Market Definition

The market involves analytical devices designed to detect and quantify biological or chemical substances through the integration of biological sensing components and physical transducers. These systems convert biological interactions into measurable electrical, optical, thermal, or mechanical signals, enabling precise and real-time analysis.

They play a vital role in improving diagnostic accuracy, environmental safety, and process efficiency across industries such as healthcare, food and beverage, biotechnology, and environmental monitoring. The report includes segmentation based on type, technology, and application across key regions.

Biosensors Market Overview

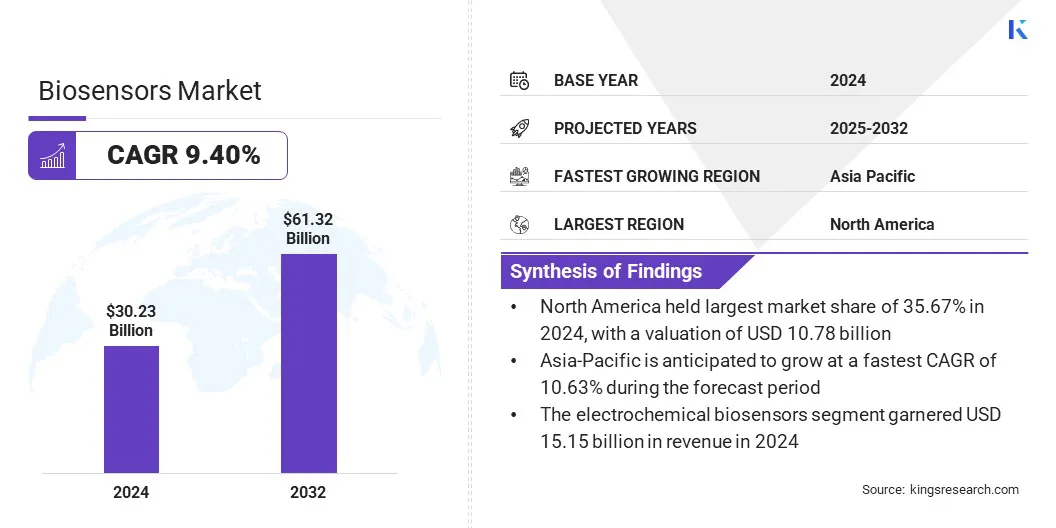

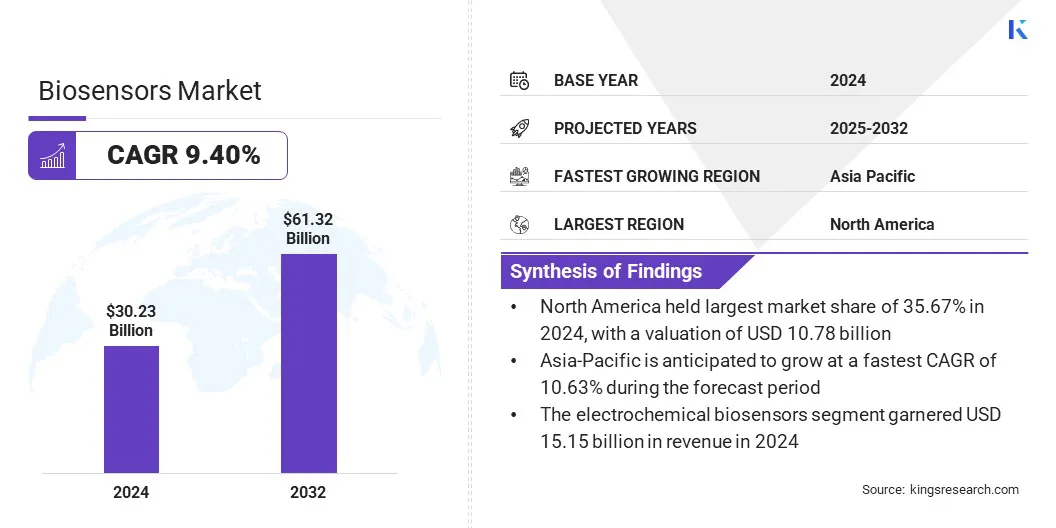

The global biosensors market size was valued at USD 30.23 billion in 2024 and is projected to grow from USD 32.70 billion in 2025 to USD 61.32 billion by 2032, exhibiting a CAGR of 9.40% over the forecast period.

The market is witnessing strong growth driven by rising demand for rapid diagnostics, expanding use in wearable health monitoring devices, and advancements in electrochemical and optical sensor technologies, enhancing accuracy, portability, and real-time data analysis.

Key Highlights:

- The biosensors industry size was recorded at USD 30.23 billion in 2024.

- The market is projected to grow at a CAGR of 9.40% from 2025 to 2032.

- North America held a market share of 35.67% in 2024, with a valuation of USD 10.78 billion.

- The wearable biosensors segment garnered USD 13.06 billion in revenue in 2024.

- The electrochemical biosensors segment is expected to reach USD 30.72 billion by 2032.

- The medical diagnostics segment is anticipated to witness the fastest CAGR of 10.16% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 10.63% over the forecast period.

Major companies operating in the biosensors market are Abbott, F. Hoffmann-La Roche Ltd, Medtronic, Bio-Rad Laboratories, Inc., DuPont, Biosensors International Group, Ltd., Dexcom, Inc., Masimo, Nova Biomedical, Universal Biosensors, Thermo Fisher Scientific Inc., Siemens Healthineers AG, Johnson & Johnson Services, Inc., Agilent Technologies, Inc., and Honeywell International Inc.

Market expansion in the biosensors sector is fueled by the growing demand for rapid, accurate, and real-time diagnostic solutions, driven by rising prevalence of chronic diseases and increasing adoption of wearable health technologies.

In response, leading players are investing in R&D for next-generation biosensor platforms, developing functionalized and miniaturized devices, and integrating advanced materials and semiconductor technologies.

Companies are also forming strategic partnerships, enhancing manufacturing capabilities, and refining commercialization strategies to improve device accessibility, accelerate deployment across clinical and home healthcare settings, and support wider market adoption.

- In June 2025, Linxens partnered with FlexMedical Solutions to develop pre-functionalized electrodes designed for advanced biosensor applications. The collaboration combines Linxens’ large-scale manufacturing capacity with FMS’s specialized biosensor expertise to speed up the creation of diagnostic devices. The partnership focuses on solutions for point-of-care testing, wearable health technologies, and management of chronic diseases.

How is the rising prevalence of chronic diseases influencing biosensor adoption?

A key factor driving the growth of the biosensors market is the rising prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and cancer. The increasing number of diabetes cases, fueled by aging populations, sedentary lifestyles, and poor dietary habits, is creating a significant need for effective disease management solutions.

Patients and healthcare providers are increasingly relying on rapid, accurate, and continuous glucose monitoring to maintain optimal blood sugar levels and prevent complications. This growing demand is accelerating the adoption of advanced biosensor technologies, including wearable and portable devices, across hospitals, clinics, and home healthcare settings, supporting real-time monitoring and improved patient outcomes.

- According to the International Diabetes Federation (IDF) Diabetes Atlas (2025), 11.1% of the global adult population (20–79 years), approximately 1 in 9 adults, is living with diabetes, with over 40% unaware of their condition. Projections indicate that by 2050, nearly 1 in 8 adults, or around 853 Billion people, will be affected, representing a 46% increase in prevalence.

How do high development and operational costs impact the adoption of advanced biosensor technologies?

A key challenge restraining the growth of the biosensors market is the high cost of advanced biosensor technologies and devices. Developing, manufacturing, and maintaining precise biosensor systems, particularly wearable and real-time monitoring platforms, requires significant investment, while integration with digital health infrastructure and skilled personnel for interpretation further increases operational expenses. These cost barriers can limit adoption, especially among small clinics, emerging markets, and home healthcare users.

To address this challenge, market players are focusing on developing cost-effective, miniaturized, and energy-efficient biosensors, offering service and training programs, and forming strategic partnerships to improve accessibility and drive wider adoption across healthcare settings.

How is the adoption of wearable health technologies driving market demand for biosensors?

A key trend influencing the biosensors market is the growing adoption of wearable health technologies. Patients and healthcare providers are increasingly integrating biosensor-enabled wearable devices to monitor physiological parameters such as glucose levels, heart rate, and oxygen saturation in real time.

These innovations enhance personalized healthcare, enable continuous monitoring, and support timely medical interventions, driving wider adoption across hospitals, clinics, and home healthcare settings, thereby driving market growth.

- In November 2023, DuPont Liveo Healthcare Solutions, in collaboration with STMicroelectronics, announced the development of a new smart wearable device for remote biosignal monitoring. The device integrates advanced materials and semiconductor technology to enable real-time tracking of physiological parameters, enhancing personalized healthcare and supporting continuous patient monitoring across clinical and home settings.

Biosensors Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Wearable Biosensors, Non-wearable Biosensors

|

|

By Technology

|

Electrochemical Biosensors, Optical Biosensors, Piezoelectric Biosensors, Thermal Biosensors, Others

|

|

By Application

|

Medical Diagnostics, Food and Beverage Industry, Environmental Monitoring, Research and Development, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Wearable Biosensors and Non-Wearable Biosensors): The non-wearable biosensors segment earned USD 17.17 billion in 2024, driven by widespread adoption in clinical laboratories and hospital diagnostic applications.

- By Technology (Electrochemical Biosensors, Optical Biosensors, Piezoelectric Biosensors, and Thermal Biosensors): The electrochemical biosensors held 50.11% of the market in 2024, supported by their high sensitivity, low cost, and ease of integration into portable devices.

- By Application (Medical Diagnostics, Food and Beverage Industry, Environmental Monitoring, and Research and Development): The medical diagnostics segment is projected to reach USD 41.63 billion by 2032, owing to the increasing prevalence of chronic diseases and the rising demand for rapid, accurate diagnostic tools.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global biosensors market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America biosensors market share stood around 35.67% in 2024 in the global market, with a valuation of USD 10.78 billion. This dominance is due to the high adoption of advanced healthcare technologies and early acceptance of innovative diagnostic solutions.

Advanced healthcare infrastructure, widespread access to state-of-the-art hospitals and clinics, and supportive reimbursement policies are further driving the adoption of biosensor technologies.

Additionally, leading companies in the North American market are strengthening their portfolios through strategic partnerships, collaborative research, and targeted R&D investments to address the expanding patient base and rising demand for advanced diagnostic solutions.

Companies are introducing advanced wearable devices, continuous monitoring systems, and point-of-care diagnostics through these initiatives, contributing significantly to regional market growth.

- In March 2024, the U.S. Food and Drug Administration cleared the Dexcom Stelo Glucose Biosensor System for over-the-counter marketing. The integrated continuous glucose monitor (iCGM) is intended for individuals 18 years and older who do not use insulin, including those managing diabetes with oral medications or non-diabetic users seeking insights into diet and exercise effects on blood sugar.

Asia-Pacific is poised for significant growth at a robust CAGR of 10.63% over the forecast period, driven by increasing healthcare awareness, rising prevalence of chronic diseases, and expanding access to modern medical facilities.

Countries such as China, India, Japan, and South Korea are witnessing a surge in diabetes, cardiovascular disorders, and lifestyle-related conditions, creating strong demand for real-time diagnostic and monitoring solutions. Government initiatives to improve healthcare infrastructure, expand insurance coverage, and promote digital health technologies are further supporting market growth in the region.

Regulatory Frameworks

- In North America, the U.S. Food and Drug Administration (FDA) regulates biosensor devices, including wearable and non-wearable systems, enforcing strict guidelines on device safety, performance, clinical validation, and labeling requirements.

- In the European Union, biosensors fall under the Medical Devices Regulation (MDR) (EU 2017/745), which sets standards for safety, efficacy, risk management, and post-market surveillance, with additional focus on CE marking and compliance with ISO standards.

- In China, the National Medical Products Administration (NMPA) oversees biosensor approvals, including evaluation of safety, performance, quality control, and registration requirements for diagnostic and monitoring devices.

- Globally, organizations such as the International Organization for Standardization (ISO) and the World Health Organization (WHO) provide guidance on device standards, quality management systems, and clinical best practices to ensure the safety, reliability, and interoperability of biosensor technologies.

Competitive Landscape

Leading players operating in the biosensors industry are focusing on technological innovation, portfolio expansion, and strategic collaborations to meet the growing demand for real-time, accurate, and non-invasive diagnostic solutions.

Companies are conducting clinical studies, pilot programs, and post-market evaluations to validate device performance, safety, and efficacy, supporting regulatory approvals and broader adoption across hospitals, clinics, and home healthcare settings. Additionally, companies are enhancing manufacturing capabilities, offering training and support programs, and forming strategic partnerships to improve accessibility and streamline device integration.

- In February 2025, Strados Labs announced a collaboration with Beth Israel Deaconess Medical Center (BIDMC) to evaluate its FDA-cleared RESP Biosensor for early detection of pulmonary edema in mechanically ventilated patients. The 12-month pilot study will enroll 20 patients and aims to validate the device’s real-time monitoring capabilities, supporting wider adoption of wearable biosensor technologies in critical care settings.

Key Companies in Biosensors Market:

- Abbott

- Hoffmann-La Roche Ltd

- Medtronic

- Bio-Rad Laboratories, Inc.

- DuPont

- Biosensors International Group, Ltd.

- Dexcom, Inc.

- Masimo.

- Nova Biomedical

- Universal Biosensors

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- Johnson & Johnson Services, Inc.

- Agilent Technologies, Inc.

- Honeywell International Inc

Recent Developments

- In August 2024, Medtronic plc received U.S. FDA clearance for its Simplera continuous glucose monitor (CGM). The platform combines the CGM, compatible with the Simplera Sync sensor, and the InPen smart insulin pen, which connects with the MiniMed 780G system, offering enhanced functionality for effective diabetes management.

- In June 2024, Abbott obtained CE Mark approval for the AVEIR DR, the first dual-chamber leadless pacemaker system globally, marking a significant innovation in cardiac therapy. The company is simultaneously extending its continuous glucose monitoring (CGM) technology beyond conventional diabetes care, enabling broader use in real-time patient monitoring and preventive health management.