Market Definition

Battery separators are essential porous membranes positioned between the anode and cathode in a battery cell to prevent electrical short circuits while allowing ionic conductivity. They ensure cell safety, efficiency, and longevity across lithium-ion, lead-acid, and emerging solid-state battery technologies.

Typically composed of polyethylene (PE), polypropylene (PP), or composite multilayers, these materials offer high thermal stability and chemical resistance. Ongoing innovations focus on enhancing mechanical strength, electrolyte wettability, and shutdown capabilities to meet the increasing performance and safety demands of electric vehicles, consumer electronics, and energy storage systems.

Battery Separator Market Overview

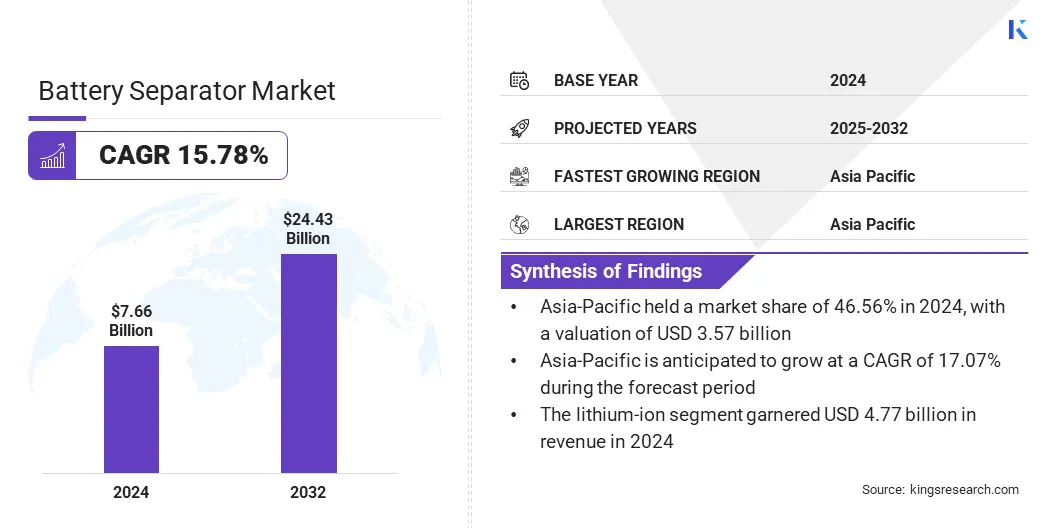

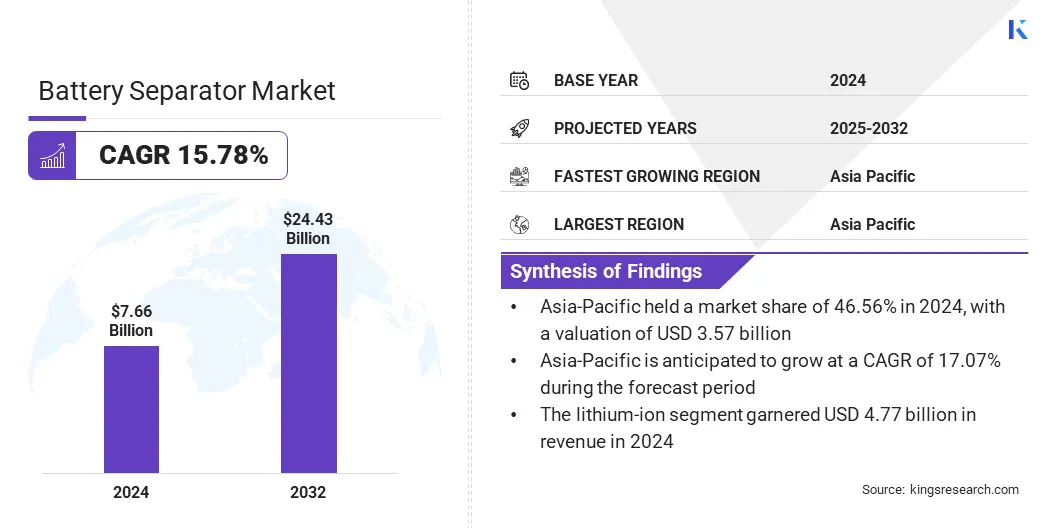

According to Kings Research, the global battery separator market size was valued at USD 7.66 billion in 2024 and is projected to grow from USD 8.76 billion in 2025 to USD 24.43 billion by 2032, exhibiting a CAGR of 15.78% during the forecast period.

This growth is driven by rising demand for electric vehicles and energy storage systems. Manufacturers are focusing on developing high-performance, heat-resistant, and ceramic-coated separators to enhance safety, efficiency, and lifecycle stability in next-generation batteries, contributing to market expansion.

Key Market Highlights:

- The battery separator industry size was recorded at USD 7.66 billion in 2024.

- The market is projected to grow at a CAGR of 15.78% from 2024 to 2032.

- North America held a share of 25.43% in 2024, valued at USD 1.95 billion.

- The lithium-ion segment garnered USD 4.24 billion in revenue in 2024.

- The polyethylene segment is expected to reach USD 11.11 billion by 2032.

- The wet battery separator segment is expected to register a share of 58.17% by 2032.

- The automotive segment accounted for a share of 53.23% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 17.07% over the forecast period.

Major companies operating in the global battery separator market are Asahi Kasei Corporation, Toray Industries, Inc., Sumitomo Chemical Co., Ltd., SK Inc., UBE Corporation, Shanghai Energy New Materials Technology Co., Ltd., Freudenberg SE, W-SCOPE CORPORATION , Sinoma Science & Technology Co.,Ltd., Mitsubishi Chemical Group Corporation., TEIJIN LIMITED. , Yunnan Enjie New Materials Co., Ltd., Cangzhou Mingzhu Plastic Co., Gellec, and Shenzhen Zhongxing Innovative Material Technologies Co., LTD.

The growing emphasis on sustainability and circular manufacturing is fueling the adoption of battery separators. To align with environmental regulations and customer expectations, manufacturers are integrating eco-friendly production practices such as solvent-free coating, recyclable polymer formulations, and closed-loop material recovery systems.

Leading players are also partnering with automakers and battery producers to develop low-carbon separator solutions that reduce lifecycle emissions and enhance supply chain transparency.

- In April 2024, ENTEK International LLC received the 2024 BCI Innovation Award for its solvent-free separator technology, which enhances sustainability without compromising mechanical strength or electrochemical performance.

How is the growing demand for battery separators in electric vehicle (EV) applications boosting market expansion?

The growth of the battery separator market is primarily fueled by the rapid adoption of electric vehicles (EVs) worldwide, which is increasing demand for high-performance lithium-ion batteries.

- According to the International Energy Agency (IEA), global electric car sales exceeded 17 million units in 2024, capturing a market share of over 20% of total vehicle sales.

This surge in EV deployment is creating a strong demand for advanced battery separators that ensure safety, thermal stability, and long cycle life. These high-performance separators improve ionic conductivity, prevent short circuits, and support high-energy-density cells, making them essential to next-generation battery technologies.

What challenges do stringent safety and performance requirements for high-energy-density batteries pose to market growth?

A key challenge impeding the progress of the battery separator market is the stringent safety and performance requirements associated with high-energy-density batteries, limiting adoption and increasing production complexity.

Ensuring thermal stability, mechanical strength, and chemical resistance is critical to prevent short circuits, thermal runaway, and battery failure, particularly in electric vehicles and large-scale energy storage systems.

To address this challenge, market players are developing advanced multilayer and ceramic-coated separators that enhance safety and durability. Additionally, manufacturers are investing in scalable production processes and rigorous quality testing to meet regulatory standards and support the growing demand for reliable, high-performance batteries.

How is the trend toward advanced separator technologies adoption positively impacting the market?

A notable trend influencing the market is the development and adoption of advanced separator technologies designed to enhance battery safety, performance, and lifespan. Manufacturers are increasingly integrating multi-layer structures, ceramic coatings, and high-strength polymer materials to improve thermal stability, mechanical integrity, and ionic conductivity.

These innovations support high-energy-density lithium-ion cells, enable fast-charging capabilities, and reduce the risk of thermal runaway. The trend toward safer, more efficient, and longer-lasting separators is further supported by the rising demand for electric vehicles, portable electronics, and large-scale energy storage systems.

- For instance, in June 2024, Asahi Kasei demonstrated a proof of concept for lithium-ion batteries featuring its proprietary high ionic conductive electrolyte. This innovation enables higher power output at low temperatures, improved durability at high temperatures, and the potential for more compact, energy-dense battery packs.

Battery Separator Market Report Snapshot

|

Segmentation

|

Details

|

|

By Battery Type

|

Lithium-ion, Lead-acid, Nickel-based, Others

|

|

By Material

|

Polyethylene, Polypropylene, Nylon and Polyester, Others

|

|

By Technology

|

Dry Battery Separator, Wet Battery Separator

|

|

By End Use

|

Automotive, Consumer Electronics, Industrial and Energy Storage Systems, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Battery Type (Lithium-ion, Lead-acid, Nickel-based, and Others): The lithium-ion segment earned USD 4.77 billion in 2024, mainly fueled by the rising adoption of electric vehicles and energy storage systems requiring high-performance, reliable, and safe battery solutions.

- By Material (Polyethylene, Polypropylene, Nylon and Polyester, and Others): The polyethylene segment held a share of 46.55% in 2024, largely attributed to its chemical resistance, mechanical strength, and widespread use in lithium-ion battery separators.

- By Technology (Dry Battery Separator and Wet Battery Separator): The wet battery separator segment is projected to reach USD 14.21 billion by 2032, owing to its superior electrolyte retention, enhanced ionic conductivity, and suitability for high-performance lithium-ion batteries.

- By End Use (Automotive, Consumer Electronics, Industrial and Energy Storage Systems, and Others): The automotive segment is projected to reach USD 14.63 billion by 2032, fueled by the increasing adoption of electric vehicles and the rising demand for high-performance, reliable battery systems in the transportation sector.

What is the market scenario in Asia-Pacific and North America region?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific battery separator market share stood at 46.56% in 2024, valued at USD 3.57 billion. This dominance is reinforced by the rapid adoption of electric vehicles (EVs) and expansion of renewable energy storage infrastructure across the region.

Countries such as China, Japan, South Korea, and India are investing heavily in lithium-ion battery production, which is creating a strong demand for high-performance separators. Manufacturers in the region are focusing on developing advanced polymer and ceramic-coated separators to meet rising safety, thermal, and efficiency requirements, bolstering regional market growth.

- According to REN21, global investment in battery storage rose by 76.8% in 2023, reaching USD 36.3 billion. China accounted for the largest share, investing approximately USD 14.5 billion, a surge of over 200% from the previous year.

The North America battery separator industry is set to grow at a robust CAGR of 14.09% over the forecast period. This notable expansion is supported by strong investments in domestic battery manufacturing and electric vehicle (EV) supply chain development in the U.S. and Canada.

The U.S. Inflation Reduction Act (IRA) has further accelerated regional production of lithium-ion batteries, promoting local sourcing of critical components such as separators. Additionally, the presence of major EV manufacturers and collaborations between material innovators and cell producers are fostering advancements in separator technology, particularly those enhancing thermal stability and safety for next-generation batteries.

- In November 2024, Asahi Kasei, in partnership with, initiated the construction of a lithium-ion battery separator manufacturing plant in Port Colborne, Ontario, Canada. The plant aims to strengthen the North American EV supply chain and is expected to begin commercial operations in 2027.

Regulatory Frameworks

- In the U.S., battery separators and related components are governed by the U.S. Department of Transportation (DOT) and the Environmental Protection Agency (EPA), which set standards for battery safety, transportation, and environmental compliance.

- In Europe, the European Union regulates battery components under the EU Battery Directive and the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) framework. These regulations ensure safe handling, chemical compliance, and end-of-life recycling of battery materials across member states.

- In China, the Ministry of Industry and Information Technology (MIIT) oversees battery safety and manufacturing standards.

- Globally, International standards such as IEC 62619 and ISO 12405 provide safety, performance, and testing guidelines for lithium-ion batteries and separators, promoting harmonization of manufacturing practices and ensuring cross-border compliance for battery components.

Competitive Landscape

Leading manufacturers in the battery separator market are prioritizing regional expansion, production scaling, and technological innovation to strengthen market presence and capture emerging growth opportunities.

Companies are investing in new manufacturing facilities and capacity upgrades across key regions to ensure stable supply chains and meet the increasing demand from the electric vehicle and energy storage sectors.

Furthermore, strategic investments in R&D are focused on developing advanced separator materials that enhance performance, safety, and sustainability. These initiatives aim to improve operational efficiency, reduce production costs, and align with the global shift toward electrification and clean energy technologies.

- In February 2025, SK IE Technology partnered with Gotion to increase the supply of battery separators for electric vehicle (EV) and energy storage system (ESS) applications, focusing on expanding their presence in the North American and European regions.

List of Key Companies in Battery Separator Market:

- Asahi Kasei Corporation

- Toray Industries, Inc.

- Sumitomo Chemical Co., Ltd.

- SK Inc.

- UBE Corporation

- Shanghai Energy New Materials Technology Co., Ltd.

- Freudenberg SE

- W-SCOPE CORPORATION

- Sinoma Science & Technology Co.,Ltd.

- Mitsubishi Chemical Group Corporation.

- TEIJIN LIMITED.

- Yunnan Enjie New Materials Co., Ltd.

- Cangzhou Mingzhu Plastic Co.

- Gellec

- Shenzhen Zhongxing Innovative Material Technologies Co., LTD