Market Definition

Chemical injection pumps are devices used to precisely deliver chemicals or additives into a process or system at controlled flow rates and pressures. They are commonly used in industries such as oil & gas, water treatment, and manufacturing to inject corrosion inhibitors, biocides, scale inhibitors, or other specialty chemicals into pipelines, tanks, or process streams.

The market encompasses the manufacturing, distribution, and application of pumps designed to deliver precise amounts of chemicals into industrial processes and systems.

Chemical Injection Pumps Market Overview

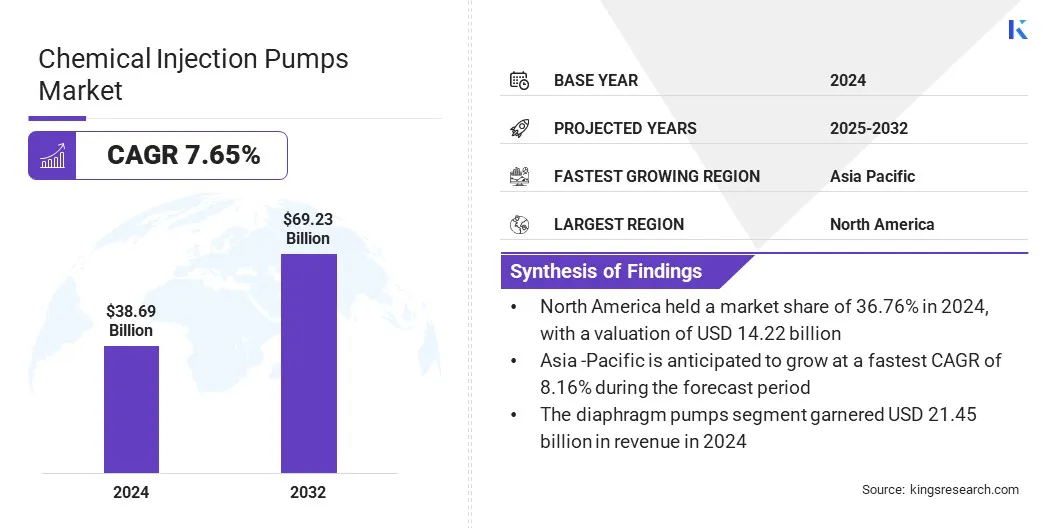

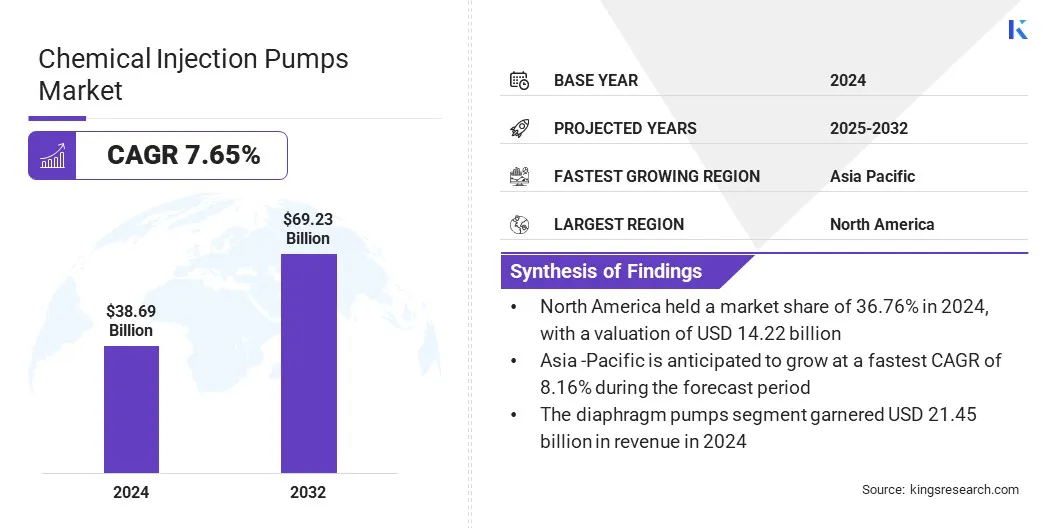

The global chemical injection pumps market size was valued at USD 38.69 billion in 2024 and is projected to grow from USD 41.31 billion in 2025 to USD 69.23 billion by 2032, exhibiting a CAGR of 7.65% over the forecast period.

Market growth is driven by the rising demand for precise chemical dosing in oil & gas, water treatment, and petrochemical industries. The growing need for corrosion prevention and scaling control in industrial pipelines and equipment is further driving the adoption of advanced chemical injection pump solutions across these sectors.

Key Highlights:

- The chemical injection pumps industry size was recorded at USD 38.69 billion in 2024.

- The market is projected to grow at a CAGR of 7.65% from 2025 to 2032.

- North America held a share of 36.76% in 2024, valued at USD 14.22 billion.

- The diaphragm pumps segment garnered USD 21.45 billion in revenue in 2024.

- The electric-driven pumps segment is expected to reach USD 32.22 billion by 2032.

- The water treatment segment is anticipated to witness the fastest CAGR of 8.94% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 8.16% over the forecast period.

Major companies operating in the chemical injection pumps market are Ingersoll Rand Inc., LEWA GmbH, Grundfos Pumps India Private Ltd., SEKO S.p.A, Graco Inc, IDEX India Pvt Ltd, SPX FLOW, Inc, PSG, ProMinent GmbH, Watson-Marlow Fluid Technology Solutions, Bruin Instruments Corp, Honeywell International Inc, McFarland-Tritan, LLC, Nikkiso Co., Ltd, and Rotech Pumps & Systems Inc.

Increasing growth in water and wastewater treatment infrastructure is driving the market. Expanding wastewater treatment capacity requires advanced chemical injection systems for disinfection, corrosion control, pH adjustment, and contaminant removal. This rising demand for reliable and efficient systems is boosting the adoption of automated, energy‑efficient, and modular chemical injection solutions across municipal and industrial water treatment projects.

- In Aug 2025, the U.S. Environmental Protection Agency (EPA) announced a 10 million-gallon expansion at the South Bay International Wastewater Treatment Plant, a 40% capacity increase that expanded its capacity to 35 million gallons per day

Market Driver

Expansion of the Oil & Gas Sector

A key driver propelling the growth of the chemical injection pumps market is the expansion of the oil & gas sector, which is increasing the need for reliable and efficient pumping solutions. Rising crude oil production and exploration activities are driving demand for systems that ensure corrosion control, scale prevention, and hydrate management.

Investments by leading energy companies and governments in advanced extraction technologies and oilfield infrastructure are increasing the volume and complexity of drilling operations. These developments are accelerating the adoption of chemical injection pumps to maintain equipment integrity, enhance flow assurance, and minimize operational downtime, thereby driving market growth.

- In July 2025, the U.S. Energy Information Administration (EIA) reported that U.S. crude oil production is projected to increase to an average of 13.4 million barrels per day by the end of 2025, up from 13.2 million barrels per day in 2024.

Market Challenge

High Initial Capital Investment

A key challenge impeding the growth of the chemical injection pumps market is the high initial capital investment required for pump procurement and installation. Chemical injection pump systems involve substantial upfront costs for advanced pump units, automation controls, corrosion-resistant materials, and integration with process systems.

Additionally, ongoing expenses for calibration, maintenance, and spare parts create barriers for small and medium-sized enterprises to adopt these systems. These cost challenges slow adoption rates and limit the market’s expansion.

To address this challenge, market players are focusing on developing cost-effective and modular chemical injection pump solutions that reduce installation and operational expenses.

They are offering scalable systems tailored to varying industrial needs for enhanced efficiency and cost optimization. Additionally, manufacturers are providing extended warranty programs, predictive maintenance services, and remote monitoring solutions to lower long-term operational and maintenance costs.

Market Trend

Development of Energy‑Efficient Pump Designs

A key trend influencing the chemical injection pumps market is the development of energy‑efficient pump designs. Manufacturers are focusing on innovations such as low‑power drives, variable speed control, intelligent sleep modes, and solar‑ready systems to minimize energy consumption while maintaining performance.

These advancements are improving operational efficiency, reducing maintenance needs, and lowering costs. Increasing emphasis on energy efficiency is enabling more sustainable pump operations and supporting the adoption of chemical injection solutions in industrial and remote environments.

- In June 2025, MCI Solutions unveiled its next‑generation multipoint chemical injection manifold, a solar‑ready system offering precise control, energy efficiency, and hazardous‑location certification. This innovation enables more accurate, customizable chemical injection across multiple points while reducing energy consumption.

Chemical Injection Pumps Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Diaphragm Pumps, Plunger/Piston Pumps, Peristaltic Pumps, Others

|

|

By Power Source

|

Electric-Driven Pumps, Hydraulic-Driven Pumps, Pneumatic-Driven Pumps, Solar-Powered Pumps

|

|

By Application

|

Water Treatment, Oil & Gas, Food & Beverage, Pharmaceuticals, Agriculture, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Diaphragm Pumps, Plunger/Piston Pumps, Peristaltic Pumps, and Others): The diaphragm pumps segment earned USD 21.45 billion in 2024 due to its high accuracy, durability, and suitability for handling corrosive and viscous fluids across multiple industries.

- By Power Source (Electric-Driven Pumps, Hydraulic-Driven Pumps, Pneumatic-Driven Pumps, and Solar-Powered Pumps): The electric-driven pumps segment held 45.00% of the market in 2024, due to its energy efficiency, low maintenance requirements, and wide industrial applicability.

- By Application (Water Treatment, Oil & Gas, Food & Beverage, Pharmaceuticals, Agriculture, and Others): The water treatment segment is projected to reach USD 24.37 billion by 2032, owing to increasing demand for safe water supply, stringent regulations, and expanding wastewater treatment infrastructure globally.

Chemical Injection Pumps Market Regional Analysis

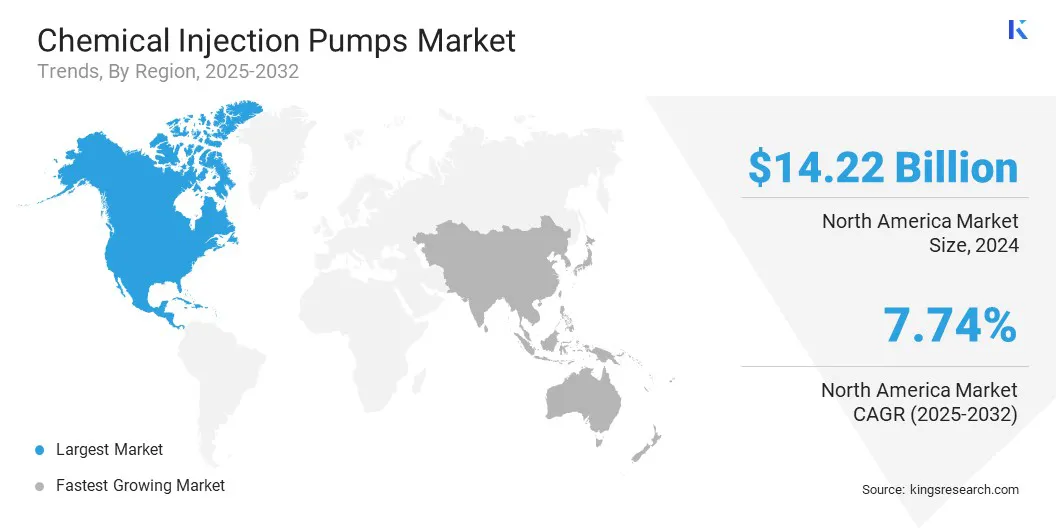

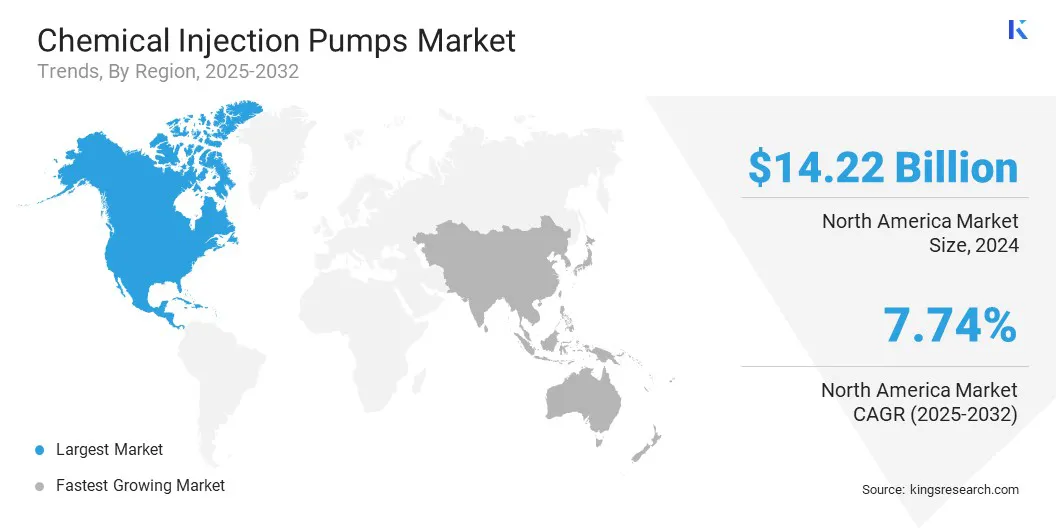

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America chemical injection pumps market share stood at 36.76% in 2024, valued at USD 14.22 billion. This dominance is driven by the rising demand for automation and precision in industrial processes, which is enhancing operational efficiency and reducing the costs of chemical injection and process management.

Increasing investments by oilfield service providers and infrastructure developers in the oil & gas, petrochemical, and water treatment sectors are fueling demand for reliable and high-performance chemical injection systems. The growing emphasis on energy efficiency and sustainability in the region is also encouraging the adoption of advanced pump designs.

- In August 2025, TASI Measurement acquired DCiii, LLC to strengthen its Remote Asset Measurement & Monitoring Division. This acquisition is enabling TASI to enhance automation, precision, and efficiency in chemical injection processes.

Asia Pacific is set to grow at a CAGR of 8.16% over the forecast period. This growth is driven by the rapid industrialization, driven by large‑scale infrastructure development and increasing manufacturing activities by governments and leading energy companies. Expanding oil & gas exploration and petrochemical production by leading energy companies and industrial manufacturers are creating strong demand for advanced chemical injection solutions.

Increasing government investment in sustainable infrastructure and the adoption of automation and energy‑efficient pump systems are further supporting growth. Additionally, regional players are focusing on strengthening manufacturing capabilities and broadening their product portfolios, thereby accelerating market growth across the region.

- In August 2025, Circor International Inc acquired Indian pump manufacturers Swelore Engineering Pvt Ltd and Hiro Nisha Systems Pvt Ltd. This acquisition adds diaphragm metering pumps, dosing packages, and high‑pressure reciprocating pumps to its industrial portfolio. It is enabling Circor to expand its pump offerings and strengthen its presence in India.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) oversees environmental safety, including the operation of chemical injection pumps in water treatment, oil & gas, and industrial applications. It regulates chemical handling, discharge limits, and compliance under laws such as the Clean Water Act, ensuring pollution control and equipment safety.

- In the UK, the Health and Safety Executive (HSE) oversees the safe operation of chemical injection systems in oil & gas, water treatment, and manufacturing. It regulates chemical storage, dosing accuracy, and equipment safety under the Control of Substances Hazardous to Health Regulations (COSHH). It ensures workplace safety, environmental protection, and regulatory compliance.

- In China, the Ministry of Ecology and Environment (MEE) regulates environmental protection and industrial safety for chemical injection pump operations in water treatment, petrochemical, and manufacturing sectors. It oversees discharge standards, chemical safety, and environmental impact assessments, ensuring pollution control, sustainable practices, and adherence to China’s energy efficiency and environmental regulations.

- In India, the Central Pollution Control Board (CPCB) oversees pollution control and industrial safety, regulating chemical injection systems in water treatment and manufacturing. It enforces guidelines under the Water (Prevention and Control of Pollution) Act and Environmental Protection Act, ensuring safe chemical dosing, effluent quality, emission control, and sustainable industrial practices.

Competitive Landscape

Companies operating in the chemical injection pumps industry are actively expanding their product portfolios by introducing modular, energy-efficient, and automation-enabled pump systems that enhance precision and reduce operational costs.

They are focusing on strategic acquisitions and partnerships to expand product and service offerings and enhance technological capabilities for the oil & gas industry. Additionally, market players are focusing on advancing water treatment solutions by integrating innovative dosing technologies that address the rising demand for sustainable chemical injection systems.

- In May 2025, Verder Group acquired a majority stake in Spanish dosing pump manufacturer ITC to strengthen its dosing pump range. This acquisition is enabling Verder to enhance its chemical injection capabilities and water treatment infrastructure.

Top Key Companies in Chemical Injection Pumps Market:

- Ingersoll Rand Inc

- LEWA GmbH

- Grundfos Pumps India Private Ltd.

- SEKO S.p.A

- Graco Inc

- IDEX India Pvt Ltd

- SPX FLOW, Inc

- PSG

- ProMinent GmbH

- Watson-Marlow Fluid Technology Solutions

- Bruin Instruments Corp

- Honeywell International Inc

- McFarland-Tritan, LLC

- Nikkiso Co., Ltd

- Rotech Pumps & Systems Inc.

Recent Developments

- In June 2025, Honeywell completed the USD 2.16 billion acquisition of Sundyne, a leader in highly engineered pumps and compressors for process industries. This acquisition is expected to expand Honeywell’s capabilities in the process industry, enhance the integration of critical equipment with advanced automation, and strengthen its presence across refining, petrochemicals, LNG, and renewable fuels.

- In July 2024, Milton Roy launched the new Primeroyal Q Series chemical metering pump, expanding its product portfolio with advanced metering technology. This series features eight drive sizes and nine liquid end technologies, delivering a maximum flow rate of 8,657 L/h and a discharge pressure of 1,035 bar.