Market Definition

Battery packaging refers to specialized enclosures and protective systems that contain, safeguard, and support battery cells or modules. These solutions are essential for maintaining safety, reliability, and performance across applications such as electric vehicles, renewable energy storage, consumer electronics, and industrial power systems.

Battery packaging is available in prismatic, cylindrical, and pouch formats in various materials such as aluminum, steel, and advanced polymers. The choice of design and material depends on factors like thermal management, structural integrity, lightweight construction, and compliance with global safety standards.

Battery Packaging Market Overview

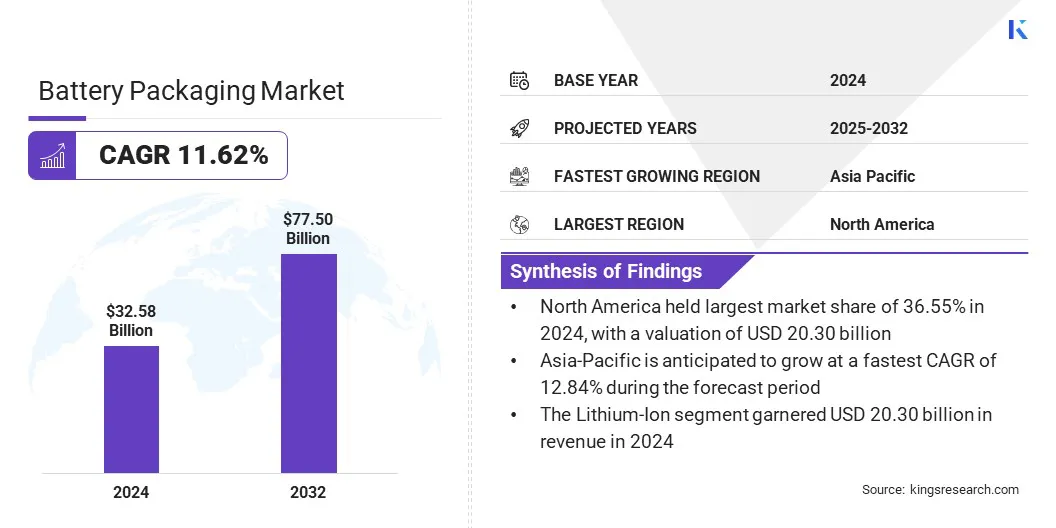

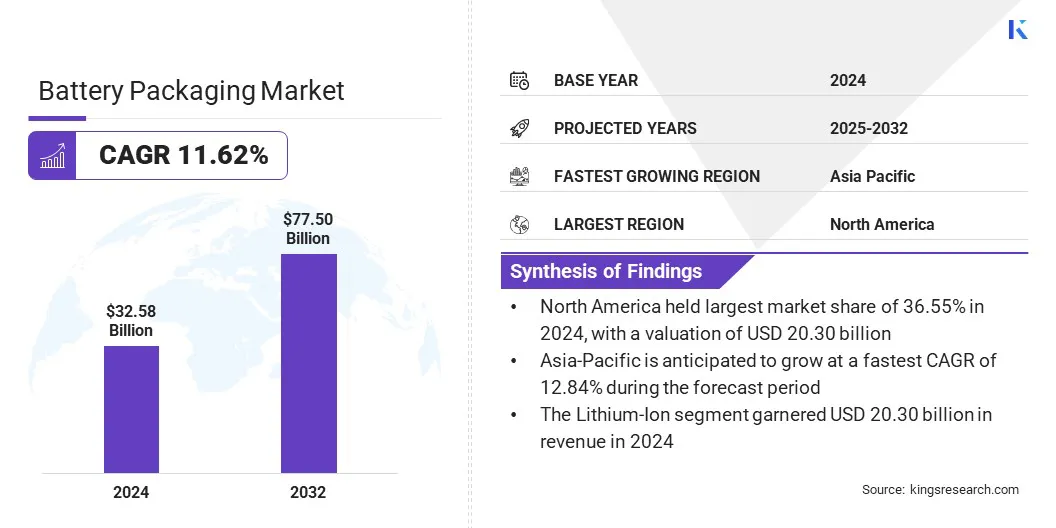

The global battery packaging market size was valued at USD 32.58 billion in 2024 and is projected to grow from USD 35.91 billion in 2025 to USD 77.50 billion by 2032, exhibiting a CAGR of 11.62% over the forecast period.

This growth stems from the rising usage of electric vehicles, renewable energy storage systems, and portable electronics. Increasing focus on safety, lightweight materials, and thermal management is shaping innovation, while strict regulatory standards along with sustainability goals are increasing demand for advanced packaging solutions worldwide.

Key Highlights:

- The battery packaging industry size was recorded at USD 32.58 billion in 2024.

- The market is projected to grow at a CAGR of 11.62% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 11.91 billion.

- The lithium-ion segment garnered USD 20.30 billion in revenue in 2024.

- The prismatic segment is expected to reach USD 31.36 billion by 2032.

- The plastics segment is anticipated to witness fastest CAGR of 12.68% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 12.84% during the forecast period.

Major companies operating in the battery packaging market are Nefab Group, Wellplast AB, C.L. Smith, Cadenza Innovation Inc., Söhner Kunststofftechnik GmbH, GWP Protective, EaglePicher Technologies, Covestro AG, Trinseo., Manika Plastech Ltd., Rogers Corporation, Anchor Bay Packaging, TOPPAN Inc., Corplex, and Air Sea Containers.

The growing focus on sustainability is driving the demand for eco-friendly, efficient, and recyclable packaging solutions. Rising regulatory requirements and environmental awareness are encouraging manufacturers to use lightweight, bio-based, and low-VOC materials that improve safety and thermal management.

Key players are investing in R&D to improve material quality, optimize battery protection, and simplify recycling. The shift toward a circular economy is also encouraging the adoption of modular and reusable designs aligned with sustainability goals and regulatory standards.

- In January 2025, Energizer Holdings introduced 100% recyclable, plastic-free packaging across its Energizer battery portfolio, reinforcing its commitment to sustainability and responsible packaging.

Market Driver

Rising Adoption of Electric Vehicles (EVs)

The growing use of electric vehicles (EVs) and energy storage systems is driving the battery packaging market. Advanced enclosures ensure safe operation and protect cells from mechanical stress, thermal fluctuations, and short circuits.

Hence, the increasing use of high-capacity battery packs creates a demand for lightweight, durable, and thermally efficient packaging solutions to optimize performance and extend lifecycle. The integration of advanced thermal management and safety technologies improves operational reliability, prompting manufacturers to invest in innovative designs.

- According to the International Energy Agency (IEA) Global EV Outlook 2025, global electric vehicle (EV) sales exceeded 17 million in 2024, accounting for over 20% of total car sales. Forecasts for 2025 indicate that EV sales are expected to surpass 20 million worldwide, representing more than one-quarter of all vehicles sold.

Market Challenge

High Material Costs and Supply Chain Challenges

A key challenge limiting the market is the high cost and limited availability of advanced materials, including thermal management components, reinforced enclosures, and insulating polymers. Fluctuations in raw material prices and supply chain disruptions can increase production costs and reduce profitability for manufacturers. This dependency creates uncertainty for battery pack producers, in import-dependent regions.

To address this challenge, companies are increasingly investing in sustainable materials, recycling initiatives, and modular designs to minimize dependence on limited raw materials and ensure a more resilient battery separator supply chain. Additionally, companies are establishing strategic supplier partnerships and adopting localized sourcing strategies to stabilize supply chains and reduce risks linked to material price fluctuations.

Market Trend

Adoption of Lightweight and Modular Battery Packaging Solutions

A notable trend in the battery packaging market is the increasing use of lightweight and modular packaging that improve thermal management, safety, and structural integrity. Manufacturers are using advanced materials, such as high-strength polymers and composites, to reduce weight while maintaining durability.

Innovations in modular designs are enabling faster assembly, easier maintenance, and improved scalability for electric vehicles and energy storage systems. These developments are supporting the shift toward high-capacity batteries, improving energy use, and ensuring compliance with evolving safety and regulatory standards.

- In December 2023, Rogers Corporation expanded its PORON EVExtend portfolio, introducing PORON EVExtend 71 and firmer PORON EVExtend 43 variants. These formulations provide high compression force and optimized performance for EV battery pad applications.

Battery Packaging Market Report Snapshot

|

Segmentation

|

Details

|

|

By Battery Type

|

Lithium-Ion, Lead-Acid, Nickel-Metal Hydride, Others

|

|

By Casing Type

|

Cylindrical, Prismatic, Pouch, Others

|

|

By Material Type

|

Metals, Plastics, Cardboard, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Battery Type (Lithium-Ion, Lead-Acid, Nickel-Metal Hydride, and Others): The lithium-ion segment earned USD 20.30 billion in 2024, mainly driven by rising adoption of electric vehicles coupled with increasing demand for portable electronics.

- By Casing Type (Cylindrical, Prismatic, Pouch, and Others): The prismatic held 40.11% of the market in 2024, due to its space-efficient design and suitability for high-capacity battery applications in electric vehicles and energy storage systems.

- By Material Type (Metals, Plastics, Cardboard, and Others): The cardboard segment is projected to reach USD 31.76 billion by 2032, fueled by its eco-friendly properties and cost efficiency.

Battery Packaging Market Regional Analysis

The market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America’s battery packaging market share stood around 36.55% in 2024, with a valuation of USD 11.91 billion in the global market. This dominance is supported by government incentives and regulatory support aimed at strengthening domestic battery manufacturing capacity.

The U.S. government has introduced funding programs and tax credits to boost the production of advanced batteries and related components. These initiatives aim to reduce dependency on imports, encourage private sector investments, and ensure a resilient supply chain.

- According to the U.S. Department of Energy (DOE), in September 2024, over USD 3 billion in grants were announced to enhance domestic production of advanced batteries and materials for electric vehicles across 14 states.

Asia-Pacific battery packaging industry is expected to show a strong growth at a robust CAGR of 12.84% over the forecast period. The market growth is supported by government-backed industrial development programs and investment incentives for domestic battery manufacturing.

Regulatory mandates emphasizing battery safety and reliability are fueling the demand for advanced packaging solutions. Strategic investments in lithium-ion battery and related materials in key markets such as China and Japan have strengthened regional production capabilities, further driving market growth in the region.

Regulatory Frameworks

- In the U.S., battery packaging is regulated under DOT (Department of Transportation) Hazardous Materials Regulations and OSHA standards. Lithium-ion batteries must comply with UN 38.3 transport testing for safe handling and shipment.

- In the EU, packaging is governed by the ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road), the Battery Directive, and REACH regulations. These ensure safety, labeling, recyclability, and environmental compliance.

- In APAC, countries such as Japan and China have introduced strict packaging standards for lithium-ion and other battery types, including safety testing, thermal management, and transport regulations to prevent hazards.

- On the international stage, IATA (International Air Transport Association) Dangerous Goods Regulations and UN Model Regulations on the Transport of Dangerous Goods provide international guidance for safe packaging, shipment, and disposal of batteries.

Competitive Landscape

Leading players in the battery packaging industry are focusing on innovation, sustainability, and strategic collaborations to strengthen their positions. Companies are introducing advanced packaging solutions that improve thermal management, safety, and lightweight performance to meet the evolving needs of electric vehicle and energy storage applications. Manufacturers are also investing in recyclable, plastic-free, and bio-based materials to align with global environmental targets.

- In June 2024, Toppan Holdings announced a strategic partnership with Toyo Seikan to establish a joint venture in Sweden, valued at approximately USD 73.6 million. This collaboration aims to supply packaging solutions tailored for automotive lithium-ion batteries.

Top Key Companies in Battery Packaging Market:

- Nefab Group

- Wellplast AB

- C.L. Smith

- Cadenza Innovation Inc.

- Söhner Kunststofftechnik GmbH

- GWP Protective

- EaglePicher Technologies

- Covestro AG

- Trinseo.

- Manika Plastech Ltd.

- Rogers Corporation

- Anchor Bay Packaging

- TOPPAN Inc.

- Corplex

- Air Sea Containers

Recent Developments

- In August 2025, Duracell launched a new range of child-safe lithium coin batteries in India, featuring a non-toxic bitter coating and tamper-proof packaging. The product line, available in CR2032, CR2025, and CR2016 sizes, was designed to reduce the risk of accidental ingestion while maintaining high-performance.

- In July 2025, Covestro launched an advanced flame-retardant encapsulation polyurethane foam for electric vehicle (EV) batteries. The technology addresses battery safety challenges and reinforces Covestro’s position as a key materials supplier in the evolving EV value chain.