Relational Database Market Size

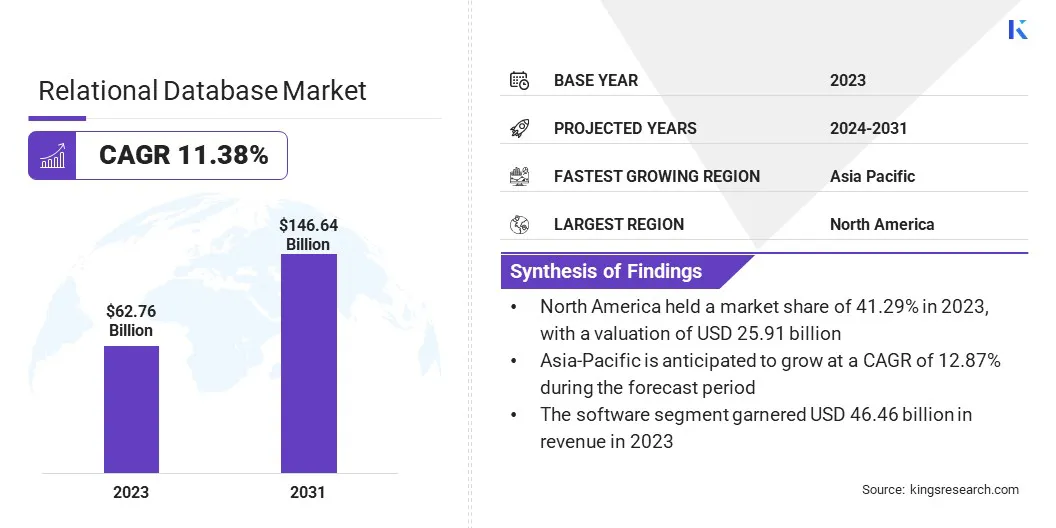

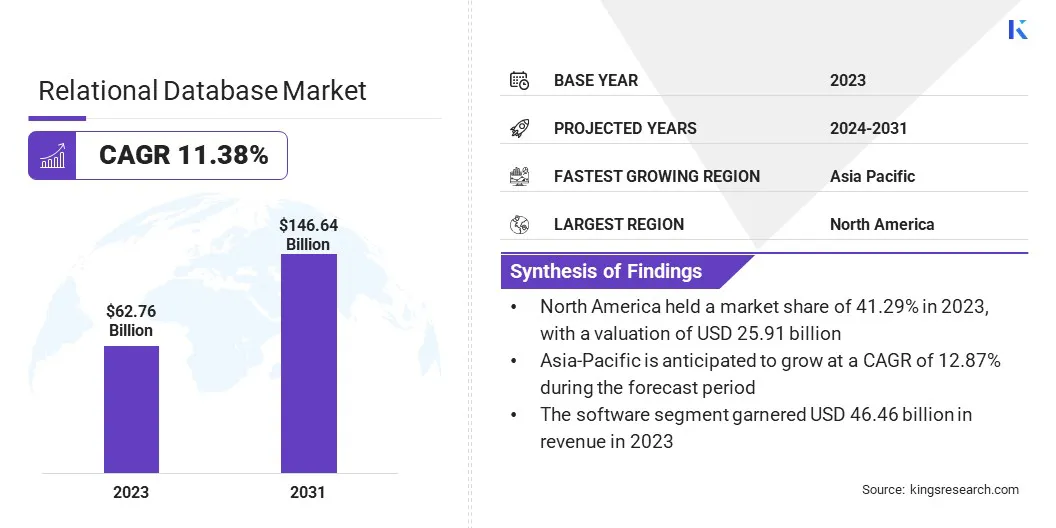

The global Relational Database Market size was valued at USD 62.76 billion in 2023 and is projected to grow from USD 68.96 billion in 2024 to USD 146.64 billion by 2031, exhibiting a CAGR of 11.38% during the forecast period. The market is growing rapidly due to the increasing need for data management, supported by digital transformation, big data analytics, and rising cloud adoption.

Businesses are leveraging relational databases for improved scalability, data integrity, and security. The adoption of AI-powered databases enhances operational efficiency, further expanding the market landscape. In the scope of work, the report includes solutions offered by companies such as Microsoft, Oracle, SAP SE, Teradata, IBM, The PostgreSQL Global Development Group, Amazon Web Services, Inc., MariaDB, Webyog Inc., Actian Corporation, and others.

The relational database market is witnessing robust growth, fueled by multiple factors such as the rapid digitalization across industries, growing adoption of cloud technologies, and the explosion of connected devices. As businesses increasingly rely on data-driven decision-making, the demand for efficient, scalable, and secure database systems is rising.

The integration of artificial intelligence (AI) and machine learning (ML) within databases is influencing the market, offering advanced analytics and automation capabilities that enhance operational efficiency. Additionally, regulatory requirements for data management and privacy are prompting organizations to adopt relational databases that ensure compliance and data integrity.

- The Ericsson Mobility Report (November 2023) estimated that IoT connections are likely to rise from 15.7 billion in 2023 to 38.9 billion by 2029, significantly increasing the volume of data stored and managed in the cloud.

This surge in data traffic emphasizes the need for robust relational databases to efficiently process, store, and manage massive datasets, thus aiding market growth. Moreover, as industries increasingly adopt IoT and smart technology solutions, the demand for databases capable of handling real-time analytics and high-volume queries is growing, thereby bolstering market expansion.

A relational database is a structured system that stores and organizes data in tables, which are made up of rows and columns. Each table represents a specific entity, with rows containing individual records and columns representing attributes of the data. Relational databases use Structured Query Language (SQL) to manage and query data, enabling efficient retrieval and manipulation.

Table relationships are established through keys to ensure data consistency and integrity. Relational databases are fundamental for business, financial, and enterprise applications due to their scalability, reliability, and ability to handle large volumes of data.

Analyst’s Review

Key players in the relational database market are aiding growth by introducing innovative solutions that enhance accessibility, performance, and scalability. Companies are increasingly prioritizing flexible, cost-effective database solutions to meet the diverse needs of businesses, especially those adopting cloud infrastructure.

- For instance, in 2023, Microsoft announced a public preview of a new Azure SQL Database free offering, providing a 32 GB serverless SQL database with 100,000 vCore seconds of compute free monthly, thus enhancing accessibility for developers and small businesses.

These advancements are designed to attract a wider customer base, including small and medium enterprises, by reducing barriers to entry and providing advanced features at lower costs, which significantly boosts market expansion.

Relational Database Market Growth Factors

The emphasis on data-driven decision-making has increased the demand for relational databases across various sectors. Organizations recognize that the ability to analyze and derive insights from large datasets is crucial for maintaining a competitive advantage in the relational database market.

Relational databases provide the structure necessary for executing complex queries, enabling businesses to gain meaningful insights efficiently. Industries such as finance, healthcare, and retail are leveraging these databases to understand customer behavior, improve operational efficiency, and enhance product offerings.

The demand for analytics tools that integrate seamlessly with relational databases is on the rise, thereby fueling market growth. The market faces challenges such as data security concerns and increasing regulatory compliance requirements. The growing threat of cyberattacks on sensitive data stored in databases poses a significant risk for organizations, making them hesitant to fully adopt cloud-based solutions.

Additionally, ensuring compliance with regulations such as GDPR and HIPAA increases the operational burden on companies. To address these challenges, key players are investing heavily in robust security measures, including advanced encryption techniques and real-time monitoring systems to detect and respond to threats promptly.

Collaborations with cybersecurity firms are enhancing the security features of relational databases. Moreover, comprehensive compliance frameworks are being developed to assist organizations in adhering to regulatory requirements and minimizing data breach risks, thereby fostering market expansion.

Relational Database Industry Trends

The integration of relational databases with NoSQL technologies is a notable trend shaping the landscape of the market. This hybrid approach enables organizations to leverage the strengths of both systems, effectively managing diverse data types while preserving structured data integrity.

Companies are increasingly recognizing that traditional relational databases may not adequately address the complexities of modern data needs, including unstructured data and real-time processing. By combining relational databases with NoSQL capabilities, businesses can enhance their data management strategies and improve overall performance.

This integration enhances application diversity, promotes innovation and efficiency, and stimulates the growth of the market.

The growing emphasis on automation and artificial intelligence (AI) in database management is revolutionizing the relational database market. Organizations are increasingly adopting intelligent database solutions that incorporate AI-driven features, including self-tuning capabilities and predictive analytics. These advancements streamline operations by automating routine tasks, improving performance, and enhancing resource allocation.

- In May 2024, Oracle Database 23ai, the latest version of Oracle’s converged database, was released as a comprehensive suite of cloud services. This long-term support release features Oracle AI Vector Search and over 300 additional major features aimed at simplifying the integration of AI with data, accelerating application development, and supporting mission-critical workloads.

AI-powered tools enable organizations to optimize queries and analyze large volumes of data quickly and efficiently, which reduces operational costs and minimizes human error.

This trend enhances the user experience while also positioning relational databases as essential components in data-driven environments. The rising demand for automated database management solutions is augmenting the growth of the relational database market.

Segmentation Analysis

The global market has been segmented based on component, application, industry vertical, and geography.

By Component

Based on component, the market has been categorized into software and services. The software segment led the relational database market in 2023, reaching a valuation of USD 46.46 billion, mainly propelled by the increasing adoption of advanced data management solutions across diverse industries.

With businesses generating vast amounts of data, relational database management systems (RDBMS) software is becoming essential for efficiently handling, storing, and retrieving structured data. The rise of cloud-based database solutions, such as Software-as-a-Service (SaaS) models, is further fueling the expansion of the segment.

Companies are investing heavily in robust RDBMS software to enhance data security, scalability, and performance, particularly in sectors such as finance, healthcare, and retail.

- In May 2024, EnterpriseDB (EDB) introduced EDB Postgres AI, a new database designed to support transactional, analytical, and AI workloads. This innovative solution integrates a PostgreSQL database with a data lakehouse and other components, facilitating seamless integration and efficient processing of diverse data types and workloads.

Continuous advancements in automation, integration with AI, and user-friendly interfaces are propelling the demand for relational database software, contributing to the growth of the software segment.

By Application

Based on application, the market has been categorized into customer relationship management, enterprise resource planning, business analytics, data warehousing, and others. The customer relationship management segment captured the largest share of 31.22% in 2023.

Businesses increasingly depend on CRM systems powered by relational databases to efficiently store and organize vast customer data, thereby improving service quality and decision-making. This integration enables real-time analytics, seamless data retrieval, and improved personalization, significantly boosting customer engagement and loyalty.

Industries such as retail, finance, and e-commerce are focusing on customer-centric approaches, leading to increased demand for robust and scalable CRM solutions. This shift is fueling the expansion of the CRM segment.

By Industry Vertical

Based on industry vertical, the market has been categorized into BFSI, healthcare, IT and telecommunications, retail and e-commerce, and others. The BFSI segment is expected to garner the highest revenue of USD 52.51 billion by 2031.

This sector increasingly relies on relational databases to manage vast amounts of transactional data, ensuring secure, efficient, and scalable data processing. The rise of digital banking, mobile payments, and regulatory requirements necessitates that financial institutions implement robust data management solutions to maintain data integrity, optimize operations, and comply with standards.

Relational databases offer flexibility in handling structured data, supporting real-time analytics for fraud detection, risk management, and personalized customer services. BFSI institutions' increasing adoption of cloud-based and hybrid data solutions is increasing the demand for reliable relational database systems, resulting in significant expansion of the segment.

Relational Database Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America relational database market accounted for the largest revenue share of 41.29% in 2023, with a valuation of USD 25.91 billion. This dominance is reinforced by the widespread adoption of advanced digital technologies across industries such as BFSI, healthcare, and retail.

Organizations in the U.S. and Canada are increasingly leveraging cloud-based relational databases to manage large volumes of structured data, enhance business intelligence, and ensure compliance with stringent regulatory standards. The presence of major technology players such as Oracle, Microsoft, and IBM, along with significant investments in data infrastructure, is supporting regional market growth.

Additionally, advancements in artificial intelligence and machine learning are boosting demand for high-performance relational database solutions, thus stimulating regional market expansion.

Asia-Pacific market is anticipated to grow rapidly, with a robust CAGR of 12.87% over the forecast period. This growth is fueled by rapid digital transformation initiatives across various sectors, including e-commerce, healthcare, and manufacturing.

Countries such as China, India, and Japan are increasingly adopting cloud-based relational databases to manage the exponential growth of data generated by connected devices and digital platforms.

The growth of small and medium-sized enterprises (SMEs) in the region is increasing the demand for affordable and scalable database solutions. Government initiatives promoting digital infrastructure and smart city projects are further contributing to the expansion of the Asia-Pacific market.

Competitive Landscape

The global relational database market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Relational Database Market

- Microsoft

- Oracle

- SAP SE

- Teradata

- IBM

- The PostgreSQL Global Development Group

- Amazon Web Services, Inc.

- MariaDB

- Webyog Inc.

- Actian Corporation

Key Industry Developments

- June 2024 (Product Launch): Actian, the data and analytics division of HCLSoftware, launched Actian Ingres 12.0. This significant release of its SQL-standard enterprise transactional database simplifies cloud deployment, enhances security, and provides analytics speed by up to 20% faster, facilitating a smoother modernization process for customers in their data utilization.

The global relational database market is segmented as:

By Component

By Application

- Customer Relationship Management (CRM)

- Enterprise Resource Planning (ERP)

- Business Analytics

- Data Warehousing

- Others

By Industry Vertical

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- IT and Telecommunications

- Retail and E-commerce

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America