliance on cloud services is creating strong demand for cloud native storage solutions that support hybrid and multi-cloud deployments.

- According to the Press Information Bureau (PIB) of India, as of December 2024, more than 300 government departments in the country are actively using cloud services.

Market Challenge

Integration Complexity with Legacy Storage Systems

A key challenge in the cloud native storage market is the integration complexity with legacy storage systems. Many enterprises rely on traditional on-premises storage that uses proprietary architectures and protocols.

Connecting these legacy systems with modern cloud native platforms requires specialized tools, extensive planning, and technical expertise. As a result, organizations face delays in fully leveraging the scalability, flexibility, and efficiency that cloud-native storage solutions offer.

To address this challenge, market players are developing hybrid and multi-cloud compatible solutions that bridge traditional and cloud-native environments. They are offering migration tools, APIs, and connectors to simplify data transfer and interoperability. Moreover, market players are providing managed solutions to guide enterprises through the planning, deployment, and optimization of cloud-native storage across their existing infrastructure.

Market Trend

Increasing Adoption of AI and Automation in Data Storage Management

A key trend influencing the cloud native storage market is the increasing adoption of AI and automation in data storage management. Market players are integrating AI-driven analytics and automated orchestration tools that enable predictive monitoring and anomaly detection across hybrid and multi-cloud environments.

These advancements are enhancing operational efficiency and optimizing resource utilization while ensuring data availability and resilience. This shift is driving enterprises to adopt intelligent, self-managing cloud-native storage solutions for handling complex workloads and improving the scalability of data-intensive operations.

- In March 2025, Huawei launched its AI-Ready Data Storage at MWC Barcelona, offering data lake solutions, diverse storage services, and the FlashEver business model. The platform is designed to help telecom carriers efficiently manage and monetize large-scale data while supporting AI-driven workloads.

Cloud Native Storage Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Object Storage, Block Storage, File Storage, Container Storage

|

|

By Deployment

|

Public, Private, Hybrid

|

|

By Application

|

Backup and Recovery, Data Archiving, Content Delivery, Database Storage, Others

|

|

By End Use

|

BFSI, IT & Telecom, Healthcare, Retail, Manufacturing, Government, Media & Entertainment, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Object Storage, Block Storage, File Storage, and Container Storage): The object storage segment earned USD 4.86 billion in 2024, driven by its scalability, cost-efficiency, and ability to manage unstructured data.

- By Deployment (Public, Private, and Hybrid): The public segment held 42.17% of the market in 2024, supported by widespread cloud adoption and demand for flexible, on-demand storage solutions.

- By Application (Backup and Recovery, Data Archiving, Content Delivery, Database Storage, and Others): The backup and recovery segment is projected to reach USD 16.07 billion by 2032, owing to increasing data protection needs and regulatory compliance requirements.

- By End Use (BFSI, IT & Telecom, Healthcare, Retail, Manufacturing, Government, Media & Entertainment, and Others): The manufacturing segment is anticipated to witness the fastest CAGR of 19.93% over the forecast period, driven by digital transformation and Industry 4.0 initiatives.

Cloud Native Storage Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America cloud native storage market share stood at 35.95% in 2024, valued at USD 4.83 billion. This dominance is attributed to the increasing adoption of hybrid and multi-cloud environments across the region.

The growing demand for high-performance, scalable storage for AI, analytics, and High-Performance Computing (HPC) is driving enterprises to adopt solutions that efficiently handle complex, data-intensive workloads. The growing shift toward containerized applications and microservices further fuels market expansion by enabling organizations to deploy and manage modular, cloud-native workloads efficiently.

- In September 2025, OpenDrives launched Astraeus, a cloud-native data services platform that enables enterprises to configure, store, manage, and deploy applications across on-premises, cloud, and hybrid environments. Astraeus addresses data fragmentation and sprawl while delivering cost-efficient, scalable, and resilient storage solutions for enterprise workloads.

Asia Pacific is set to grow at a CAGR of 20.75% over the forecast period. This growth is attributed to the rapid adoption of cloud technologies and the expansion of data-intensive applications across sectors such as healthcare, BFSI, and manufacturing. Enterprises in the region are increasingly deploying containerized applications and microservices, which require scalable cloud native storage solutions to manage distributed workloads efficiently.

Additionally, the increasing need for automated and cost-efficient data management is prompting enterprises to adopt modern storage platforms to simplify operations, thereby fueling market growth.

- In April 2025, Rakuten Symphony and Nirmata announced successful testing and certification of the Kyverno policy engine for Rakuten Cloud-Native Platform and Rakuten Cloud-Native Storage. The integration enables enterprises to enforce security, compliance, and operational policies across Kubernetes deployments.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) regulates data protection, privacy, and security standards for cloud-native storage services. It oversees compliance with laws such as the Federal Information Security Management Act (FISMA) and ensures the transparent handling of sensitive data. The FTC also monitors interoperability, data portability, and fair competition in cloud services.

- In the UK, the Information Commissioner’s Office (ICO) enforces data privacy, protection, and governance for cloud-native storage. It ensures compliance with UK GDPR and the Data Protection Act 2018, requiring encryption, access controls, breach notification, and accountability.

- In China, the Cyberspace Administration of China (CAC) governs data security, privacy, and cloud service operations, including cloud-native storage. It enforces the Personal Information Protection Law (PIPL) and Data Security Law (DSL), requiring encryption, data localization, and strict access controls while monitoring cloud reliability, resilience, and compliance with government reporting standards.

- In India, the Ministry of Electronics and Information Technology (MeitY) regulates cloud-native storage to ensure a secure digital infrastructure. It enforces the IT Act 2000, the Data Protection Bill, and cloud guidelines, overseeing data protection, access controls, interoperability, and data localization.

Competitive Landscape

Major players operating in the market are enhancing cloud-native storage solutions and software stacks to support containerized applications for efficient management of persistent workloads.

They are developing solutions to increase scalability and operational efficiency across hybrid and multi-cloud infrastructures. Additionally, players are focusing on providing tools for deploying and managing distributed data to help organizations optimize resources and accelerate cloud native storage adoption.

- In May 2025, Nutanix introduced Cloud Native Acropolis Operating System (AOS) at its NEXT Conference. The solution extends enterprise storage and advanced data services to Kubernetes services and cloud-native bare-metal environments without requiring a hypervisor. The solution enables enterprises to protect and manage stateful Kubernetes workloads with resiliency and simplified operations across hybrid and multi-cloud environments.

Top Key Companies in Cloud Native Storage Market:

- Amazon Web Services, Inc

- Microsoft Corporation

- Google LLC

- Alibaba Group Holding Limited

- Pure Storage, Inc

- NetApp Inc

- Dell Inc

- Hewlett Packard Enterprise Development LP

- SUSE Group

- MinIO, Inc

- Cloudian, Inc

- Cohesity, Inc

- Nutanix, Inc

- IBM Corporation

- Huawei Corporation.

Recent Developments

- In July 2025, Google Cloud and DDN launched Google Cloud Managed Lustre, a fully managed, cloud-native parallel file system powered by DDN EXAScaler technology. The solution delivers high-performance, scalable storage for AI pipelines, hybrid environments, and HPC workloads, enabling enterprises to accelerate data-intensive compute tasks in the cloud.