Market Definition

The market refers to the segment of biopharmaceuticals that develops and commercializes targeted therapies combining monoclonal antibodies with cytotoxic agents. ADCs are designed to deliver potent drugs directly to diseased cells, improving therapeutic outcomes while limiting systemic toxicity.

The market encompasses various products, including Kadcyla, Adcetris, Enhertu, Padcev, Trodelvy, Polivy, Besponsa, and Mylotarg, along with other emerging ADCs. The key applications for these products are in the treatment of different cancers, such as breast cancer, blood cancer (leukemia, lymphoma, and multiple myeloma), urothelial cancer, and other cancer types.

The materials involved are primarily the biological components of the antibody and the synthetic chemical components of the linker and payload. This report's scope covers key segments by product, target, technology, and application.

Antibody Drug Conjugate Market Overview

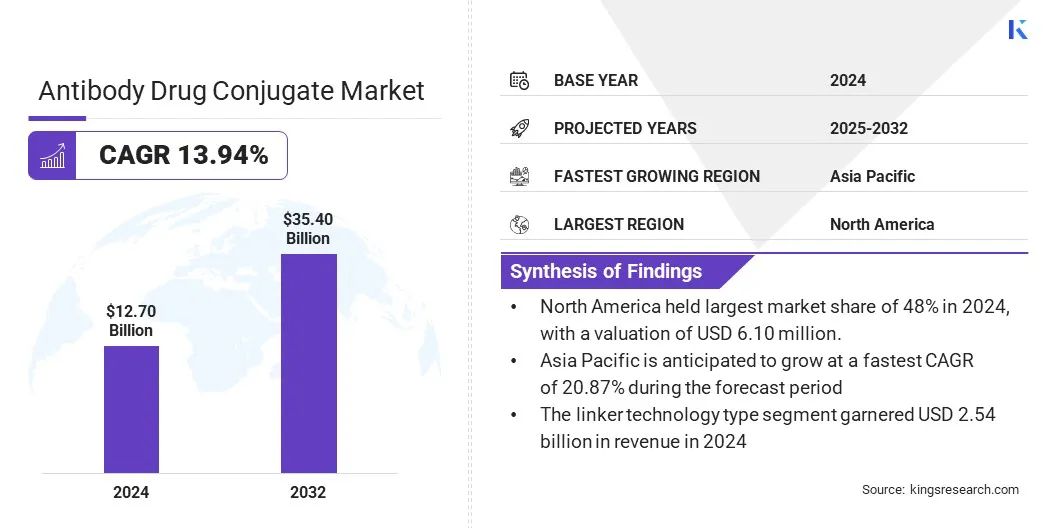

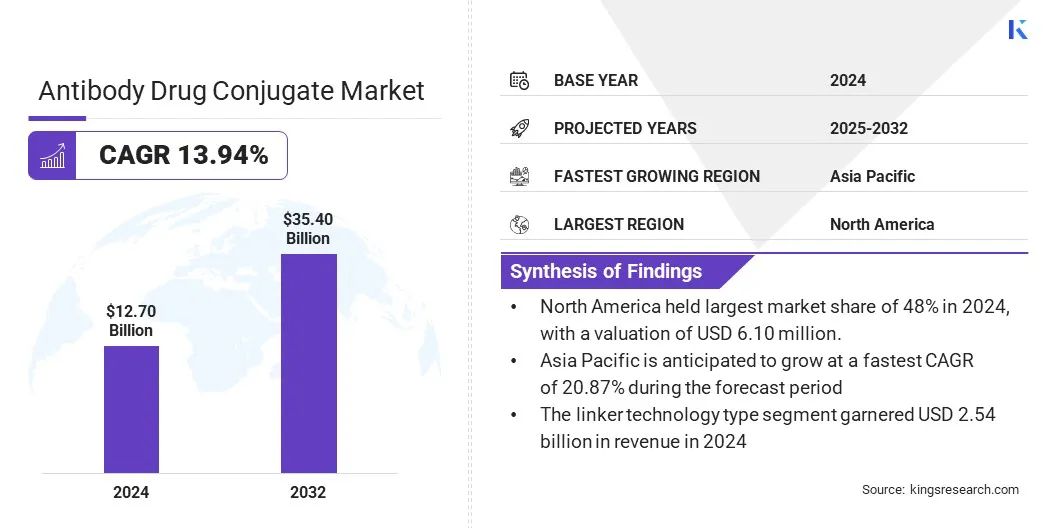

The global antibody drug conjugate market size was valued at USD 12.70 billion in 2024 and is projected to grow from USD 14.20 billion in 2025 to USD 35.40 billion by 2032, exhibiting a CAGR of 13.94% during the forecast period.

The global ADC market is growing as pharmaceutical companies and biotechnology firms expand pipelines with next-generation conjugates.

Rising investment in targeted oncology therapies, favorable regulatory approvals, and active collaborations between drug developers and contract manufacturing organizations are shaping industry expansion. Multiple ADCs have gained commercial success, reinforcing their therapeutic value and driving broader clinical adoption.

Key Market Highlights:

- The antibody drug conjugate industry size was recorded at USD 12.70 billion in 2024.

- The market is projected to grow at a CAGR of 13.94% from 2024 to 2032.

- North America held a market share of 48% in 2024, with a valuation of USD 6.10 billion.

- The kadcyla segment garnered USD 2.54 billion in revenue in 2024.

- The HER2 segment is expected to reach USD 12.61 billion by 2032.

- The blood cancer segment is expected to reach USD 13.49 billion by 2032.

- Europe is anticipated to grow at a CAGR of 12.08% during the forecast period.

Major companies operating in the antibody drug conjugate market are Astellas Pharma, AstraZeneca, ADC Therapeutics, Bristol Myers Squibb, Byondis B.V., Daiichi Sankyo, Genentech, Gilead Sciences, GSK, ImmunoGen, Iksuda Therapeutics, Mersana Therapeutics, Pfizer, F. Hoffmann-La Roche Ltd., Sanofi.

Progress in linker chemistry, site-specific conjugation methods, and novel payload classes is improving therapeutic application and its clinical use. Partnerships between large biopharma and ADC specialists are accelerating development and global roll-out of products.

- In January 2025, Arais Biotech AG entered into an RCO (Research Collaboration and Option to License Agreement) with Chugai Pharmaceutical Co., Ltd.. Arais will utilize its proprietary linker-conjugation platform AraLinQ to generate ADCs for targets using antibodies.

Market Driver

Increasing Demand for Targeted Cancer Therapies

A key driver of the ADC market is the growing demand for targeted cancer therapies that deliver higher efficacy with reduced toxicity. Oncology patients require treatments that provide improved survival outcomes while minimizing side effects compared to traditional chemotherapy.

Pharmaceutical companies are expanding ADC pipelines, integrating innovations in antibody design, payload potency, and linker chemistry.

- In April 2025, Arais Biotech AG announced its partnership (Research Agreement) with Johnson & Johnson to develop ADC's. The agreement aimed at accelerating development timelines and reducing costs by using Arais's proprietary ADC linker platform AraLinQ. The platform has previously demonstrated efficiency with the development of potent, stable and uniform ADC therapeutic candidates.

Accelerated approval from regulatory agencies for therapies creates favorable pathways for market entry. Healthcare systems are adopting ADCs due to their ability to optimize therapeutic outcomes thus reducing overall treatment burdens. These factors position these therapies as an essential tool in global cancer care.

Market Challenge

Cost and Scalability Concerns due to Need for Specialized Facilities

One major challenge in the antibody drug conjugate market is the complexity of manufacturing that creates cost and scalability constraints. ADCs require specialized facilities, advanced conjugation technologies, and strict quality control standards to ensure safety and consistency.

This complexity is limiting accessibility in many regions and is increasing the time needed for commercialization. Overcoming this challenge requires the adoption of modular manufacturing platforms along with investment in process automation.

Stronger collaboration with contract development and manufacturing organizations facilitates transfer of knowledge and reduces the time to market for novel therapies and molecules.

- For instance, in January 2024, Celltrion, Inc. collaborated with WuXi XDC to provide integrated solutions for the development and manufacturing of ADCs, which can help streamline processes and improve patient outcomes.

Standardizing production processes and leveraging advanced analytical tools are improving efficiency, lowering costs, and ensuring product quality. Addressing these bottlenecks enables the industry to provide broader patient access and support long-term market expansion.

Market Trend

Ongoing Expansion of Combination Therapies to Improve Patient Outcomes

A major trend shaping the antibody drug conjugate market is the ongoing expansion of combination therapies. Combination therapies involve the use of ADCs with immunotherapies and checkpoint inhibitors to enhance treatment outcomes.

Clinical trials are exploring synergistic effects that deliver higher response rates in resistant cancers. Pharmaceutical companies are forming strategic partnerships to advance these combination platforms and diversify therapeutic applications beyond oncology. This includes treatment for autoimmune and infectious diseases.

Ongoing advances in biomarker identification and patient stratification support this trend by enabling precise targeting. There is growing interest in adopting such integrated approaches, as they demonstrate strong clinical benefits.

- In February 2025, the U.S. Food and Drug Administration approved the supplemental ‘Biologics License Application’ for ADCETRIS (brentuximab vedotin) in combination with lenalidomide and rituximab for adults with relapsed or refractory large B-cell lymphoma. The decision was based on Phase 3 ECHELON-3 trial results, which showed significant overall survival benefit. The approval addressed patients ineligible for stem cell transplant or CAR-T therapy, expanding treatment options for difficult-to-treat lymphoma cases.

Antibody Drug Conjugate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Kadcyla, Adcetris, Enhertu, Padcev, Trodelvy, Polivy, Besponsa, Mylotarg, Others

|

|

By Target

|

HER2, CD22, CD30, TROP2, Nectin-4, BCMA, Others

|

|

By Technology

|

Type (Cleavable Linker, Non-cleavable Linker, Linkerless), Linker Technology Type (VC, Sulfo-SPDB, VA, Hydrazone, Others), Payload Technology (MMAE, MMAF, DM4, Camptothecin, Others)

|

|

By Application

|

Blood Cancer (Leukemia, Lymphoma, Multiple Myeloma), Breast Cancer, Urothelial Cancer & Bladder Cancer, Other Cancer

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Kadcyla, Adcetris, Enhertu, Padcev, Trodelvy, Polivy, Besponsa, Mylotarg, Others): The Kadcyla segment earned USD 2.54 billion in 2024 due to its established efficacy in treating HER2-positive breast cancer and its long-standing presence in the market.

- By Target (HER2, CD22, CD30, TROP2, Nectin-4, BCMA, Others): The HER2 held 30% of the market in 2024, due to the high incidence of HER2-positive cancers and the success of HER2-targeting ADCs like Kadcyla and Enhertu.

- By Technology (Type, Linker Technology Type, Payload Technology): The linker technology type segment is projected to reach USD 4.27 billion by 2032, owing to advancements in developing stable and efficient linkers that improve the therapeutic index of ADCs.

- By Application (Blood Cancer, Breast Cancer, Urothelial Cancer & Bladder Cancer, Other Cancer): The blood cancer held 38% of the market in 2024, due to the success of ADCs targeting hematological malignancies and the increasing number of regulatory approvals for these indications.

Antibody Drug Conjugate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America antibody drug conjugate market share stood around 48% in 2024 in the global market, with a valuation of USD 6.10 billion. The market's growth is primarily attributed to the presence of a robust pharmaceutical and biotechnology ecosystem, significant research and development funding, and a favorable regulatory environment.

The region has a high prevalence of cancer that necessitates the development of advanced healthcare infrastructure. This results in early adoption of novel therapies. Additionally, presence of authoritative organizations such as the U.S. Food and Drug Administration (FDA) supports the expedited approval of innovative cancer treatments, thus facilitating market entry for new ADCs.

- For instance, the FDA's March 2024 guidance document, "Clinical Pharmacology Considerations for Antibody-Drug Conjugates," provides specific recommendations to assist the industry in the development of these complex therapies.

Europe is poised for significant growth at a robust CAGR of 12.08% over the forecast period. The key factor driving this growth is the increasing investment in research and development for oncology therapies.

European countries are actively engaging in clinical trials and academic collaborations to advance ADC development. Government initiatives and a focus on precision medicine in national healthcare systems are also contributing to the uptake of ADCs.

- For intance, in March 2024, AstraZeneca completed the acquisition of Fusion to accelerate the development of next-generation radio conjugates for cancer treatment, a move that strengthens the company's presence in the European market and highlights the region's appeal for strategic investments.

Regulatory Frameworks

- In the United States, the Food and Drug Administration regulates antibody drug conjugates (ADCs) as biologics under the Biologics License Application pathway. Approval covers both the antibody and the drug component, with guidance provided on clinical pharmacology.

- In the European Union, the European Medicines Agency evaluates ADCs as biologic medicines through centralized authorization, applying existing quality and clinical standards while preparing additional guidance.

- In Japan, the Pharmaceuticals and Medical Devices Agency requires full nonclinical and clinical studies before approving ADCs as new active substances.

- In China, the National Medical Products Administration regulates ADCs under its biologics framework and applies clinical trial and production guidelines to support development and oversight.

Competitive Landscape

The global antibody drug conjugate market is characterized by strategic collaborations and acquisitions among key players.

A core strategy employed by companies in this market is forming partnerships to leverage complementary expertise in different components of the ADC design, such as antibodies, linkers, and payloads. This allows for the acceleration of research and development, risk sharing, and the expansion of pipelines.

- For instance, in January 2025, MediLink Therapeutics entered into a global collaboration and license agreement with Zai Lab to use its TMALIN antibody-drug conjugate platform in developing ZL-6201, an LRRC15-targeting ADC. The candidate, which used an antibody discovered by Zai Lab, displayed encouraging preclinical data.

List of Key Companies in Antibody Drug Conjugate Market:

- Astellas Pharma

- AstraZeneca

- ADC Therapeutics

- Bristol Myers Squibb

- Byondis B.V.

- Daiichi Sankyo

- Genentech

- Gilead Sciences

- GSK

- ImmunoGen

- Iksuda Therapeutics

- Mersana Therapeutics

- Pfizer

- Hoffmann-La Roche Ltd.

- Sanofi

Recent Developments

- In September 2025, BioNTech and Duality Biologics announced that their Phase 3 trials in China evaluating trastuzumab pamirtecan (BNT323/DB-1303) versus trastuzumab emtansine in HER2-positive unresectable or metastatic breast cancer had met its primary endpoint of progression-free survival at an interim analysis. The results, reviewed by an independent monitoring committee, supported discussions with China’s drug regulator regarding a potential Biologics License Application submission.

- In September 2024, Araris Biotech AG entered into an agreement with Innate Pharma to acquire its portfolio of patents related to antibody drug conjugate transglutaminase conjugation technology. The patents covered the use of bacterial transglutaminase for linking different payloads to antibodies. This acquisition expanded Araris’ intellectual property portfolio and supported their efforts in developing next-generation site-specific ADCs.

- In February, 2024, Daiichi Sankyo launched its facility in Singapore to focus on oncology research and antibody-drug conjugate development. The office established a regional hub for research, development, and pharmacovigilance quality assurance in Asia Pacific. The initiative aimed to expand the company’s oncology pipeline and strengthen collaboration within Singapore’s scientific ecosystem.