Market Definition

Refined petroleum products are hydrocarbon-based substances obtained from the processing and refining of crude oil in refineries. They include fuels like gasoline, diesel, jet fuel, kerosene, liquefied petroleum gas (LPG), heating oil, and lubricants. These products are primarily used as energy sources for transportation, heating, power generation, and as raw materials in the petrochemical industry for manufacturing plastics, chemicals, and other industrial goods.

Refined Petroleum Products Market Overview

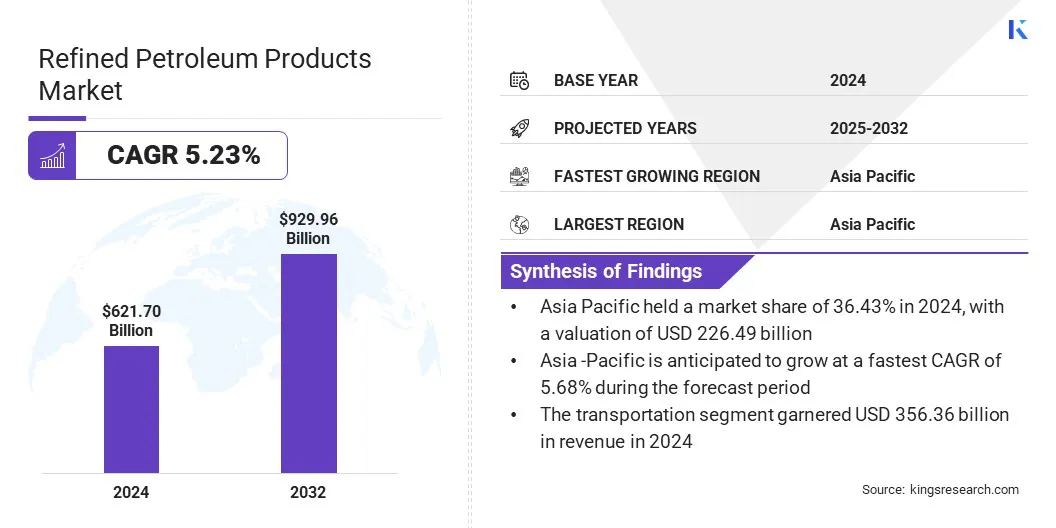

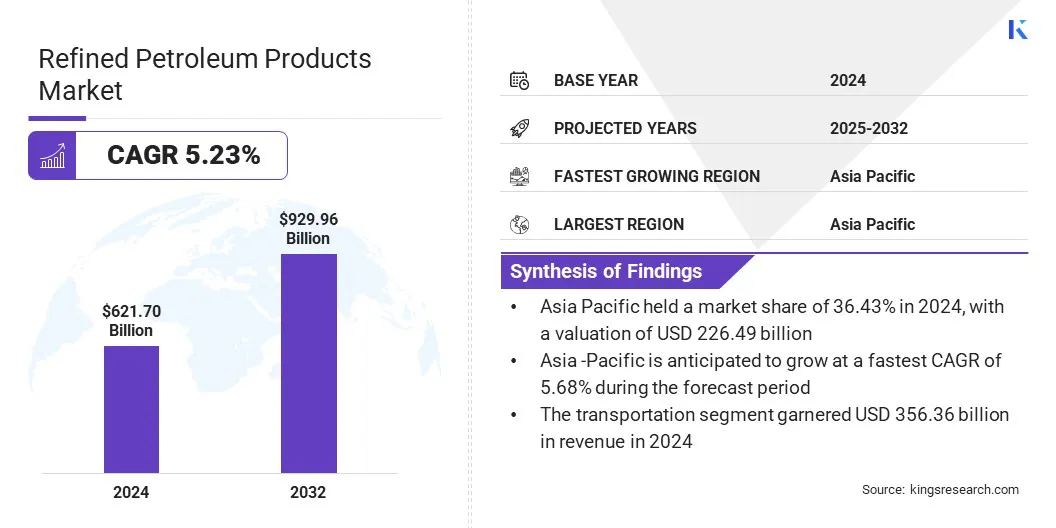

The global refined petroleum products market size was valued at USD 621.70 billion in 2024 and is projected to grow from USD 650.78 billion in 2025 to USD 929.96 billion by 2032, exhibiting a CAGR of 5.23% during the forecast period.

The market growth is driven by the expansion of fuel retail networks and an increase in fuel consumption. The market is further driven by the increasing consumption of gasoline, diesel, and jet fuel, supported by the expansion of road, air, and maritime transport activities.

Key Highlights:

- The refined petroleum products industry size was recorded at USD 621.70 billion in 2024.

- The market is projected to grow at a CAGR of 5.23% from 2025 to 2032.

- Asia Pacific held a market share of 36.43% in 2024, with a valuation of USD 226.49 billion.

- The gasoline segment garnered USD 227.17 billion in revenue in 2024.

- The transportation segment is expected to reach USD 542.06 billion by 2032.

- North America is anticipated to grow at a CAGR of 5.42% during the forecast period.

Major companies operating in the refined petroleum products market are Exxon Mobil Corporation, Shell plc, China Petroleum & Chemical Corporation, PetroChina Co. Ltd., BP p.l.c., Chevron Corporation, TotalEnergies, Reliance Industries Limited, LUKOIL, Valero Energy Corporation, Indian Oil Corporation Ltd, Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, ROSNEFT, and Nayara Energy Limited.

Rising air travel is driving the market by creating higher demand for aviation fuels. Airlines are procuring more jet fuel to support growing passenger and cargo flights, prompting refiners to expand production and supply. This heightened need for aviation fuel is contributing to market growth and strengthening revenue opportunities across the market.

- In January 2025, the International Air Transport Association (IATA) reported that total full-year air travel traffic for 2024, measured in revenue passenger kilometers (RPKs), rose 10.4% compared to 2023. This surge in passenger demand is fueling growth in the market by boosting the need for aviation fuels to support expanding passenger and cargo flights globally.

Market Driver

Increasing Global Oil Demand

A major factor driving the refined petroleum products market is the increasing global demand for oil, supported by rising consumption in transportation, industrial, and energy applications.

Refiners are expanding production capacities and upgrading facilities to meet the growing demand for gasoline, diesel, jet fuel, and other petroleum-based products. Rapid industrialization and urban growth are further boosting consumption levels, encouraging investments in refining infrastructure, storage, and distribution networks.

- According to the International Energy Agency (IEA), global oil demand is projected to grow by 720 kb/d, reaching 104.4 mb/d in 2026.

Market Challenge

Volatility in Crude Oil Prices

A significant challenge in the refined petroleum products market is the volatility in crude oil prices. Refining operations depend heavily on crude oil as the primary feedstock, and fluctuations in its price directly affect production costs and profit margins.

Unpredictable price changes make it difficult for refiners to manage procurement, plan budgets, and maintain stable pricing for end products. This instability in price can disrupt supply planning and hinder the market growth of refined petroleum products..

To address this challenge, market players are adopting diversified sourcing strategies and entering into long-term supply agreements to stabilize procurement costs. They are using hedging instruments to mitigate the financial impact of price swings. Companies are also investing in advanced forecasting systems to improve demand planning, enabling them to respond quickly to market volatility and protect profitability.

Market Trend

Shift Towards Cleaner and Low-Sulfur Fuels

A key trend influencing the refined petroleum products market is the shift towards cleaner and low-sulfur fuels to meet environmental regulations and reduce harmful emissions.

Market players are investing in advanced refining processes and desulfurization technologies to achieve ultra-low sulfur content while maintaining fuel performance. This shift is accelerating the adoption of environmentally friendly fuels across transportation, industrial, and power generation sectors. These advancements are enabling refiners to align with global sustainability goals, improve air quality, and cater to the growing demand for cleaner energy solutions.

- In February 2025, Pertamina introduced Diesel X, an ultra-low sulphur diesel fuel with 10 PPM, developed at the Balongan Refinery. The product is designed to enhance fuel efficiency and reduce emissions.

Refined Petroleum Products Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Gasoline, Diesel, Fuel Oil, Liquefied Petroleum Gas, Others

|

|

By Application

|

Transportation, Industrial, Chemicals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Gasoline, Diesel, Fuel Oil, Liquefied Petroleum Gas, and Others): The gasoline segment earned USD 227.17 billion in 2024, due to high vehicle ownership rates and rising fuel consumption in urban and suburban areas.

- By Application (Transportation, Industrial, Chemicals, and Others): The transportation segment held 57.32% of the market in 2024, owing to increasing road freight movement and growing passenger vehicle usage.

Refined Petroleum Products Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific refined petroleum products market share stood at 36.43% in 2024, with a valuation of USD 226.49 billion. This dominance is significantly attributed to the expansion of integrated refining and retail operations, which increase production efficiency in the region.

Moreover, rapid industrialization and urbanization across the region are fueling the demand for transportation fuels and energy-intensive industries. The growing number of vehicles in emerging economies such as China and India is increasing the need for gasoline and diesel, thereby boosting the consumption of refined petroleum.

Moreover, regional players are expanding their refinery capabilities to strengthen fuel distribution and service station networks. This approach is maintaining the consistent availability of refined products and thereby contributing to market expansion in the region.

- In January 2024, Star Petroleum Refining Public Company Limited (SPRC) acquired Chevron Asia Pacific Holdings Limited’s Caltex-branded fuels marketing business in Thailand. The acquisition aims to integrate SPRC’s refining operations with nationwide fuel distribution and retail sales, enhancing its value chain and market presence in the country.

North America refined petroleum products industry is expected to register a CAGR of 5.42% over the forecast period. This growth is attributed to the expansion of retail fuel networks that are increasing market accessibility in the region and steady industrial growth in the manufacturing and petrochemical sectors, sustaining the consumption of refined petroleum products for energy and feedstock purposes.

Advancements in refining technologies and the expansion of domestic refining capacities are enabling the efficient production and supply of high-quality petroleum products, supporting market growth in the region.

Additionally, players are enhancing their market presence by acquiring retail outlets that support consistent fuel availability. This is enabling efficient fuel distribution and supporting steady growth in refined petroleum product consumption across the region.

- In August 2024, FEMSA signed a definitive agreement to acquire 100% of Delek US Holdings’ retail convenience business, including inventories, for approximately USD 385 million. Through this acquisition, FEMSA will gain 249 corporate stores located in Texas and New Mexico. This will enable the company to enter the U.S. convenience and mobility sector and strengthen its retail fuel presence.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates refined petroleum products by setting fuel quality standards, emissions limits, and renewable fuel mandates. It oversees the reduction of pollutants from fuels and engines, enforces clean air laws, promoting cleaner fuel formulations to minimize environmental impact and public health risks in transportation and industrial sectors.

- In India, the Petroleum and Explosives Safety Organization (PESO) regulates safety standards for refined petroleum products, overseeing storage, transportation, and handling. It enforces compliance with hazardous material regulations, ensuring public and environmental safety, while supporting the petroleum sector's growth by maintaining strict quality control and safety protocols.

- In China, the National Energy Administration (NEA) governs refined petroleum products by controlling fuel production quotas, pricing policies, and quality standards. It ensures energy security, promotes clean energy transition, regulates refinery capacities, and oversees the sustainable development of petroleum refining to align with national environmental and economic goals.

Competitive Landscape

Major players operating in the refined petroleum products industry are focusing on joint ventures to expand operational capabilities and market reach. They are acquiring large stakes in storage infrastructure to strengthen supply chain efficiency and improve access to key logistics hubs.

Operators are enhancing import capacity for fuels and biofuels to meet the evolving needs of the transportation, industrial, and energy sectors. Additionally, they are focusing on optimizing terminal operations to provide flexibility and reliable services to current and future customers.

- In October 2024, Trafigura acquired a 50% stake in Meroil Tank S.L. from Meroil S.A., forming a 50-50 joint venture. The venture operates refined petroleum product storage infrastructure in the port of Barcelona, aiming to enhance import capacity and logistics for fuels and biofuels.

Key Companies in Refined Petroleum Products Market:

- Exxon Mobil Corporation

- Shell plc

- China Petroleum & Chemical Corporation

- PetroChina Co. Ltd.

- BP p.l.c

- Chevron Corporation

- TotalEnergies

- Reliance Industries Limited

- LUKOIL

- Valero Energy Corporation

- Indian Oil Corporation Ltd

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited

- ROSNEFT

- Nayara Energy Limited.

Recent Developments (M&A)

- In May 2024, Aramco acquired a 40% stake in Gas & Oil Pakistan Ltd. The acquisition expands its global retail network and strengthens its presence in Pakistan’s fuel distribution sector through more than 1,200 fuel stations.

- In November 2024, ConocoPhillips completed the USD 22.5 billion acquisition of Marathon Oil Corporation, including USD 5.4 billion in net debt. The deal expands ConocoPhillips’ U.S. shale portfolio by adding low-cost assets in the Permian, Eagle Ford, Bakken, and Oklahoma basins, located adjacent to its existing shale operations.

in India