Market Definition

The market comprises chemical products used as intermediates in fragrance formulations, pharmaceutical synthesis, and industrial processing. These products deliver the consistent purity and stability required for downstream chemical reactions and specialty applications.

The report covers segmentation by grade, application, end-use industry, and region, outlining trends in demand, production capabilities, and regulatory considerations. Acetophenone is used across sectors such as personal care, pharmaceuticals, polymers, and specialty chemicals to support synthesis workflows and value-added product development.

Acetophenone Market Overview

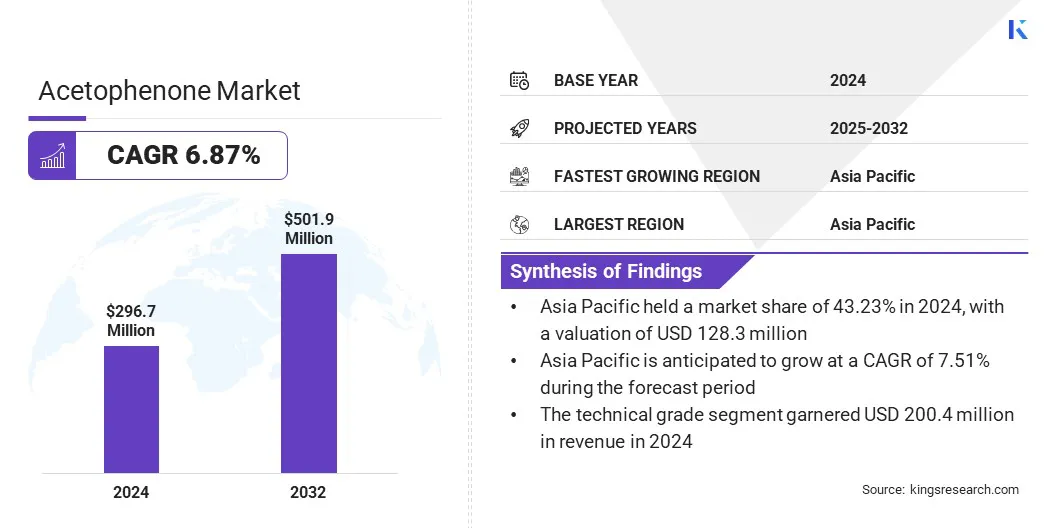

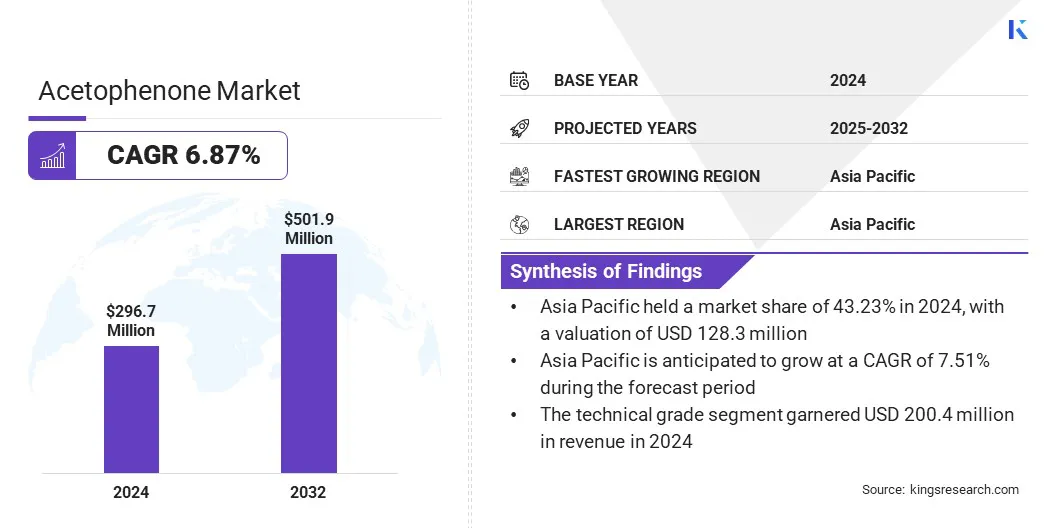

The global acetophenone market size was valued at USD 296.7 million in 2024 and is projected to grow from USD 315.1 million in 2025 to USD 501.9 million by 2032, exhibiting a CAGR of 6.87% over the forecast period.

The market is driven by rising demand from fragrance and flavor manufacturers that use acetophenone as a key aromatic intermediate to enhance product formulations. Expanding pharmaceutical synthesis in regions with strong chemical manufacturing ecosystems, such as Asia Pacific and Europe, is also supporting growth as acetophenone enables efficient production of active ingredients and specialized chemical intermediates.

Key Market Highlights

- The acetophenone industry size was valued at USD 296.7 million in 2024.

- The market is projected to grow at a CAGR of 6.87% from 2025 to 2032.

- Asia Pacific held a market share of 43.23% in 2024, valued at USD 128.3 million.

- The technical grade segment garnered USD 200.4 million in revenue in 2024.

- The ethylbenzene oxidation segment is expected to reach USD 283.9 million by 2032.

- The pharmaceuticals segment is anticipated to witness the fastest CAGR of 7.68% over the forecast period.

- North America is anticipated to grow at a CAGR of 6.69% through the projection period.

Major companies operating in the acetophenone market are Solvay, INEOS AG, Mitsui Chemicals, Inc., SI Group, Inc., Haicheng Liqi Carbon Material Co., Ltd., Clarion Drugs Ltd, BASF SE, Seqens, Kishida Chemical Co., Ltd, Tokyo Chemical Industry Co., Ltd., Thermo Fisher Scientific Inc., S D Fine Chem Limited, Versalis S.p.A., Symrise AG, and Dollmar SpA.

Increasing use in resin, polymer, and coating applications strengthens its role in industrial manufacturing, creating steady demand across multiple end-use sectors. Capacity expansion, improved production technologies, and a strong focus on purity and compliance contribute to supply stability and broaden commercial adoption.

- In May 2024, MDPI published an article reporting 252 naturally derived acetophenone compounds identified up to January 2024, with the highest numbers found in the genera Melicope and Acronychia. The article outlines their structural characteristics and summarizes documented biological activities, including cytotoxic, antimicrobial, antimalarial, antioxidant, and antityrosinase effects.

What factors are driving growth in the acetophenone market?

Expanding use of acetophenone in fragrance and flavor formulations is driving the market. Its stable aromatic profile supports consistent performance in perfumes, deodorants, detergents, and air care products. Incorporating acetophenone into complex blends ensures predictable sensory output and enables large-scale formulation work.

The growing production of personal care and household products increases the need for reliable aromatic intermediates. Rising consumer preference for premium and long-lasting scents reinforces its role in global fragrance manufacturing. Strengthening demand across fine fragrances and mass-market formulations supports wider adoption in scent development.

How is raw material volatility affecting the growth of the acetophenone market?

A key challenge in the market is the volatility in raw material availability that affects manufacturers dependent on petroleum-derived feedstock such as ethylbenzene and styrene. Fluctuations in supply, price instability, and quality variations increase production costs and complicate capacity planning for chemical producers.

These constraints limit operational efficiency and reduce the ability to maintain stable output. To address this challenge, producers invest in process optimization, pursue alternative sourcing strategies, and strengthen supplier partnerships to ensure consistent material flow and cost control.

What trends are shaping the acetophenone market?

A key trend in the market is the rising preference for high-purity grades in pharmaceutical synthesis. These grades support efficient reaction pathways and help manufacturers meet stringent regulatory and quality requirements. High-purity acetophenone enables cleaner synthesis of active pharmaceutical ingredients, reducing impurities and improving overall process reliability.

Growing investment in both specialty and generic drug production is increasing the use of high-specification intermediates, encouraging producers to upgrade technologies and expand capacity. This shift strengthens long-term demand for high-purity acetophenone across global pharmaceutical workflows.

Acetophenone Market Report Snapshot

|

Segmentation

|

Details

|

|

By Grade

|

Technical Grade, and Pharmaceutical Grade

|

|

By Manufacturing Process

|

Ethylbenzene Oxidation, Cumene Oxidation, and Others

|

|

By End-Use Industry

|

Personal Care & Cosmetics, Pharmaceuticals, Plastics & Polymers, Food & Beverage, and Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Grade (Technical Grade and Pharmaceutical Grade): The technical grade segment earned USD 200.4 million in 2024, primarily due to its extensive use in resins, polymers, coatings, and fragrance formulations across large-scale industrial applications.

- By Manufacturing Process (Ethylbenzene Oxidation, Cumene Oxidation, and Others): The ethylbenzene oxidation held a share of 57.32% of the market in 2024, due to its high yield, cost-effective operation, and widespread adoption among large chemical producers.

- By End-Use Industry (Personal Care & Cosmetics, Pharmaceuticals, Plastics & Polymers, Food & Beverage, and Others): The personal care & cosmetics segment is projected to reach USD 169.6 million by 2032, owing to rising demand for fragrance ingredients and consistent use of acetophenone in perfumes, deodorants, detergents, and other scented formulations.

What is the market scenario in Asia Pacific and North America?

Based on region, the global acetophenone market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific acetophenone market share stood at 43.23% in 2024, valued at USD 128.3 million. This dominance is due to the expanding chemical and specialty manufacturing clusters across the region. Countries such as China, India, and South Korea continue to scale production facilities that rely on stable supplies of key intermediates.

Personal care, pharmaceutical, and polymer producers are increasing acetophenone consumption to meet rising domestic and export demand. Growing investment in process improvement and capacity upgrades is further strengthening Asia Pacific’s role in global supply chains.

- In April 2025, In India, Deepak Chem Tech Ltd announced an investment of INR 35 billion (US$407 million) to establish new phenol, acetone, and isopropanol plants at Dahej, Gujarat. The project increases domestic production capacity for these intermediates and supports downstream polycarbonate resin applications, while expanding the company’s overall manufacturing base.

North America acetophenone industry is set to grow at a CAGR of 6.69% over the forecast period. This growth is supported by the presence of well-established pharmaceutical, personal care, and specialty chemical manufacturers across North America.

Companies in the region rely on high-quality aromatic intermediates to meet strict formulation and regulatory requirements. Acetophenone is increasingly used in advanced synthesis workflows and fragrance development, strengthening its role in value-added product manufacturing. Rising investment in process innovation and technology upgrades is encouraging producers to expand capabilities and enhance supply reliability across the region.

Regulatory Frameworks

- In the U.S., the Toxic Substances Control Act regulates the manufacture, import, and processing of acetophenone. It ensures chemical safety through reporting, evaluation, and control measures relevant to industrial chemical use.

- In the European Union, the CLP Regulation (Classification, Labelling and Packaging Regulation, EC No 1272/2008) regulates the classification, labeling, and packaging of acetophenone. It standardizes hazard communication to improve workplace and product safety across the chemical value chain.

- In India, the Chemicals Management and Safety Rules regulate the registration and safety oversight of acetophenone. It establishes requirements for hazard communication, inventory submission, and compliance within industrial operations.

Competitive Landscape

Companies in the acetophenone industry are strengthening their competitive position through investments in high-purity production technologies, process optimization, and efficient oxidation methods. They are focusing on improving product consistency, supply reliability, and compliance with stringent quality standards required in pharmaceutical, personal care, and polymer applications.

Market participants are expanding their portfolios with advanced grades and customized formulations designed for specialized end-use industries. Additionally, they are enhancing their global presence through strategic partnerships, capacity expansion, and collaboration with downstream manufacturers to secure long-term supply agreements and broaden market reach.

Key Companies in Acetophenone Market:

- Solvay

- INEOS AG

- Mitsui Chemicals, Inc.

- SI Group, Inc.

- Haicheng Liqi Carbon Material Co., Ltd.

- Clarion Drugs Ltd

- BASF SE

- Seqens

- Kishida Chemical Co., Ltd

- Tokyo Chemical Industry Co., Ltd.

- Thermo Fisher Scientific Inc.

- S D Fine Chem Limited

- Versalis S.p.A.

- Symrise AG

- Dollmar