Market Definition

The market involves the systematic dismantling, decommissioning, and processing of retired aircraft to recover materials and components for reuse, resale, or safe disposal. The report covers segmentation by aircraft, material, component, and region, providing insights into market trends, growth drivers, and technological advancements in aircraft recycling.

Aircraft recycling reduces environmental impact by minimizing waste and emissions and enables circular use of high-value metals, composites, and electronics. Applications span commercial, military, and private aviation sectors, while recovered materials support aerospace manufacturing, construction, and industrial operations, enhancing both sustainability and operational efficiency.

Aircraft Recycling Market Overview

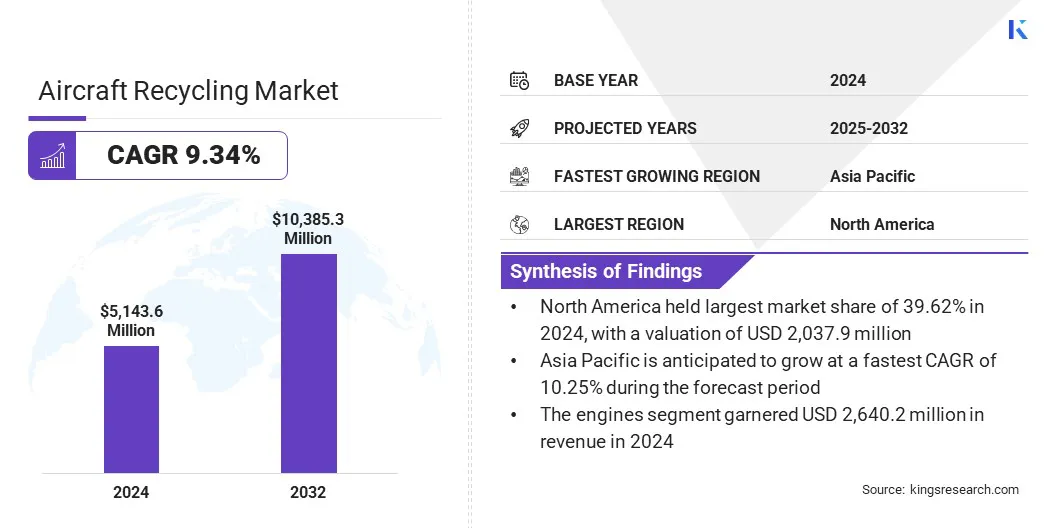

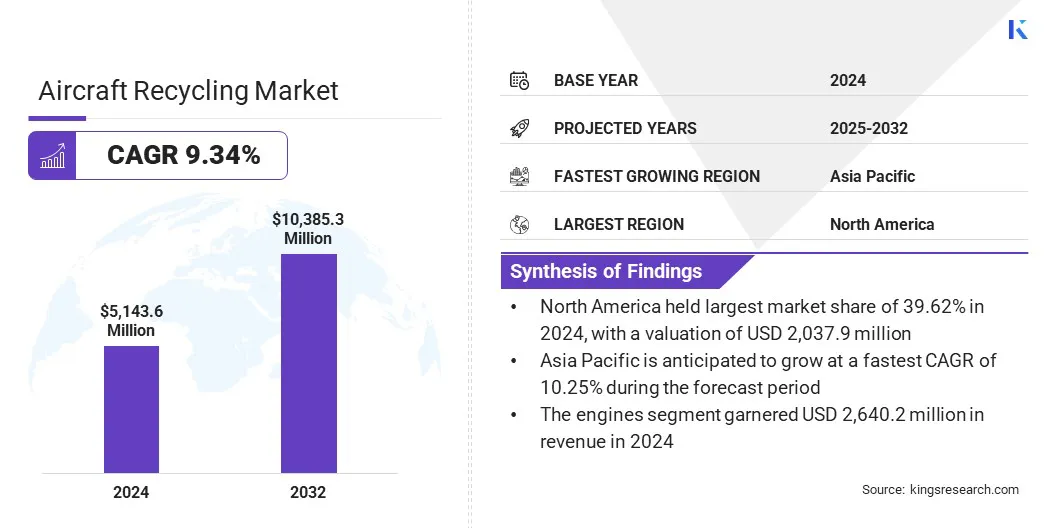

The global aircraft recycling market size was valued at USD 5,143.6 million in 2024 and is projected to grow from USD 5,560.2 million in 2025 to USD 10,385.3 million by 2032, exhibiting a CAGR of 9.34% over the forecast period.

This growth is fueled by the increasing need for efficient aircraft recycling solutions that recover high-value metals, composites, and components from retired fleets. Growing emphasis on sustainable practices across commercial and military aviation, along with stringent environmental regulations, is encouraging broader adoption of recycling initiatives.

Key Highlights

- The aircraft recycling industry size was valued at USD 5,143.6 million in 2024.

- The market is projected to grow at a CAGR of 9.34% from 2025 to 2032.

- North America held a market share of 39.62% in 2024, valued at USD 2,037.9 million.

- The narrow-body segment garnered USD 2,122.8 million in revenue in 2024.

- The aluminum segment is expected to reach USD 4,981.7 million by 2032.

- The engines segment is anticipated to witness the fastest CAGR of 9.71% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 10.25% through the projection period.

Major companies operating in the aircraft recycling market are Aircraft End-of-Life Solutions (AELS) B.V., Aircraft Solutions, Air Salvage International Ltd, TARMAC AEROSAVE, Aviation International Recycling, APOC, Vallair, AerSale, Inc., Airbus, The Boeing Company, MAGELLAN AIRCRAFT SERVICES LLLP, CAVU Aerospace, Inc, GA Telesis, Delta Air Lines, Inc., Amentum Services, Inc.

Expanding applications of recycled materials in aerospace manufacturing, construction, and metal industries are further supporting market demand. Continuous technological advancements in dismantling and material recovery processes, combined with rising awareness of environmental impact, are accelerating the adoption of aircraft recycling globally.

- In April 2025, Emirates joined the Aviation Circularity Consortium alongside SL Metals to promote circular economy practices in aviation. The collaboration aims to support sustainable end-of-life aircraft solutions and enhance supply chain decarbonisation.

How Are Rising Aircraft Retirements Driving Growth in the Market?

Rising aircraft retirements are significantly contributing to the growth of the aircraft recycling market, as a large number of older commercial and military aircraft are being phased out each year.

Operators are replacing aging fleets with newer, fuel-efficient models, resulting in an increasing volume of end-of-life aircraft available for dismantling and material recovery. These retired aircraft contain valuable metals, composites, and electronic components that can be reused or sold across aerospace, construction, and industrial sectors. The steady rise in retired aircraft globally provides a reliable feedstock, expanding both the scope and profitability of recycling operations.

- In February 2025, Rolls-Royce, with the UK Ministry of Defence and Additive Manufacturing Solutions Ltd, recycled components from retired RAF Tornado aircraft into metal powders for 3D printing. The process produced and tested a nose cone and compressor blades for the Orpheus engine demonstrator, supporting the UK’s circular economy goals and sustainable defense manufacturing.

How Does Complex Material Composition Impact Aircraft Recycling?

Complex material composition poses a significant barrier to the growth of the aircraft recycling market. Modern aircraft use advanced composites, mixed metals, and layered structures that are difficult to dismantle and process efficiently. Recovering metals, carbon-fiber components, and electronics requires specialized equipment, expertise, and investment, raising operational costs and limiting efficiency.

To overcome these challenges, companies are increasingly investing in specialized separation technologies, automated dismantling systems, and strategic partnerships with expert recyclers. These efforts aim to enhance material recovery rates, reduce processing costs, and support sustainable aircraft recycling practices.

What Are the Key Impacts of Rising Advanced Material Recovery Technologies in Aircraft Recycling?

The aircraft recycling market is witnessing a growing shift toward the adoption of advanced material recovery technologies. Increasing demand for efficient dismantling and high-yield recovery of metals, composites, and avionics is driving investment in automated systems, robotics, and precision separation techniques.

These technologies enable safer, faster, and more cost-effective recycling operations, supporting aerospace, construction, and industrial applications that rely on high-quality recovered materials.

Operators are increasingly integrating sophisticated equipment and software to optimize workflows, improve material tracking, and enhance recovery efficiency. Continuous innovation in dismantling and processing methods allows for handling complex aircraft structures and advanced materials with greater precision.

- In January 2025, Unical and ecube registered 100 aircraft recycling projects under the AFRA-CAAC program using Block Aero’s blockchain-powered Registry-as-a-Service. The initiative aims to improve the traceability of recycled aircraft components, streamline dismantling and recovery operations, and expand global market access by simplifying certification and compliance requirements.

Aircraft Recycling Market Report Snapshot

|

Segmentation

|

Details

|

|

By Aircraft

|

Narrow-Body, Wide-Body, Regional Jets, and Turboprop

|

|

By Material

|

Aluminum, Composites, Titanium alloys, and Others

|

|

By Component

|

Engines, Landing Gear, Avionics, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Aircraft (Narrow-Body, Wide-Body, Regional Jets, and Turboprop): The narrow-body segment earned USD 2,122.8 million in 2024 primarily due to the higher volume of retirements and widespread use in commercial aviation.

- By Material (Aluminum, Composites, Titanium alloys, and Others): The aluminum held a share of 48.62% of the market in 2024, due to its high recyclability, widespread use in aircraft structures, and strong resale value.

- By Component (Engines, Landing Gear, Avionics, and Others): The engines segment is projected to reach USD 5,471.0 million by 2032, owing to their high value, demand for refurbishment, and extensive reuse in aerospace applications.

What is the current market scenario in North America and Asia Pacific for this market?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America aircraft recycling market share stood at 39.62% in 2024, valued at USD 2,037.9 million. This dominance is driven by a large aging aircraft fleet, well-established recycling infrastructure, and increasing emphasis by airlines, operators, and regulators on sustainable practices. Moreover, supportive regulations coupled with government initiatives promoting material recovery and waste reduction are further boosting market growth in this region.

- In June 2023, Capgemini and AWS jointly introduced Capgemini’s Lifecycle Optimization for Aerospace digital platform at the International Paris Air Show. The platform is designed to optimize the entire lifecycle of aircraft components by automating inspection processes, analyzing wear data, and supporting decisions on repair, reuse, or recycling.

Growing demand for high-value recovered components such as aluminum, titanium, composites, and avionics is a key factor driving aircraft recycling activity in North America. Airlines, MRO (maintenance, repair, and overhaul) providers, and aftermarket parts suppliers are increasingly sourcing refurbished components to reduce procurement costs and address supply chain delays.

In response, specialized recycling companies, aircraft dismantling facilities, and OEM-affiliated service providers are investing in advanced dismantling machinery, precision material-separation systems, and digital traceability tools. These strategic investments are improving recovery efficiency, boosting profitability, and reinforcing North America’s leading position in the global market.

Asia Pacific aircraft recycling industry is set to grow at a CAGR of 10.25% over the forecast period. This growth is driven by the expanding commercial aviation sector, rising aircraft retirements, and increasing demand for recovered metals and components across aerospace and industrial applications. Adoption of advanced dismantling technologies and investments in modern recycling facilities are improving efficiency, recovery rates, and operational sustainability.

Additionally, government initiatives promoting environmental responsibility and material reuse are supporting regional market expansion. Continuous focus on technological improvements, process optimization, and compliance with environmental standards is further accelerating the development of the Asia Pacific market.

- In August 2024, Airbus’s Lifecycle Services Centre in Chengdu, China, dismantled and recycled its first aircraft, a retired A330-200 owned by Hengqin Winglet Aircraft Technology Company. The project, conducted in collaboration with the Airbus China R&D and Innovation Centre and Hengri Corporation, represents the first on-site aircraft recycling in China and supports Airbus’s sustainability and circular economy goals.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) regulates aircraft certification, dismantling, and component handling. It ensures safe disposal of end-of-life aircraft, proper management of hazardous materials, and compliance with airworthiness directives, supporting safe and efficient recycling operations.

- Globally, the Aircraft Fleet Recycling Association (AFRA) Guidelines regulate best practices for aircraft end-of-life management. They provide a framework for environmentally responsible and economically efficient dismantling, material recovery, and component reuse in the market.

Competitive Landscape

Companies in the aircraft recycling industry are strengthening their competitive position through investments in advanced dismantling technologies, sustainable recovery processes, and strategic collaborations or acquisitions. They are focusing on recovering high-value materials, components, and avionics to meet quality, safety, and regulatory standards across aerospace and industrial applications.

Market players are expanding capabilities with automated processing systems, specialized recycling facilities, and refurbishment services to address evolving demand and complex aircraft structures. Additionally, they are enhancing operational efficiency and market reach through technical support, process optimization, and partnerships with technology providers and logistics specialists.

- In June 2025, Constellium and TARMAC Aerosave recycled aluminum from end-of-life aircraft into high-performance material for aerospace use. The project demonstrated the recyclability of metallic airframes and supported circular economy objectives in the sector.

Top Key Companies in Aircraft Recycling Market:

- Aircraft End-of-Life Solutions (AELS) B.V.

- Aircraft Solutions

- Air Salvage International Ltd

- TARMAC AEROSAVE

- Aviation International Recycling

- APOC

- Vallair

- AerSale, Inc.

- Airbus

- The Boeing Company

- MAGELLAN AIRCRAFT SERVICES LLLP

- CAVU Aerospace, Inc.

- GA Telesis

- Delta Air Lines, Inc.

- Amentum Services, Inc.

Recent Developments

- In June 2025, Toray Advanced Composites, Daher, and Tarmac Aerosave launched a joint end-of-life aircraft recycling program focused on thermoplastic composites. The initiative aims to recover, reuse, and repurpose continuous-fiber thermoplastic materials from retired aircraft, starting with parts from the Airbus A380, to establish a closed-loop recycling system and support the aviation industry’s net-zero objectives.

- In June 2025, Constellium, in collaboration with TARMAC Aerosave, successfully recycled and remelted aluminum from end-of-life aircraft into new material suitable for aerospace applications. This process demonstrates the recyclability of complex aerospace aluminum alloys while maintaining their performance. The initiative uses significantly less energy than primary aluminum production and results in lower CO₂ emissions, supporting more sustainable practices in the aviation industry.