Market Definition

The market comprises vessels and services that move bulk and containerized cargo through inland waterways and coastal routes. Barges enable cost-efficient and environmentally sustainable transport of dry cargo, liquid cargo, and specialized materials.

The report covers segmentation by fleet, barge type, and application, providing insights into operational trends, growth drivers, and technological advancements in propulsion and navigation systems. Barge transportation supports large-scale commodity movement and intermodal logistics across industries such as coal and crude petroleum, chemicals, metal ores, agriculture, and rubber and plastics.

Barge Transportation Market Overview

The global barge transportation market size was valued at USD 18.41 billion in 2024 and is projected to grow from USD 19.59 billion in 2025 to USD 30.95 billion by 2032, exhibiting a CAGR of 6.75% during the forecast period. This growth is primarily driven by increasing trade of coal, crude petroleum, and agricultural products, supported by expanding industrial production and rising global energy demand.

Market growth is driven by government investments and bilateral agreements aimed at improving navigability and linking major river systems across regions. The expansion of integrated waterways in Europe, Southeast Asia, and North America enhances trade efficiency while reducing reliance on overland transport.

Key Highlights:

- The barge transportation industry size was recorded at USD 18.41 billion in 2024.

- The market is projected to grow at a CAGR of 6.75% from 2025 to 2032.

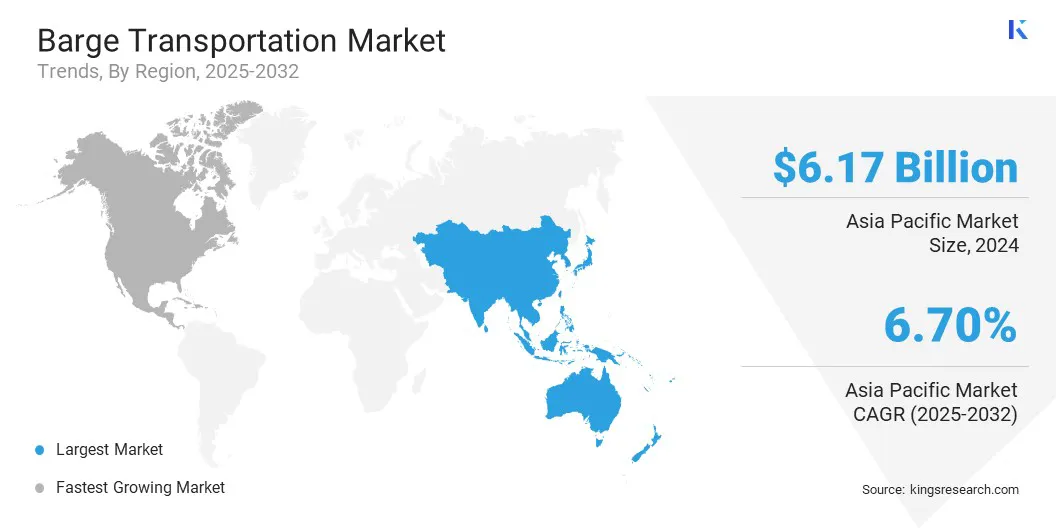

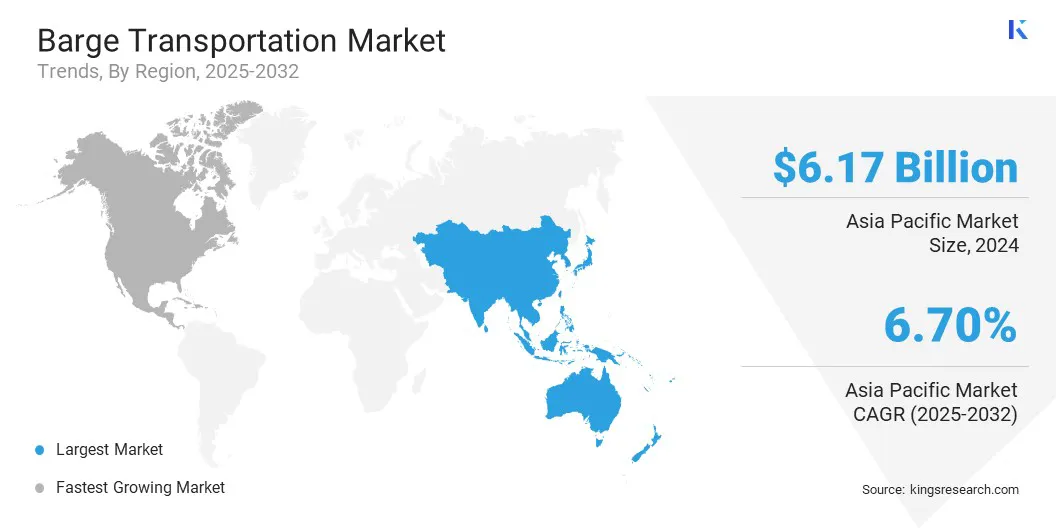

- Asia Pacific held a share of 33.49% in 2024, valued at USD 6.17 billion.

- The dry cargo segment garnered USD 7.76 billion in revenue in 2024.

- The covered segment is expected to reach USD 10.19 billion by 2032.

- The agriculture segment is anticipated to witness the fastest CAGR of 6.96% over the forecast period.

- North America is anticipated to grow at a CAGR of 6.85% through the projection period.

Major companies operating in the barge transportation market are Kirby Corporation, Future Proof Shipping, American Commercial Barge Line, McAllister Towing and Transportation Company, Inc., Ingram Marine Group, Campbell Transportation Company, Inc., Blessey Marine Services, Inc., Florida Marine Transporaters, PACC Offshore Services Holdings Limited, Rhenus Logistics SE & Co. KG, Rooskens Group, VTG GmbH, Gulf Agency Company Limited, Alter Logistics Company, and A.P. Moller - Maersk.

Strengthened corridor connectivity supports multimodal logistics networks and facilitates smoother cargo transition between ports and inland terminals. Such connectivity aligns with global supply chain diversification and supports omnichannel retail strategies through seamless inventory distribution across regional markets using barge-based transport solutions.

- In May 2025, Rhenus Group signed a memorandum of understanding (MoU) with the Inland Waterways Authority of India to deploy 100 barges in phases. The first phase will include 20 barges and six pushers, targeting the transport of over one million tonnes of cargo annually by the end of 2025.

What is driving the adoption of advanced low-emission propulsion systems in the barge transportation market?

The adoption of low-emission propulsion technologies in the barge transportation industry is driven by increasingly stringent environmental regulations and the need to reduce carbon intensity across fleets.

Manufacturers and operators are investing in retrofitting programs and collaborative R&D initiatives to integrate sustainable technologies without compromising cargo capacity or range. The adoption of advanced, low-emission barges reflects the industry’s strategic shift toward energy efficiency, ensuring compliance and long-term operational sustainability across inland and coastal waterways.

- In February 2024, Future Proof Shipping, supported by the EU-funded Flagships and Interreg ZEM Ports NS projects, launched the hydrogen-powered H2 Barge 2 to operate emission-free along the Rhine between Rotterdam and Duisburg, demonstrating effective cross-border collaboration in advancing sustainable shipping.

Why does the aging barge fleet pose a major obstacle to the growth of the barge transportation market?

The aging barge fleet presents a significant obstacle due to its technical and structural limitations, as older vessels were not built to accommodate advanced propulsion or digital control systems. Retrofitting these barges with hybrid engines, battery modules, or LNG storage often requires substantial redesign of hulls, electrical systems, and weight distribution.

Additionally, evolving safety and emission standards increase the complexity, cost, and time required for compliance. Many operators face operational downtime and limited access to specialized shipyards capable of handling such upgrades, leading to operational delays and slowing the sector’s transition toward sustainable and efficient barge operations.

To address this challenge, industry participants are adopting modular retrofit kits, standardized engineering designs, and partnership models with shipyards focused on alternative fuel integration. Collaborative R&D initiatives are streamlining retrofit certification and reducing project lead times, enabling the more efficient modernization of legacy barges.

Why are technological advancements emerging as a notable trend influencing the barge transportation market?

Technological advancements are reshaping the market through the rapid adoption of electrification across short-distance cargo routes. Operators are increasingly deploying fully electric barges to reduce fuel expenses and achieve zero-emission performance within regulated urban corridors.

Advancements in battery technology and charging infrastructure are making electric propulsion more viable for commercial deployment. Regulatory incentives and port-side electrification programs are accelerating the transition to cleaner fleets. The introduction of fully electric barges for short-haul inland routes underscores the industry’s transition to cleaner, cost-effective, and future-ready waterway logistics.

- In October 2025, Inland Terminal Group, backed by M&G’s infrastructure team, launched the fully electric barge MS Den Bosch Max Green. Equipped with swappable battery containers developed in collaboration with Zero Emission Services, the initiative aims to support logistics decarbonization in Europe, with backing from the Dutch National Growth Fund and the Province of South Holland.

Barge Transportation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Fleet

|

Dry Cargo, Liquid Cargo, Specialty Barges

|

|

By Barge

|

Covered, Open, Tugged, Others

|

|

By Application

|

Coal & Crude Petroleum, Rubber & Plastic, Metal Ores, Chemicals, Agriculture, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Fleet (Dry Cargo, Liquid Cargo, and Specialty Barges): The dry cargo segment generated USD 7.76 billion in revenue in 2024, mainly due to rising bulk trade of coal, grains, and construction materials across major inland and coastal waterways.

- By Barge (Covered, Open, Tugged, and Others): The open segment is poised to record a CAGR of 6.96% through the forecast period, propelled by growing transport of oversized and weather-resilient commodities that demand flexible loading and unloading operations.

- By Application (Coal & Crude Petroleum, Rubber & Plastic, Metal Ores, Chemicals, Agriculture, and Others): The metal ores segment is estimated to hold a share of 29.94% by 2032, fueled by expanding steel production, mining activities, and increased reliance on barges for raw material logistics.

What is the market scenario in Asia Pacific and North America region?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific barge transportation market stood at 33.49% in 2024, valued at USD 6.17 billion. This dominance is attributed to growing transport of dry bulk commodities, industrial raw materials, and agricultural goods through inland and coastal waterways. Ongoing port infrastructure upgrades, improved navigability, and integration of digital monitoring systems have improved cargo handling efficiency.

Additionally, investments in energy-efficient and low-emission fleets indicate a shift toward sustainable operations. Regional logistics operators are focusing on optimizing multimodal connections between ports and inland trade routes, ensuring efficient cargo throughput and expanded barge utilization across major trade corridors.

- In February 2024, the Indian government announced plans to operationalize 50 waterways by 2047 and promote low-draft vessel designs, including tug-barge configurations, to expand and modernize inland water transport infrastructure.

The North America barge transportation industry is projected to expand at a CAGR of 6.85% over the forecast period. This growth is propelled by the modernization of inland waterway infrastructure and the rising demand for energy commodities and industrial goods. Investments in automated navigation systems and digital cargo tracking are enhancing operational reliability.

Fleet owners are upgrading existing barges to comply with stricter emission standards through hybrid propulsion and fuel-efficient designs. The regional market further benefits from expanding intermodal logistics frameworks that strengthen connections between river terminals and industrial zones, ensuring improved efficiency and capacity utilization across the regional transport ecosystem.

- In July 2025, GT USA, a subsidiary of Gulftainer Group, partnered with Great Lakes East LLC, a subsidiary of The Great Lakes Towing Company, to introduce a monthly barge service between Port Canaveral and San Juan. The service facilitates consistent exports of construction materials, including lumber, steel coils, sheet piles, rebar, and general cargo from the Canaveral Cargo Terminal.

Regulatory Frameworks

- In the U.S., the Inland Waterways Navigation and Environmental Sustainability Program (IWNESP) governs infrastructure modernization and environmental compliance across inland waterways. It ensures safe navigation, lock maintenance, and habitat restoration relevant to barge operations.

- In the EU, the Inland Waterways Transport Directive (2006/87/EC) regulates technical standards for vessels operating on European inland waterways. It promotes harmonized safety norms, vessel certification, and emission control to enhance operational uniformity across member states.

- In China, the Inland Waterway Regulation Act oversees navigation safety, vessel registration, and pollution control. It supports standardized barge fleet development and low-emission operations in industrial and agricultural corridors.

- In India, the Inland Vessels Act (2021) enforces safety, construction, and operational requirements for inland water transport. It strengthens vessel monitoring, enhances crew certification standards, and facilitates interstate cargo movement through improved regulatory oversight.

- In Brazil, the National Waterway Transport Regulation (ANTT Resolution No. 912/2022) supervises barge operation licensing and waterway infrastructure usage. It aims to promote efficient utilization of navigable rivers and ensure compliance with cargo safety standards.

- In Australia, the Marine Safety (Domestic Commercial Vessel) National Law Act (2012) regulates operational safety, maintenance, and crew competency for domestic barges. It mandates adherence to environmental and navigational protocols critical to sustainable waterway transport.

Competitive Landscape

Key companies operating in the barge transportation industry are expanding fleet capacity, adopting hybrid and LNG-powered propulsion systems, and integrating automation to improve barge efficiency. They are securing long-term charter agreements and developing inland logistics corridors to secure consistent cargo flow. Strategic partnerships with port authorities and technology providers are enhancing supply chain coordination and operational transparency.

Firms are increasing R&D expenditure to develop standardized vessel designs and improve retrofit solutions for legacy fleets. Digitalization initiatives such as real-time tracking and predictive maintenance are being implemented to reduce downtime. Continuous investments in infrastructure alliances and cross-sector collaborations remain central to sustaining competitive positioning.

- In April 2025, Arc Boat Company partnered with Diversified Marine Inc. to enter the commercial sector. The initiative aims to strengthen U.S. maritime leadership through advanced powertrains and software-driven vessel production.

Key Companies in Barge Transportation Market:

- Kirby Corporation

- Future Proof Shipping

- American Commercial Barge Line

- McAllister Towing and Transportation Company, Inc.

- Ingram Marine Group

- Campbell Transportation Company, Inc.

- Blessey Marine Services, Inc.

- Florida Marine Transporaters

- PACC Offshore Services Holdings Limited

- Rhenus Logistics SE & Co. KG

- Rooskens Group

- VTG GmbH

- Gulf Agency Company Limited

- Alter Logistics Company

- P. Moller - Maersk

Recent Developments (Product Launches)

- In May 2025, CMA CGM launched Vietnam’s first fully electric container barge to advance river transport decarbonization in Southeast Asia. This initiative led to the formation of Green River Transportation in collaboration with Gemadept, promoting sustainable logistics across the Mekong Delta and reinforcing both companies’ commitment to low-emission maritime transport.

- In November 2024, BOA launched a semi-submersible heavy lift barge engineered for multi-industry applications. The vessel offers a 31.65-meter submersing depth, 75,000-ton deadweight capacity, 35-ton/m² deck strength, 20,000m³/hr ballasting capacity, and a hybrid power system, demonstrating advanced engineering for complex offshore and industrial transport operations.