Market Definition

The market involves software platforms, algorithms, and AI-enabled systems designed to analyze medical data and support disease detection, classification, and clinical decision-making. These solutions apply machine learning, deep learning, natural language processing, and computer vision techniques to interpret diagnostic inputs such as medical images, pathology slides, laboratory results, physiological signals, and clinical records.

AI-based diagnostic tools transform complex clinical data into actionable insights by identifying patterns, anomalies, and predictive markers with high accuracy and consistency. They support early disease detection, risk stratification, workflow prioritization, and diagnostic standardization across radiology, pathology, cardiology, neurology, and other clinical specialties.

This enables improved efficiency, diagnostic confidence, and patient outcomes in hospitals, diagnostic centers, and healthcare systems.

AI in Medical Diagnostics Market Overview

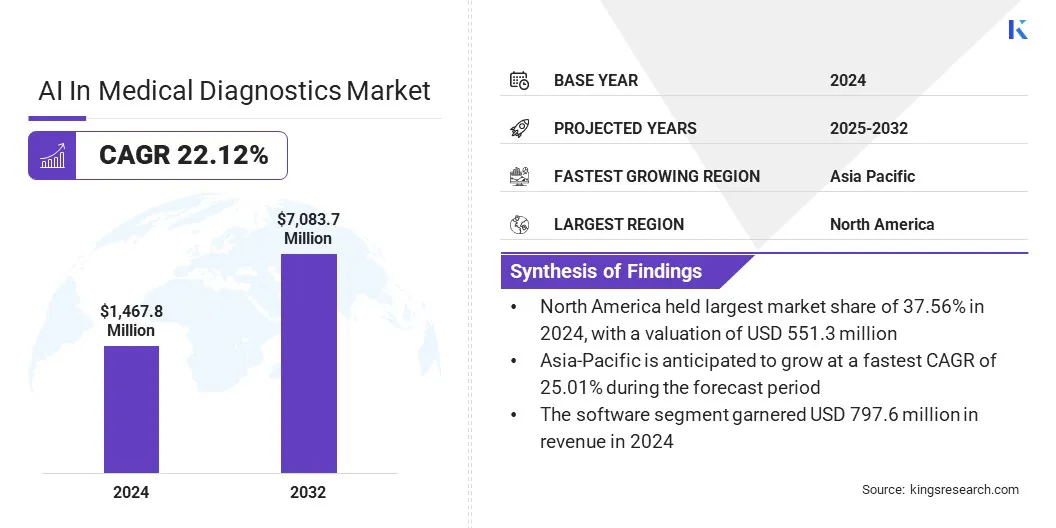

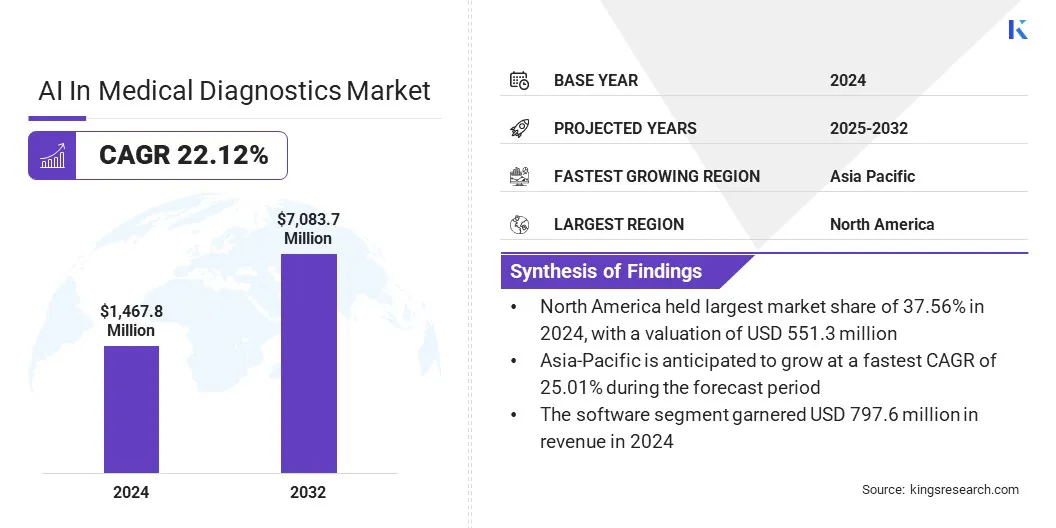

According to Kings Research, global AI in Medical Diagnostics market size was valued at USD 1,467.8 million in 2024 and is projected to grow from USD 1,749.2 million in 2025 to USD 7,083.7 million by 2032, exhibiting a CAGR of 22.12% over the forecast period.

The market is expanding due to the increasing demand for tools that enhance diagnostic accuracy, workflow efficiency, and early disease detection. Market growth is supported by rising imaging volumes, clinician shortages, expanding clinical validation, and broader integration of AI-driven analysis across healthcare settings.

Major companies operating in the global AI in Medical Diagnostics industry are Aidoc, Olympus, Akoya Biosciences, Inc., Siemens Healthineers AG, Zebra Technologies Corp., Imagen, AliveCor, Inc., GE HealthCare, Cleerly, Inc., Heartflow, Inc., Ibex Medical Analytics, Nano-X Imaging Ltd, Lunit Inc., EchoNous Inc., and NVIDIA Corporation.

Key Highlights:

- The AI in Medical Diagnostics market size was recorded at USD 1,467.8 million in 2024.

- The market is projected to grow at a CAGR of 22.12% from 2025 to 2032.

- North America held a market share of 37.56% in 2024, with a valuation of USD 551.3 million.

- The software segment garnered USD 797.6 million in revenue in 2024.

- The radiology segment is expected to reach USD 3,321.4 million by 2032.

- The hospitals & clinics segment is anticipated to witness the fastest CAGR of 23.75% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 25.01% over the forecast period.

Market growth in the AI in medical diagnostics sector is supported by regulatory progress and expanding clinical validation of AI-based diagnostic tools. Regulatory agencies are approving an increasing volume of AI-powered imaging, pathology, and screening software under Software as a Medical Device (SaMD) frameworks, providing clearer pathways for commercialization.

These approvals reduce adoption risk for healthcare providers and encourage broader clinical evaluation across diagnostic workflows. In response, technology providers are increasing investments in clinical validation studies, post-market performance monitoring, and explainable AI features to meet regulatory and clinician requirements.

These developments are strengthening trust in AI-enabled diagnostics and supporting wider deployment across hospitals and diagnostic centers.

- In June 2024, AliveCor announced dual U.S. FDA clearance for its KAI 12L AI technology and the Kardia 12L ECG System. The AI enables detection of 35 cardiac determinations, including heart attacks, using a reduced leadset, supporting faster identification of life-threatening cardiac conditions through a handheld, AI-powered 12-lead ECG system.

What is driving the growing adoption of AI-based solutions for early and accurate disease detection in medical diagnostics?

A key driver supporting the growth of the AI in medical diagnostics market is the increasing focus on early and accurate disease detection by healthcare providers, hospital networks, and diagnostic laboratories across major therapeutic areas.

Healthcare providers are prioritizing earlier identification of conditions such as cancer, cardiovascular disease, and neurological disorders to improve treatment outcomes and reduce long-term care costs. This shift is reinforced by the rising volume and complexity of diagnostic data, including high-resolution imaging and multimodal clinical information that can be difficult to interpret through manual analysis.

AI-enabled diagnostic algorithms are increasingly adopted to enhance sensitivity and specificity by detecting early-stage abnormalities and supporting consistent clinical interpretation. Hospitals and diagnostic centers are integrating these tools to enable earlier intervention, reduce diagnostic variability, and improve clinical confidence, thereby strengthening the clinical and economic value proposition of AI-driven diagnostic solutions.

- In November 2025, Siemens Healthineers launched a new AI-enabled radiology services suite designed to improve diagnostic workflows and hospital operations. The offering spans scheduling, image acquisition, and reporting, using AI to summarize clinically relevant findings and simulate operational scenarios, supporting greater efficiency and decision-making across radiology departments.

What strategies are market participants adopting to overcome the high cost and technical complexity of AI-enabled medical diagnostic solutions?

A key challenge restraining the growth of the AI in medical diagnostics market is the high cost and technical complexity associated with deploying and maintaining advanced AI-enabled diagnostic solutions. Developing, validating, and integrating clinically compliant AI software, imaging platforms, and data infrastructure requires substantial investment.

In addition, the need for high-quality annotated datasets, skilled data science expertise, and ongoing model monitoring increases operational complexity for healthcare providers. These factors may limit adoption, particularly among smaller hospitals, diagnostic centers, and resource-constrained healthcare systems.

To address this challenge, market participants are focusing on scalable cloud-based deployment models, standardized integrations, and user-friendly interfaces, while expanding training, support services, and strategic partnerships to improve accessibility and drive broader clinical adoption.

How is the integration of AI technologies into routine clinical workflows reshaping diagnostic practices in the medical diagnostics market?

A key trend influencing the AI in medical diagnostics market is the increasing integration of AI technologies directly into routine clinical workflows. Healthcare providers are moving beyond standalone AI tools toward solutions embedded within PACS, LIS, and EHR systems to support seamless diagnostic decision-making.

This integration allows AI algorithms to operate alongside existing imaging and reporting processes, enabling real-time case prioritization, automated annotations, and structured report generation. Embedding AI within familiar clinical environments improves clinician adoption, reduces workflow disruption, and supports consistent use across departments.

These advancements strengthen operational efficiency, enhance diagnostic standardization, and accelerate the transition from pilot deployments to enterprise-scale implementation, thereby driving sustained market demand.

- In July 2024, GE HealthCare and Amazon Web Services (AWS) announced a strategic collaboration to develop purpose-built foundation models and generative AI applications for medical diagnostics. GE HealthCare selected AWS as its strategic cloud provider to support AI-powered workflows aimed at improving diagnostic accuracy, streamlining healthcare operations, and enhancing patient care outcomes.

AI in Medical Diagnostics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Software, Hardware, Services

|

|

By Application

|

Radiology, Pathology, Cardiology, Neurology, Others

|

|

By End User

|

Hospitals & Clinics, Diagnostic Imaging Centers, Pathology Laboratories, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Software, Hardware, and Services): The software segment earned USD 797.6 million in 2024, driven by increasing adoption of AI algorithms for image analysis and automated diagnostics across hospitals and diagnostic centers.

- By Application (Radiology, Pathology, Cardiology, Neurology, and Others): The radiology held 43.23% of the market in 2024, due to widespread adoption of AI-enabled imaging solutions that enhance detection accuracy and workflow efficiency.

- By End User (Hospitals & Clinics, Diagnostic Imaging Centers, Pathology Laboratories, and Others): The hospitals & clinics segment is projected to reach USD 4,274.5 million by 2032, owing to large-scale deployment of AI diagnostic tools to manage high patient volumes and address clinician shortages.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America AI in medical diagnostics market share stood around 37.56% in 2024 in the global market, with a valuation of USD 551.3 million. This dominance is attributed to the advanced healthcare infrastructure in this region, high adoption of digital health technologies, and increasing deployment of AI across hospitals and diagnostic centers.

The market growth is further supported by the presence of imaging OEMs, and cloud technology providers that accelerate innovation and commercialization. Increasing diagnostic imaging volumes, clinician shortages, and demand for early and accurate disease detection are driving the adoption of AI-enabled solutions across radiology, pathology, and cardiology workflows.

In addition, supportive regulatory frameworks and sustained healthcare IT investments by government agencies are further increasing the demand for AI-enabled medical diagnostic solutions across the region.

- In November 2025, Aidoc partnered with AdventHealth to launch one of the largest AI imaging deployments in the U.S., spanning multiple hospitals and radiology centers across Florida and Kentucky. The initiative leverages Aidoc’s AI platform to help clinicians rapidly identify urgent cases, accelerate diagnostic workflows, and enhance patient safety for millions of patients annually.

Asia-Pacific is poised for significant growth at a robust CAGR of 25.01% over the forecast period, driven by rapidly expanding healthcare infrastructure and increasing government initiatives to digitize healthcare systems.

Rising healthcare expenditure, growing private hospital networks, and the adoption of telemedicine are accelerating demand for AI-based diagnostic solutions. Rising imaging volumes and expanded preventive care programs across oncology, cardiology, and infectious diseases are increasing clinical adoption of AI-based diagnostic solutions.

- In May 2024, Akoya Biosciences partnered with Shanghai KR Pharmtech to co-develop KR-HT5, a spatial biology diagnostic platform built on Akoya’s PhenoImager HT technology. The solution received premarket approval from China’s National Medical Products Administration (NMPA) to support next-generation pathology workflows, enhancing clinical decision-making and adoption of AI-enabled diagnostics in the region.

Regulatory Frameworks

- In the U.S., AI in medical diagnostics solutions are primarily regulated as Software as a Medical Device (SaMD) under FDA guidelines. The FDA evaluates safety, effectiveness, and clinical validation through premarket submissions, while providing guidance for algorithm updates, real-world performance monitoring, and risk management.

- In the EU, the European Medicines Agency (EMA) and national competent authorities oversee AI-based diagnostic tools, requiring conformity with the Medical Device Regulation (MDR) and in vitro diagnostic regulation (IVDR), emphasizing clinical evidence, transparency, and post-market surveillance.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) regulates AI diagnostics, mandating evidence of safety, accuracy, and interoperability while restricting unsupervised clinical deployment without thorough evaluation.

- Globally, the WHO is promoting governance frameworks for AI in healthcare, recommending international cooperation on ethical use, transparency, and equitable access while supporting innovation and clinical adoption.

Competitive Landscape

Leading players in the AI in medical diagnostics market are focusing on technological innovation, strategic collaborations, and portfolio expansion to meet the rising demand for accurate, efficient, and scalable diagnostic solutions.

Companies are developing advanced AI-enabled platforms for radiology, pathology, cardiology, and multimodal diagnostics to enhance detection accuracy, workflow efficiency, and clinical decision support.

These firms are conducting clinical validation studies, pilot deployments, and real-world performance evaluations to demonstrate reliability, reproducibility, and compliance with regulatory standards. Strategic partnerships, cloud integration, and the acquisition of specialized AI startups are further facilitating adoption across hospitals, diagnostic centers, and healthcare networks.

- In December 2025, GE HealthCare and Mayo Clinic announced the GEMINI-RT initiative, a collaborative effort to advance personalized radiation therapy and cancer care. The partnership focuses on innovation in treatment prediction, planning, automation, workflow, and monitoring for radiation oncology, building on their long-standing Strategic Radiology Research Collaboration.

List of Key Companies:

- Aidoc

- Olympus

- Akoya Biosciences, Inc.

- Siemens Healthineers AG

- Zebra Technologies Corp.

- Imagen

- AliveCor, Inc.

- GE HealthCare.

- Cleerly, Inc.

- Heartflow, Inc.

- Ibex Medical Analytics

- Nano-X Imaging Ltd

- Lunit Inc.

- EchoNous Inc.

- NVIDIA Corporation

Recent Developments

- In September 2025, Olympus Corporation commercially launched its OLYSENSE CAD/AI portfolio in the U.S. and Europe. The AI-powered portfolio facilitates earlier detection and improved clinical outcomes, with European launches including CADDIE, CADU, and SMARTIBD, and the U.S. launch featuring CADDIE with detection capabilities.

- In October 2024, Olympus’ group company Odin Medical Ltd. (Odin Vision) received CE marking in Europe for its cloud-AI endoscopy devices CADDIE, CADU, and SMARTIBD under the Medical Device Regulation (MDR), enhancing operational efficiency and clinical outcomes in endoscopy.

- In April 2024, GE HealthCare launched Caption AI on its Vscan Air SL wireless handheld ultrasound system, enabling clinicians to capture diagnostic-quality cardiac images with real-time guidance and automated ejection fraction estimation. The technology supports rapid point-of-care cardiac assessments, improving clinical decision-making and workflow efficiency.