Market Definition

The market refers to the industry focused on the design, production, and sale of motorized or towable vehicles equipped with living accommodations. These vehicles include motorhomes, campervans, travel trailers, fifth wheels, and pop-up campers.

They are primarily used for leisure travel, camping, and long-term mobile living. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Recreational Vehicle Market Overview

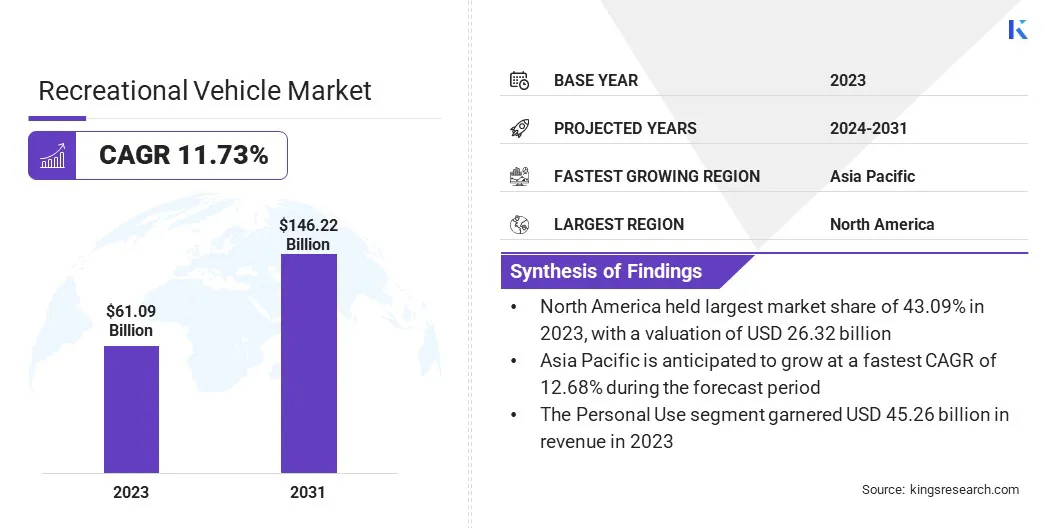

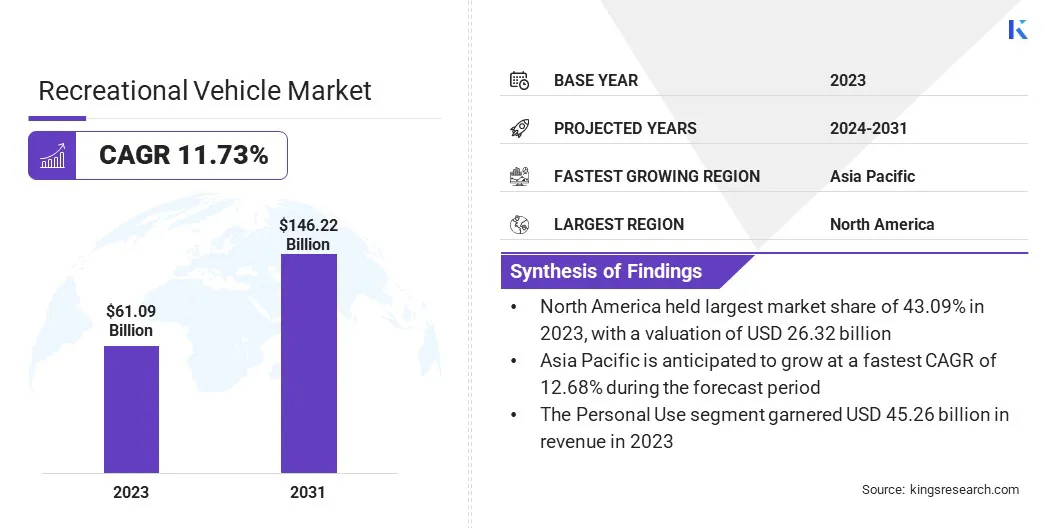

Global recreational vehicle market size was valued at USD 61.09 billion in 2023, which is estimated to be valued at USD 67.28 billion in 2024 and reach USD 146.22 billion by 2031, growing at a CAGR of 11.73% from 2024 to 2031.

The growing popularity of outdoor recreation such as road trips and camping, is driving RV sales globally. People increasingly seek flexible travel experiences, leading to a surge in demand for RVs for adventure and exploration.

Major companies operating in the recreational vehicle industry are Aliner, Dethleffs, Forest River, Inc, Gulf Stream Coach, Hymer GmbH & Co. KG, REV Group, The Swift Group, THOR Industries, Trigano S.p.A., Winnebago Industries, Ember Recreational Vehicles, JCBL Group, RV India, SRMPR Auto Manufacturing Pvt Ltd, and Lightship.

The market is driven by the increasing interest in outdoor recreation and road travel. Consumers are seeking more flexible and immersive travel experiences, with RVs offering an ideal solution.

The demand for technologically advanced RVs is rising as they offer features like connectivity, mobile apps, and smart monitoring systems for enhanced convenience and safety. As more people embrace the RV lifestyle, manufacturers are launching innovative designs and solutions to meet the evolving needs of consumers.

- In Feb 2025, THOR Industries expanded its Global Connected Vehicle Platform to North America, enhancing RV adventures with mobile connectivity, location services, and a partnership with Roadtrippers. Airstream, a division of THOR Industries, offering smart monitoring, dealership support, and travel content, boosting deeper brand connection and more rewarding, tech-enabled RV experiences.

Key Highlights

- The recreational vehicle industry size was recorded at USD 61.09 billion in 2023.

- The market is projected to grow at a CAGR of 11.73% from 2024 to 2031.

- North America held a market share of 43.09% in 2023, with a valuation of USD 26.32 billion.

- The gasoline segment garnered USD 30.60 billion in revenue in 2023.

- The motorized RVs segment is expected to reach USD 73.71 billion by 2031.

- The personal use segment had a market of 74.09% in 2023.

- The online sales segment is anticipated to grow at a CAGR of 14.28% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 12.68% during the forecast period.

Market Driver

"Rising Popularity for Outdoor Recreation"

The rising interest in outdoor recreation is a key growth driver for the recreational vehicle (RV) market. As more individuals seek the freedom of road trips, camping, and nature exploration, RVs have become a popular choice for those desiring flexible, self-sufficient travel.

The growing consumer preference for versatile, all-in-one travel solutions is fueling the adoption of RVs, particularly among families, millennials, and retirees eager for adventure.

Additionally, the increasing desire to disconnect from daily routines and explore off-the-beaten-path destinations has significantly propelled RV sales, driving the ongoing expansion of the RV industry.

- In March 2024, JCBL Limited launched its Signature Motorhome, marking its entry into the Indian RV industry. This luxury motorhome offers 80% customization, with features like king-sized beds, a kitchen, entertainment systems, and spacious living areas.

Market Challenge

"High Initial Cost"

High initial cost remains a significant challenge in the recreational vehicle (RV) market, particularly in emerging economies where affordability is a key concern. The high price of purchasing a recreational vehicle, combined with taxes and customization expenses, limits access for a broader consumer base.

To address this, manufacturers can explore modular designs, offer flexible financing options, and introduce compact, budget-friendly models.

Market Trend

"Digital Transformation"

The recreational vehicle (RV) market is experiencing a significant shift toward digital transformation and enhanced operational efficiency. Dealerships are increasingly adopting advanced technologies to automate financial processes, streamline operations, and reduce manual workloads.

This trend is driven by the need for improved accuracy, faster transaction handling, and stronger vendor relationships. As the industry evolves, integrating digital solutions across business functions boosts productivity and supports better decision-making, contributing to the overall modernization and sustained growth of the RV market.

- In Feb 2025, REPAY partnered with Lightspeed DMS to optimize vendor payments for RV dealerships. This integration automates accounts payable, enhances payment security, and replaces manual processes with digital solutions, helping dealerships streamline operations, reduce errors, and strengthen vendor relationships across the RV and broader recreational retail landscape.

Recreational Vehicle Market Report Snapshot

|

Segmentation

|

Details

|

|

By Fuel Type

|

Gasoline, Diesel, Electric/Hybrid

|

|

By Vehicle Type

|

Motorized RVs [Class A Motorhomes, Class B Motorhomes (Camper Vans), Class C Motorhomes], Towable RVs (Travel Trailers, Fifth-Wheel Trailer, Folding Campers, Truck Campers)

|

|

By End Use

|

Personal Use, Commercial Use

|

|

By Distribution Channel

|

Direct Sales, Online Sales, Rental Platforms & Fleet Sales

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Fuel Type (Gasoline, Diesel, Electric/Hybrid): The Gasoline segment earned USD 30.60 billion in 2023 driven by widespread availability, cost-effectiveness, and strong demand for traditional fuel-powered RVs across various global markets.

- By Vehicle Type (Motorized RVs, Towable RVs): The Motorized RVs segment held 54.09% of the market in 2023, supported by increasing consumer preference for fully integrated, self-driving units offering greater convenience and mobility.

- By End Use (Personal Use, Commercial Use): The Personal Use segment is projected to reach USD 105.30 billion by 2031, fueled by rising interest in recreational travel, flexible lifestyles, and demand for adventure-oriented, self-contained mobile living.

- By Distribution Channel (Direct Sales, Online Sales, Rental Platforms & Fleet Sales): The Online Sales segment is anticipated to have a CAGR of 14.28% during the forecast period, as digital platforms simplify vehicle comparison, customization, financing, and purchasing, enhancing buyer convenience and market reach.

Recreational Vehicle Market Regional Analysis

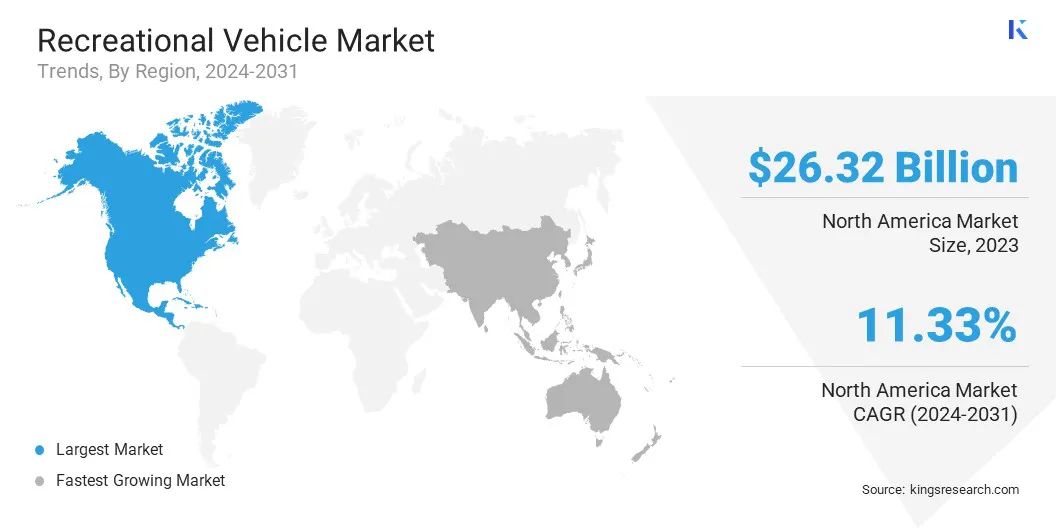

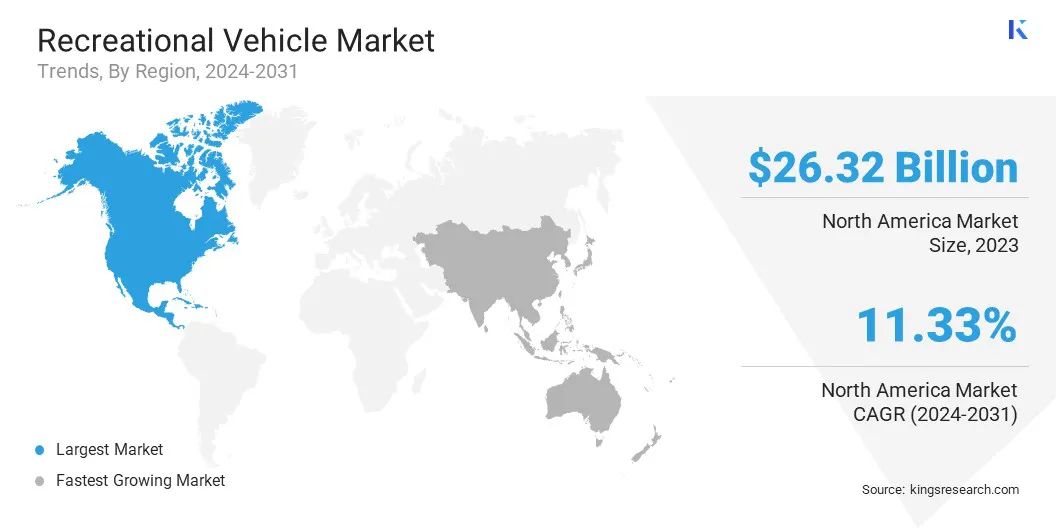

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America recreational vehicle market share stood around 43.09% in 2023 in the global market, with a valuation of USD 26.32 billion. North America remains the dominating region in the market, driven by a strong culture of road travel, well-developed infrastructure, and high disposable incomes.

Technological advancements, availability of diverse RV models, and rising interest in outdoor recreational activities further support market expansion. Additionally, the presence of major manufacturers and a well-established dealer network contribute to North America's leadership in RV production, innovation, and consumer adoption.

- In Jan 2023, Winnebago unveiled the eRV2, its all-electric, zero-emission RV prototype, at the Florida RV SuperShow. Built on a Ford E-Transit chassis, it features sustainable materials, advanced battery technology, solar power, and smart connectivity, reflecting growing demand for eco-friendly, modern RV travel experiences.

Asia Pacific recreational vehicle industry is poised for significant growth at a robust CAGR of 12.68% over the forecast period. Asia Pacific is emerging as the fastest-growing region in the market, driven by rising disposable incomes, growing interest in road travel, and increasing awareness of RV lifestyles.

Countries like China, India, and Australia are witnessing a surge in domestic tourism, encouraging demand for recreational vehicles. Government initiatives to improve road infrastructure and promote local tourism further support market growth.

Additionally, the expansion of online sales channels and availability of customizable, compact RV models are making RV ownership more accessible across the region.

Regulatory Frameworks

- The European Union’s Euro 7 emissions standards are being introduced to reduce vehicular pollution and enhance electric vehicle battery performance. These regulations are expected to impact the design and production of recreational vehicles (RVs) across the region.

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) regulates vehicle and equipment safety. RV manufacturers must comply with standards set under Title 49 and Title 23 of the Code of Federal Regulations to ensure alignment with national safety and operational guidelines.

- In India, the Central Motor Vehicle Rules (CMVR) of 1989 established the framework for vehicle safety, emissions, and operational standards. These rules apply to RVs as well, ensuring regulatory compliance in terms of road safety and environmental impact.

Competitive Landscape

Companies in the recreational vehicle (RV) industry are increasingly focusing on innovation and sustainability, developing more eco-friendly models and enhancing technological features. Manufacturers are integrating electric powertrains, improving energy efficiency, and offering greater customization options for consumers.

There is a strong emphasis on improving the overall user experience through advanced safety systems, smart connectivity, and enhanced comfort. Additionally, companies are exploring new business models, such as online sales and rental services, to cater to the growing demand for recreational travel and outdoor adventures.

- In September 2024, Thor Industries unveiled the world’s first hybrid Class A motorhome, the eRV2, at the Florida RV Supershow. Built on Harbinger's electric chassis, it combines a 140-kWh battery, gasoline range extender, and solar rooftop. With an estimated range of 500 miles, it addresses range anxiety and supports sustainable, off-grid travel.

List of Key Companies in Recreational Vehicle Market:

- Aliner

- Dethleffs

- Forest River, Inc

- Gulf Stream Coach

- Hymer GmbH & Co. KG

- REV Group

- The Swift Group

- THOR Industries

- Trigano S.p.A.

- Winnebago Industries

- Ember Recreational Vehicles

- JCBL Group

- RV India

- SRMPR Auto Manufacturing Pvt Ltd

- Lightship

Recent Developments (Strategic Realignment)

- In March 2025, THOR Industries announced a strategic realignment, integrating Heartland Recreational Vehicles under Jayco, Inc. This restructuring aims to optimize operational efficiencies and streamline business processes. Additionally, certain private label brands from Heartland will be transferred to Dutchmen Manufacturing, enhancing overall brand synergy and improving margins across THOR's RV divisions