Market Definition

The market encompasses the production, distribution, and utilization of recycled rubber derived from end-of-life tires and rubber products. It includes various segments such as whole tire reclaim (WTR) rubber, butyl reclaim rubber, and ethylene propylene diene monomer (EPDM) reclaim rubber, each catering to specific applications across industries.

This market involves key stakeholders, including raw material suppliers, manufacturers, processors, distributors, and end users across sectors such as automotive, construction, and industrial goods.

Reclaimed Rubber Market Overview

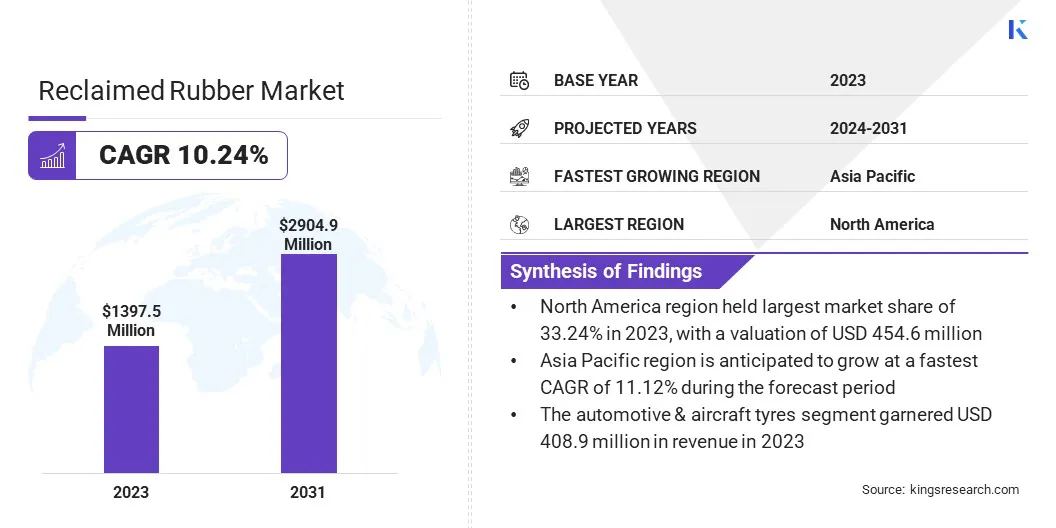

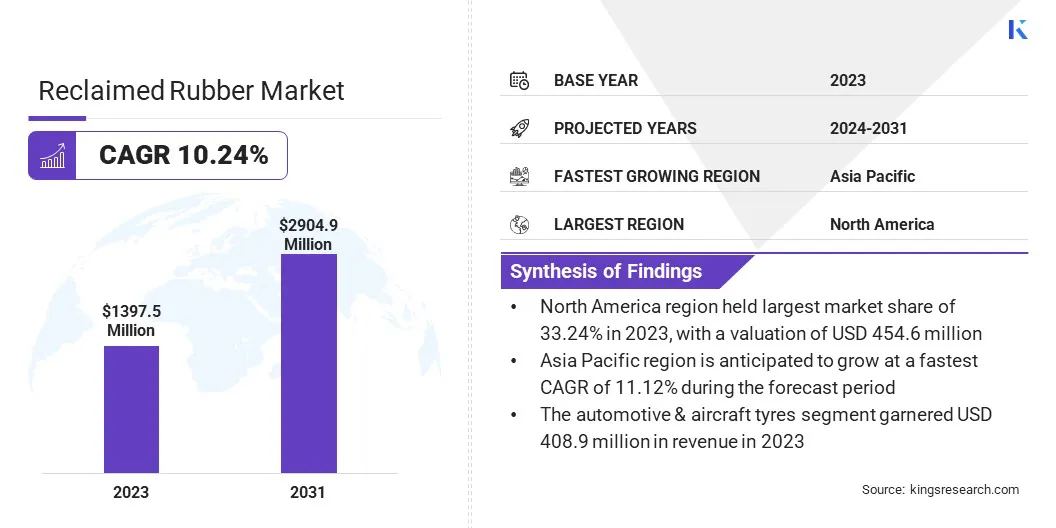

The global reclaimed rubber market size was valued at USD 1397.5 million in 2023 and is projected to grow from USD 425.0 million in 2024 to USD 2904.9 million by 2031, exhibiting a CAGR of 10.24% during the forecast period.

The market is driven by increasing sustainability initiatives and cost advantages over virgin rubber. The rising demand for eco-friendly and durable materials in industries such as automotive, construction, and footwear is fueling the market.

Major companies operating in the reclaimed rubber industry are Bolder Industries, Lehigh Technologies, Inc., Liberty Tire Recycling, Anwer Rashid Industries, Eldan Recycling A/S, Scandinavian Enviro Systems AB, GRP LTD., EezeeMix, ARP Materials Inc., GRP LTD., ELGI Rubber, Lead Reclaim & Rubber Products Ltd., Eswar Rubber Products Pvt. Ltd., Rubber-Cal, and SINO RUBBER.

Reclaimed rubber offers enhanced processing efficiency, reduced energy consumption, and lower raw material costs, making it a preferred choice for manufacturers. Government policies promoting circular economy practices and waste reduction further support the market growth.

Key Highlights:

- The reclaimed rubber industry size was valued at USD 1367.5 million in 2023.

- The market is projected to grow at a CAGR of 10.24% from 2024 to 2031.

- North America held a market share of 33.24% in 2023, with a valuation of USD 454.6 million.

- The whole tyre reclaim rubber segment garnered USD 396.1 million in revenue in 2023.

- The automotive & aircraft tyres segment is expected to reach USD 869.7 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 11.12% during the forecast period.

Market Driver

Cost Efficiency and Sustainability Initiatives

The market is driven by its cost-effectiveness and the growing emphasis on sustainability and circular economy initiatives. Reclaimed rubber provides a more affordable alternative to virgin rubber, reducing raw material costs while maintaining performance, making it a preferred choice in industries such as automotive, footwear, and industrial manufacturing.

This cost advantage is particularly beneficial for tire production and retreading, where manufacturers seek to optimize expenses without compromising quality. Additionally, increasing global awareness of environmental sustainability and regulatory measures focused on waste management are accelerating the adoption of reclaimed rubber.

Governments and organizations are actively promoting recycling initiatives to reduce landfill waste and carbon emissions, further boosting the demand for reclaimed rubber in various applications. These factors collectively contribute to the expansion of the market, making reclaimed rubber a key material in sustainable manufacturing practices.

- In March 2025, the Recycled Rubber Coalition introduced the Better Play Initiative (BPI), a nationwide public education campaign aimed at equipping community leaders with reliable information on the safety and benefits of crumb rubber and recycled rubber surfaces. The initiative highlights how recycled rubber repurposes 220 million end-of-life tires annually, offering sustainable and cost-effective solutions for parks, playgrounds, and playing fields.

Market Challenge

Ensuring Quality Consistency

A major challenge in the reclaimed rubber market is maintaining consistent quality and performance across different batches. Reclaimed rubber is derived from end-of-life tires and various rubber products, hence, variations in raw material composition can lead to inconsistencies in mechanical properties, durability, and elasticity.

This poses a significant hurdle for manufacturers, especially in high-performance applications such as automotive tires and industrial components, where precise material specifications are required. A potential solution to this challenge lies in advancements in rubber processing technologies and improved sorting methods.

Enhanced devulcanization techniques, stricter quality control measures, and the adoption of advanced material testing methods can help ensure uniformity in reclaimed rubber properties.

Market Trend

Technological Advancements in Recycling

The market is registering notable trends, driven by advancements in recycling technologies that are enhancing the quality and durability of reclaimed rubber. Innovations in devulcanization and processing techniques are enabling manufacturers to improve the mechanical properties, elasticity, and strength of reclaimed rubber, making it more comparable to virgin rubber.

These technological improvements are expanding its applicability across various industries, allowing for greater efficiency in production and increased adoption in high-performance sectors. As a result, reclaimed rubber is becoming a more viable and sustainable alternative in manufacturing, contributing to the circular economy while meeting industry demands for cost-effective and eco-friendly materials.

- In March 2024, HEXPOL Compounding announced an investment in a devulcanization line in Europe. This initiative enables in-house mechanical devulcanization of rubber, supporting a circular economy. The company reduces reliance on virgin materials by reclaiming cured rubber scrap, which was previously discarded or used as low-quality filler. The devulcanization process restores cured rubber to an uncured state, preserving its polymer, carbon black, and plasticizers for reuse in new rubber products, reinforcing the viability of rubber recycling.

Reclaimed Rubber Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Whole Tyre Reclaim Rubber, Butyl Reclaim Rubber, EPDM Reclaim Rubber, Others

|

|

By End Use

|

Automotive & Aircraft Tyres, Retreading, Belts & Hoses, Footwear, Molded Rubber Goods, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product (Whole Tyre Reclaim Rubber, Butyl Reclaim Rubber, EPDM Reclaim Rubber, Others): The whole tyre reclaim rubber segment earned USD 396.1 million in 2023, due to its widespread use in tire manufacturing and industrial rubber products, driven by cost-effectiveness and sustainability benefits.

- By End Use (Automotive & Aircraft Tyres, Retreading, Belts & Hoses, and Footwear): The automotive & aircraft tyres segment held 29.90% share of the market in 2023, due to the growing adoption of reclaimed rubber in tire production, enhancing durability while reducing manufacturing costs and environmental impact.

Reclaimed Rubber Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for 33.24% share of the reclaimed rubber market in 2023, with a valuation of USD 454.6 million. The strong market position of the region is attributed to the well-established automotive and tire manufacturing industries, which actively incorporate reclaimed rubber to reduce production costs and improve sustainability.

Environmental regulations promoting recycling and circular economy initiatives further support market expansion. Additionally, the presence of major rubber processing companies and advancements in rubber recycling technologies have contributed to the widespread adoption of reclaimed rubber in the region.

- In May 2024, the Tire Industry Association (TIA) and the U.S. Tire Manufacturers Association launched the Tire Recycling Foundation to enhance tire circularity. The initiative aims to recycle 100% of end-of-life tires by funding research, education, and intervention projects. The foundation will prioritize rubber-modified asphalt (RMA) adoption for sustainable infrastructure. This effort builds on USTMA’s ongoing advocacy for responsible tire recycling.

The market in Asia Pacific is poised to grow at a significant CAGR of 11.12% over the forecast period, driven by rapid industrialization and increasing demand for cost-effective raw materials in key industries such as automotive, construction, and footwear.

The expanding vehicle production in the region, particularly in China and India, has amplified the usage of reclaimed rubber in tire manufacturing and retreading applications. Furthermore, supportive government policies, rising environmental awareness, and the availability of abundant raw materials from end-of-life tires are driving the market.

The growing presence of rubber recycling facilities and technological advancements in reclaiming processes are further enhancing the region’s market potential.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates the management and recycling of scrap tires under the Resource Conservation and Recovery Act (RCRA), promoting the use of reclaimed rubber to reduce landfill waste and environmental impact.

- In Europe, the European Chemicals Agency (ECHA) oversees the regulation of reclaimed rubber under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) framework, ensuring its safe use in manufacturing.

Competitive Landscape

The reclaimed rubber industry is highly competitive, with leading players prioritizing technological advancements, production capacity enhancements, and strategic alliances to solidify their foothold in the market. Companies are investing in advanced rubber recycling technologies to enhance product quality, improve efficiency, and expand application areas.

Mergers and acquisitions are common strategies used to gain access to new markets and strengthen supply chains. Additionally, manufacturers are emphasizing sustainable practices, such as increasing the use of eco-friendly processing techniques and adopting circular economy models to align with regulatory requirements and customer preferences.

Research and development efforts are directed toward improving the durability and performance of reclaimed rubber to cater to high-end applications, including premium tire manufacturing and industrial rubber goods. Companies are also forming collaborations with raw material suppliers and end users to expand their global presence, ensuring a stable supply chain and fostering long-term business growth.

- In October 2024, Toyoda Gosei Co., Ltd. announced the expansion of its rubber recycling capacity at the Morimachi Plant in Japan. Leveraging proprietary devulcanization technology introduced in FY2021, the company is set to launch a second recycling line in FY2025, doubling annual capacity to 1,200 tons. This advancement will enable up to 20% recycled material integration into new rubber products. Additionally, Toyoda Gosei is exploring natural rubber recycling and collaborating with automakers to establish a comprehensive end-of-life vehicle rubber recovery system.

List of Key Companies in Reclaimed Rubber Market:

- Bolder Industries

- Lehigh Technologies, Inc.

- Liberty Tire Recycling

- Anwer Rashid Industries

- Eldan Recycling A/S

- Scandinavian Enviro Systems AB

- GRP LTD.

- EezeeMix

- ARP Materials Inc.

- GRP LTD.

- ELGI Rubber

- Lead Reclaim & Rubber Products Ltd.

- Eswar Rubber Products Pvt. Ltd.

- Rubber-Cal

- SINO RUBBER

Recent Developments (Partnerships)

- In November 2024, Ecore International announced a minority growth investment from General Atlantic’s BeyondNetZero climate growth fund. The investment will support Ecore’s organic and inorganic growth, enhance operational and technology infrastructure, and accelerate its circularity and net-zero strategies. Ecore reclaims and repurposes its products through its TRUcircularity program, preventing rubber waste from entering landfills and reinforcing its commitment to sustainability.